In May, global cinemas accounted for $1.4 billion in box office. This is the third best global monthly result since March 2020. It was supported by a significant increase in the global access to movie theatres. The number of cinemas open by market share grew up to 76% (+12%) worldwide at the end of May. The highest level since the pandemic-era peak of 79% in the first week of October last year! May illustrated the simple equation for speeding up on the road to recovery – More cinemas open, more attractive movies to show, more box office coming in!

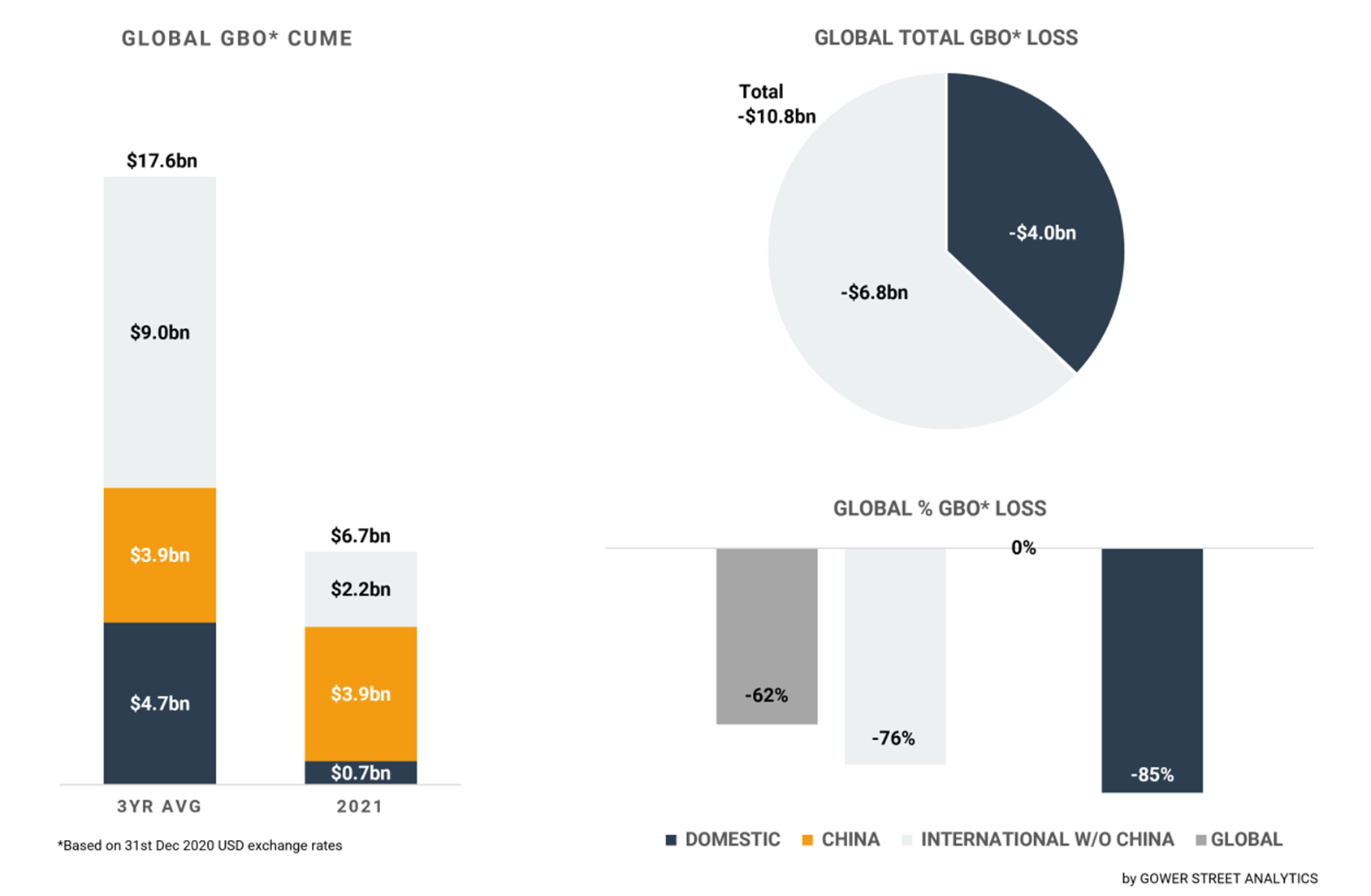

The stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three (pre-pandemic) years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

Gower Street’s latest Global Box Office Tracker (GBOT) shows that 2021 global box office grew to $6.7 billion in May, from $5.3 billion a month ago. At the end of May, the current 2021 global box office deficit compared to the average of the last three pre-pandemic years (2017-2019) is -$10.8 billion, a drop of -62%.

A bit more than half to the global box office in May was delivered by China with $0.7 billion. It was their third best result since the pandemic began. It is just behind the record-breaking Chinese New Year February this year and the Golden Week October last year. As in those two months, this May performance was also mainly driven by a lucrative holiday week, the Labour Day holiday. Set from May 1- 5 this period achieved another all-time high this year, grossing nearly $260 million with a phalanx of successful new local titles.

However, none of those topped the monthly charts. Instead it was F9 with $186 million, of a current $200 million total, that raced to #1. This is already the best cume of a US title in China since HOBBS & SHAW in August 2019. For the May 21 play-week it drove China – the second time this month – past the Stage 5 marker of Gower Street’s Blueprint To Recovery (measured as a weekly box office result equivalent to those in the top quartile of weekly business in the previous two pre-pandemic years). A second impressive proof that foreign titles can still score big in China after GODZILLA VS KONG gave the first example in March.

China’s 2021 box office is $3.9 billion at the end of May. It is tracking even with the 2017-2019 three-year average for the first five months of the year.

The Domestic market has some way to go until numbers of that size are reached. At the beginning of June it had achieved a total of $0.7 billion for 2021, tracking -85% behind the three-year average, a total of -$4 billion. Nevertheless the market has also now finally reclaimed its rightful place as the #2 global box office market in 2021, overtaking an initially very strong Japan on May 1. It further recorded the best monthly result since March 2020 with a $222m box office, a small uptick of 3% over April.

The Domestic market saw big progress in May on the exhibition side of the business. The number of movie theaters open by market share went up to 75% at the end of May from 61% a month ago. This is by far the highest level of operating sites since the pandemic began over 14 months ago.

This is a key element in the framework that allowed the Domestic market hit Stage 3 of Gower Street’s Blueprint To Recovery for the first time during the May 28 Memorial Day play-week. The Stage 3 target is measured as a weekly box office result equivalent to the lowest grossing week in the previous two pre-pandemic years. This is an important step in the recovery process, signifying a consistency of audience engagement over a minimum period.

The play-week was fuelled by the national holiday and two openers with A QUIET PLACE, PART II and CRUELLA. The two titles combined accounted for 86% of the week’s $118 million total. An exceptionally promising sign for the capability of the current market is that the first week’s result of A QUIET PLACE, PART II is 3% ahead of the very successful first instalment. This despite capacity restrictions and a quarter of movie theaters (by market share) remaining closed across the Domestic market. A lot to build on in the months to come.

The same can be said about the International market (excluding China). The number of cinemas open by market share grew to 67% at the end of May, up from 48% a month before. This is the highest number since the beginning of November last year. The main driver was the EMEA region. Major International markets with the UK and FRANCE finally re-opened after many months of closure. Italy further saw a bigger expansion of cinemas opening in May, boosting its number of cinemas open by market share to 73% up from just 13%.

The EMEA box office in May was the biggest since last October, when the second wave of wide closures started. In its first play-week back (starting May 19), France immediately generated its second best result since the start of the pandemic; achieving a Stage 3 level performance for the fourth time. The UK hit its Stage 3 target for the first time in the second play-week back (starting May 28), lifted by a national holiday (May 31) and school half-term holidays alongside new openers THE CONJURING: THE DEVIL MADE ME DO IT and CRUELLA joining holdover PETER RABBIT 2.

The comeback of the UK and France was a much-needed addition to only a few strong EMEA markets in the year so far, mainly Russia. Its 2021 cume at the end of May was $257 million, accounting for nearly half (46%) of the EMEA cume. That makes Russia currently the fourth biggest market in the world; it is showing a deficit of just -22% against the average of the last three pre-pandemic years (2017-2019). Of all Comscore-tracked markets only China is performing better.

As in EMEA, May saw many cinemas re-opening in Latin America. At the end of May 62% of cinemas were open by market share, significantly up from 47% a month earlier. This is the highest level since the peak of 64% in mid-December. Ecuador, Colombia and Mexico were the markets seeing the highest gains in May.

The positive developments in EMEA and Latin America helped the International market (excluding China) to reach the second best monthly international box office of the current year. The International monthly total of $0.5 billion is just slightly behind the prior month’s $0.6 billion. The 2021 International box office total reached $2.2 billion at the end of May with a deficit against the three-year average of -$6.8 billion (-76%).

That the International May results are not higher is due to the Asia Pacific region. After being the most stable region during the pandemic for a long period, multiple countries of the region were hit more severely than before by Covid-19 and connected restrictions. The region recorded its lowest monthly box office since July last year during May.

Taiwan, one of just four global markets that had reached Stage 5 levels, needed to close its cinemas for the first time in May. Malaysia needed to close nearly all its cinemas for the fourth time since March last year. In the last week of May the Australian state of Victoria, including the capital Melbourne, also moved into another lockdown.

This is a reminder that the recovery is not always as simple as just forward progress. It is fragile and we will most likely continue to see setbacks. Until then there is more hope on the schedule. Japan, the #3 market globally, allowed key prefectures of Tokyo and Osaka to re-open cinemas June 1. These prefectures represent around 35% of the market and were shut since April 25. The Netherlands is also welcoming back guests to cinemas from June 5 having been closed five and half months.

This article was originally published on Screendollars’ newsletter #171 (June 7, 2021) and on the Screendollars website here.