There was so much happening at the global box office in 2021 it was, perhaps, easy to overlook one of the most significant pieces of news: The Kingdom of Saudi Arabia (KSA) overtook Italy in annual box office (in US$ terms). This put Saudi Arabia into the top 6 markets in the Europe, Middle East, and Africa (EMEA) region. It marked the first time on modern record that one of the so-called “big six” European markets (UK/Ireland, France, Germany, Russia, Italy, and Spain) had been supplanted.

KSA grossed approximately $238 million in 2021, a rise of nearly 95% on 2020’s $122.5 million. This put the Middle Eastern market ahead of Italy ($196m) and behind Spain ($296m).

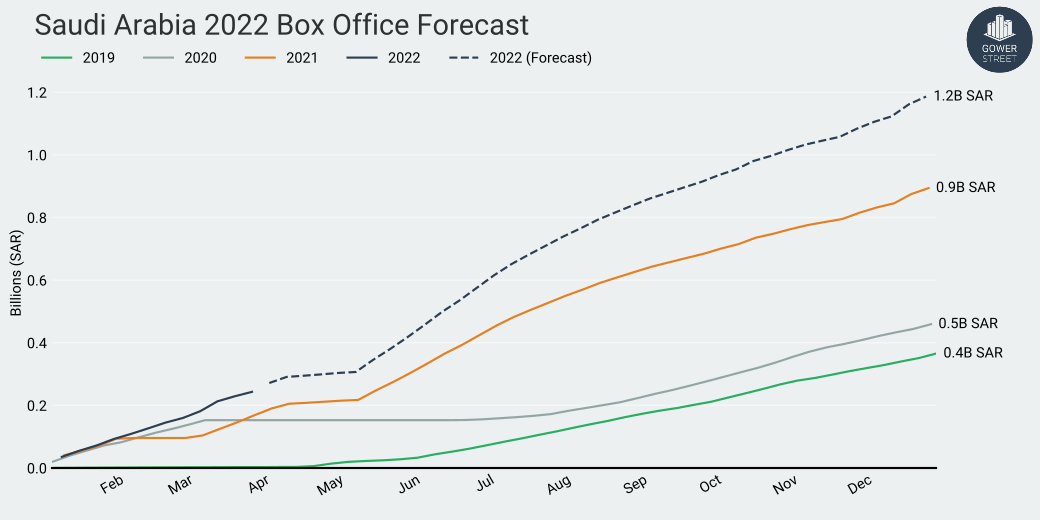

A conservative estimate for 2022 at this stage would suggest a box office this year (as current exchange rates) of at least $290 million, and more likely significantly higher, perhaps $315-395 million. Business to date in 2022 is tracking approximately 45% ahead of 2021. With nearly three months of actual box office play-weeks completed this year, if the remaining weeks delivered average gains of 18% year-on-year the market (at current exchange rates) would finish at approximately $293 million (and overall year-on-year gain of 23%). If that average gain could be increased to 30% the market would finish at $316 million (+33% year-on-year) – this is the estimate shown on the graph below; a 50% average increase in remaining weeks would deliver a $355 million result; while a 70% average gain in remaining weeks would offer a $395 million year (up 65% in total box office against 2021).

The average gain in play-weeks so far in 2022 has been 61%, although this has been skewed by a few weeks of complete closure in February 2021. Among individual weeks of wide-market play the highest week-to-week comparative gain seen against the equivalent week of 2021 has been +50%, however there have also been weeks of decline.

As the market enters this year’s Ramadan, marking a period of low box office until May, we take a look at how Saudi Arabia quickly established itself as a major player on the international box office scene.

The market’s first full year of operating, 2019, generated approximately $97.5 million. This means in just a short time, and while the whole world has struggled with box office regression amid the pandemic, Saudi Arabia has overtaken long-standing European markets featuring in the global top 20, such as the Netherlands, Poland and its Middle Eastern neighbour UAE. It is likely to stay ahead of these markets and is already tracking well ahead of Netherlands and UAE in Q1 2022, although the Netherlands lost most of January due to a lockdown. (NB: It should be noted that Saudi Arabia is yet to be included in official international top 20 rankings as featured in the MPA’s annual Theme Report).

Whether KSA remains in the top 6 EMEA markets long-term will depend a great deal on recovery progress in the Spanish and Italian markets in this and future years, as well as KSA’s continued rapid expansion of its exhibition sector (see below). Both Spain and Italy are currently tracking ahead of KSA in US$ terms for Q1 this year (Italy by approximately 18% and Spain by 33%).

Italy’s box office was particularly handicapped in 2021 by cinema closure lasting through nearly the full first four months of the year. Spain witnessed an especially rocky recovery, unable to sustain business above a base level of pre-pandemic business (measured by Gower Street on our Blueprint To Recovery as a play-week grossing box office equivalent to at least the lowest grossing week recorded in 2018-2019) for more than three consecutive weeks in the year. This is in sharp contrast to most major European markets (as shown in Gower Street’s subscriber-only State Of The Market report).

Although KSA may not hold its top 6 EMEA position in 2022 its presence in the top 6 in 2021 signalled it was proving to be the major growth market it was predicted it could be in 2018. Its re-entry into the top 6 in the coming years seems likely. This makes KSA arguably the most exciting market in the region and one of key focus for the industry globally going forward.

Rapid Build

The rise of KSA as a major box office player on the global stage has been swift.

In December 2017, the country announced movie theatres would be allowed to open for the first time in over 35 years. In January 2018 the Saudi government’s Public Investment Fund (PIF) fully incorporated the Development Investment Entertainment Company (DIEC). On April 4 of that year it was announced by PIF that DIEC had signed a deal with AMC to operate AMC cinemas in KSA. The agreement revealed that DIEC and AMC expected to open 30-40 cinemas across 15 Saudi cities over the following 5 years and 50-100 locations in approximately 25 cities by 2030 (more recent statements have adjusted that goal to 2034).

The news of the AMC deal came jointly with an announcement that the Saudi Ministry of Culture and Information had granted the first cinema operating licence to DIEC. The PIF subsidiary opened its first cinema just two weeks later, on April 18 2018, in the King Abdullah Financial District in a converted symphony concert hall with 450 seats. The first film to play on the 45-foot screen: Marvel’s BLACK PANTHER.

VOX Cinemas, the largest exhibitor in the Middle East and North Africa (MENA) region, also entered the new market quickly. VOX announced it had been awarded one of the first licenses to operate cinemas in Saudi Arabia on April 20, 2018 with plans to open 600 screens over the following five years. It opened KSA’s first multiplex, a 4-screen site at Riyadh Park Mall, later that month. Since then 14 further VOX locations have opened, most recently a 5-screen site at the Galleria Mall in Jubail in October 2021. The company operates 154 screens across its 15 locations in six cities (also including Dammam, Hail, Jeddah, and Tabuk). Nine sites are in the capital Riyadh.

The Riyadh-based Muvi Cinemas became the first wholly home-grown exhibitor brand in KSA, launching in 2019 with a site at the Mall of Arabia in Jeddah in August of that year. It has since become the leading exhibitor in terms of locations and screens, operating 21 sites incorporating 184 screens – this is up from 10 sites and 103 screens at the start of 2021. These include the market’s biggest cinema at the Mall of Dharhan (in Dharhan), which opened in October 2020 and has 18 screens with a collective 2,368 seats!

There are currently 10 AMC sites operating in KSA. Lebanon’s Empire Cinema has five locations in KSA; Latin American chain Cinepolis has two. This brings the total number of locations at the close of 2021 to 53 – up 20 from the start of that year – with a collective 430 screens. Other operators, including Cinemacity, iPic Entertainment, India’s PVR, and Kuwait National Cinema Company, are looking to enter the market either directly or in partnership with local partners.

Bahaa Abdulmajeed, business development manager for entertainment and culture at the Saudi Ministry of Investment, speaking at the Red Sea International Film Festival in December 2021, said KSA has ambitious plans to “increase the number of cinema screens from 430 to 2,600 by 2030.” These are projected to be across 350 locations.

The promotion of culture and the entertainment sector is a key objective of KSA’s Vision 2030 strategic economic and social reform plan, first laid out in April 2016, before the cinema-ban had been lifted. The production of a local film industry, creating the infrastructure to deliver 100 local films by the end of decade, is also part of the plan (27 new Saudi films played at the Red Sea International Film Festival in December last year).

Action Stations

As the box office market has grown in Saudi Arabia so, naturally, has what it can contribute to the global takings of a Hollywood title. The top earning title released in 2018 was action title MISSION: IMPOSSIBLE – FALLOUT ($366k) ahead of OCEAN’S 8 ($206k).

Within a year this had grown incredibly. In 2019, the top release title JOKER grossed $9.1 million, with FAST & FURIOUS spin-off HOBBS AND SHAW second with $4.6 million. By 2021 the top title in-year, Egyptian comedy A STAND WORTHY OF MEN (WA’FET REGALA), had generated a massive $15.6 million – this was overtaken in terms of top release by SPIDER-MAN: NO WAY HOME ($16.9m). The third-placed title, CRUELLA, had matched JOKER’s $9.1 million and a total of 15 titles had grossed more than HOBBS AND SHAW’s $4.6 million.

It is not just major blockbusters benefiting, with the relative novelty of cinema itself seeming to help some, especially action, titles overperform in the territory compared to other markets. In 2020 the top film, as it was in the US, was BAD BOYS FOR LIFE ($8.8m) with TENET third ($6.25m), but between them was Liam Neeson vehicle HONEST THIEF ($7.7m) while the top five were rounded out by Gerard Butler disaster movie GREENLAND ($5.3m) and the live action MULAN ($4.6m). Saudi Arabia was the top earning international market on both HONEST THIEF and GREENLAND, representing 17.3% and 10.6% of each film’s worldwide market share, respectively.

Guy Ritchie’s WRATH OF MAN came in at #4 in 2021 with $8.3 million. The film narrowly outperformed NO TIME TO DIE ($8.05m) – the Bond film not having an existing cinematic legacy in the new cinema market – but, more significantly, KSA represented 7.71% of WRATH OF MAN’s global market share compared to 1.11% on the Bond title.

Current #1, Michael Bay’s AMBULANCE, sees KSA as its top performing territory so far, ahead of markets releasing the film the same day, including Mexico and UAE. The film’s second weekend, which dropped just 20% from its launch, was less than 2% lower than the opening weekend in leading EMEA box office market UK/Ireland.

However, the expansion of the market might also suggest an expansion of the types of movies finding favour. In total, according to data from our partners at Comscore Movies, action/adventure movies accounted for 46% of total box office in 2019 and 48% in 2020. In 2021 this dropped to 41% of box office with more of a mix among the year’s top 10 including three Egyptian comedies: A STAND WORTHY OF MEN, NOT ME (MESH ANA) ($8.25m), and MUM IS PREGNANT (MAMA HAMEL) ($6m); family title CRUELLA; and horror A QUIET PLACE, PART II ($6.2m).

Another Egyptian comedy, January-release FOR ZIKO, is the top title to date in 2022 ($11m).

Where Next?

How a rapidly emerging market might progress in always difficult to judge. However, Saudi Arabia’s arrival on the international box office scene has coincided with the COVID-19 pandemic which makes it even more unpredictable as none of the data for years’ past can provide any real trend-line.

The market only opened in 2018 and began 2019 at very low levels of box office, not rising above 1 million Saudi Riyals (currently approximately $267,000) in any given play-week until mid-April of that year. By June 2019 it had topped 10 million Riyals for the first time; in the opening play-weeks of 2020 it was on the cusp of 20 million before the pandemic brought a 12-week shutdown between mid-March and the end of May.

By the end of July business was back to 10 million Riyal levels but it would take until the first play-week of 2021 (beginning December 31, 2020) for the market to record its first 20 million Riyals week, fuelled by Pixar’s SOUL, in week 2, enjoying a 57% rise from its opening week; WONDER WOMAN 1984 at #2 in week 3; and relatively obscure new-release thrillers PRIMAL, starring Nicolas Cage, and LEGACY OF LIES landing the #3 and #4 spots.

The June 3 play-week that year brought a first 30 million Riyals box office (with CRUELLA #1 in week 2, supported by the opening of THE CONJURING: THE DEVIL MADE ME DO IT at #2) – a level repeated three more times in 2021 and again, for the first time in 2022, just a few weeks ago in the March 10, 2022 play-week (when THE BATMAN saw an 11% rise in business in week 2 and Pixar’s TURNING RED delivered an opening week box office of $1.46 million).

An article on the BBC in 2018 noted that “Saudi authorities and cinema operators believe there is a huge untapped market that could generate up to $1bn in annual ticket sales by 2030.”

Given how quickly the market has already achieved near quarter of that goal, despite having to contend with resulting disruptions (not least to the pipeline of Hollywood releases) of the pandemic, and the potential, in our estimation, of it rising to perhaps 30-35% of that goal this year, the overall expectation of KSA becoming a $1 billion market by the close of the decade does not seem unreasonable. Even at a compound growth rate of just 18% per year (including in 2022) the market would hit that target.

This is certain to make Saudi Arabia an increasingly key player in the strategy of Hollywood studios in the coming years.