It seems safe to say that most of the distribution and exhibition community will be glad to put March 2025 behind it. It proved a largely dismal box office month with a Global box office of just $1.725 billion.

That makes March 2025’s box office the lowest single-month result in two and a half years. Analysts have to look back to September 2022 for a worse single-month result ($1.36bn)! It’s also the first month to drop below $2 billion globally since September last year ($1.76bn).

The Global March result was -32% behind March 2024, -16% behind the same month in 2023 and a massive -46% behind the average of the last three pre-pandemic years (2017-2019).

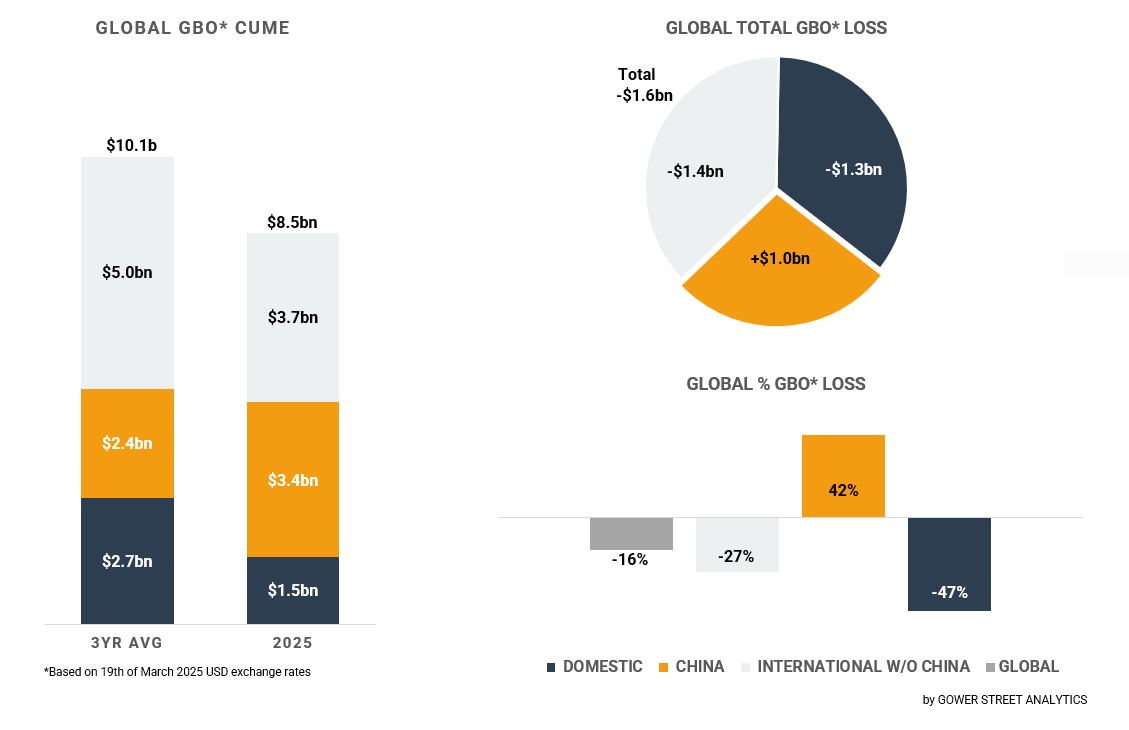

At the close of Q1 the Global box office stood at $8.49 billion for 2025. Thanks to the robust Chinese Q1 and a solid International result this has put the current year +7% ahead of 2024 at the same stage, +9% ahead of 2023, and -16% behind the average of the last three pre-pandemic years (2017-2019).

On this month’s Global Box Office Tracker (GBOT, above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

Domestic

The Domestic market once again took a bigger hit than China and the International (exc. China) market, where local titles were once again drawing audiences and filling gaps in many markets. The Domestic market grossed an estimated $416 million, putting it -45% behind 2024, -37% behind 2023, and -59% behind the pre-pandemic average. It was the lowest March result in the market since 2021!

At the close of Q1 the Domestic market stands at $1.46 billion. That puts it -13% behind the same stage in 2024, -17% behind Q1 2023, and -47% behind the 2017-2019 average.

China

China took in $263 million in March. That was on par with the same month in 2023 but down -31% on 2024 and -54% behind the pre-pandemic average.

Thanks to the record-breaking Chinese New Year, fuelled by NE ZHA 2, the market enjoyed a $3.37 billion Q1. This marks another Chinese record! The quarter was +46% ahead of the same period in 2024, +54% ahead of Q1 2023, and stands +42% ahead of the pre-pandemic average.

International (exc. China)

The International market (exc. China) fared slightly better than both China and Domestic in March. Total International (exc. China) box office for the month hit $1.045 billion. This was -26% behind 2024, -9% down on 2024, and a slimmer -36% short of the 2017-2019 average. Even so it was the worst March since 2022.

As Q1 came to an end the region’s box office hit $3.66 billion. This put it -7% behind 2024 at the same point, -5% behind Q1 2023, and -27% behind an average of the last three pre-pandemic years. Even so those figures are much healthier than the Domestic market.

Outlook

March may have been a month to forget but the first quarter was stronger, and not purely because a singular Chinese title. Even so the reliance on local hits was what prevented the International marketplace from suffering as badly as the Domestic market.

Cinemas are looking to Q2 to bring the Hollywood gold-rush! With a late Easter, school holidays dominate many markets in April which offers fertile ground to this week’s A MINECRAFT MOVIE. Then a slew of blockbusters come thick-and-fast in May and June, kicking off with Marvel’s THUNDERBOLTS*. This is followed by horror reboot FINAL DESTINATION: BLOODLINES, the live action version of Disney classic LILO & STITCH, Tom Cruise taken on one last mission in MISSION: IMPOSSIBLE – THE FINAL RECKONING, and Jackie Chan teaming with Ralph Macchio for crossover legacy sequel KARATE KID: LEGENDS!

June is looking equally stacked with Lionsgate’s JOHN WICK spin-off BALLERINA, DreamWorks taking a leaf out of Disney’s book with a live action version of hit animation HOW TO TRAIN TO YOUR DRAGON, Danny Boyle’s bringing the horror franchise he began back to life with 28 YEARS LATER, Pixar’s ELIO, Warner Bros’ epic F1, and horror sequel M3GAN 2.0.

Things are definitely looking up for Q2!