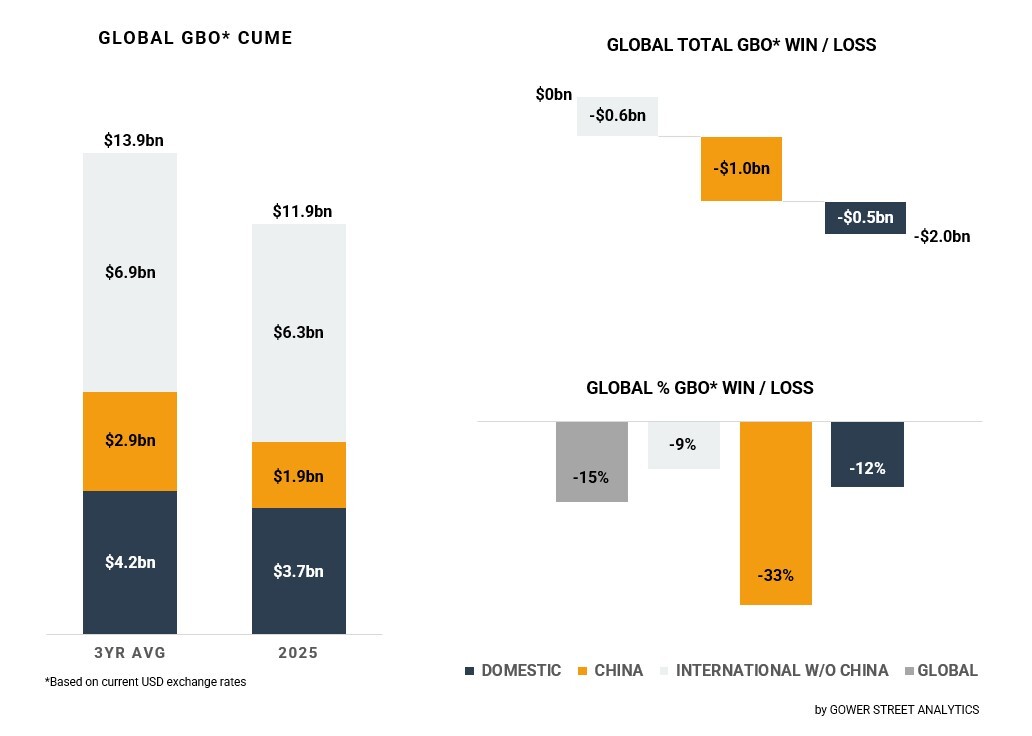

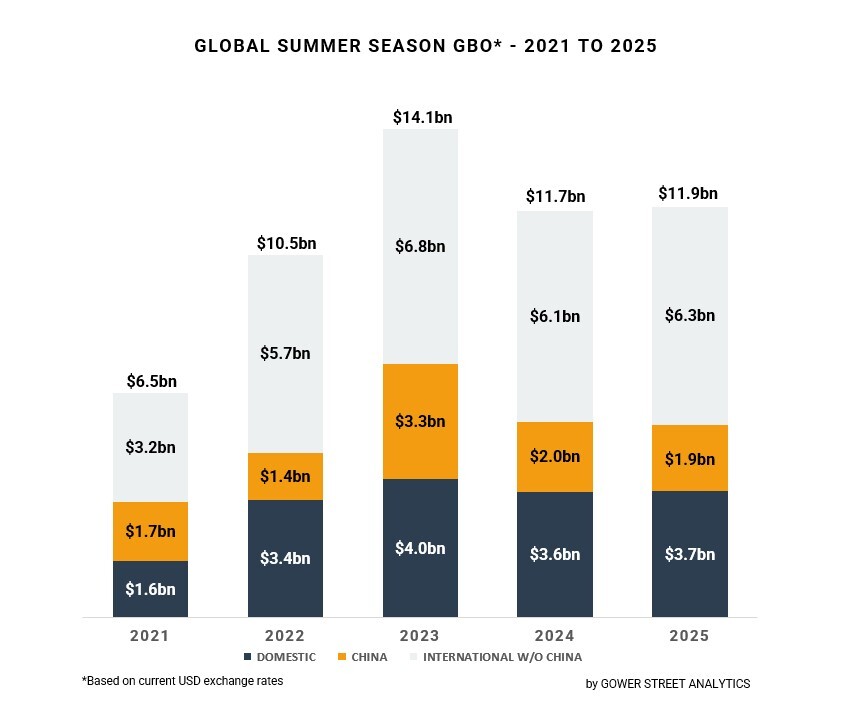

As reported on our latest Global Box Office Tracker for August, the result for this year’s Global summer box office (May 1 to Aug. 31) has come in at $11.9 billion. That is the 2nd best summer season since 2019, only behind the ‘Barbenheimer’ summer of 2023 (-16%, $14.1bn). This is slightly ahead of 2024’s summer season (+1%, $11.7bn) and -15% below the three-year pre-pandemic average (2017-2019) for this season ($13.9bln).

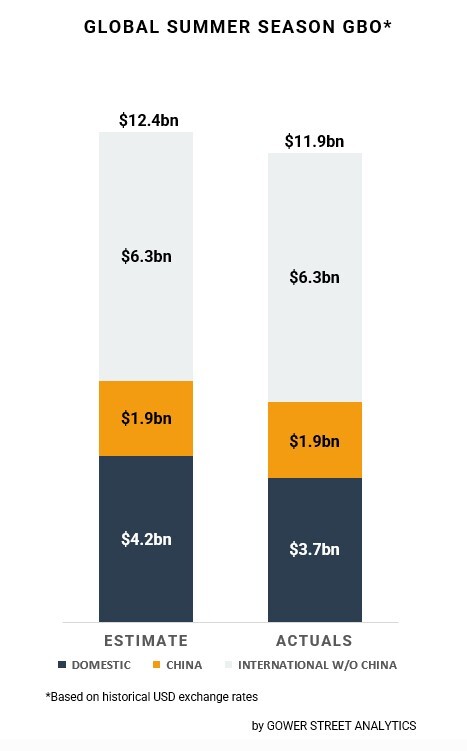

We provided estimates for the summer, on request to trade press in mid-June (see Deadline’s original article here). The Domestic market came in below our estimate. The International (exc. China) and Chinese results came in in-line with our projections. Internationally Hollywood titles performed significantly closer to our expectations. Additionally overall International results also benefitted slightly (by approximately $300m, which is less than a 5% variance) from exchange rate fluctuations between the rates used for the estimate provided and those currently. This, once again, showcases the importance of varied content including local content that can maintain, support and boost cinemas alongside a robust Hollywood slate of titles.

The International market (excluding China) saw the best result, earning $6.3 billion. That is +4% up on last year ($6.1bn) and -7% below 2023 ($6.8bn). It is also only -9% below the pre-pandemic average for this period ($6.9bn).

The Domestic market is a bit behind International with $3.67 billion, although that is still marginally above last year (+1%, $3.64bn). It is -8% behind 2023 ($4bn) and -12% below the level of the 2017-2019 average for this period ($4.16bn).

The Chinese market had the weakest summer with only $1.9 billion. That is below the past two summer periods: -6% down on last year ($2bn) and -43% below 2023 ($3.3bn). More significantly it is -33% below the pre-pandemic average for this period ($2.9bn)!

Each of these three key markets can be compared to the other post-pandemic years on the graph below:

WHAT: TOP TITLES

The Top 5 global releases this summer generated a combined box office of $3.75 billion. This is nearly a third of the global summer total (32%). The highest grossing global release was Disney’s LILO & STITCH with $1.035 billion. The only US release this year so far to cross the $1 billion mark. The second highest grossing title was Universal’s JURASSIC WORLD: REBIRTH with $855 million in the period. The live action version of Universal’s HOW TO TRAIN YOUR DRAGON came in third place, grossing $632 million globally. Apple’s F1® THE MOVIE (distributed by Warner Bros.) rushed to rank #4 with a cume of $613 million within the summer season. At #5 Warner’s SUPERMAN delivered a global total of $611 million.

Two international releases that had a significant impact on the summer box office were Chinese war drama DEAD TO RIGHTS and Japan’s anime smash DEMON SLAYER: INFINITY CASTLE. DEAD TO RIGHTS didn’t travel and grossed $404 million of its $407 million cume only in China. DEMON SLAYER: INFINITY CASTLE had a bigger share in the Asian markets outside of Japan it already opened in with approximately $50 million of its $251 million global cume at the end of August.

WHERE: SUB-REGIONS

This was one of the key elements that got the international sub-region of Asia Pacific (excluding China) performing +19% above the summer period last year, the best of the three sub-regions. Asia Pacific (excluding China) also had the lowest drop against the summer of 2023 (-4%). Even so it was the only sub-region that didn’t beat the summer total of 2022, being marginally down by -1%. Further Asia Pacific (excluding China) had the biggest gap to the pre-pandemic average with -12%.

In contrast, the sub-region of Latin America had the smallest gap to the three-year benchmark being, down just -2%. At the same time it had the highest drop to the summer season last year with -7%. It also dropped -6% to the period in 2023, which is in the middle of the three sub-regions.

Europe, Middle East and Africa (EMEA) had the biggest fall to the record-breaking Barbenheimer summer of 2023 being down -10%. The sub-region solidly ranked as second best sub-region against last year (-2%) and the level of the 2017-2019 average for this period (-8%).

WHEN: MONTHLY COMPARISON

The summer season at the global box office started strong in May except for China. The International (excluding China) and Domestic markets recorded the highest grossing May since 2019. May was +40% up on the same month last year and +3% on the same month in 2023. Also, the gap to the average of the last three pre-pandemic years (2017-2019) was at a narrow -6%! In contrast to the global box office trend China recorded the second lowest May result of the past five years, -55% percent below the pre-pandemic average.

June saw mixed results. On one side the sub-regions of EMEA and Latin America both performed well above the pre-pandemic three-year average (2017-2019) by +5% and +3% respectively. The Domestic market had to carry the burden of the high bar previous Junes have set, which were some of the best months of the decade: June 2023 ranking #5 (-16%), June 2022 #7 (-15%) and June 2024 #8 (-14%). This June the Domestic market was -27% below the pre-pandemic three-year average, weaker than most other major markets. Just China also had another weak month, recording the lowest grossing June in China this decade, ignoring that of 2020 when cinemas were closed. The market performed only half of the pre-pandemic average for the month.

In July the Domestic and International (exc. China) markets posted their biggest monthly results of 2025 so far. Despite the success the figures were not totally enough to match the Global or Domestic results for the month in the past two years, both of which saw $1 billion global releases in mid-July. The Domestic market was -4% behind 2024, while being -16% behind 2023. However, the International (exc. China) market was especially strong this year with box office surpassing July 2024 by +4%. It still lagged that phenomenal 2023 result, but by a slimmer -11%. China recovered a bit compared to the prior months in July, coming in at least just -29% behind the average of the last three pre-pandemic years (2017-2019).

In August the Chinese box office woke up more recording the second highest August result of the past five years, just behind the record year 2023 (-23%). The gap to the pre-pandemic average was also a summer season best of just -16%. The international sub-region of Asia Pacific (excluding China) had an even better month than China, recording the highest monthly box office since August 2019! The rest of the global market had a more muted August. The Domestic and International (exc. China) markets combined were -10% below last August, the biggest gap month-on-month over the summer season. The month also was -13% below the three-year benchmark, the second worst, behind June (-14%).