Last week, even before President Trump laid out a set of guidelines for how states might be able to re-open domestic movie theaters, Cinemark suggested a goal to start having sites re-open at the beginning of July. UNIC (the international union of cinemas), while not committing to dates, also suggested it has a July timeline “in mind” for re-openings.

Major titles were exiting the calendar even before mass theater closures took hold across North America in mid-March. Many titles have found a new, for some possibly tentative, new home on the calendar either later this year or by moving into next. Other titles have, in turn, been displaced; a few have abandoned theatrical plans completely; and others remain unset. So, what does the current landscape look like?

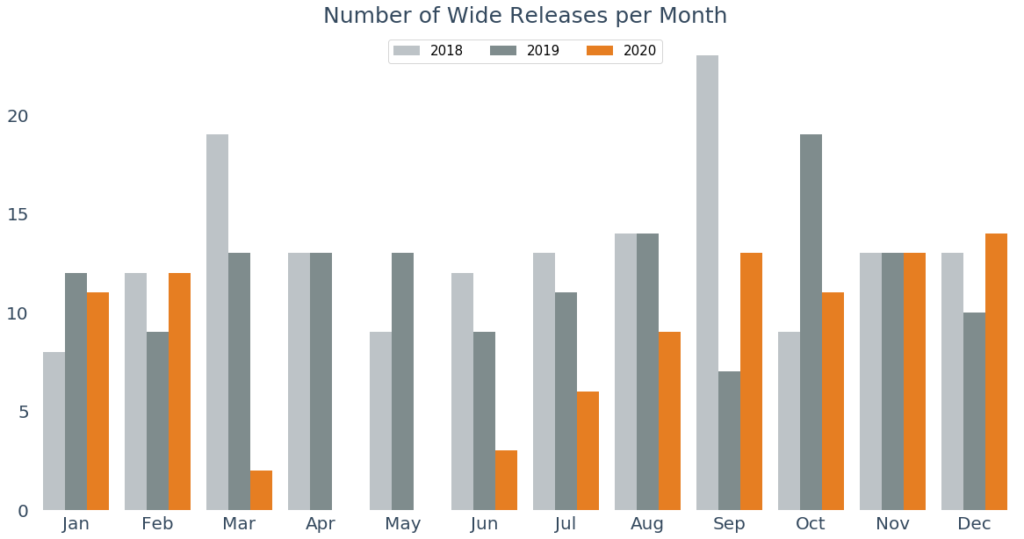

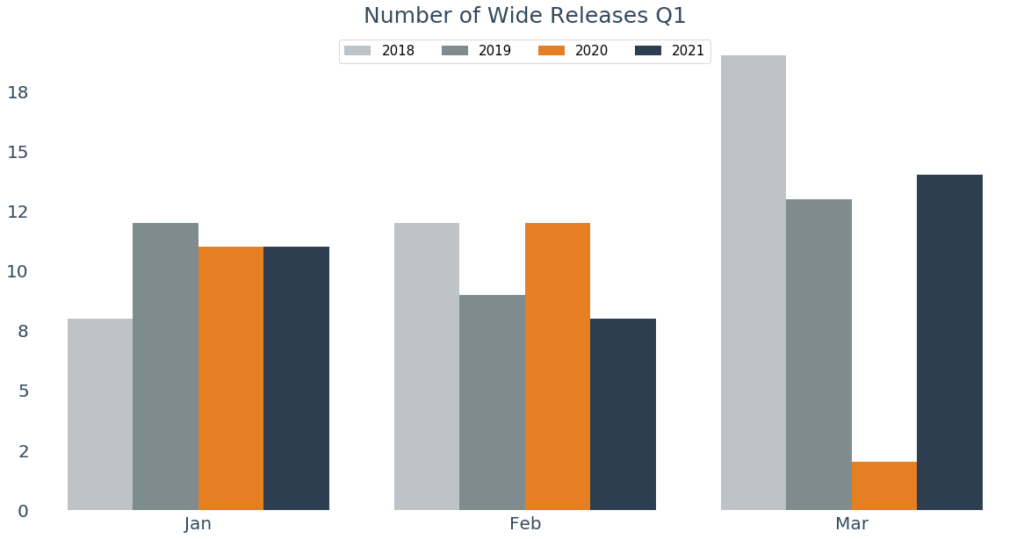

Gower Street has looked ahead at what is currently dated through the back end of 2020 and into 2021. We’ve compared the number of titles from the past two years (2018 and 2019) released in at least 1,000 domestic theaters and, considering box office results of those past-year movies, analyzed how these numbers compare to currently dated upcoming titles of 2020 and 2021 that Gower Street analysts estimate would expect to see a similar minimum-level of release.

The first graph (above) looks at 2020 releases currently scheduled compared to 2018 and 2019. The exodus of titles from March and Q2 is evident. At present there are 33% fewer titles, of the scale mentioned, that have or are due to open in 2020 compared to 2019 and 40% less than 2018. This is largely due to the March-June period devastated by the virus, with the remaining eight months collectively seeing numbers on par with 2019. A few stragglers remain dated in June but, even if these don’t move in time, it is questionable how many theaters would be ready to play them.

Q3 is where titles start to re-emerge but with uncertainty rife July has less titles dated than the same month last year and August is also behind. It is unlikely many more titles will opt for July. This is not just due to the uncertainty of re-opening and audience return but also the threat of the titles that are dated. Christopher Nolan’s TENET, which to date has held fast to its July 17 release, is currently the first major tentpole set to test the waters, with the younger-skewing MULAN a week later.

August is not traditionally a month that draws many blockbusters. Last year HOBBS AND SHAW (launched Aug. 2) was the only August release that delivered more than $100 million domestic. With WONDER WOMAN 1984, one of the most anticipated titles of this year, now re-positioned to August 14 it is unsurprising others are wary of dating near it (that mid-month spot leaves little room). Animated title THE SPONGEBOB MOVIE: SPONGE ON THE RUN will go a week ahead.

September and Q4 are quickly filling up, offering a stronger end of year line-up than was anticipated at year’s start. September 2019 had a relatively low number of wide releases compared to the previous year (less than one third of 2018, when titles sought to avoid IT: CHAPTER TWO). This year A QUIET PLACE, PART II and the third CONJURING film compete for audience attention.

October has fewer wide-release titles scheduled than in 2019 but those present include franchise heavy-hitters VENOM 2, DEATH ON THE NILE and HALLOWEEN KILLS. November already sees the number of releases on par with the previous two years, with BLACK WIDOW, SOUL, GODZILLA VS KONG, and NO TIME TO DIE leaving little room for others to jump in.

December 2020 has 40% more releases scheduled as were released the same month in 2019 (14 vs 10) – and that is without a single title willing to go in the first week of December against the second week of the Bond film. Last year big franchise hitters STAR WARS: THE RISE OF SKYWALKER and JUMANJI: THE NEXT LEVEL kept competitors low. Titles moving in this year include Disney’s FREE GUY and Paramount’s TOP GUN: MAVERICK (which displaced THE TOMORROW WAR). However, this does include titles due to open in December but which will not expand wide until January, such as RESPECT and THE LAST DUEL.

The second graph (below) looks ahead to 2021 and specifically Q1. The full year has more titles dated than we’re expecting to see in 2020 but there is still a lot of space to be found beyond Q1, which already has as many new release titles set as seen in Q1 2019. February currently sees fewer titles than 2020. This is likely due to the presence of ETERNALS in a mid-month slot equivalent to BLACK PANTHER in 2018. March is already seeing more titles scheduled than in 2019 with GHOSTBUSTERS: AFTERLIFE, RAYA AND THE LAST DRAGON, and MORBIUS all moving in during the past few weeks. Q2 has 40% less titles currently dated than the same period of 2019.

Among those still unset, Tom Hanks war drama GREYHOUND and musical IN THE HEIGHTS seem certain to look for awards-qualifying positions. There may be more that abandon theatrical plans, following titles like THE LOVEBIRDS, which sold to Netflix, and ARTEMIS FOWL, which will debut on Disney+.

A big challenge will be for horror titles. James Wan’s MALIGNANT, SAW spin-off SPIRAL, the Guillermo Del Toro-produced ANTLERS, and Janelle Monae-starrer ANTEBELLUM are among those still seeking new positions. September and October have three massive horror franchise titles set with A QUIET PLACE PART II, THE CONJURING: THE DEVIL MADE ME DO IT and HALLOWEEN KILLS. Add between these the remake of CANDYMAN and horror-edged comic-book title VENOM 2 and it would be a brave distributor that slotted another horror into that window.

December has proven a weak spot for the genre, even seasonally-edged like last year’s BLACK CHRISTMAS ($10.4m lifetime). The previous horror to try a December release had been 2016’s INCARNATE ($4.8m). November also proved no boon for last year’s DOCTOR SLEEP ($31.6m), 2018’s OVERLORD ($21.7m) and THE POSSESSION OF HANNAH GRACE ($14.8m), 2016’s SHUT IN ($6.9m), or 2015’s VICTOR FRANKENSTEIN ($5.8m). Given that 2018’s HALLOWEEN did 87% of its box office in its first two weeks, one option might be to go on Halloween weekend, two weeks after HALLOWEEN KILLS, to claim one dominant week before BLACK WIDOW enters the frame.

There will inevitably be further moves, both in and out of this year, but the biggest fear is yet another unknown: with so much riding on Q4 and Q1 what will audiences and the industry do if there is a resurgence of the virus before any vaccine is developed?

This article was original published in Screendollars’ newsletter #113 (April 20, 2020). Please note: in the original article the title count for December 2019 was incorrectly shown as 7 rather than 10. This has been corrected in the above.

If you have comments or questions about Gower Street’s charts please contact us.