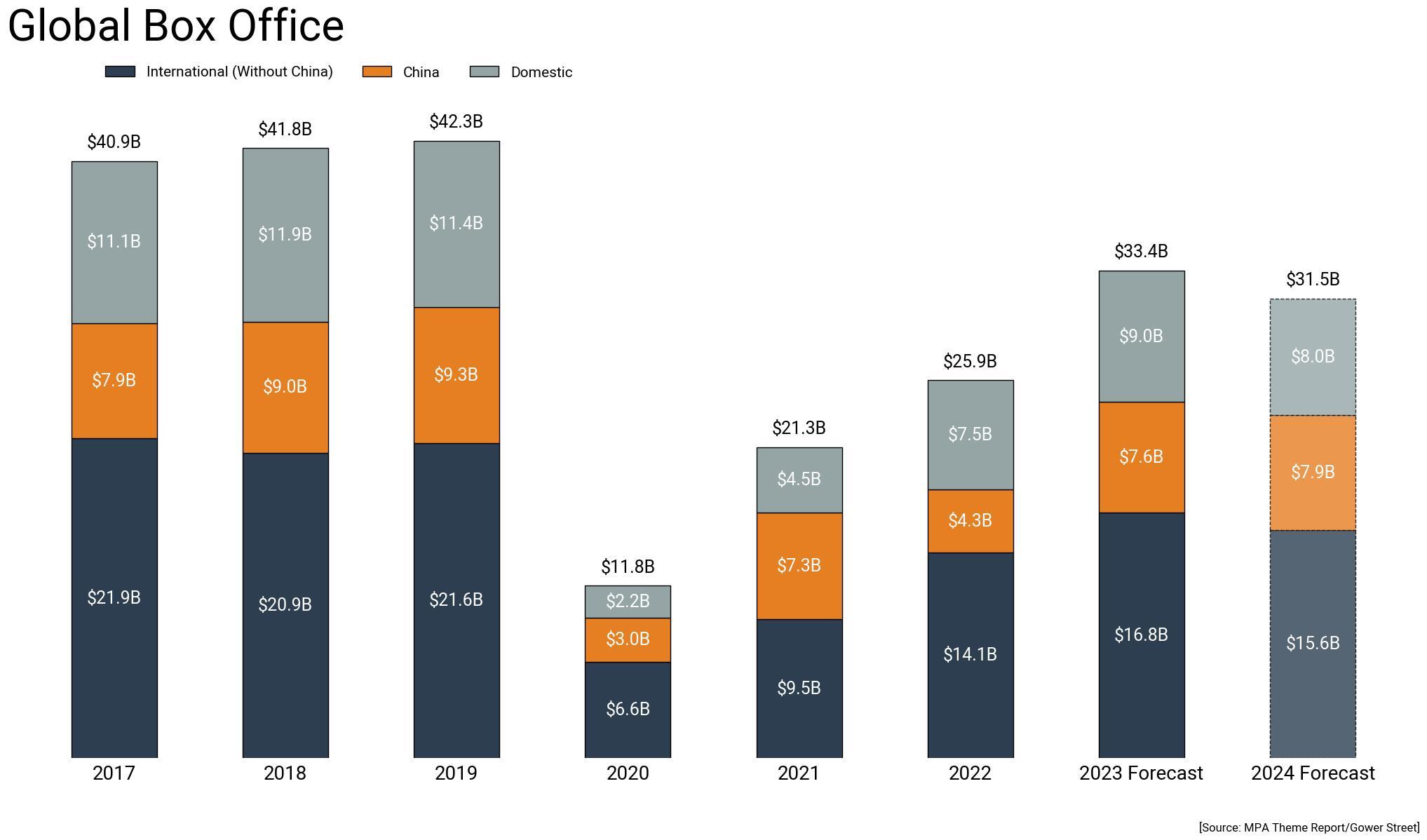

Gower Street Analytics estimates 2024 Global box office will reach $31.5 billion.

This marks the first post-pandemic downturn in Gower Street’s annual forecast, with 2024 currently anticipated to finish approximately 5% behind the estimated full-year 2023 result (currently estimated at $33.4bn). A final Gower Street 2023 Global box office estimate will be released in the first week of January.

“Given that we lost 50% of production time in 2023, the anticipated 5% year-on-year decrease in 2023 is not indicative of a declining interest in cinema, but simply a direct consequence of limited product availability,” said Gower Street CEO Dimitrios Mitsinikos. “In fact, as July 2023 marked a record-breaking month at the Global box office, we know that there is a robust audience demand for compelling theatrical releases.”

The 2024 Global projection would put the year -20% against the average of the last three pre-pandemic years (2017-2019).

“The impact of the recent writers’ and actors’ strikes on the release calendar, in terms of global-appeal Hollywood product, has been significant,” said Rob Mitchell, Director of Theatrical Insights at Gower Street. “That is the key driver of this slight regression in recovery momentum we’re seeing in 2024 that looks to postpone any chance of returning to pre-pandemic levels until 2025.”

A number of major titles have postponed previously-scheduled 2024 release until 2025. These include a host of Disney titles, including Marvel’s BLADE, CAPTAIN AMERICA: BRAVE NEW WORLD, FANTASTIC FOUR, and THUNDERBOLTS, the live action SNOW WHITE, James Cameron’s AVATAR 3, and Pixar’s ELIO. Other major titles delayed until 2025 include Paramount’s MISSION: IMPOSSIBLE – DEAD RECKONING, PART 2, and Lionsgate’s as-yet-untitled DIRTY DANCING sequel. There are also titles, such as Sony’s SPIDER-MAN: BEYOND THE SPIDER-VERSE, which are yet to land on a new date having been removed from the 2024 release calendar.

“Based on productions currently on our radar, we expect 2025 to be a very good year at the Global box office and hopefully a positive trend-setter for the second half of this decade,” added Gower Street CEO Dimitrios Mitsinikos.

Of course, space in the 2024 release calendar can also offer opportunity for both non-Hollywood titles and alternative offerings. Such examples have been seen recently with the $250 million-grossing global concert hit TAYLOR SWIFT: THE ERAS TOUR and the ongoing Domestic and International successes for titles such as THE BOY AND THE HERON and GODZILLA MINUS ONE from Japan.

For 2024 the Domestic (North American) market is anticipated to finish 11% down on 2023 (est.) at approximately $8.0 billion. This is -30% against the 2017-2019 average and only a slim +7% ahead of 2022.

The International market (excluding China) is anticipated to finish 7% down on 2023 (est.) at approximately $15.6 billion, aiding by local productions. This is -21% against the 2017-2019 average but +12% ahead of 2022. Within this the three key regions are estimated as follows:

• EMEA $8.0bn (-23% vs 2017-2019 ave; -9% vs 2023 est., +13% vs 2022)

• Asia Pacific (exc. China) $5.2bn (-22% vs 2017-2019 ave, -2% vs 2023 est., +6% vs 2022)

• Latin America $2.4bn (-15% vs 2017-2019 ave, -8% vs 2023 est., +22% vs 2022)

Increasingly less reliant on Hollywood product, China currently shows a modest year-on-year gain in its 2024 projection at $7.9 billion (+5% vs 2023 est.). However, due to the limited release calendar at this stage it remains the hardest market to predict.

“The International market is a bit less impacted by the limited release calendar caused by the Hollywood strike, compared to Domestic,” said Gower Street’s chief analyst Thomas Beranek who led the work on the 2024 projection, which utilizes data from Gower Street’s flagship FORECAST service based on the current release calendar alongside additional analyst assessment. “Local and international titles have more space to shine in each market when the supply of attractive US-product is shortened. This has been proven frequently since the pandemic disrupted both production and release cycles in 2020.”

It should be noted that this is a very early prediction and Gower Street would expect to see further changes to the release calendar result in some fluctuation. There are also a significant number of “Untitled” studio releases currently dated which, as more becomes known about these titles, are likely to impact projections. The projection can also not account for unexpected global events.

Please note: Figures shown in the stacked bar graph show US$ figures at historical exchange rates for years prior to 2023 and at current exchange rates for Forecast years (2023-2024). Percentage comparisons for 2024 against pre-pandemic years in the text are based on like-for-like local currency numbers converted at current exchange rates for greater accuracy.