The summer season kept rolling in June. Strong holdovers and weekly wide releases delivered a solid Global box office of $2.5 billion. Not every release succeeded, but multiple hit. The sub-regions of Europe, Middle East, and Africa (EMEA) and Latin America both performed well above the pre-pandemic three-year average (2017-2019) by +5% and +3% respectively. However, Asia Pacific continued to struggle, especially China. The Domestic market had to carry the burden of the high bar previous Junes have set.

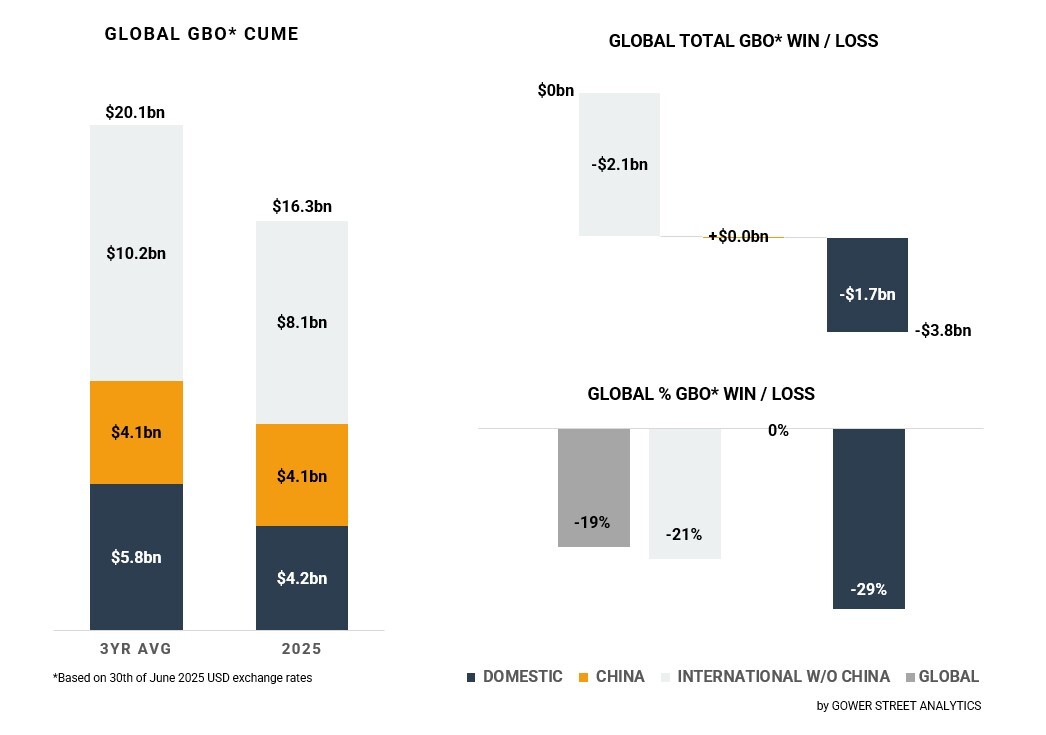

After the first half year the total Global box office is estimated to have reached $16.3 billion for 2025. That is +8% above the same period last year and only -3% below the one in 2023. Overall, it’s the fourth highest grossing half year of the decade behind the second halves of 2024 (-2%) and the year before (-6%). The Global cume remains -19% (or $3.8 billion) behind the pre-pandemic three-year average for the second month in a row.

This June, weekly wide releases and strong holdover titles allowed six global releases to gross more than $100 million within the month. The combined box office of these six titles was $1.5 billion! The highest grossing global movie in June was Universal’s live-action version of HOW TO TRAIN YOUR DRAGON with an impressive $463 million. This was followed by a pair of strong May holdovers: Disney’s LILO & STITCH (adding $395m in June) and Paramount’s MISSION: IMPOSSIBLE – THE FINAL RECKONING ($244m). Warner Bros’ release of Apple’s F1® THE MOVIE made a great start off the grid on the final weekend of the month, taking $164 million. Lionsgate’s JOHN WICK spin-off BALLERINA was 5th for the month with $128 million. To complete the studio set, Sony’s 28 YEARS LATER slipped over the $100 million mark before month-end to deliver $106 million.

On this month’s Global Box Office Tracker (GBOT, above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

International box office (excluding China)

An International skew of the major global releases in the market supported an overperformance of the International box office (excluding China) in June. The region contributed 56% of the worldwide box office in the month. This is the second highest share within any month of this year so far and significantly above the historical 47%. The month of June is usual a weaker season for the region, grossing the second lowest box office of the year. This year June was better, recording the third best month of the year so far with $1.43 billion, only -1% behind May and -7% below January. It’s also only -5% below the pre-pandemic average for the month. That is the lowest gap of the past 12 months!

China

China’s box office has been in a slump for multiple months. After touching light with the record shattering NE ZHA 2 results in January and February the market fell off. June was another weak month, grossing $262 million. That is just marginally stronger than the prior months. It was the lowest grossing June in China this decade, ignoring that of 2020 when cinemas were closed. The market performed only half of the pre-pandemic average for the month. The four months after February recorded four of the five widest gaps to the historic benchmark in the past 12 months.

The Chinese market desperately needs a blockbuster by the market’s standards. In May, no title was able to even cross the $50 million mark within the month. It was a rare month, where two of the top 3 movies were coming from the US. MISSION: IMPOSSIBLE grabbed the top spot adding $48 million for a $64 million cume. Local crime drama SHE’S GOT NO NAME grossed a solid $46 million at #2. HOW TO TRAIN YOUR DRAGON followed at #3 with $32 million. Japanese franchise hit DETECTIVE CONAN: ONE-EYED FLASHBACK generated a strong $24 million over the last four days of June.

Despite the poor box office since March, the first two months of the year were so astonishingly strong that China still recorded the highest grossing half year of the pandemic. Just +2% ahead of the second half year of 2023. This is even with the pre-pandemic average. It is the second-best value of the tracked Top 20 major markets. Still, it is a long way down from the peak of +72% at the end of February. Up until now, China was the global market with the highest cumulative box office in 2025. At the end of June, the Domestic market gained that spot with a total of $4.15 billion, while China stands at $4.06 billion.

Domestic

Despite achieving the “highest grossing global territory” title for the first time this year, the month of June brought mixed results for the Domestic market. It’s historically the third highest grossing month of the year. Achieving $843 million is below the strong June results of the past three years, which were some of the best months of the decade: June 2023 ranking #4 (-16%), June 2022 #6 (-15%) and June 2024 #7 (-14%). This June the Domestic market is -27% below the pre-pandemic three-year average, weaker than most other major markets.

In the past years June always had at least one movie breaking above the $300 million mark within the month. Last year had INSIDE OUT 2 ($469m), 2023 SPIDER-MAN: ACROSS THE SPIDER-VERSE ($332m), and 2022 both TOP GUN: MAVERICK ($362m) and JURASSIC WORLD: DOMINION ($316m). This year the $200 million mark was just barely achieved by HOW TO TRAIN YOUR DRAGON ($203m). The box office was a bit more spread out among multiple movies. Six movies were able to cross $50 million, the third most this decade; on par with July last year. Nine titles crossed $30 million in June, the decade’s best, in line with December 2023 and February 2020, though not enough to balance out the missing blockbuster break-out box office.

Still, June was the third best month of the year so far and closed a very strong quarter, being neck-and- neck with the highest grossing quarters of the decade. It was in-line with Q2 (-0.4%) and Q3 2023 (-0.4%) plus marginally behind Q3 last year (-1.2%). This encouraging quarter narrowed the gap to the three-year average significantly from -47% at the end of Q1 to -29% now. Regardless of this impressive improvement, the Domestic market only ranks #15 of the tracked Top 20 major markets compared to the pre-pandemic average. However, it has the fourth biggest year-on-year growth of the tracked Top 20 major markets after six months with +13%.

Outlook

June had many stories of success to tell. Compared to most periods this decade a wider range of product was on offer. Not everything broke through, but much did. Moreover, the increased choice in itself supports a sustainable future of the theatrical business, widening the breadth of audiences coming to cinemas.

In July, the theatrical market continues to see strong line-up, promising further prosperous months of multiple tentpoles and robust holdovers. A trio of major blockbuster arrive in July with JURASSIC WORLD: REBIRTH, SUPERMAN and THE FANTASTIC FOUR: FIRST STEPS. The month is complemented by the family-targeted SMURFS and horror re-quel I KNOW WHAT YOU DID LAST SUMMER.

The summer this year shouldn’t end in July. August also has a diversely filled release calendar for the season with FREAKIER FRIDAY, BAD GUYS 2, NAKED GUN, WEAPONS, NOBODY 2 and THE ROSES. That should ideally extend the successful summer we’re in!