In November, global cinemas accounted for $0.8 billion box office. This is the lowest result since July. While being at the low end of the last four months, the November box office isn’t a sign of a new dramatic downwards trend. It is more an illustration of the current dependency of global results from the size of new released Chinese blockbusters in the remaining absence of Hollywood studio titles.

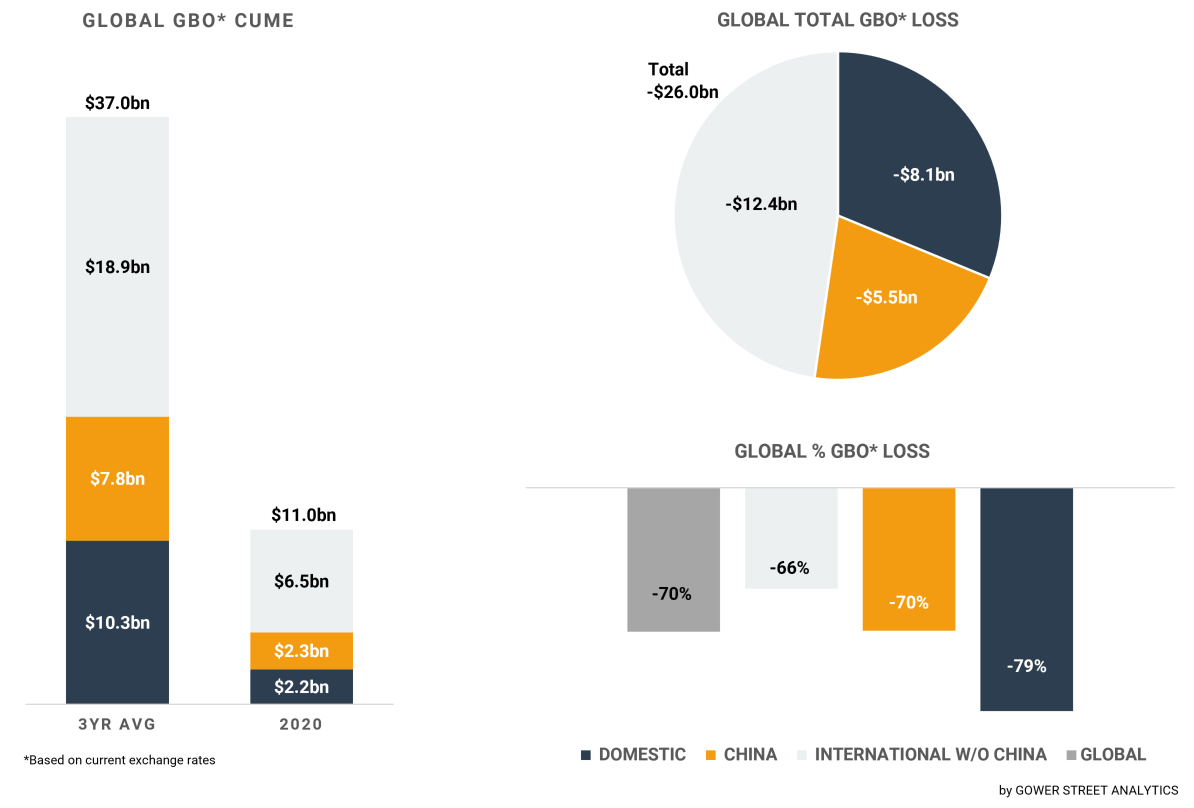

The latest update of Gower Street’s Global Box Office Tracker (GBOT) shows that the 2020 global box office grew to $11.0 billion in November from $10.2 billion a month ago. From the beginning of April, when it stood at $5.9 billion, until the end of November, box office grew in total by $5.1 billion.

The main part of the global box office growth in November was delivered across the International market (excluding China) with $0.5 billion. This is the same ballpark as in the prior months, bringing the cume to $6.5 billion by the end of November.

Compared to the performance in previous months China is showing the biggest variance. Coming out of the historically hugely lucrative October that delivered $0.9 billion, November came in at just $0.3 billion. This was driven by the traditionally weaker season of the year and the lack of outstanding-performing releases like THE EIGHT HUNDRED (now at $437m) in August and September. The Chinese 2020 cume grew from $2.06 billion to $2.33 billion within last month.

The Domestic market clearly continues to be the slowest growing among these three, again contributing only $0.1 billion. Domestic box office in November increased from $2.13 billion to just $2.20 billion.

The stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three years and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

In China, the month of November saw no movie crossing $100 million in contrast to previous months. Its highest grossing title in November was the performance of holdover release THE SACRIFICE, which did $68 million of its current $165 million total. Just one new release, local crime thriller CAUGHT IN TIME, came near that number with $62 million in November. Still mainly driven by these two titles China has further reduced its percentage box office loss compared to the average box office over the previous three years from a peak of -94% in July to -70% now. Total loss grew slightly from -$5.3 billion to -$5.5 billion.

At the same time the International market (excluding China) lost another -$1.2 billion, which adds up to a loss of -$12.4 billion until the end of the month. That this number isn’t even bigger is down the positive development of APAC (excluding China) in general and Japan in particular. Over 80% (82%) of the International box office in November was generated in APAC (excluding China) and over half of that in Japan (54%). Mainly due to that, Japan, like China, has made significant headway in recouping market losses. Full-market box office in Japan is currently tracking -45% behind an average of the past three years, having been -65% behind in early July.

Japan’s phenomenon DEMON SLAYER THE MOVIE: MUGEN TRAIN is still the main cause of that while it continues to dominate. It has now been on top of the Japanese box office for seven weeks in a row and is already the #2 highest grossing movie of all-time in its home country ($261.1m), behind only 2001’s SPIRITED AWAY. The film has also held the #1 spot in Taiwan for five consecutive weeks and is now that market’s highest grossing animated film of all-time (now at $18m). Last, but not least, in Hong Kong DEMON SLAYER has led the charts for three weeks (now at $4m).

The main brake to further international recovery in November was Europe. The region delivered the lowest box office since June as its cinemas shut down in the majority of countries. After the rapid rise of COVID-19 cases in Europe, Italy and France were the first to re-close their cinemas in the final week of October. The UK, Germany, the Netherlands and Austria, among others, followed in November. At the end of the month the market share of theatres open across the EMEA region had fallen to 24%, a dramatic drop from a peak of 89% at the start of October!

The recovery from this second closure will take longer than December as the COVID-19 cases remain on a significant level around the continent. The Netherlands already re-opened their cinemas again at the end of November, while the UK (Dec. 3) and France (Dec. 15) follow in December. However, business will stay limited with even more severe restrictions put in place than before being re-closed. Germany and Italy are forced to sit out the usually very lucrative holiday season, as their cinemas won’t be allowed to re-open before the beginning of next year.

A more positive outlook comes from Latin America. Mexico and Brazil have further re-opened cinemas and in November they were joined by Colombia. Despite cinemas being allowed to re-open there with significant restrictions from late August few did so. Only on the Nov. 26-29 weekend did multiple circuits began their re-openings, which increased the number of cinemas open by market share to 32% and pushed Colombia to be the latest market to achieve the Stage 2 target of Gower Street’s Blueprint To Recovery as Latin America continues its slow return. Other Latin American heavyweight countries like Argentina, Chile and Peru are yet to comeback.

In the domestic market place the number of cinemas open by market share has unfortunately further come down in the period of November to just 41% for the Thanksgiving weekend. It had stood at 55% at the start of November, having hit 61% at the end of September. An additional rise in virus cases brought further lockdowns across a number of US states and Canadian provinces.

As a result of that the Domestic losses added another -$1 billion up to their now -$8.1 billion total. The percentage box office loss compared to the average box office over the previous three years grew too from -77% to -79%.

Especially impacted by the re-closure of many cinemas in the Domestic market and across Europe, the number of global cinemas open by market share dropped further to 60% at the end of November. This is down from 70% at the beginning of the month and a peak of 79% at the end of September.

At least Thanksgiving gave some hope with the rarity of a new studio release. Universal’s THE CROODS: A NEW AGE topped global business with $35 million from 8 markets, including $18.9 million in China on its opening weekend. The sequel had the biggest post-lockdown Domestic 3-day opening ($9.6 million) for any film to date. This shows that when attractive mass-audience titles are on offer there remains an audience appetite. In Domestic that seems even the case with a shortened window in place, as A NEW AGE will be available to rent digitally by Christmas. No numbers to rave about, but given the circumstances we’re in, this is a good sign for the future. WONDER WOMAN 1984, here we go.

This article was originally published in Screendollars’ newsletter #146 (December 7, 2020).