It is now three months since the majority of global cinemas closed down due to the COVID-19 pandemic. By the end of the box office week commencing March 13 less than 25% of global theaters were reporting business. A week earlier that number had been over 70%. A week later it would be it would be less than 6%!

Now, each week, we’re seeing positive news coming from the international marketplace; some form of growth, whether from a new market opening or an open market expanding its business. But there is a challenge facing all market exhibitors beyond their control: the lack of major global releases.

It will have come as a disappointment to exhibitors on Friday when they learned that two of the first major tent-poles still slated for release, including the seemingly rocksteady TENET, had moved. TENET, which has held fast to a July 17 date for months, shifted just a couple of weeks to July 31. Shifting further back is WONDER WOMAN 1984, from mid-August to October 2.

The moves sparked a flurry of activity in the domestic market. GREENLAND moved back two weeks and BILL AND TED FACE THE MUSIC jumped forward a week, both onto August 14. UNHINGED also shifted back to July 10. BIOS, which had been set for October 2, will now go in mid-April 2021. GODZILLA VS KONG and TOM AND JERRY have also now moved to 2021 dates, while Robert Zemeckis’ THE WITCHES is now unset (it had been Oct. 9). James Bond film NO TIME TO DIE moved up a few days. Meanwhile Disney’s THE ONE AND ONLY IVAN is the latest title to forego theatrical in favor of a Disney+ debut (it had been due Aug. 14).

Last week Gower Street’s Global Box Office Tracker showed year-on-year deficits were still growing significantly. This is of little surprise. By this point in 2019 titles released since mid-March had included: AVENGERS ENDGAME (GBO through June 16, 2019: $2.74bn); ALADDIN (approximately $725m); POKEMON DETECTIVE PIKACHU ($420m); SHAZAM! ($366m); DUMBO ($353m); GODZILLA: KING OF THE MONSTERS ($340m); JOHN WICK: CHAPTER 3 – PARABELLUM ($276m); US ($254m); X-MEN: DARK PHOENIX ($204m); THE SECRET LIFE OF PETS 2 ($155m); ROCKETMAN ($133m); PET SEMATARY ($113m); and MEN IN BLACK INTERNATIONAL ($102m after one weekend).

Those 13 titles alone delivered global box office of nearly $6.2 billion within the equivalent three-month period to that we have lost since mid-March in 2020. And that is not accounting for smaller titles released; local hits released; and holdover titles. South Korea, for example, had seen Palme d’Or (and eventual Oscar) winner PARASITE open May 30, grossing WON 71.5 billion ($60.2m) by June 16 – the end of its third weekend on release. The top holdover, CAPTAIN MARVEL, delivered close to $370 million between Monday March 18 (the day after its second weekend – the equivalent day to the start of this year’s mass closures) and mid-June.

Now more markets and movie theaters are opening, everyone is talking about the need for big global titles to give a much-needed boost and help drive more of the regular audience back into those restricted-capacity auditoria. Markets are seeing some new releases but the need for a global event movie is evident when you look at those operating, even the markets that appear to be doing well.

Let’s look at Netherlands and South Korea.

The Netherlands saw all cinemas implement a 100-person per auditoria capacity on Thursday March 12 before all major circuits closed completely from 6pm on Sunday March 15. At point of closure a strong Dutch market saw box office running 4% ahead of 2019. Cinemas in the market were allowed to re-open on Monday June 1. By that point, following 11 weeks of complete closure, the Dutch market now saw box office running at a deficit of 42% compared to the same point in 2019 – a loss of over €54 million ($61m) according to our partners at Comscore.

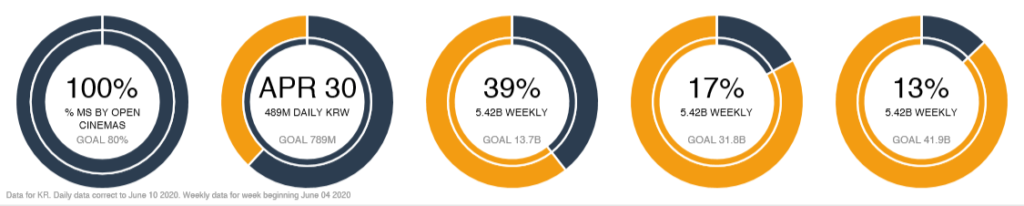

In contrast, South Korea never completely closed cinemas. Major circuits closed a portion of sites between late March and late April, when they re-opened for the April 30-May 3 holiday (Buddha’s Birthday) weekend. Despite this the market is suffering much bigger year-on-year losses than Netherlands, tracking 67% behind 2019 through May 31.

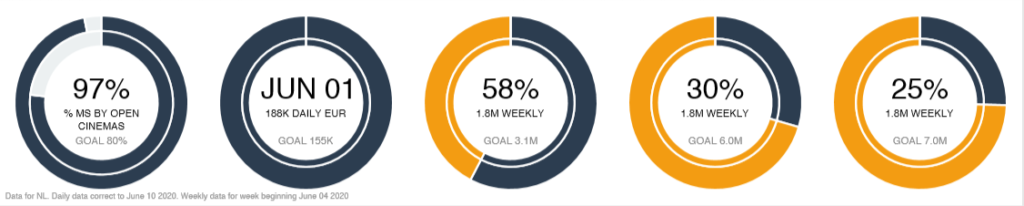

The Netherlands has seen an immediate positive response from local audiences to cinemas re-opening. Like Hong Kong, which we reported on a few weeks back, the market was able to bring the vast majority of cinemas back, albeit at reduced capacity, at the same time. Gower Street’s market growth tracker for the Netherlands (see above), which looks at progress towards the 5-stages of our Blueprint To Recovery, shows that Stage 1 (80% of theaters by market share re-open) and Stage 2 (single-day box office equivalent to the lowest grossing day in the past two years) were hit immediately. That the Stage 2 marker was achieved on June 1 – the first day back – showed an instant willingness for audiences to engage.

The first full week of recovery business (June 4-10) achieved 58% of the Stage 3 goal (the weekly equivalent to Stage 2) and was already 25% of the way towards Stage 5 (a week in the top quartile). This was achieved in a market where the top performing title was local comedy drama DE BEENTJES VAN SINT-HILDEGARD, released in mid-February, ahead of new-release US horror I SEE YOU. But is that level of business sustainable in a market without major titles releasing?

Tracking the week-to-week business in our Road To Recovery reports we are seeing that many markets struggle to maintain that initial enthusiasm from audiences in the absence of major releases to drive them in. Netherlands itself saw week-on-week business drop 32% this weekend (June 11-14), despite the opening of a new local comedy at #1 (RUNDFUNK: JACHTERWACHTER)South Korea is a perfect example of this.

That April 30-May 3 holiday weekend delivered a solid result (the biggest 4-day box office in eight weeks – remember, the partial cinema closure had been for less than 5 weeks). The 7-day box office was $3.4 million, fueled by a host of newly released titles led by TROLLS WORLD TOUR. However, the subsequent four weeks saw business fall back to a level between $1.85-1.95 million. The market was still seeing new launches (Woody Allen’s A RAINY DAY IN NEW YORK, Daniel Radcliffe prison-drama ESCAPE FROM PRETORIA and Kristen Stewart horror title UNDERWATER all took lead positions) but there were no blockbuster titles.

Then June 4 brought the first of several major local titles to release: thriller INTRUDER. The film, about a man’s family who face strange changes when his sister returns 25 years after she went missing, had originally been planned for release in March.

The audience desire for new, high-profile content was immediately evident and boosted by a promotion of the Korean Film Council (KOFIC). The 4-day weekend (June 4-7) saw INTRUDER take $2.2 million – more than the entire April 30-May 3 holiday weekend. The market saw a 7-day result of $4.45 million – the best result in 14 weeks since the February 27 week delivered $4.47 million (when THE INVISIBLE MAN opened #1). INTRUDER accounted for 60% of business. But that still only took the Stage 3 tracker for Korea to 39% of the goal (see above).

This weekend has seen another local title take the reigns: mystery drama INNOCENCE, about an attorney trying to prove that her mother, who has lost her memory, is innocent of murder. Another local mystery title, ME AND ME, is queued up for June 18; and zombie apocalypse film #ALIVE for June 24. Pixar’s ONWARD will enter the mix from June 17. The combination of a new Hollywood studio release alongside new local content may bring a further boost towards that Stage 3 goal, but let’s not forget that goal is based on the lowest-grossing week from 2018-2019.

The KOFIC promotion should continue to help – its three-week campaign (now in week 2) in designed to reboot the local industry, offering discount vouchers (worth approximately half the ticket price) to guests buying cinema tickets. But it’s going to take a lot more to progress the tracker towards the Stage 4 (median business) and Stage 5 goals.

That’s where globally-marketed tent-pole titles like MULAN (currently set to go first on July 24) and TENET will be vital. Growth is happening. More markets are returning: California has finally allowed traditional movie theaters to re-open from this weekend; Italy and France are set to re-open cinemas in the next 10 days. But global markets were working toward TENET’s mid-July date as a goal. The limited two-week move, and the presence of MULAN a week earlier, only puts the timetable back a week or two but global exhibitors will be watching with bated breath in the hope further delays don’t come.

It is a chicken and egg situation: distributors want to see exhibitors recovering in order to release major titles; but true recovery is only likely to come when new, global, blockbuster content is available. Until then local industries are doing what they can to keep the lights on, build consumer confidence, and prepare. So, please Hollywood, bring on the big hitters!

An earlier version of this article was original published in Screendollars’ newsletter #121 (June 15, 2020)