A soft breeze of summer appeared in May adding some life to the global box office. Desperately needed after a very calm April, and many calmer months before, global wide releases opened on a weekly base in May. These helped lift the month to a global box office of $2.1 billion. That is +11% up on the prior month and positions the month in the third quartile of the past 12 months in the three key global markets. The Domestic and Chinese markets even achieved the second highest grossing months of the year.

Despite that, May is down -24% against the same month last year, -4% against May 2022 and -31% against the three-year pre-pandemic average (2017-2019). The attractive group of movies on the schedule this past May never looked to have the potential to match the numbers generated by the May 2023 slate, which included GUARDIANS OF THE GALAXY, VOL. 3 ($846m), FAST X ($709m) and THE LITTLE MERMAID ($570m), or that of 2022 with DOCTOR STRANGE IN THE MULTIVERSE OF MADNESS ($956m) and TOP GUN MAVERICK ($1.5bn). At the end they came in collectively even a bit below the modest predictions, but not massively.

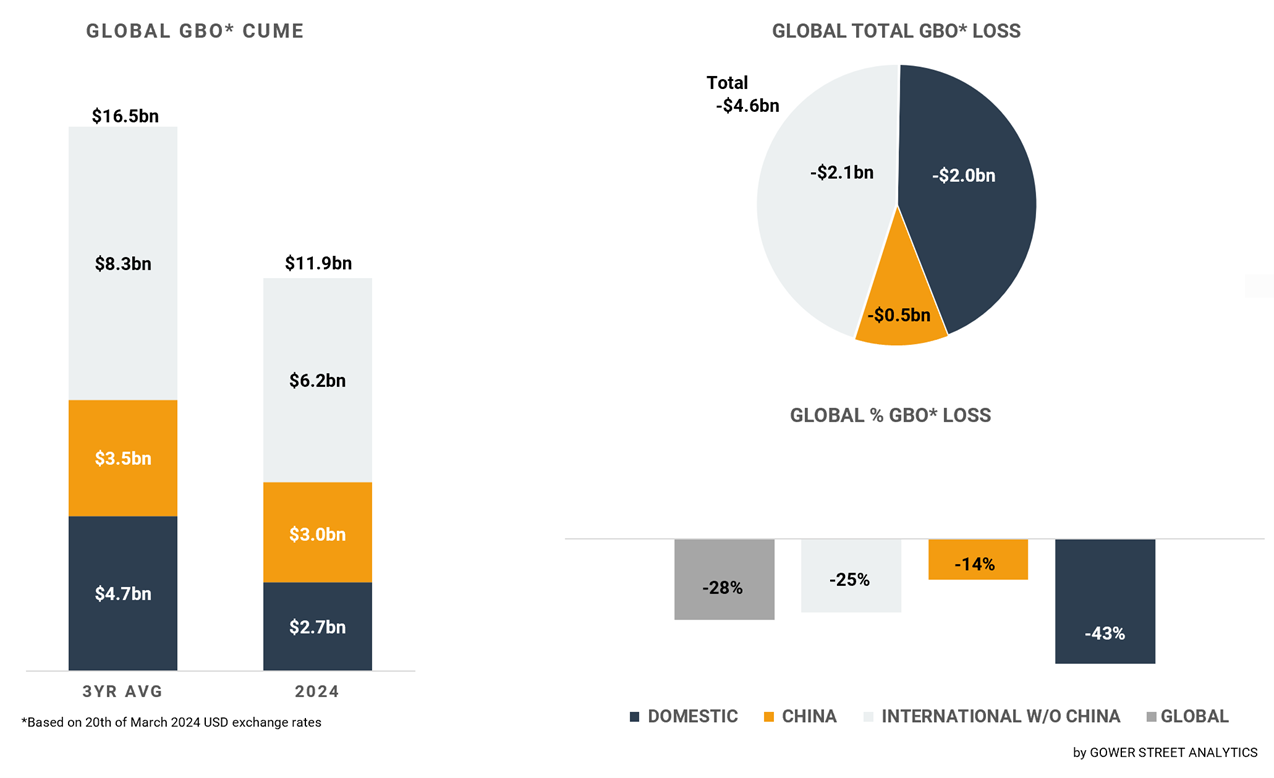

After five months the total global box office is estimated to have reached $11.9 billion for 2024. The running year is now -11% below the same period in 2023 and +19% above the one in 2022. The gap to the three-year benchmark is at -28%.

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

The global box office in May was driven by five new tentpole releases. While no global new release was able to cross $100 million worldwide within April, this month four titles crossed that benchmark.

The clearly highest grossing global release in May was Disney’s KINGDOM OF THE PLANET OF THE APES with approximately $321 million. At the end of its run, it will most likely get in the ballpark of MAD MAX: FURY ROAD ($380m) and INDIANA JONES AND THE DIAL OF DESTINY ($384m). This puts it also near the last instalment of the long running APES franchise with WAR OF THE PLANET OF THE APES, when deducting China and Russia ($368m). It would be a bit further away – even with these adjustments – from the RISE OF THE PLANET OF THE APES ($440m) and DAWN OF THE PLANET OF THE APES ($582m).

The second highest grossing global release in May was Universal’s THE FALL GUY. Adding approximately $139 million for a cume of $153 million at the end of the month. It will most likely finish a bit ahead of TICKET TO PARADISE ($169m), around the level of THE HITMAN’S BODYGUARD ($183m), BAYWATCH ($178m) and THE A-TEAM ($177m). Slightly behind THE LOST CITY ($193m) and BULLET TRAIN ($239m), the prior movie directed by David Leitch.

The following two highest grossing global releases in May were family titles. At #3 Paramount’s live action movie IF and at #4 Sony’s animated GARFIELD. IF grossed $124 million in May. Based on its current performance the original title will likely end in the ballpark of TOMORROWLAND ($209m) and CHRISTOPHER ROBIN ($198m). Above MR. POPPERS PENGUINS ($189m) and HOP ($184m), but below PADDINGTON 2 ($227m).

GARFIELD generated $121 million in the month. It has already surpassed the live-action GARFIELD: A TALE OF TWO KITTIES ($143m) from 2006 at the beginning of June. It will almost certainly also outgross GARFIELD: THE MOVIE ($203m) from 2004. It’ll likely end around the level of Universal’s long-runner MIGRATION ($298m), which is above Disney’s recent WISH ($255m) and THE PEANUTS MOVIE ($247m).

As fifth highest grosser of the month, Warner’s FURIOSA fuelled May with $94 million globally. After the first two weekends in, it’s likely that the title will end above JUPITER ASCENDING ($184m), GHOST IN THE SHELL ($170m) and MATRIX RESURRECTION ($157m). Not that far below ALIEN: COVENANT ($241m) and BLADE RUNNER 2049 ($259m). Unfortunately, it is clearly far beneath the prior hailed franchise instalment MAD MAX: FURY ROAD ($380m).

As a result of the phalanx of wide releases the Domestic market had the highest number of titles grossing more than $40 million within the month since January with 5. That helped to lift the Domestic box office to $554 million in May, the second highest result this year, behind March (-27%).

That is still just the #8 result in the past 12 months; nearly a third behind May in the past two years (2023: -29%, 2022: -31%); and a gap of -43% to the three-year average. That keeps it in line with the year so far. At the end of May the Domestic cume is $2.7 billion, which is -22% behind last year at the same time and -2% lower than the period in 2022.

Like the Domestic market, China recorded its second highest grossing month of the year with $408 million. This is just behind the huge Chinese New Year month February (-74%). Only marginally impacted by the reduced US-studio output, China is performing on an elevated level being just -14% down on May last year and -24% below the three-year average.

The month was dominated by Labor Day holiday releases. The four top titles of May were all released for this lucrative period and contributed 69% of the month’s total. Local comedy THE LAST FRENZY grossed $100 million to catch the #1 spot. It’s followed by Chinese / Hong Kong action movie TWILIGHT OF THE WARRIORS: WALLED IN with $77 million. Just a glimpse behind is local crime hit FORMED POLICE UNIT with $70 million. The quartet is completed by Japanese breakout SPY X FAMILY CODE: WHITE grossing $35 million.

A bit over half of May’s global box office (54%) came from the International market (excluding China). Latin America had the weakest month of the three sub-regions, recording the widest gap against the three-year average at -32% and the biggest drop to the prior year (-41%). The sub-region of Asia Pacific (excluding China) dropped a bit less at -28% against both May last year and the pre-pandemic average for the month. Europe, Middle East, and Africa (EMEA) was the strongest performing sub-region in May. This month was just down -15% on the same period last year. The gap to the three-year average was -22%.

A major driver for EMEA was the performance of France, being +12% above the pre-pandemic benchmark and +14% above May last year. The market recorded its best month of the year so far elevated by local smash UN P’TIT TRUC EN PLUS (A LITTLE SOMETHING EXTRA). With tremendous holdovers the directorial debut of comedian Artus had 4.8 million admissions in May. Already more than the lifetime of OPPENHEIMER (4.6m adms) last year. It’s very likely that it will surpass LA FAMILLE BELIER, the French hit from 2014 (7.5m adms during its run), which was remade in the US as Academy Award-winner CODA. That would make it the biggest French movie of the past ten years!

That A LITTLE SOMETHING EXTRA was missing for most markets in May. It was a decent month for a month that – foremost in North America – is connected with exceptional expectations. The release schedule this year was never capable of fulfilling these inflated demands, especially after DEADPOOL & WOLVERINE moved to July, a delay caused by last year’s strikes. The results were in the range of what was expected for the global releases of May, but nevertheless it was at the lower end of that range.

The same set of movies might have performed a bit better were it not for a sparser release calendar, as has been seen since the end of last summer. If audiences are drawn less frequently to cinemas by attractive diverse movies they miss the chance of seeing marketing materials to pull them in again, reducing awareness combined with losing the habit of going to the movies. This lowers the performance of titles in release, a pattern observed during the early post-pandemic months.

Thankfully the longest period of a low-filled release calendar is over. The movie offer and box office returns should continue to evolve over the upcoming months. In June INSIDE OUT 2, BAD BOYS: RIDE OR DIE, and A QUIET PLACE: DAY ONE all open to hopefully make-up further ground on the road of recovery.