Chinese New Year might have fallen in January this year but it’s impact was felt throughout February as the leading International market fuelled a colossal result. February 2025 delivered an astonishing $3.8 billion at the Global box office.

This made February the second highest grossing of the decade to date, only falling behind July 2023 when the “Barbenheimer” phenomenon drove receipts. What’s more it also meant that Global results topped the pre-pandemic three-year average (2017-2019) by 7%. The last time Global box office surpassed the 2017-2019 averages in a month was all the way back in August 2023.

Of course, China was the driver of this success delivering over 58% of the month’s global market share with $2.2 billion. That stands as the market’s biggest single-month box office ever, ahead of February 2021’s $1.67bn!

The Chinese success was largely borne on the back of a single title, NE ZHA 2 which accounted for more than three quarters (77%) of China’s February total! The smash-hit animated sequel grossed $1.69 billion within February and stood at over $1.9 billion at month’s end since its CNY launch. The film became the first in history to gross over $1 billion in a single market, beating 2015’s STAR WARS: THE FORCE AWAKENS’ Domestic result of $937 million, and is now heading over $2 billion. It is also the highest-grossing animated release of all-time globally, surpassing last year’s Pixar hit INSIDE OUT 2 ($1.7bn). Currently sitting at #7 on the all-time highest-grossers chart, ahead of SPIDER-MAN: NO WAY HOME, it also looks likely to surpass FORCE AWAKENS’ final global tally of $2.07 billion to finish in the all-time top 5!

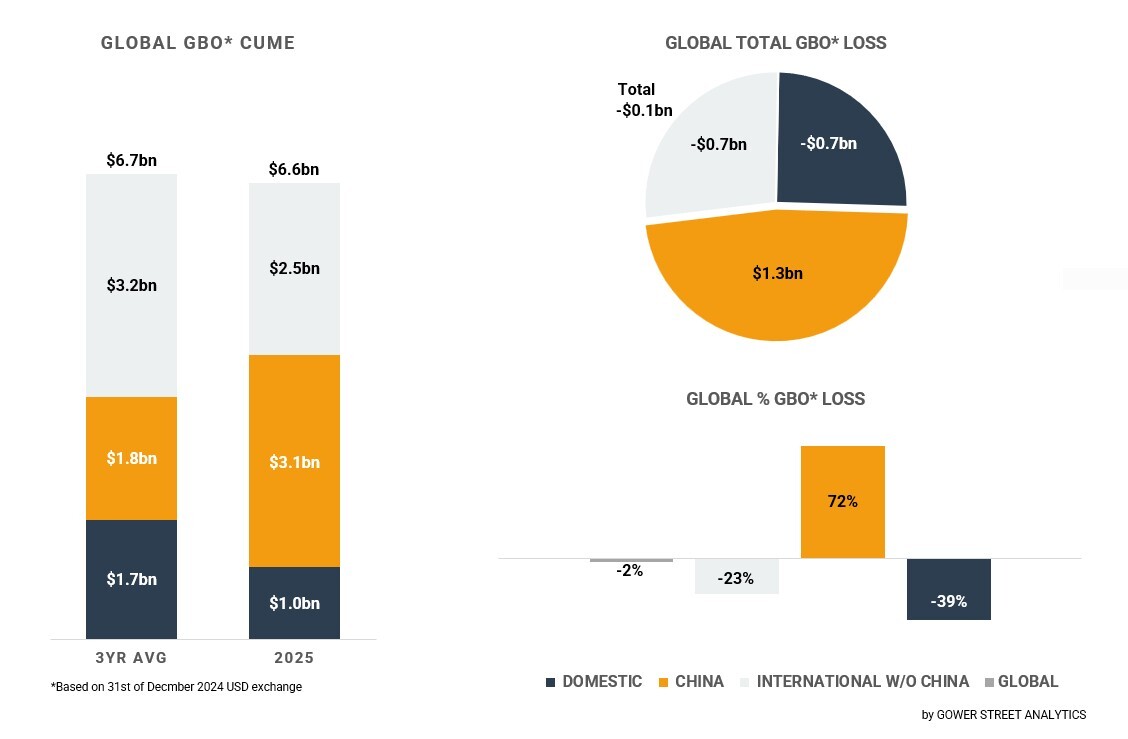

On this month’s Global Box Office Tracker (GBOT, above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

In stark contrast to China, both the Domestic and International (exc. China) markets saw modest February results. The Domestic result of $493 million was only the second best February of the post-pandemic period, up +24% on 2024 but still lagging -3% behind 2023. However, it was a more substantial -39% behind the pre-pandemic three-year average. The month’s box office was the market’s lowest since last October ($491m) and the third weakest of the past 12 months.

Internationally (exc. China) February was down on both of the past two years, -3% behind 2023 and -6% behind 2024. However, its deficit against the 2017-2019 was slightly better than Domestic at -28%. Unfortunately that extended the deficit for the year-to-date compared to the pre-pandemic average from -18% at the close of January to -23% a month later.

Among the International sub-regions Europe, Middle East and Africa (EMEA) performed strongest, defying the broader International trend with the best post-pandemic February result to date ($677m) to finish +5% ahead of the same month in 2023 and +2% ahead of 2024. It also showed the slimmest gap (-25%) to the pre-pandemic average among the three sub-regions. Latin America’s month ($117m) came in narrowly ahead of 2024 (+1%) but -18% short of February 2023, while the gap against the pre-pandemic average was an even greater -30%. Asia Pacific (exc. China) was the weakest of the international sub-regions in February, coming in -12% behind 2023, -21% short of 2024, and -34% behind the 2017-2019 average with $290 million.

An unexpectedly robust Chinese market rescued the Global box office in February and British hit BRIDGET JONES: MAD ABOUT THE BOY helped the International marketplace to avoid the bigger deficits seen in the Domestic market. A late Easter means March also lacks predictable hits. This could offer opportunity for new-release titles from auteur directors like Bong Joon-ho’s MICKEY 17 and Steven Soderbergh’s BLACK BAG as well as Disney’s live action version of the studio’s very first animated classic SNOW WHITE. However, it also risks a further expansion of the deficit against the pre-pandemic average by the end of Q1. The industry will be looking ahead to later quarters for better results across the Domestic and International (exc. China) markets to get 2025 onto a more secure track.