The unprecedented impact of COVID-19 on the global box office over the past few months has raised much concern and speculation for the future of our industry. By April 5, the majority of territories had shut down completely leaving less than 1% of movie theaters across the globe still able to report box office figures. Now, the immediate question for most is ‘how do we recover?’

Gower Street specialises in release date optimisation via our theatrical market simulation tool FORECAST. As a film analytics company, we have been tracking the global box office decline since the outbreak began. We have already published our 5-stage Blueprint To Recovery, which identifies the key markers of market recovery.

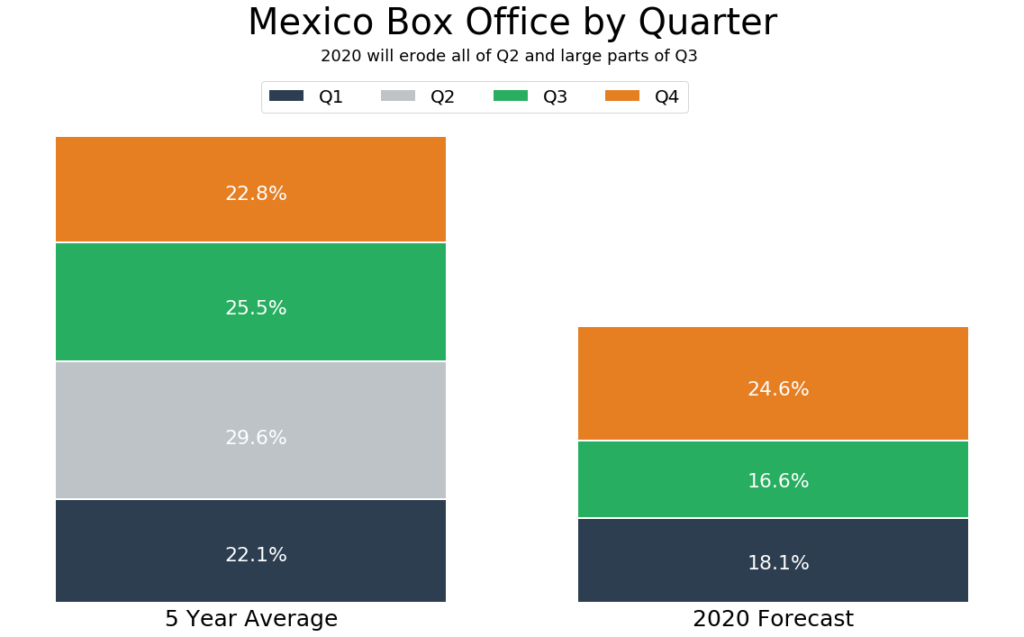

This article is focused on our analysis for Mexico, exploring how far 2020 could end up behind the annual average GBO of the last 5 years. We will review the decline for Q1, the impact of the shutdown in Q2 and the potential recovery rates for Q3 and Q4.

Further articles will be published for the remainder of our major territories: Australia and Spain. We have previously published articles on this topic for UK/Ireland, Germany and the Domestic market.

Mexico’s average annual box office over the last 5 years totals MX$16.3 billion. The visual above shows that the share of box office across the quarters differ. Q1 and Q4 have the lowest share, each contributing 22% of the year’s total. Q2 has the highest share, contributing almost 30% of the year’s total, followed by Q3 with 25.5%. Unfortunately, Q2 and Q3 are expected to be impacted the most due to the Coronavirus outbreak.

The impact of COVID-19 wasn’t felt in Mexico until relatively late compared to other territories, with only 164 cases confirmed on March 19. In an effort to react quickly to reduce the spread, the Government of Mexico implemented social distancing measures on March 20, enforcing the closure of schools and the suspension of large gatherings. This prompted the closure of all movie theaters on March 31. As a result, the first quarter of 2020 held up slightly better than our other curated markets with a reported figure of MX$2.95 billion – accounting for 18.1% of the average annual GBO vs the 5-year average of 22.1%.

When, and to what degree, the country will reopen is being monitored by state using a colour-coded system. The colours serve as an indication of the degree in which a state can reopen social, economic and educational activities.

- Red: The region may open only essential activities.

- Orange: The region may open non-essential economic activities at a reduced capacity as well as reduced activity in public spaces.

- Yellow: The region may open all economic activities, allow reduced cultural activities and lighten controlled care of vulnerable populations.

- Green: The region may open schools and drop restrictions in public areas

The colour assigned is determined by four factors: the percentage of hospital occupation; hospitalization trend; COVID-19 syndrome trend; and the percentage of cases tested positive for COVID-19.

On May 25, Mexico recorded the highest number of daily cases seen so far of 3,684. As of Friday May 29, all states were coded Red, which indicates that the occupancy level per hospital is currently over 70%. However, since May 25 the number of daily cases declined to just 185 (recorded on June 1). The decision to begin easing restrictions requires the occupancy level per hospital to sit between 51-70%. The government expects this could start as early as June 15, at which point if a state turns Orange theatres expect to have permission to reopen at 40-50% of their maximum capacity. Many states however are cautious of reopening due to a lack of testing and could well make the decision to delay.

We expect that the majority of Q2, usually representing 29.6% of the average annual GBO, will be lost due to the small percentage of the market that will be able to open from June 15 and how late this falls in the quarter.

Estimating the rest of the year

To establish an end of year prediction, we began by creating a ‘best case’ scenario for Q3 & Q4. For Q3, we added up all the titles with a lifetime GBO estimate over MX$25 million dated within this period (as of June 1). Assuming each title reaches its full lifetime estimate (estimates based on pre-COVID / fully functioning market) Q3 would represent 18.6% of the annual average for that quarter. If we assume that Q4 performs as though unaffected and represents the average 22.8%, 2020 could be 42.9% behind the average annual GBO.

Working from this ‘best case’ scenario we then needed to take into consideration the amount of product in the market and incorporate social distancing measures into the analysis.

2020 Current Calendar

The next major titles in the calendar are MULAN and TENET both dated on July 24. The number of releases from a major studio in the calendar for Mexico has declined from 105 in 2019 to 68 in 2020. In 2019, 58 titles were released during Quarters 1 and 2. This year Q1 released 22 titles and Q2 has released zero titles due to the closures. The number picks up during Quarters 3 & 4 to total 46 titles vs 47 in 2019.

There has also been significant loss to the number of local titles dated for 2020. In 2019, 21 local titles released during Q1, 26 each in Q2 and Q3 and 37 in Q4 totaling 110 titles for the year. This year we had 14 local titles in Q1, 2 titles in Q2 (dated after June 15) and currently just 8 titles each dated in Q3 and Q4, totaling 32 titles for the whole year.

Given the lack of product compared to previous years and taking into consideration audience’s willingness to return to cinemas, we needed to calculate a re-opening market percentage that would reflect these differences in the current market to historical years. We calculated this to be 10% of the historical average for the same date.

To get from this re-opening percentage to our end of year (EOY) prediction we calculated a reasonable rate of recovery, that is, the rate at which weekly grosses will increase and is effectively a measure of consumers’ willingness to return to the cinema. We believe that this is likely to be product driven and will continue steadily, reaching a return to full confidence by the end of the year. Our Lead Data Scientist, Dr Iain Rodger created a model that takes us from our re-opening percentage to an end of year total. This uses the EOY expected drop, re-opening market percentage and the 5-year average GBO per week to estimate the corresponding growth rate.

Social Distancing

We addressed capacity restrictions by employing social distancing day caps. More information on how we have calculated the caps can be found here. The calculation in part uses an assumption around seating restrictions within in the auditorium. In this instance, The National Chamber Of The Film Industry (CANACINE) has proposed a ‘Sitting Chessboard’ seating arrangement which allows for a higher maximum occupancy level than we accounted for in the assumption specified in the article. We have therefore modified this calculation accordingly and come to the following social distancing models: strict (each day capped at MX$44.9m); moderate (MX$62.8m cap); and relaxed (MX$94.3m cap).

-

- Strict: If strict social distancing measures were applied everyday between July 1 – December 31 (so every day capped at MX$44.9m), and every single day reached that cap, 2020’s maximum potential would end up 31.18% behind the average annual GBO.

-

- Moderate: If we incorporated our moderate cap of MX$62.8 million a day from October 1 to December 31 the years maximum potential would improve and sit 21.07% behind the annual average GBO.

-

- Relaxed: Finally if we incorporated all 3 caps from July to the end of the year (so strict July 1 – Aug 31, moderate Sep 1 – Oct 31, relaxed Nov 1 – Dec 31) the year would sit 5.98% behind the annual average GBO.

These scenarios include the MX$2.9 billion grossed in Q1, plus the maximum that could be achieved in Q3 and Q4. Of course, we recognize that it is extremely unlikely that every day will hit its daily cap, but these scenarios serve to give us a starting point to work with.

Based on Mexico’s early implementation of lockdown and the latest guidance regarding occupancy and seating restrictions, we have implemented moderate social distancing measures from July – August (MX$62.8m) and relaxed social distancing measures between September – December (MX$94.3m) into FORECAST.

With these parameters in place, Q3’s share of box office reduces from 18.6% (calculated from our estimates) to 16.6%. Q4 is estimated to achieve just over the average for that quarter with 24.6%. This indicates that we may be over maximum capacity for Q3 but still have room in Q4. Incorporating our totals for Q1, Q2 and Q4, and assuming that Q2 will be lost in the worst case scenario, 2020 would be expected to reach is MX9.61 billion, 41.0% behind the average (providing that every day met its maximum potential).

We will reach Stage 2 (crossing over MX$8.4m for the day) on Saturday July 4 during the opening week of BLITHE SPIRIT. Stage 3 (MX$193m for the week) is achieved the week of August 7, the opening week of THE SPONGEBOB MOVIE: SPONGE ON THE RUN. We surpass Stage 4 and Stage 5 (MX$323m / MX$390m for the week) in the week of October 30, the opening week of BLACK WIDOW. This result supports our initial belief that recovery is likely to be driven by major titles.

Of course, this prediction for the EOY and the 5 Stages relies on several changeable factors which we will continue to monitor throughout the year and adjust our predictions accordingly.