The unprecedented impact of COVID-19 on the global box office over the past few months has raised much concern and speculation for the future of our industry. The immediate question for most has been ‘how do we recover?’. As a Film Analytics company, specialising in release date optimisation via our theatrical market simulation tool FORECAST, this question has been the driving force behind our work since the pandemic began.

Gower Street has been tracking the global box office loss since the outbreak first began impacting cinema attendance globally. By April 5 less than 1% of cinemas across the globe were reporting box office figures. The majority of territories shut down completely, with no indication of when they would be able to re-open.

We have been using this time to not only track, but also predict, what global recovery could look like, and have already published our 5-stage Blueprint To Recovery, identifying the key markers of market recovery. Recovery will differ per territory and is dependent on many factors, such as: capacity restrictions following social distancing measures; economic pressures; audience willingness to return; staggered re-openings across regions/states; differing re-opening plans per exhibitor; and lack of product in the market.

We have used the following steps to analyse how 2020 will compare to the average annual gross box office (based on the last 5 years): how much we have lost from Q1; how much we could lose from Q2; what we can reasonably expect when cinemas reopen; and where the annual box office could end up.

This article explores these steps for the Germany, but we will also be publishing an article for each of the major territories we curate in FORECAST over the coming days: Domestic; Mexico; Australia; and Spain. We previously published an article about UK & Ireland box office recovery, which you can read here.

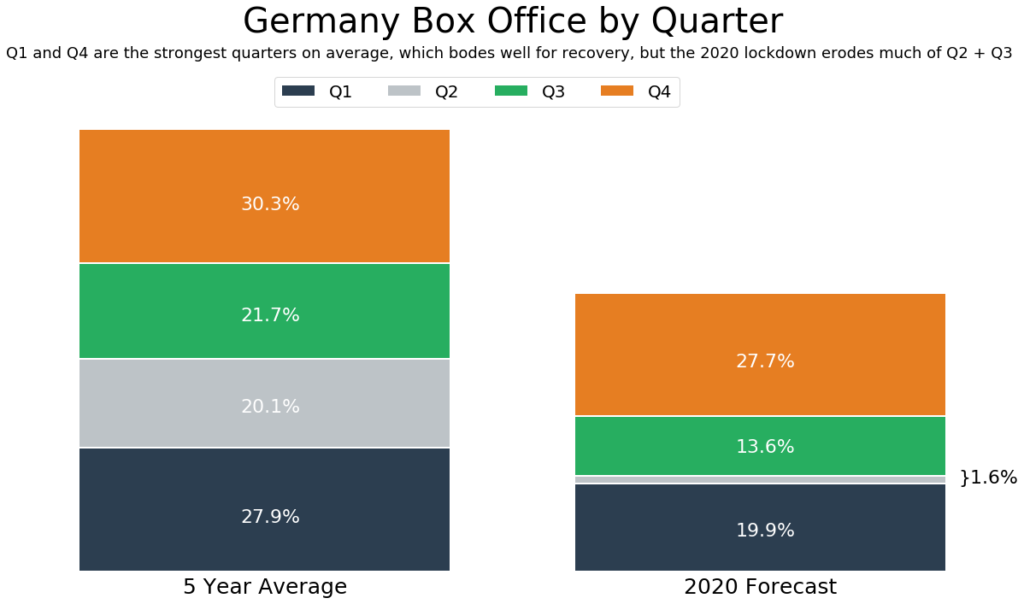

As demonstrated above, the split of German box office is different per quarter. Based on 5-year averages, Q1 and Q4 are the strongest periods, with 27.9% and 30.3% of the yearly total, respectively. This bodes well for recovery as these two quarters will likely be the most active at the box office in 2020.

However, Q1 did see a small downturn this year. German cinemas were ordered to close on March 17, following a weekend of admissions at a much lower level than usual. As a result of this Q1 box office in 2020 was €201.3 million, only 19.9% of the total 5-year average.

The Drive-In Boom and the Route to Recovery

Germany is unique in comparison to other territories though, as drive-in cinemas (or Autokinos, as they are known locally) have become hugely popular in a short space of time. This has provided a small boost to the Q2 box office. Whilst in some territories the gross for Q2 will be 0, Germany has grossed €9.5 million in theatrical box office to date during Q2. We estimate that if it continues on a similar trajectory, it will reach 1.6% of the 5-year average.

The weekend of April 30 was the peak of drive-in attendance with a 4 day gross of nearly €1.5 million, putting German box office already at Stage 2 in our 5 Stage Blueprint For Recovery. Stage 2 is when box office hits the lowest day’s box office gross from the past two years, achieved on May 2 with a daily total of €425,000. Because of the unexpected growth of drive-in cinemas, Germany effectively surpassed Stage 1 and went straight to Stage 2. Stage 1 is when 80% of cinemas (by market share) are in operation.

In addition to this, cinemas in Germany are starting to show signs of re-opening. 48 ‘traditional’ cinemas were open across Hessen, Saxony, and Schleswig-Holstein as of this weekend (May 21-24). A further 11 states have permitted cinemas to reopen on staggered dates between now and June 30, and in total these 14 states represent a market share of approximately 90%. As we expected, re-opening is a slow process, meaning drive-in cinemas are still responsible for the lion’s share of box office gross at present.

Predicting the recovery process for the German box office is difficult, partly because two states (Niedersachsen and Bremen) have yet to announce when they will allow cinemas to re-open. More significantly, these official state announcements do not indicate the willingness of cinemas to return. Many are likely to remain cautious and take longer to re-open to the public, as indicated by the progress in the states open thus far. Likewise, with drive-in cinemas seeing a surge in popularity, it remains to be seen if audiences will feel safer continuing to attend those, rather than re-engaging with traditional cinemas. With this in mind, our expected size of the market starts at a very low level, with the week commencing June 4 at just 5% of the five-year average for that week.

This increases in small percentage increments over the following weeks, building towards the two July tentpole releases: TENET and MULAN. It remains to be seen if these films can reach their full box office potential in a marketplace limited by social distancing, but a lack of competitive holdover titles should work in their favour. Currently we have Q3 in Germany tracking at 13.6% of the 5-year average for the period. This reduction in gross is a result of having less product in the market than previous years, and the limitations of social distancing.

The amount of films dated will be a vital indicator of recovery throughout this year, as 2020 currently only has 344 titles dated in Germany (including those already released), around half of 2019’s total of 754 films. For Q3 there are currently just 94 new releases dated. If we calculate the potential Q3 gross based on estimates for these titles alone, with no adjustments for social distancing, it sits at 11.96% of the yearly total. This shows us that there is still some scope for films to be added to the calendar with Q3 release dates, based on the potential indicated in our graph above.

Stage 3 of Recovery, and the Impact of Social Distancing

What is particularly notable about TENET is that the week of its release, July 16, is also the week in which we are expecting German box office to hit Stage 3 of our 5 Stage Recovery Plan. Stage 3 is our base week: the first full week of operation in which box office reaches the lowest result from the past two years. What this demonstrates is that the current expectations for box office recovery rely heavily on the placement of tentpole titles, but also that it is challenging to make accurate predictions with the release calendar in its current state of constant flux. At this time, our expectations of when markets could hit the 5 Stage targets is still subject to potential adjustment as we find out more information about re-openings and adjust our predicted market size accordingly.

Still, it is worth exploring social distancing in more detail for Germany. Our analysis shows that it may not have as deep an impact as in other territories around the globe, based on average cinema attendance prior to the pandemic. We have worked with 3 different social distancing models: strict, moderate, and relaxed. Our strict social distancing model means that daily box office in Germany is capped at a maximum of €3 million. If this were to be applied to German box office from July 1st through to the end of the year, with every day hitting the €3 million cap, then 2020 box office would be -17% behind our 5-year average.

The results for phased social distancing measures are much more promising. We have used two models here. One model that relaxes social distancing measures to cap box office at €5 million from October 1 until the end of the year. The second model covers strict social distancing (€3m daily cap), moderate social distancing (€5m cap) and relaxed social distancing (€7m cap), for two months each between July 1 and the end of December. In the case of both models, there is no measurable impact on box office potential as they would not prevent cinema attendance levels from reaching their current average. We are using the first of these two phased models in FORECAST to adjust for social distancing measures anticipated to be in place at least until the end of 2020. Our social distancing models are explained in more detail here.

Christmas: A True Indication of Recovery

As previously discussed, Q4 is a key period for box office in Germany, so examining the rate of recovery is particularly vital during this time. As it stands, there are two very strong tentpole releases well positioned in October and November which look set to bring the box office to stages 4 and 5 of our Recovery Plan, BLACK WIDOW on the week commencing October 28 and NO TIME TO DIE on the week commencing November 12. Stage 4 is the first full week to achieve a median level of business based on the past 2 years, in Germany this is a week gross of €18 m. Stage 5 is an equivalent performance to those in the top quartile of weekly business from the past two years, and in Germany this is a week gross of €21 million. We reached these predictions by implementing our analysis on the rate of recovery in FORECAST, so there is of course scope for these estimates to change. Most importantly, it again shows the market’s reliance on the placement of strong tentpole titles in order to recover.

However, Christmas is the period that should show us how far box office recovery has truly come. Although there is an absence of a big franchise title like STAR WARS, or THE HOBBIT, there is still a strong line up of content available this year (THE CROODS 2, SOUL, TOP GUN MAVERICK and DUNE). Christmas is always a popular time for cinemas in Germany and it will be interesting to see if it can help boost Q4 gross back towards normal levels. A reasonable target is Q4 of 2018, which grossed €272 million in Germany. This was another year without any of the aforementioned franchise titles, and the lowest grossing Q4 of the past five years. Currently we believe Q4 in Germany has the potential to gross up to €279 million in a best-case scenario, as our graph indicates, accounting for 27.7% of the 5-year average gross.

End of Year Prediction

To get to our predicted end of year (EOY) total we needed to implement a reasonable rate of recovery, that is, the rate at which we think weekly grosses will grow and is effectively a measure of consumers’ willingness to return to the cinema. Our Lead Data Scientist, Dr Iain Rodger, has created a model that takes the EOY expected drop, re-opening market percentage, and 5-year average GBO (per week) to calculate the corresponding growth rate.

We factored in our recovery rate, re-opening market percentage, and social distancing caps, to calculate that 2020 ending at 37.2% less than the average annual GBO of €1 billion is achievable based on each day hitting its full potential. This would translate into approx. €635.7 million annual gross for 2020.

Of course, this prediction relies on several changeable factors, and our analysis is something we will continue to revisit and adjust throughout the year as cinemas re-open and we have more information at our disposal.

All data accurate as of 29th May, historical data supplied by Comscore.