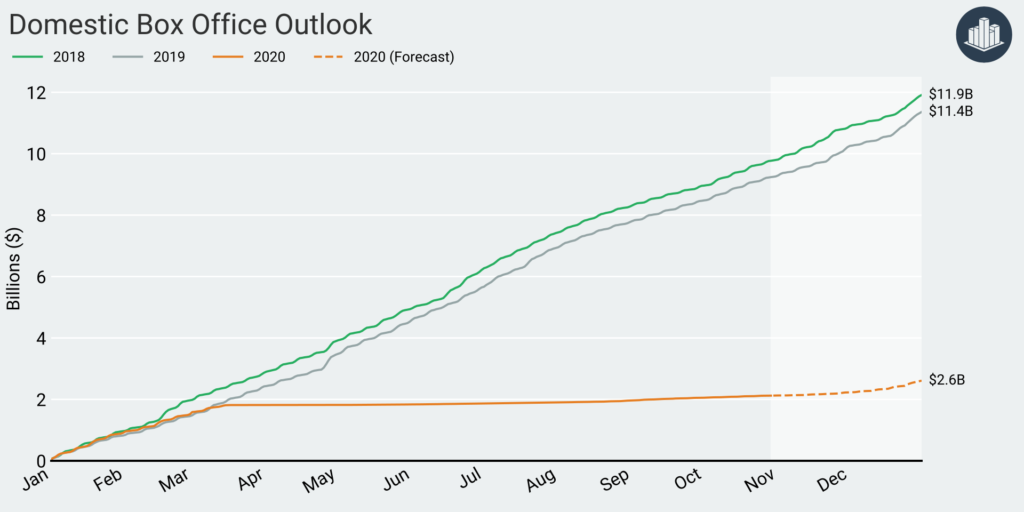

In Gower Street’s first weekly article in Screendollars for 2020 (published Jan. 5) we predicted that the 12-month Domestic box office forecast would finish below 2019. This was in keeping with a general opinion across the industry, which saw many analysts suggesting the line-up of titles did not, on paper, look to offer the same level of appeal as those of last year, although our estimate, we argued, would likely be higher than many expected. In the article we included a caveat: “Of course, much can change over a 12-month period.”

2020 Outlook

But no-one could have expected how much would change. No-one knew the devastation that would be reaped upon the global industry by the impact of the COVID-19 pandemic. With just two months left to run in 2020, Gower Street estimates now place the full year at just $2.55 billion – a far cry from the $11.1 billion estimate predicted in January. This will be the first time Domestic box office has fallen below $3 billion since 1983 ($2.75bn) and the lowest annual result recorded since 1981 ($918.3m).

Exit Strategy

With more titles exiting the calendar completely in favor of streaming options (including recent losses of Pixar’s SOUL and Paramount’s COMING 2 AMERICA) the media has been quick to, once again, claim the end is nigh for cinema as streaming accelerates to become the “next big thing”. But the theatrical experience has survived many challenges before, adjusting to exist in parallel to television, VHS, DVD, gaming, etc. In 1981, when box office fell 45% year-on-year from 1980’s $1.66 billion, the “scourge” of home video was the focus of blame and fear. The US imported 2.57 million VCRs from Japan in 1981 – becoming the biggest market for the, then, novel device. Hollywood has adjusted its output and filmmakers their approach time and again to make and maintain a vibrant theatrical offering.

Of course, the primary problem currently facing the industry is not as simple as alternate technology. Streaming platforms have been the de facto beneficiaries of the negative impact of the pandemic on movie theaters but the challenge represented by the streamers already existed and would have grown regardless, if perhaps at a slower rate. But the virus and the uncertainty it has spread has caused major studios to continually back-away from 2020 releasing. This has left smaller titles to try and fill the void. To paraphrase Gloria Swanson’s character Norma Desmond in Billy Wilder’s 1950 classic SUNSET BLVD (when cinemas and movie studios were beginning to face the challenge of television): “Cinema is big! It’s the pictures that got small!”

Gower Street’s latest update of the Domestic Release Changes Visualization is below. For best results view this page in a desktop browser such as Google Chrome. The visualization begins with the calendar as it was at the beginning of January this year, and progressing through all the changes we have seen this year so far. Each film is a circle, its size showing the relative size of the predicted or actual box office. The colour represents the studio releasing it: circles fade when the film releases. As the animation progresses, films moving to a future date arc over the top of the timeline. Films moving forward arc under the line. Any film that is removed completely or remains unset simply drops off the calendar. Move your mouse over the circles and arcs to get more information on the films and calendar changes. You can also drag the timeline further into the future to visualize all the release changes and how they stretch into 2021 and beyond.You might need to refresh the page to see it. Hit ‘play’ to begin:

Looking Forward

The studios have, more-or-less, written this year off. But, like Norma Desmond, is 2021 now ready for its close-up?

With the UK, France and Germany the latest European majors, following Italy last week, to announce re-closures due to rising virus cases it seems likely more titles will delay again. In recent weeks we have started to see the first clear signs of Q1 nervousness. Sony’s GHOSTBUSTERS: AFTERLIFE, having moved out of July this year to March 5, 2021, has now moved again to June 11; Paramount animation RUMBLE moved back from Jan. 29 to May 14, 2021 (having also originally been due out in July this year); even Aretha Franklin biopic RESPECT, which had looked like a potential major awards-season player, did not prove to be rock steady, with United Artists’ shifting the film from Jan. 15 to Aug. 13.

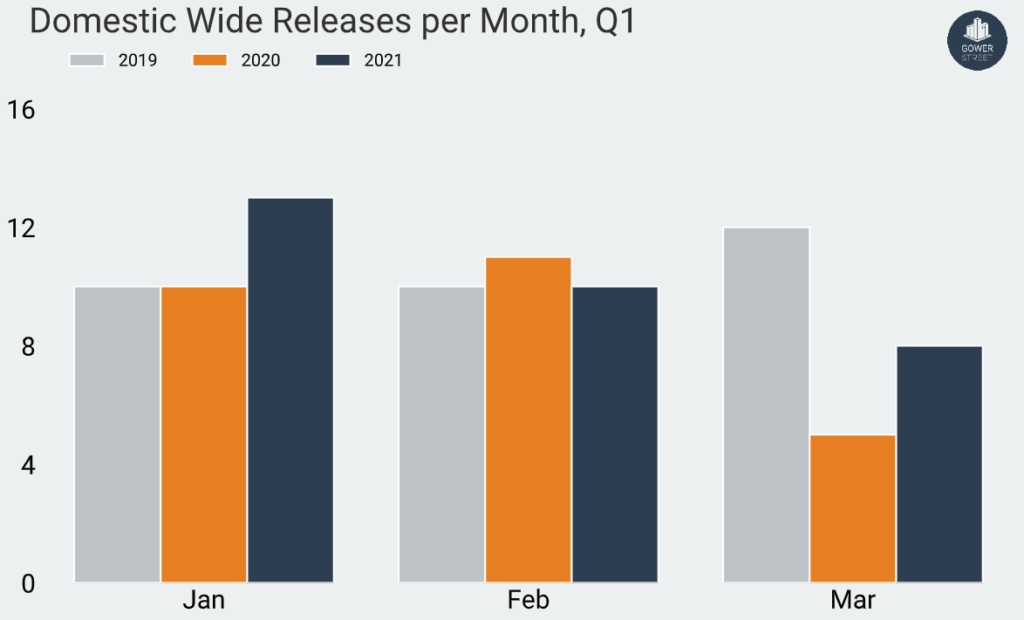

In our Screendollars article of Sept. 21 we looked at the crush of titles already evident in the first quarter of 2021 with January seeing more wide-release titles dated than in 2019 or 2020; February on par with 2019 and March showing slightly more space. We have updated this graph for Q1 2021 below, however, despite the recent moves little overall has changed, with other titles having moved in.

Studios had previously appeared nervous to release into open and ready international markets while key parts of the Domestic market remained closed. Should they stay put in the calendar or retreat to a no-more certain later date? As British punk band The Clash sang in 1982, following that sub-$1 billion box office year in 1981: “If I go, there will be trouble. And if I stay it will be double.” For the studios it was a catch-22. Go they did.

Whatever international box office potential there was for studio movies in July, August and, post-TENET, late-September and October has been lost. Now, as New York has started to re-open (with 25% of movie theaters by market share open in the state last weekend), key, lucrative European markets are re-closing. Latin America is still lagging behind EMEA and Asia Pacific markets in its first stages of recovery.

In 2019 over 60% of global grosses for top 100 Hollywood titles came from the international marketplace. Even without China (one of the few major markets currently operating strongly) that number would still be over 50%. If studios were unwilling to take a risk with a portion of the Domestic market unavailable, a minority share of the global box office potential on studio titles, it seems even less likely they would do so with Domestic opening but international once again retracting. This will present further challenges to the sustainability of many exhibitors and as the industry looks ahead to the oncoming winter with no more certainty Q1 2021 seems certain to witness further delays and abandonments. Independent films and distributors have found personal success filling the gaps in many markets and will likely continue to be relied on for sustenance. The theatrical experience will undoubtedly endure, as it has before, but studio releases may not be ready for their close-up for some time yet and challenges remain ahead.

This article was originally published in Screendollars’ newsletter #141 (November 2, 2020).