This week brought more devastating news for global exhibitors as Disney juggled its slate moving BLACK WIDOW and WEST SIDE STORY out of 2020 and delaying DEATH ON THE NILE to December, among other changes. Meanwhile, AMC is selling up to 15 million shares to raise funds and Cineworld reported a $1.6 billion pre-tax loss for H1 2020, compared to a $140 million profit in H1 2019. Given that cinemas were open without restrictions for most of Q1, with most of that loss attributed to the virus impact on Q2, it is not surprising Cineworld said that further closures could cause uncertainty about “the group’s ability to continue as a going concern.”

Gower Street’s research clearly shows that sustainable industry recovery will be impossible without a greater pipeline of major titles.

As regular readers will know, Gower Street implemented a 5-stage Blueprint To Recovery to track the progress of markets, tracked by our partners at Comscore Movies, towards achieving key box office levels. These were designed as indicators of recovery. The three key stages based on weekly box office were stage 3 (a base week, equivalent to the lowest grossing week of the past 2 years); stage 4 (equivalent to the median week of the past 2 years); and stage 5 (equivalent to a week in the top quartile of the past 2 years). Achieving stage 3 shows at least a core audience willing to return. Achieving all 5 stages would indicate that, from an audience perspective, the market was where it needed to be for recovery. But audiences need content to keep them coming back.

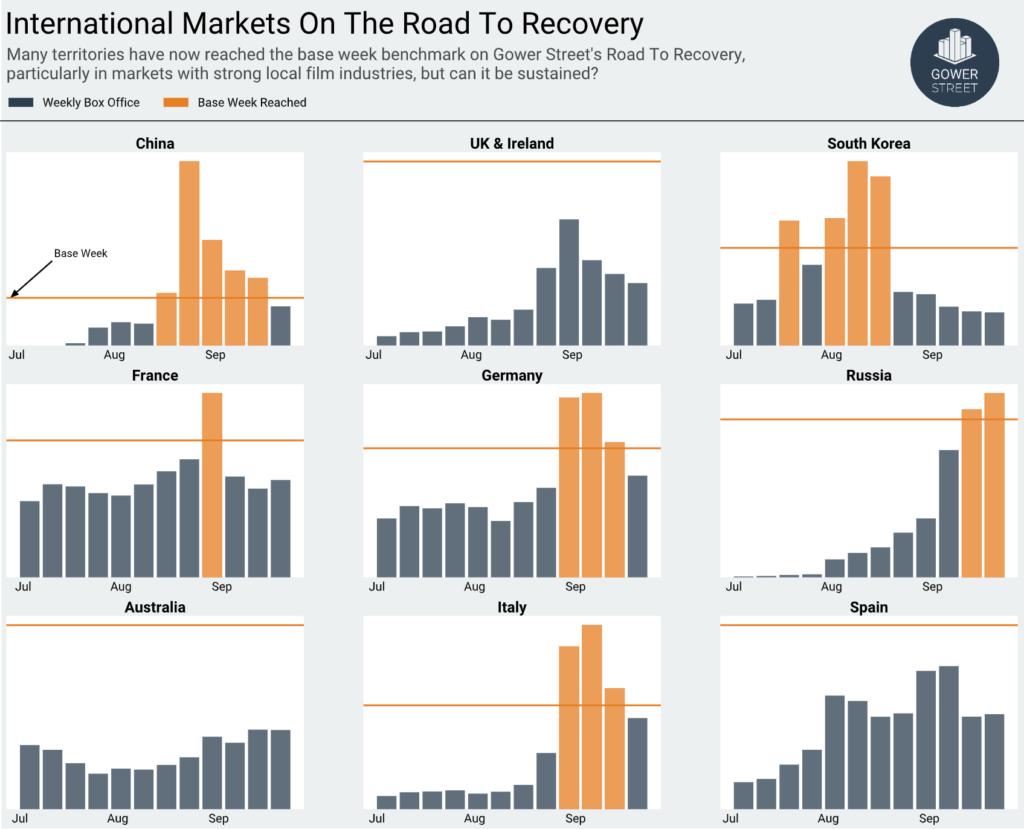

The multi-image above looks at 9 key territories and how their business is performing. Each image shows where the base (stage 3) level sits in each market. We can clearly see the markets that have and have not achieved this level but, more worryingly, we can see that even this most basic achievement is hard to sustain without content.

Stage 3 Markets: The Haves…

As of this week 12 international markets tracked by Comscore have achieved the stage 3 level: China, Japan, South Korea, Hong Kong, Singapore, Taiwan, France, Germany, Italy, Russia, Austria and the Netherlands. The small Canadian province of Prince Edward Island has also done so. Sustaining it has proven trickier.

South Korea first achieved stage 3 thanks to local hit TRAIN TO BUSAN PRESENTS PENINSULA; repeating the feat with the releases of further local hits STEEL RAIN 2: SUMMIT, DELIVER US FROM EVIL, and OKAY MADAM. However, renewed severe capacity restrictions following a rise in cases around Seoul saw box office drop off subsequently.

Warner Bros’ bold release of Christopher Nolan’s TENET has proven a boon in international markets around the world. France, Germany, Italy, Austria and Hong Kong all achieved stage 3 in the film’s opening week. Russia and Singapore saw strong second-week holds for TENET combine with the new release of MULAN (denied theatrical release in many hungry markets) to finally hit stage 3. The Netherlands and Japan, both of which had previously hit stage 3, saw box office return to that level upon TENET’s release (Japan does not feature in the graphic due to the style of local reporting).

…And Have Nots

UK/Ireland, Spain and Australia have yet to achieve stage 3. Australia had been further handicapped by the implementation of new restrictions in Melbourne since mid-July.

The boost from TENET is clearly evident in both UK/Ireland and Spain, while Spain also shows a boost 4-weeks ahead of TENET with the opening of local hit FATHER THERE IS ONLY ONE 2. However, both markets saw only limited levels of re-opening ahead of their first big event title with a general lack of content on offer.

Markets such as France and Germany were already building a solid audience base with local and independent titles prior to TENET’s release, slowly building consumer confidence. That was not a necessity in all markets. Russia and Italy both witnessed a swifter return (although it should be noted that the summer is generally a quiet time at the box office in Italy, making TENET’s timing impeccable in that market).

Mexico and Brazil are not included in the image as Latin America is much further behind on its box office Road To Recovery than Europe and Asia Pacific.

The Road Ahead: Sustainability and Opportunity

But what of sustainability? France proved a one-week wonder before levels fell back to similar levels seen across July and August, a stability aided by the country’s strong pipeline of local product. Singapore also managed only a single week at the stage 3 level.

Russia repeated for a second week in the play-week just ended (Sept. 17-23) with YA romantic drama AFTER WE COLLIDED taking over the #1 spot in its first week. Hong Kong did the same, with three new releases (local drama I’M LIVIN’ IT; Disney’s MULAN; and Chinese romantic fantasy LOVE YOU FOREVER) opening in support of TENET (holding well at #1).

Germany and Italy also saw success with AFTER WE COLLIDED, adding support in TENET’s second week and boosting the market to an even higher level. THE NEW MUTANTS also entered the fray in both markets, however a lack of major titles releasing in this past week resulted in both markets falling back below the stage 3 level this past week.

AFTER WE COLLIDED has also found surprise success in the UK, where the original film (a hit in Germany, Italy and Russia) did not receive a theatrical release last year. Its success demonstrates what is possible for film’s willing to launch. In Russia its opening was nearly 25% ahead of the first film; in Germany it was only 12% behind – this despite capacity restrictions in both markets and not all cinemas being re-open (more than 20% of cinemas by market share in Russia remain closed). In the UK an opening on just 46 locations expanded to 387 in week 2 and then 456 in week 3 as audience appetite became immediately apparent. The film had grossed over £2 million ($2.65m) by the close of its third week (Sept. 24) and will soon overtake the UK box office of all-star awards contender BOMBSHELL, which released in the market in mid-January two months before shutdown.

The Juggernaut: China

Of the two markets that have achieved stage 4 (China and Taiwan), China has also hit Stage 5. Mega-hit THE EIGHT HUNDRED (now the top grossing global title of 2020, having surpassed BAD BOYS FOR LIFE) was the key driver in the achievement of all three weekly stages. Its previews boosted the market to hit stage 3 before its opening week (supported by LOVE YOU FOREVER) achieved stages 4 and 5. The following week sat around stage 4 level again (98%). But even in China box office levels in the latest week have once again fallen below stage 3 levels as MULAN nose-dived in week 2 (-69%) from a disappointing start.

Help in on hand for China. The country’s Golden Week begins Thursday, October 1 (the National Day holiday). The week is one of the Chinese market’s two key box office periods, alongside the Chinese New Year which was lost this year with China closing all cinemas just days before the lucrative holiday. Titles opening include delayed CNY releases VANGUARD, starring Jackie Chan, and the animated LEGEND OF DEIFICATION; as well as patriotic sequel MY PEOPLE, MY HOMELAND. These should boost China back up the recovery levels.

But other markets lack similar potential saviors, at least until the arrival of James Bond title NO TIME TO DIE – currently still scheduled for November. Both UK/Ireland and Australia now look likely to have to wait for 007 to take them to stage 3.

Cinemas around the world have got themselves COVID-ready, often at significant expense. International audiences have shown a willingness to return. But without attractive new content to keep audiences coming the exhibition sector will continue to struggle. If more distributors don’t step up in support of international exhibitors in the coming months then markets already on their road to recovery may hit a dead end.

This article was originally published in Screendollars’ newsletter #136 (September 28, 2020).