In September, after six consecutive months of losses, the global box office finally began to show recovery. The global box office for the past month was $860 million, according to Gower Street’s Global Box Office Tracker (GBOT). This is lower than the $1 billion August, but, as September is on-average a weaker month, the result was an improvement to overall loss against the 3-year average. September’s $860 million was 66% behind the average, as opposed to 73% behind in August.

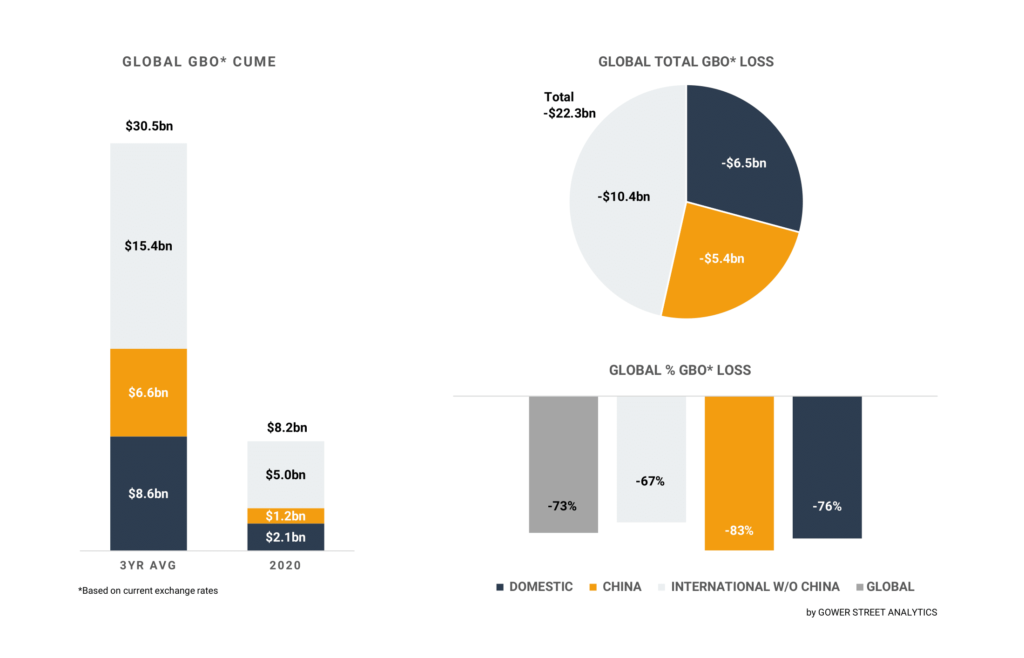

The global market now sits 73% behind the 3-year average, a 1-point improvement from a month before (74%). Whilst this may seem small, every victory is important, and this was a telling sign of the willingness of audiences around the world to return, before the events of the latest weekend.

The stacked bar graph on the left shows total levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three years and where those losses are currently coming from. The bar graph on the bottom right shows the percentage drops globally.

Whilst China has been closing the gap on the 3-year average for the past three months (now at 83% behind), September marked an important recovery milestone for International (excl. China). For the first time since the pandemic, the combined box office of international markets has shown no change from the previous month – 67% for both August and September. This marks a notable improvement to the former situation, where losses were growing month-by-month.

In these international markets, the greatest improvements have been seen within the EMEA and Asia Pacific regions. The total loss for the EMEA region fell from 63% to 62% with France, Germany, Spain, Russia, Austria, Portugal and Netherlands all showing small signs of improvement. In Asia Pacific (excluding China) there were similarly positive signs in the last month. After September, the total loss was equal with the month before (73%), but a closer look into the region shows individual successes. Japan, Singapore, Hong Kong and Taiwan all saw losses reduced, with Taiwan the best outside of China (falling from 71% to 66%). The picture is not as promising in the Lat Am region and Domestic market, where losses continue to increase in both following struggles with managing rising cases of coronavirus.

Much of the credit for the box office resurgence in September can fall at the feet of two noteworthy films: TENET and THE EIGHT HUNDRED. In September alone TENET added an estimated $230m, and Chinese blockbuster THE EIGHT HUNDRED accounted for $149m just in China. The combined box office of these two films was 44% of the entire monthly takings.

However, the additional 56% has come from myriad of different titles. In what Gower Street has been calling the TENET-effect, the release of Christopher Nolan’s latest offering in late August created a ripple effect for cinema globally. In Europe, titles such as FATHER THERE IS ONLY ONE 2 saw a resurgence throughout TENET’s release, converse to the usual crowding-out effect of a blockbuster title. Alongside this, there were surprise hits such as AFTER WE COLLIDED which released to very little promotion but nevertheless has amassed $32.6m since it’s early September release – predominantly in Europe. Moving focus from Europe, another notable release was the highly controversial Disney title, MULAN. Despite forgoing theatrical releases in all Disney+ markets the film has made $57.7m to date internationally. Almost 67% of that total comes from China ($39.2m).

The relative success of September comes with an unfortunate caveat. September is not traditionally a blockbuster month. We are however now heading into crucial months of the year, particularly over the holiday season, with a baron release calendar. The latest move this week saw James Bond title NO TIME TO DIE forego its November mission for an April 2021 opening. The result leaves already struggling international exhibitors currently without a tent-pole release until December!

The last month has proven that when distributors put their faith in audiences and release films theatrically the faith can be repaid. The international box office has been starting to fire up, but without releases the picture in a months’ time will inevitably look far less encouraging.

The Global Box Office Tracker features weekly in Gower Street’s International Road To Recovery report, currently still available on a free trial.

This article was originally published in Screendollars’ newsletter #137 (October 5, 2020).