In a week that saw chances of further theatrical recovery in some markets this year torpedoed by new calendar moves and abandonments, followed by exhibitor closures, it was easy to be distracted away from extraordinary positive news coming out of Asia. Markets across the Asia Pacific region were showing what is possible on the road to recovery. China, in particular, delivered an extraordinary play-week for October 2-8, following the October 1 National Day holiday.

China’s National Day holiday (also known as Golden Week) is one of the two most important box office weeks on the Chinese calendar, alongside Chinese New Year. China’s cinemas missed out on Chinese New Year in 2020, having been closed down in January just prior to the holiday. As a result, the National Day holiday week was all-the-more important, and it did not disappoint.

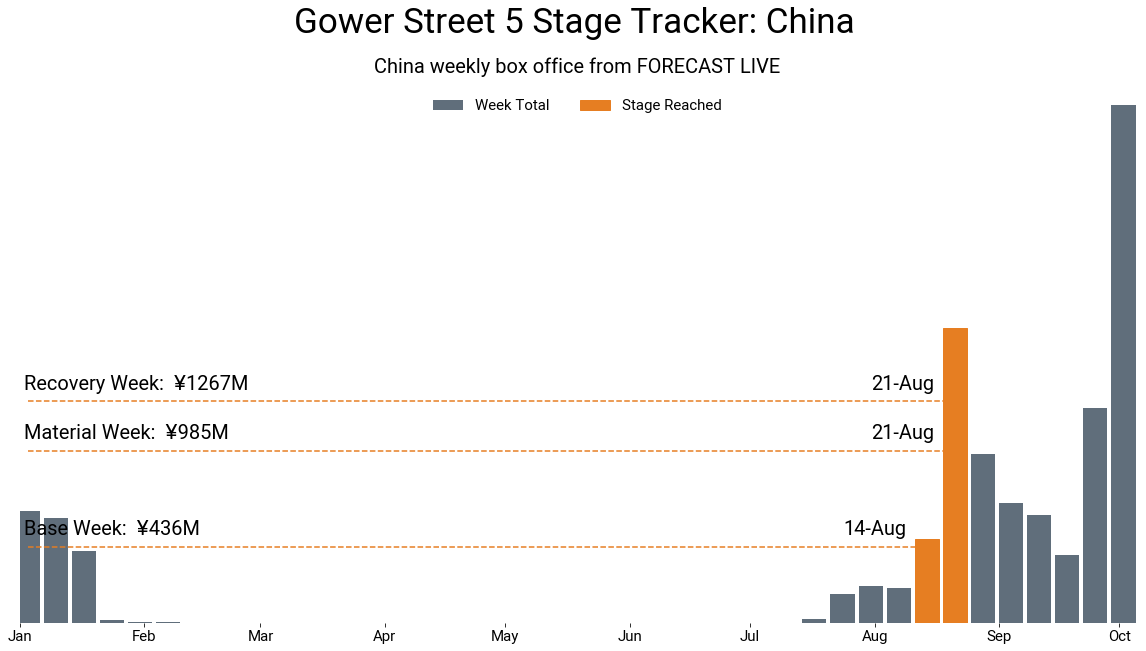

China has previous achieved the Stage 5 “recovery” level on Gower Street’s Blueprint To Recovery for the Aug. 21 play-week. But this was dwarfed by the Oct. 2 play-week (see graph below) which delivered ¥3.2 billion ($471.4m), according to our partners at Comscore. This is 153% ahead of the level needed to reach Stage 5 – a weekly box office equivalent to a week in the top quartile of the past two years.

The result delivered China’s biggest box office week since February 2019!

Multiple local titles opened for the holiday, headed by patriotic sequel MY PEOPLE, MY HOMELAND and animated film JIANG ZI YA (LEGEND OF DEIFICATION), which between them accounted for 82% of market share for the Oct. 2 play-week. Jackie Chan title VANGUARD was among other new openers.

The success shows that China is now essentially back to business as usual, at least as far as bringing audiences back to cinemas is concerned. The Oct. 2-4 weekend was 570% up on the previous week, which had itself re-achieved Stage 4 levels (equivalent to the median week of the past two years) thanks to the National Day holiday itself (which fell on a Thursday). In 2019 the equivalent (Oct. 4-6) weekend had also seen a 566% week-on-week rise. This year’s National Day holiday 3-day weekend was 3.3% ahead of 2019. The Oct. 2 play-week was 24.5% ahead of the equivalent (Oct. 4) play-week in 2019. However, the actual 7-day Oct. 1-7 Golden Week box office was slightly down (-15%) comparing like-for-like, having taken ¥3.7 billion ($544.1m) in 2020 and ¥4.35 billion ($609.4m).

With Domestic prospects further hampered by Regal closures, the loss of Pixar’s SOUL to Disney+, and the removal of NO TIME TO DIE and DUNE from the 2020 calendar it now looks certain China will finally surpass the Domestic market this year, for the first time. In 2019 the remainder of the year from this point out in China delivered approximately ¥10.7 billion ($1.6bn at current exchange rates). Although Hollywood titles accounted for over 25% of that, it still means that if China is able to sustain normal audience levels in the way we have seen in recent weeks the market could end the year close to $3 billion – a level now out of the Domestic market’s reach in 2020. This is despite Chinese cinemas having been closed for a full six months – a longer sustained closure than in any other global market.

But China was not alone in seeing a boost to its recovery fortunes last week. In South Korea a host of new titles opened for the Chuseok (Harvest Festival) holiday on Oct. 1. Led by local titles PAWN and THE GOLDEN HOLIDAY, followed by Gerard Butler film GREENLAND, the Oct. 1 play-week was just a breath under local Stage 3 levels (99.9%) – a result Korea has not come close to since last achieving it in mid-August having seen capacity restrictions re-imposed. The holiday week was 64% up on its predecessor. The four leading titles (which also included local documentary THANK YOU: KIM HOJOONG’S FIRST FAN MEETING MOVIE) collectively accounted for 79% market share for the Oct. 1 play-week, with PAWN single-handedly delivering 43%.

Hong Kong and Taiwan both celebrated the Mid-Autumn Festival on Oct. 1. Hong Kong delivered a HK$23.5 million ($3.0m) play-week which saw TENET hold at #1 in week 4, backed up by Japanese anime opener DORAEMON: NOBITA’S NEW DINOSAUR. The week was 16% up week-on-week (the 4-day weekend +31%). It was the market’s fourth consecutive week to hit Stage 3 levels – showing a sustained core-audience engagement.

In Taiwan, the Oct. 2 play-week was 6% up week-on-week delivering the 8th consecutive Stage 3-level week with TWD 74.5 million ($2.6m). The market has previously achieved Stage 4 levels twice, for the Aug. 28 and Sept. 4 play-weeks. Local romantic drama YOUR NAME ENGRAVED HEREIN headed business, accounting for nearly a third (32%) of business.

Although neither Malaysia nor Singapore had holidays both markets also enjoyed week-on-week boosts thanks to major Chinese releases. Malaysia saw the Oct. 1 play-week up 12% week-on-week to MYR 1.54 million ($371k), with VANGUARD opening #1 and accounting for 69% market share. The Jackie Chan action movie was also top of the chart in Singapore, where it accounted for 38% of a S$959k ($703k) play-week that was 48% ahead of the previous week. JIANG ZI YA also opened (at #2) in Singapore, itself grabbing another 22% of the market. Neither result was at Stage 3 levels, however.

Even Australia and New Zealand were getting in on the action as school holidays (which began Sept. 26 and run until Oct. 11 in both markets) continued. Australia delivered a A$7.4 million ($5.35m) Oct. 1 play-week, which was 4% up week-on-week. TROLLS WORLD TOUR (at #1) and THE SECRET GARDEN (at #3) enjoyed +9% and +5% boosts despite both being in their third weeks on release. Other family titles also benefitted from the first full week of school holidays. In New Zealand, a NZ$2.1 million ($1.4m) play-week was also up 4% led by second-week holdover THE WAR WITH GRANDPA (+20%), which accounted for a fifth (20%) of market share. THE SECRET GARDEN, also in week 2, was up +1% while Australian-Belgian animation 100% WOLF (already a hit in the family-movie-starved UK) opened at #3.

North America and Europe may be reeling from the latest round of delays, cancellations, and closures but this week’s Asia Pacific successes show there is still plenty of recovery progression in other parts of the world. Hollywood studios might want to consider tapping into this.

This article was originally published in Screendollars’ newsletter #138 (October 12, 2020).