The news earlier this month that Cineworld Group would be re-closing its Cineworld, Picturehouse and Regal circuits in the UK and US hit headlines around the world. This week, Cineworld boss Mooky Greidinger wrote to UK Prime Minister Boris Johnson requesting support to help save the UK’s cinema industry “to avert a generation of adults and children suffering a cultural blackout.” But amid the Hollywood studio delays, cancellations, and now major exhibitor closures, some titles have been scoring big. Both independent distributors and exhibitors in the UK have seen and grasped an opportunity.

UK/Ireland independent distributors have flourished since re-opening began in Ireland on June 29, followed by England July 4 and Scotland July 15. Shear Entertainment, Altitude Film Entertainment and Vertigo Films collectively account for more than 19% of business since re-opening began – a higher market share than all non-studio distributors combined in 2019. Market shares for UK independent cinemas have also risen slightly in 2020 compared to 2019.

Gower Street has focused on six titles, released since UK/Ireland cinemas re-opened, that cover the spectrum of normal releases. These include animated, teen, British art-house, foreign-language, star-driven, and blockbuster titles.

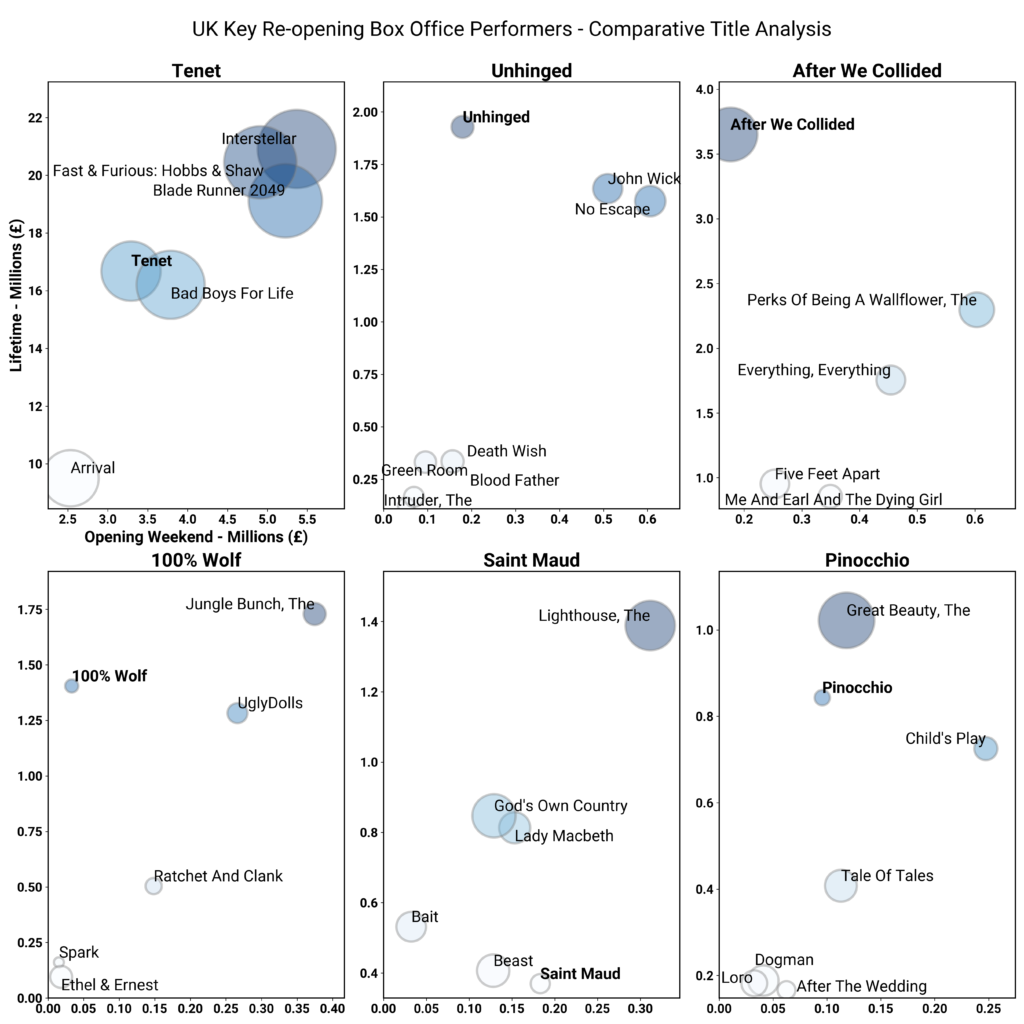

In this analysis we compare the performance of each of the six chosen films (TENET, UNHINGED, AFTER WE COLLIDED, 100% WOLF, SAINT MAUD and PINOCCHIO) to a set of relevant comparative titles. In each of the six graphs the X axis shows opening weekend; the bigger the opening the further to the right of the graph the title appears. The size of the bubble represents the site average for opening weekend. The Y axis shows lifetime box office; the higher the cume the higher the title (all subject titles remain on release).

The first graph (top left) looks at TENET. While TENET’s results may be deemed disappointing relative to titles like Christopher Nolan’s INTERSTELLAR or August 2019 release HOBBS & SHAW, it’s box office levels are impressive given market capacity restrictions and the fact a portion of the market remained closed (8% of UK cinemas by market share) at time of opening. TENET has dominated the post-lockdown landscape grossing £16.7 million (over 35% of all post-lockdown box office) and boosted Warner Bros to a colossal 46% market share.

Comparing TENET to BAD BOYS FOR LIFE, the highest grossing Hollywood title worldwide in 2020, TENET recorded a slightly smaller opening weekend and site average. Despite this it has gone on to out-perform the Will Smith sequel (£16.2m). It did this with no existing brand; lacking an A-list star of Smith’s attraction; and amid significant restrictions. Without Cineworld’s closure it is also reasonable to think it may yet have come close to BLADE RUNNER 2049 (£19.1m), another film with a known brand and bigger stars.

But the real success stories are seen in the independent arena. Russell Crowe thriller UNHINGED has become the fourth highest release ever for UK indie stalwart Altitude. The film’s size and older A-lister thriller selling point might previously have seen it performing akin to film’s like Bruce Willis’ DEATH WISH or Mel Gibson’s BLOOD FATHER. Released July 31, as the major exhibitors began re-opening, UNHINGED was the first major post-lockdown release in the UK with a big-name star. Despite capacity restrictions and only 45% of cinemas being open by market share the film delivered a bigger opening than the above titles.

The benefit to Altitude of taking the risk to release is obvious. UNHINGED opened on a similar (237) number of sites to 2018’s DEATH WISH (208) with an almost identical site average, but while DEATH WISH’s lifetime was only 2.1x its opening, the multiple for UNHINGED so far is 10.75x its opening! Its success has allowed it to even out-perform titles like JOHN WICK, a film whose opening was nearly three times as big.

Altitude has released multiple films since cinemas re-opened and has accounted for more than 6% market share of post-lockdown box office. Perhaps more importantly the distributor’s box office performance for the period is tracking only 19% behind the equivalent period of 2019 – an impressive feat given that the total box office for the period is 89% behind 2019.

AFTER WE COLLIDED is not only the sequel to a film never released into UK cinemas, it is only the fourth film ever released theatrically by Shear Entertainment. The company’s previous biggest performer grossed £123k – less than half the opening weekend of AFTER WE COLLIDED. Shear had no theatrical releases in 2019. The film started small, opening at just 40 locations, but its impressive site average (£4,410) quickly brought other exhibitors on board and, to Thursday (Oct. 15), it had achieved a phenomenal 20.7x multiple for a gross of £3.65 million, beating the likes of YA comp. titles from eOne, Fox and Warner Bros in the process. This means Shear, a distributor many had not heard of at the beginning of the year, has accounted for 7.8% of post-lockdown market share (the third biggest of any distributor) and 1.2% of the entire 2020 market!

Vertigo Films has two films in our focus: Australian-Belgian animation 100% WOLF and the Italian-language live-action adaptation of PINOCCHIO from Matteo Garrone (director of hard-hitting crime dramas GOMORRAH and DOGMAN). The distributor’s success in this period has seen it grossing 76% more than the same period in 2019 and achieving a 5.35% market share.

Second-tier animation titles are common and rarely make significant in-roads. In 2019, 46 animated films released theatrically in UK/Ireland. Of those only 18 grossed over £1 million: 11 released by major studios; another 6 by the bigger independents: Lionsgate, StudioCanal, eOne and STX. 100% WOLF opened small at 124 locations with little fanfare July 31. In normal circumstances it might have quickly disappeared, but family audiences were hungry for content. The film has gone on to achieve an astounding 42x multiple for a gross to date of £1.4 million – out-performing the likes of STX’s more aggressively-marketed UGLYDOLLS, released in a similar window (Aug. 2019) on substantially more screens (434).

Meanwhile, Garrone’s PINOCCHIO has also taken advantage of the opportunity to be discovered. The highest grossing Italian-language film at the UK/Ireland box office since 2013’s Oscar-winning THE GREAT BEAUTY, PINOCCHIO has more than doubled both the gross and multiple of Garrone’s adult-skewed fairy-tale TALE OF TALES. It has out-grossed Vertigo’s own release of 2019’s CHILD’S PLAY – an English-language release, based on a well-known brand, in a popular (horror) genre. Outside of current circumstances it is unlikely the film could have grossed half as much. Apart from a few Bollywood titles, the only fully non-English language, live action, fiction films to gross more than PINOCCHIO since the beginning of 2019 in UK/Ireland are Oscar-winner PARASITE and Pedro Almodovar’s PAIN AND GLORY. The highest grossing Italian-language film of 2019 was Paolo Sorrentino’s LORO with £183k. While, PINOCCHIO does feature Roberto Benigni, director/star of the most successful Italian-language film ever at the UK/Ireland box office, Oscar-winner LIFE IS BEAUTIFUL (£3.08m), Benigni’s next best performer in the UK had been Woody Allen’s largely English-language TO ROME WITH LOVE (£658k) eight years ago!

The most recent release in our group is StudioCanal’s SAINT MAUD, the directorial debut of Rose Glass. The psychological horror is the latest British film to capture the attention of local press, drawing enthusiastic reviews in a similar way to recent British art-house hits BAIT, BEAST, LADY MACBETH and GOD’S OWN COUNTRY. But, releasing into a barren calendar, SAINT MAUD had the opportunity to release on over 300 screens, three-times the opening number of LADY MACBETH and substantially more than other comp. titles. Accordingly, it saw a bigger opening than all those mentioned. Only on release for a single-week at time of analysis it’s lifetime appears low but by the end of its second weekend (Oct. 18) it is predicted to (more-or-less) match the lifetime of BAIT on its way to a £1 million+ UK gross that would head it closer to Universal’s January-release of awards-corridor psychological horror THE LIGHTHOUSE, which boasted both well-known stars (Robert Pattinson and Willem Dafoe) and a hot-topic director (THE WITCH’s Robert Eggers). StudioCanal’s market share for the post-lockdown period is higher than the distributor saw in 2019, with SAINT MAUD already accounting for over half of the result.

The results show that, even in a market yet to achieve a Stage 3 level of recovery on Gower Street’s Blueprint To Recovery, there are audiences ready and willing to come out for distributors, and exhibitors, bold enough to take an opportunity. Many other international markets are performing even better. Now may be the time for more distributors and exhibitors to practice what Altitude’s managing director Hamish Moseley recently termed “pandemic pragmatism”.

This article was originally published in Screendollars’ newsletter #139 (October 19, 2020).