The final month of the year set a bold exclamation mark to the worldwide recovery process. Global cinemas accounted for a box office of $2.9 billion! That is the second highest monthly result since the January 2020. Just slightly behind the $3.1 billion in October. All that despite China performing only its 9th best result in the same timeframe.

Both the Domestic and International (excluding China) markets that recorded their biggest box office results since before the pandemic began! The major portion of these numbers was delivered by one title, SPIDER-MAN: NO WAY HOME with a December box office of $1.3 billion!

December might be called the first real recovery month on a global scale based on Gower Street’s 5-Stage Blueprint To Recovery. A marvelous 26 of the 30 territories tracked in our State Of The Market report reached the highest Stage 5 target for a full play-week at least once during the month. This is equivalent to a performance in the top quartile of weekly business in the two pre-pandemic years (2018-2019). More than half (17) of the tracked territories did it at least twice.

Prior to December only 11 territories had achieved Stage 5 at all since the pandemic started. Eighteen territories reached Stage 5 the first time, including France, Australia and Hong Kong. Nine surpassed Stages 4 and 5 in one go, including the Domestic market, Italy, Spain, Mexico, Brazil and Malaysia. Peru even stretched that to Stage 3 – the final market of our 30 tracked to surpass that basic stage. South Korea is the only remaining tracked market, that has not reached either Stage 4 or 5 yet.

This is a huge step forward towards a global market as a whole reacting as normal, with an ebb and flow dependent on the release calendar.

The catalyst for that was as aforementioned SPIDER-MAN: NO WAY HOME. After just a bit over half a month playing it got the highest grossing global title since FROZEN 2 in 2019 ($1.45 billion) with a current total of $1.4 billion (Domestic $622m, Intl $759m). It is already #12 in the all-time ranking and constantly climbing. It is also the only title in that sphere that hasn’t seen a release in China.

SPIDER-MAN dominated most markets it was released in. In the current five highest grossing territories for the title, it accounted for at least half of the impressive December earnings. Mexico is leading this group with 72% of the country’s monthly box office, followed by South Korea (67%), the Domestic market (61%), the UK (60%) and Australia (48%).

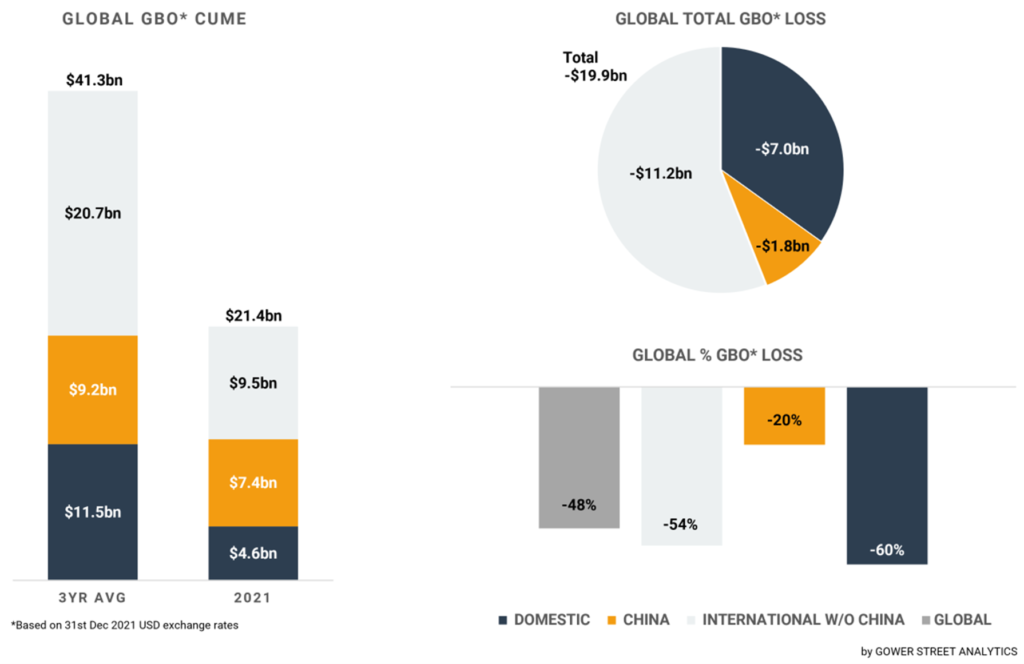

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three (pre-pandemic) years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

According to Gower Street’s latest monthly Global Box Office Tracker, the 2021 global box office grew to $21.4 billion in December. Since the beginning of July, box office has increased by $13.2 billion. That means nearly two third of the year’s total global box office (62%) had been achieved in the second half of 2021 (vs. 50% historically). The 2021 global box office tracked -$19.9 billion behind an average of 2017-2019, a drop of -48%. Nevertheless, 2021 ended 78% above the year-end result for 2020 ($12bn according to the MPAA’s Theme Report 2020).

The Domestic market did $920 million in December. This is the best result since December 2019! The month represents one fifth (20%) of the $4.55 billion 2021 domestic total (vs. 10% historically). SPIDER-MAN: NO WAY HOME contributed the major share with $573 million. It was followed far behind by two family titles: SING 2 with $75 million and November holdover ENCANTO with $47 million. Although the December performance of the Domestic market is remarkable, it’s still -23% below the three-year average for the month. It must of course be considered that it’s historically the most lucrative month of the year beside July. Except for October (-16%) this number has been significantly lower, causing the year-end result to track -60% behind the three-year average, a total of -$7.0 billion.

The biggest part of the global box office growth in December was delivered across the International market (excluding China) with $1.6 billion, the best result since January 2020! This brings the cume to $9.5 billion by year-end. This 2021 result is -$11.2 billion and -54% below the three-year average.

While all three International subregions had a successful final month of the year, Latin America was a standout. The December result was over a third (37%) above the period’s three-year average, clearly better than in APAC (-25%) and EMEA (-29%). The peak for Latin America up until now, within the pandemic, was -34% in October, most other months were significantly below that. It was the extraordinary performance of SPIDER-MAN: NO WAY HOME that lifted the region’s level nearly on its own, providing over 70% of most LATAM markets’ December results (e.g. Brazil and Peru, both 78%; Argentina 75%; Chile 72%).

One major highlight of the APAC region in December came from Japan. Local anime JUJUTSU KAISEN 0: THE MOVIE had the second highest opening of all time with $23.5 million. Just behind the highest grossing movie of all time in Japan DEMON SLAYER THE MOVIE: MUGEN TRAIN (opening $43.9m, total $383m). Although only released on Dec. 24 it already ranks #5 of all titles released in Japan since the pandemic began with $48 million.

The EMEA region saw strong performances in December by multiple territories, especially the UK and France, on one side. On the other side it continued to be impacted by rapidly rising cases of Covid-19 in many countries. In Germany national restrictions, including some regional lockdowns are still in place, muting the results. After renewing capacity restrictions and a 5pm curfew, preventing evening shows from Nov. 28, the Netherlands entered lockdown Dec. 20 including closure of cinemas until at least mid-January!

How quick a recovery from such closures of cinemas can ideally be nearly two years into the pandemic is illustrated by Russia. In November the market was pulled down by a short-term shutdown at the beginning of the month to the lowest box office of the year. In December Russia bounced back to the second best result of the year with $62 million, on par with the three-year average. For the whole year Russia is -24% behind – the second lowest deficit of all Comscore-tracked markets.

The only market with a better outcome of -20% was China. It finished the year clearly as highest grossing global territory for the second year in a row with a $7.4 billion total. That is $1.8 billion down from the three-year average. Nevertheless, China had a mediocre finish. It generated $430 million box office in December. This is up 43% from November, the second worst single month box office result since cinemas re-opened in August 2020. Still, for the sixth time in the last seven months its monthly total was below the Domestic number. The December box office was also below the same period last year (-27%) and below the three-year average (-38%). The market was dominated once again by local titles. FIREFLIES IN THE SUN, a sequel to SHEEP WITHOUT A SHEPHERD, led the month with $131 million. Ranking #2 was SCHEMES OF ANTIQUES with $67 million within the month.

Globally 2021 ends in a much better state than 2020. The global theatrical business has shown an impressive recovery over the last couple of months. Several titles demonstrated how the market can stretch even with restrictions. All-time records can be broken on territory, regional and global levels. The trend is pointing significantly upwards, even with the Omicron variant spreading around the world, causing record numbers of new Covid-19 cases.

The toolbox to fight the virus has been drastically extended. The re-closure of cinemas has been the exception so far and requires higher measures than before. The number of cinemas open by market share still is at 87%, just shy of the pandemic best 90.1% reached in the December 3 play-week. This is far above the 56% at the beginning of the year, marking rock bottom since mid-August 2020. 2022 should continue the path of recovery, even if smaller steps back won’t be avoidable.