It took AVATAR 13 years to have a sequel released. It hopefully won’t take the global theatrical industry that long to return to pre-pandemic revenue levels. Heading into the third year since the first cinemas were forced to close due to the COVID-19 outbreak the industry has made significant steps forward. 2022 ended with a global box office of approximately $25.9 billion that’s 22% higher than the prior year in US$ terms ($21.3bn, MPA historical FX rate – although actually 27% higher in like-for-like terms at current exchange rates) and 119% more than in 2020 ($11.8bn). However, it’s getting clearer every month, that the continuing recovery has slowed down for a while now.

December generated a global box office of $2.5 billion, that makes it the 4th best month of 2022. However, it’s still -35% below the three-year pre-pandemic average for December. That is identical to the deficit for the whole year vs the 2017-2019 average. It’s also -13% below the $2.8 billion achieved in December 2021, but nearly 2.5 times as much as in 2020 when many cinemas around the world were closed (+147%).

December closed a quarter that illustrated how challenging it is, and most likely will continued to be, to reach pre-pandemic heights any time soon. Around July 2021, the numbers of cinemas open by market share started to be constantly above 80% again. Comparing Q4 of 2022 against all quarters since then, its $6.2 billion is just higher than the total box office collected in Q3 2021 (+19%). It’s below all other quarters (Q4 ’21: -18%; Q1 ’22: -2%; Q2 ’22: -7%; Q3 ’22: -11%). Even taking out the recently struggling Chinese market, Q4 of 2022 (with $5.5bn) is only just above the amounts gained in Q3 2021 (+34%) and Q1 2022 (+31%), but still slightly below the other three quarters (Q4 ’21: -4%; Q2 ’22: -10%; Q3 ’22: -2%).

Nevertheless, there are also encouraging signs that substantial recovery and growth is still happening. In December the International market (excluding China) achieved the 2nd highest grossing month since January 2020 with $1.55 billion. Just a glimpse behind July 2022 (-3%).

Additionally, the breadth of the worldwide recovery reached another peak in December. In each of the play-weeks from the 16th and 23rd of December, 26 of the 30 territories tracked in our global State Of The Market report reached at least Stage 4 on Gower Street’s 5-Stage Blueprint To Recovery, which marks the median level of the weekly business seen across the last two pre-pandemic years (2018-2019). The prior record for consecutive weeks was in the play-weeks from 17th and 24th of December 2021 with 25 and 23 territories, respectively, reaching at least Stage 4. Getting to 26 market hitting Stage 4 in a single week is a record in itself. It shows the capability of the post-pandemic international markets when the right movies hit the screen.

The positive aspects of the December performance can mainly be attributed to the long awaited release of AVATAR: THE WAY OF WATER. More than half (53%) of the month’s global box office was delivered by just that one title, with $1.3 billion in the period!

After only a bit over half a month playing it has already achieved the highest grossing global title since SPIDER-MAN: NO WAY HOME in 2021 ($1.9 billion) with a total of $1.5 billion (Domestic $465m, Intl $1.05bn) prior to the current weekend. It is #9 in the global all-time ranking and constantly climbing.

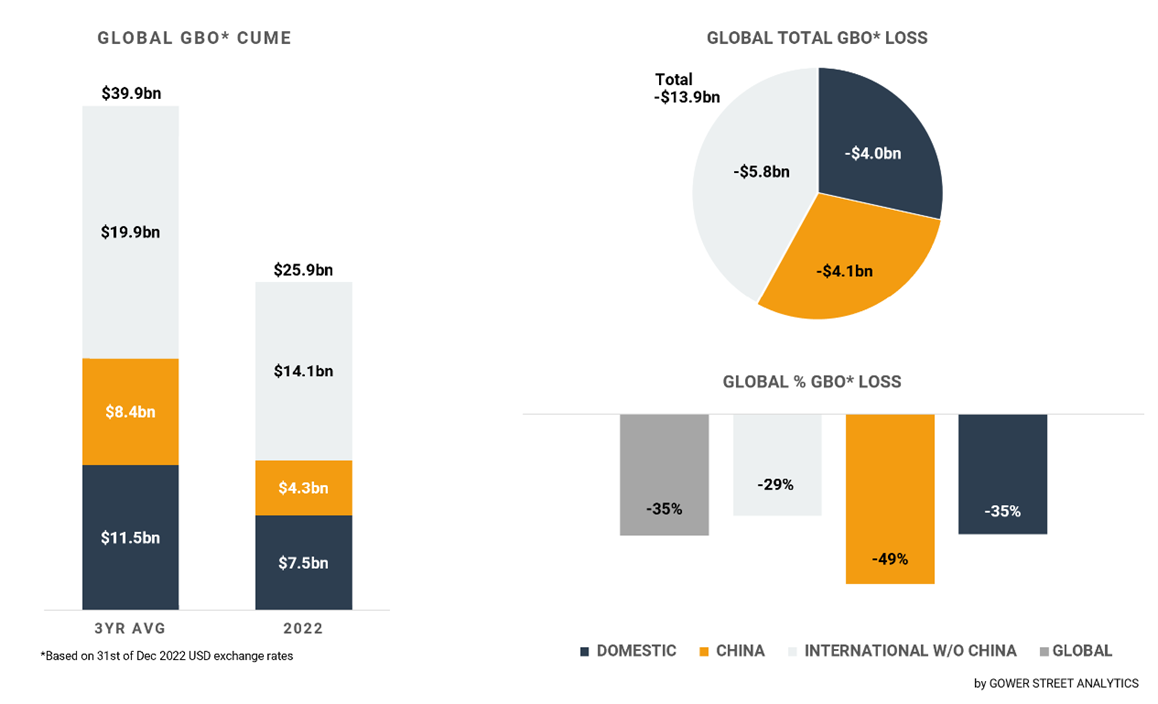

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

The biggest part of the global box office in December was delivered across the International market (excluding China) having a worldwide box office share of 63%, the highest of the year! The month came in -20% below the average box office of the last three pre-pandemic years in the same period. It increased the 2022 total to $14.1 billion and closed the gap to the pre-pandemic benchmark to -29%, the smallest of the year.

The highest grossing sub-region with over half (53%) the month’s International (excluding China) total was again Europe, Middle East, and Africa (EMEA). It recorded the best month of 2022 and the 2nd best since February 2020, just -3% behind October 2021. The region was carried by strong performances in multiple major markets. Germany saw their highest grossing monthly result and France their 2nd best of the decade, while Italy achieved the #1 month since January 2020 and Spain had their #2.

Despite having such a strong month on a monetary level, the December in EMEA was coming in -27% below the average of the last three pre-pandemic year. The lowest number of all three sub-regions that month. Historically December is clearly the strongest month of the year in EMEA, compared to just #3 in Asia Pacific (excluding China) and #7 in Latin America.

That helped Asia Pacific (excluding China) to have the lowest gap of the sub-regions against the three-year pre-pandemic average at only -11%. At the same time December was just its 4th highest grossing month of the year. The main drivers of that performance were Japan and South Korea.

South Korea recorded by far its best month since July, after struggling in the period since. The month ended -16% below the three-year average. South Korea is currently the #4 global market for AVATAR: THE WAY OF WATER, which dominated the month with a 57% market share. Moreover, multiple successful local productions followed especially holdover THE OWL ($16m) at #2 and HERO ($11m) at #3.

Japan had another tremendous month coming in 17% above the average of the last three pre-pandemic years! In contrast to most other territories AVATAR: THE WAY OF WATER didn’t top the month’s ranking here. With a disappointing performance, grappling also with technical projection issues, it ended at #3 with about $16 million. Nearly three times as much was collected by local manga- based anime THE FIRST SLAM DUNK at #1 in December with $47 million. It was followed by local holdover hit SUZUME which added $28 million to its current $78 million total.

Latin America was the only of the three sub-regions that was down on December 2021 (-32%). It was the extraordinary performance of SPIDER-MAN: NO WAY HOME in that time-frame that pushed the reference month up to be clearly the 2nd highest grossing of the decade. AVATAR was not able to do the same. However, against the three year pre-pandemic average the sub-region scored the 2nd lowest gap of the year and 3rd lowest since February 2020 at only -13%.

The Domestic market ended the year with a more muted result than would be expected in the, historically, 2nd highest grossing month of the year. It came in at #4 for the year with $691 million, which is -28% below the same period last year. AVATAR: THE WAY OF WATER contributed the majority (58%) of that amount with $401 million. It was the first time since SPIDER-MAN: NO WAY HOME that a single release crossed $400 million within a month. On the flipside the number of titles the box office spread across that month was very limited. Only 7 titles had a monthly result of more than $10 million, this is the lowest number since January 2022.

Looking at the Domestic December result from a seasonal perspective, it was -42% below the average of the last three pre-pandemic years in the same period. This is just #9 in 2022 and clearly below the percentage drop for the whole year of -35%. The lowest gap of the running year was reached in July with -31%.

As in the Domestic market, China also finished 2022 with a monthly result that was further away from the three-year pre-pandemic average than that of the whole year. December came in -64% below, while the whole year ended -49% below. The peak was reached early in February, when the market’s total was on par with the three-year average. From March onwards Covid-19 and it’s tackling policies weighted the market down to different degrees. China generated a box office of $225 million in December. That was significantly up from a desolate November ($82m), the lowest grossing month since July 2020, but still left December ranking #7 in a very volatile year.

Despite the challenges, with a current total of $170 million for AVATAR: THE WAY OF WATER, China is by far the strongest international market for that movie. The release is already the highest grossing non-Chinese release of 2022 and the 3rd highest since the beginning of 2020. However, given the first AVATAR did $204 million in its initial release, when the market had a fraction of the screens it currently operates, and even a re-release of the first film in March 2021 achieved $55 million, it’s clear that the current impact of massive covid infections has limited the market’s potential enormously.

China is calculated to have finished 2022 at approximately $4.33 billion, putting it -36% behind 2021. It is one of only three markets Comscore and Gower Street track to show a year-on-year loss. The others being Hong Kong (-6%), which suffered a four-and-a-half-month closure at the start of the year and Russia (-43%) with its aggression-caused US studio boycott since March.

It’s obvious the past year brought further recovery but also challenges for the global box office. The upcoming year is expected to follow that path. Numerous titles demonstrated how the theatrical market can be stretched. All-time records can be broken on territory, regional and global levels. It’s now about consistency. A more evenly split out, diverse release schedule is key to have a chance to get back to and beyond pre-pandemic box office levels.

A version of this article appeared on Screendollars Jan. 8.