What a month, what a Quarter, what a first half-year of 2023! In June the global box office generated $2.9 billion, outperforming the remarkable levels of the two prior months (May +6%, April +3%). That helped Q2 2023 to reach $8.6 billion. This was clearly the best quarterly result since 2019 surpassing this year’s first quarter ($7.8bn) by +10%.

After the disruption of the Covid-19 pandemic the recovery of the global theatrical industry has made fundamental progress in 2023. The gap to pre-pandemic results has closed significantly. The first half of 2023 contains four of the five months with the lowest deficits compared to the average of 2017-2019 since the pandemic first shut cinemas around the world in March 2020. Three of them are the Q2 trifecta: April (-14%), May (-9%), and June (-6%)! Consequently Q2 was only -10% down on the same period pre-pandemic. This is by far the best quarterly result, ahead of Q1 this year (-23%).

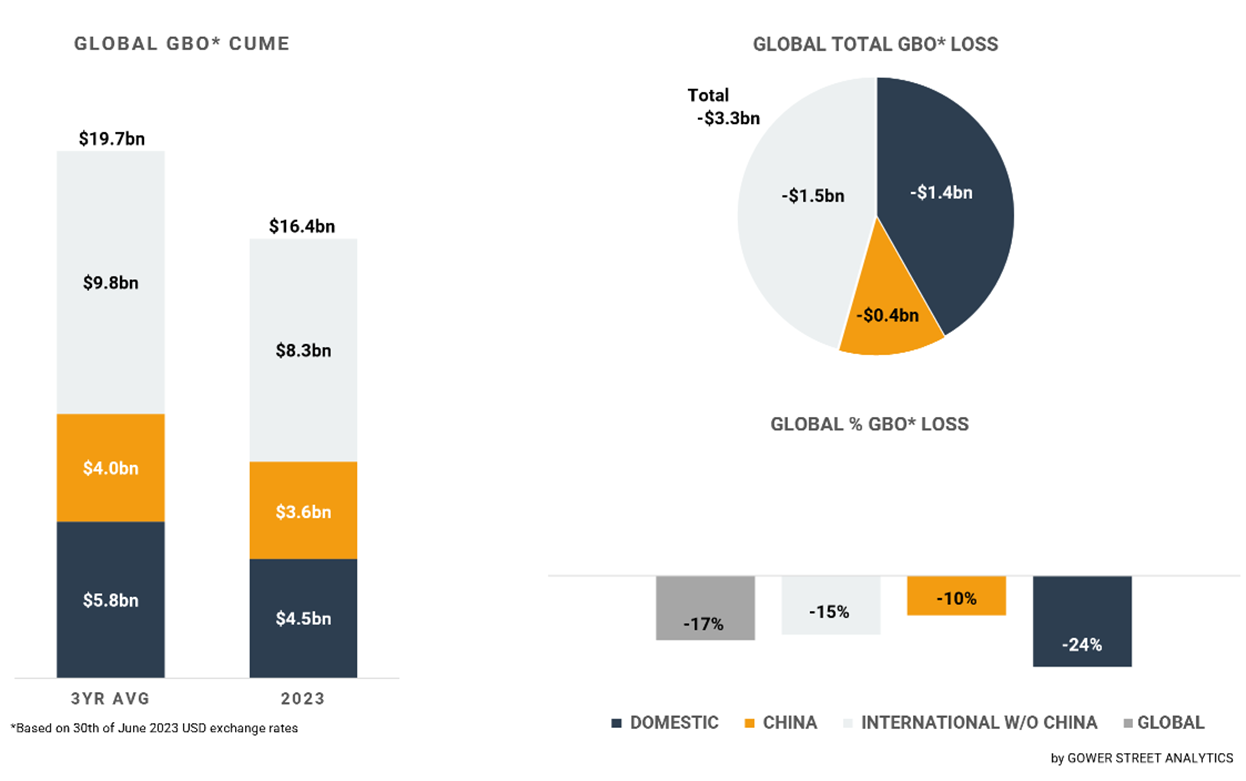

The two highest grossing Quarters since 2019 combined delivered a global box office for the first half of 2023 of $16.4 billion. That is an impressive +27% above the second half of last year, the prior highest grossing 6-month period of the current decade.

At the end of June, 2023 global box office is tracking -17% behind the pre-pandemic three-year average. That is half the previous lowest gap for a half-year period since 2019, recorded by H2 2022 (-34%). 2023 is currently tracking +29% ahead of 2022 and more than doubles 2021 (+122%) at the same stage!

On this month’s Global Box Office Tracker (GBOT, above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

Compared to the prior month, an increased number of movies contributed to the June result. The month had at least one global US-studio wide release each week. These five main releases generated a combined box office of $1.4 billion. On top of the new releases four key holdover titles added around $580 million.

Globally Sony Pictures’ SPIDER-MAN: ACROSS THE SPIDER-VERSE achieved the highest box office in June with $591 million. It was expected to be a breakout sequel to the innovative Oscar-winning INTO THE SPIDER-VERSE from 2018. The size of its growth was nevertheless a welcome surprise. At the end of June it was already +54% ahead of the global total of the prior instalment ($384m). The Domestic month result of $332 million is even +75% ahead of INTO THE SPIDER-VERSE ($190m). It’s currently the third highest grossing title of the year and ranks #5 among the ten SPIDER-MAN centred movies in the Domestic market!

TRANSFORMERS: RISE OF THE BEASTS was the second highest global grossing title in June delivering approximately $367 million. Nearly two thirds (64%) came from the International market (inc. China) with $236 million. Despite this sizable number, it’ll end at the bottom of the franchise. Far away from reaching the franchise’s global best, 2011’s TRANSFORMERS: DARK SIDE OF THE MOON ($1.12bn), and International leader, 2014’s TRANSFORMERS: AGE OF EXTINCTION ($859m). At least in the Domestic market with its $131 million in June, RISE OF THE BEASTS already overtook the prior two TRANSFORMERS movies (BUMBLEBEE $127m, TRANSFORMERS: THE LAST KNIGHT $130m).

The third highest grossing new release in June was THE FLASH. Facing multiple challenges the superhero movie grossed $233 million within the month. In the DC Universe that puts it ahead of BIRDS OF PREY ($205m, +14%), THE SUICIDE SQUAD ($169m, +38%) and this years SHAZAM! FURY OF THE GODS ($134m, +74%). The current cume suggests it will end short of $300 million. That would be behind BLACK ADAM ($393m), BATMAN BEGINS ($374m) and SHAZAM! ($368m).

Pixar’s ELEMENTAL started its roll out mid-month. At the end of June it had collected $160 million. Disney also released INDIANA JONES AND THE DIAL OF DESTINY in the final days of June, contributing $51 million to the global total.

The biggest holdover title in June was THE LITTLE MERMAID. As in June it was the third highest grossing release in the month, adding approximately $283 million for a total of $516 million at the end of June. That is already above the totals of MALEFICENT: MISTRESS OF EVIL ($492m, +5%) and the live action DUMBO ($353m, +46%). The current cume suggests it will end a bit above CINDERELLA ($542m) from 2015.

The other three highest grossing holdover titles in June are also, currently, the three highest grossing global titles of the year. FAST X added approximately $158 million for a total of $695 million. GUARDIANS OF THE GALAXY, VOL. 3 contributed a further $85 million for a global of $835 million. Above all shines THE SUPER MARIO BROS. MOVIE achieving $57 million for a stunning total of $1.336 billion. It’s now the #17 highest grossing movie of all time globally, just marginally behind HARRY POTTER AND THE DEATHLY HALLOWS: PART 2 ($1.342bn).

Thanks to a packed release calendar the Domestic market achieved $1.01 billion in June. That is the second highest grossing month since 2019 and the first month to top $1 billion since July last year! Three titles grossed more than $100 million within the month and for the first time since January 2020, 10 titles grossed more than $20 million in that period.

The Domestic market also saw the best Quarter of the decade in Q2 with $2.7 billion, dethroning the same period last year, being +14% ahead ($2.4bn). Q2 was just -13% below the three-year average. That reduced the gap for the running year significantly from -36% at the end of March to -23% at the end of June.

The first half of 2023 grossed $4.46 billion in total at the Domestic box office. It outgrossed H2 2022 by +18%. After just six months 2023 is nearing the Domestic 2021 whole year total of $4.5 billion!

China joined the Domestic market in having an extraordinary June. China recorded $567 million in the month, the 2nd highest grossing month outside of Chinese New Year or Golden Week holidays since 2019. The month even performed +9% above the three-year average! The main driver of that was local thriller LOST IN THE STARS, contributing 42% of the market’s month with $236 million despite only opening for the Chinese Dragon Boat Festival holidays on June 22. LOST IN THE STARS is the third highest grossing movie in China this year!

Additionally US-studio releases claimed four of the following five positions in China’s June ranking. These generated a combined box office of $180 million: TRANSFORMERS: RISE OF THE BEASTS ($83m), SPIDER-MAN: ACROSS THE SPIDER-VERSE ($48m), THE FLASH ($25m), and holdover FAST X ($24m). For these four titles China remains the #1 international territory. Despite US-studio results staying below heights of the past, they are getting a bigger part of the Chinese market again.

Like China the International sub-region of Latin America was performing above the pre-pandemic three-year average in June, exceeding it by +5%. That is the third month in a row (April +6%, May +16%) and the fourth time since February 2020. Q2 was +9% above as a whole. Shrinking the gap for the running year at the end of June drastically down to just -4% from -21% at the end of Q1.

The two other International sub-regions are further behind pre-pandemic box office levels. Nevertheless, both are constantly evolving, mirroring the global level of recovery. Asia Pacific (excluding China) was -9% short of the three-year average for Q2. Europe, Middle East, and Africa (EMEA) was -10% behind. That reduced the gap to -17% after the first half year in 2023 for both down from -24% (APAC) and -23% (EMEA) at the end of March.

On a macro level the global theatrical industry had another encouraging month performing at the top end of the decade. But, on an individual title level multiple major releases performed at the low-end of expectations. It’s a sign of regained strength that the theatrical industry is holding the degree of recovery despite these shortcomings. Still, it prevents major growth to peak performances of last years’ June and probably July. The upcoming weeks offer various promising high-profile releases with MISSION: IMPOSSIBLE – DEAD RECKONING PART ONE, BARBIE and OPPENHEIMER. There is a good shot to get to the heights of July 2022, the 2nd highest grossing global month of the decade with $3.2 billion. A release date swap of single titles between June and July might have increased the diversity of the offer at the time and raised the individual titles and markets result even more significantly.

From August onwards the year-on-year growth should increase again given the density of the release calendar in comparison. The first half of 2023 accelerated the recovery and narrowed the gap to pre-pandemic box office results substantially. To get to and even beyond this level an even greater variety of movies in terms of age, gender, taste and ethnicity of its audience need to be delivered, dated in a way that reduces cannibalisation of overlapping audiences to a minimum. This will extend the capability of the theatrical marketplace in most territories.