Grossing like it’s 2019? Almost! Box office for the International market (excluding China) ended June only marginally below pre-pandemic levels. It was only -$43 million (or -3%) short of the average of the last three pre-pandemic years (2017 -2019), with a total of $1.5 billion. That is by far the lowest monthly deficit of the pandemic and clearly stands ahead of a -15% deficit in May and a -22% deficit in December 2021 – the months showing the second and third lowest deficits against the pre-pandemic average.

To put things in perspective June is also, historically, the second weakest month of the year internationally, but this recovery to near pre-pandemic levels across the International market (and surpassing the pre-pandemic average in a number of major markets) is, perhaps, the most positive sign of the potential for theatrical business to regain pre-pandemic normalcy yet.

This June box office was substantially growing for the fourth consecutive month. As a box office total, it was the second highest grossing single-month since January 2020. December 2021 ($1.59bn) remains the top grossing pandemic-era month, while May 2022 comes in third ($1.38bn).

The Domestic market even topped that, recording the highest grossing month since December 2019 with $975 million in June! Just a glimpse away from grossing a billion and a pandemic-era best. Still, that remains -14% down against the three-year average. In contrast to the International market (excluding China), June is historically the third highest grossing month of the year in Domestic.

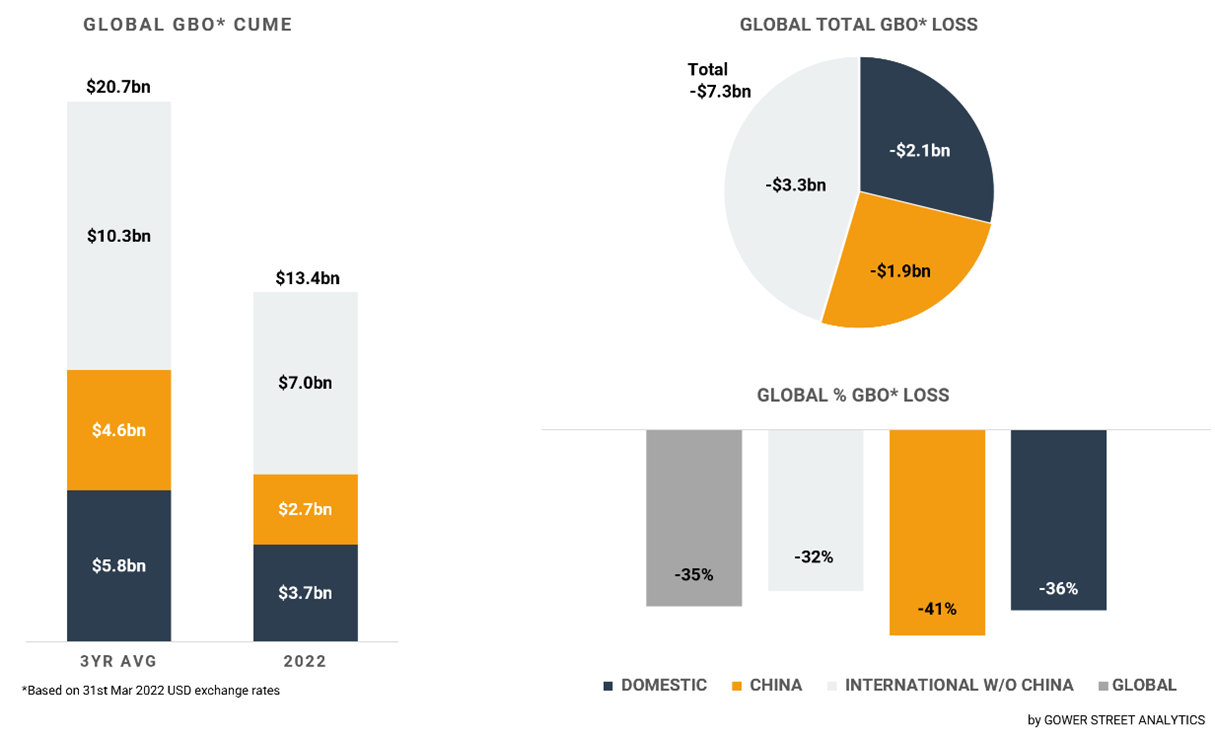

These terrific results end the first half of 2022 on a high. The total global box office added $2.8 billion in June bringing the total up to an estimated $13.4 billion after six months of the year. This is over $5 billion ahead of the same stage in 2021, but approximately $7.3 billion (-35%) behind the average of the last three pre-pandemic years (2017-2019). At the end of June, 2022 has already surpassed (+14%) the 2020 full-year total ($11.8bn) and is nearly at two thirds (63%) of last year’s $21.3 billion full-year result.

On this month’s Global Box Office Tracker (GBOT, above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

As in May the major drivers of the fabulous June results were two global blockbusters. One, unchanged from May, was TOP GUN: MAVERICK which generated impressive holdover numbers. The other was June opener JURASSIC WORLD: DOMINION. The pair of titles contributed over two thirds of the Domestic (70%) and a bit more than half of the International (54%) June total.

JURASSIC WORLD: DOMINION delivered a box office of approximately $782 million within the month. It’s already the fourth highest grossing US title since STAR WARS: THE RISE OF SKYWALKER ($1.07bn) in December 2019, only behind SPIDER-MAN: NO WAY HOME ($1.9bn), TOP GUN: MAVERICK ($1.1bn) and DOCTOR STRANGE IN THE MULTIVERSE OF MADNESS ($953m). The Domestic market easily ranked #1 globally on the title with $316 million, representing 32% of the market’s total within the month. That result was followed by China’s $122 million (44% local market share), Mexico with $41 million (52% MS), UK/Ireland with $36 million (27% MS), South Korea with $23 million (18% MS), and Australia with $21 million (23% MS).

TOP GUN: MAVERICK added $706 million in June to reach an astonishing cume of $1.05 billion at the end of the month. As previously mentioned, that makes it the second highest grossing US title since December 2019. This is the first time a Tom Cruise title has achieved $1 billion and the first time a Paramount title has done so without China and Russia (TRANSFORMERS franchise sequels DARK OF THE MOON and AGE OF EXTINCTION are Paramount’s previous $1bn global grossers). Domestic was the highest grossing territory for TOP GUN as well, at #1 in the month with $362 million (current total $571m), representing a 37% market share. That terrific performance is followed by UK/Ireland with $55 million (42% MS, CT $86m), Japan with $48 million (35% MS, CT $60m), Australia with $36 million (40% MS, CT $53m), France with $22 million (27% MS, CT $38 million) and Germany with $17 million (29% MS, CT $26m).

Beside those two crowning titles a few more supported the growth in June. LIGHTYEAR claimed $170 million within the month. That was disappointing for the first Pixar film to receive a global theatrical release in over two years, but still a substantial contribution to the global total. Domestic delivered $99 million followed by Mexico with $15 million and UK/Ireland with $9m.

Baz Luhrmann’s first movie in nearly a decade, ELVIS opened in June as well with a monthly total of $78 million. Domestic again led with $48 million in June. The next two stand out territories were UK/Ireland with $9 million and Australia with $8 million. Lastly, DOCTOR STRANGE IN THE MULTIVERSE OF MADNESS added another $66 million to it’s now $952 million total, evenly split between the Domestic and the International markets.

The Asia Pacific (APAC) region continued its phenomenal results from May in June. It performed 6% above the three-year average and recorded the highest grossing single-month since December 2019, beating the former high of the prior month. That reduced the deficit against the pre-pandemic three-year average in 2022 significantly to -31%, down from -38% at the end of last month and -47% when finishing the first quarter! For the first time in 13 months APAC delivered the highest box office among the three International regions.

Four markets in the APAC region stood out as performing on or beyond pre-pandemic levels. Australia was leading the group being 21% above the three-year average in June. Followed by New Zealand’s 15%, Japan’s 12% and South Korea with 4%. These were all pandemic best results, with the exception of Japan which had the best number since November 2020 when local phenomenon DEMON SLAYER: MUGEN TRAIN catapulted the country to exceptional box office spheres.

The Europe, Middle East and Africa (EMEA) region’s box office also showed the lowest percentage drop against the three-year average during the pandemic at just -6%. That reduces the deficit for the first half year to -33%, coming from -41% at the end of the first quarter.

As in the APAC region multiple EMEA major markets were performing around or beyond pre-pandemic levels. UK/Ireland’s June total was an impressive 17% higher than the monthly three-year average, the Netherlands came in 12% above. France was on par (-0.08%) and Germany just slightly below with -1.5%. France and the Netherlands achieved pandemic best numbers of that metric. Germany and the UK/Ireland were 2nd best in June after the NO TIME TO DIE-inflated October of 2021.

The Latin America region remained on a high level in June without significant growth compared to the prior month. The region was down -15% on the average of the three pre-pandemic years. That was slightly better than the -16% from May and behind the outlandish +30% from December 2021. That cuts the deficit for the first half year to -34%, down from -44% at the end of the first quarter.

China finally found some traction in June to gross $302 million. Nearly tripling the result from the prior month (+169%). That is also just -7% behind June last year and the best result since the Chinese New Year month of February ($1.6bn). However, it’s still at the lower end of the pandemic monthly totals and -49% behind the three-year average for June. That further increased the deficit for the running year to -41% after being at -18% at the end of the first quarter!

On the June 12 weekend in China, the number of cinemas open by market share topped 80% for the first time in 3 months! That helped to allow the first movie to cross $100 million in a single month since February with JURASSIC WORLD: DOMINION. Its $122 million in June is more than the whole market’s last two months totals (April $89m, May $112m). The JURASSIC WORLD sequel is also the highest grossing US title in China since F9 ($215m) in May 2021, though it’ll end well below the two previous instalments in China, which did $230 million in 2015 and $265 million in 2018.

Beside JURASSIC WORLD local drama LIGHTING UP THE STARS also contributed to the month’s growth. It delivered $74 million within June of a current $135 million total. That is by far the highest grossing local title since Chinese New Year.

The recovery of the global box office continues to widen and stabilize on pandemic best levels. In June, of the 30 territories tracked in our global State Of The Market report 29 reached at least once the basic Stage 3 target (a week equivalent to the lowest grossing week in 2018-2019), or higher, on Gower Street’s Blueprint To Recovery for a full play-week. The only one that didn’t was Russia, which still lacks new blockbuster product due to their aggression-caused US studio boycott. Furthermore 25 of the 30 tracked territories crossed Stage 3 as a minimum in all four play-weeks in June! Even among the five that didn’t, Spain and Ecuador got above the basic level in three and China plus Ecuador in two play-weeks.

The accelerating trend of a significant recovery should persist for a fourth straight month in July. MINIONS: THE RISE OF GRU already got off to a very strong start last weekend and THOR: LOVE AND THUNDER arrives this week. NOPE and DC LEAGUE OF SUPERPETS will follow in the coming weeks. A more challenging phase can be expected from August, when the frequency of strong blockbuster product is getting lower again for a while.