It is now nearly four years since the Covid-19 pandemic put a break on the theatrical industry. It’s been a long road to recovery. The accelerated growth of the past two years showed the strength and resilience of the cinematic world. Multiple records have been broken. Five of the top-16 highest grossing global movies of all-time have been released since. Three months of this year performed above the monthly average of the last three pre-pandemic years (2017-2019), another two showed just a single digit deficit. July was the first month of the decade crossing $4 billion ($4.6bn). January and August this year were two of the three months of the decade that crossed $3 billion.

In that context November falls short, generating only $1.9 billion globally. It’s the lowest grossing month since the same month last year ($1.8bn); marginally behind September this year (-3%), the only other month in 2023 that failed to cross $2 billion. While being up on the same month in 2021 (+8%) and 2022 (+7%), it’s minor growth compared to the rest of the year. Except for February – due to the month swap of Chinese New Year – no other month had an increase on 2022 lower than June’s +10% and while June was the 3rd highest grossing month last year, November was only #9, thus a far lower benchmark.

This and last year the number of attractive global movies ready to be released from September onwards was lower than needed to sustain the levels of recovery achieved earlier in both years.

Moreover, up until August the highly anticipated sequel DUNE: PART TWO was set to open the month, releasing on November 3. It moved to March next year due to the actors strike at that point in time. No other tentpole filled the slot. The first six-time Academy Award winning instalment grossed $402 million, while being still impacted by the pandemic market conditions. Given this, November lost a significant amount of box office.

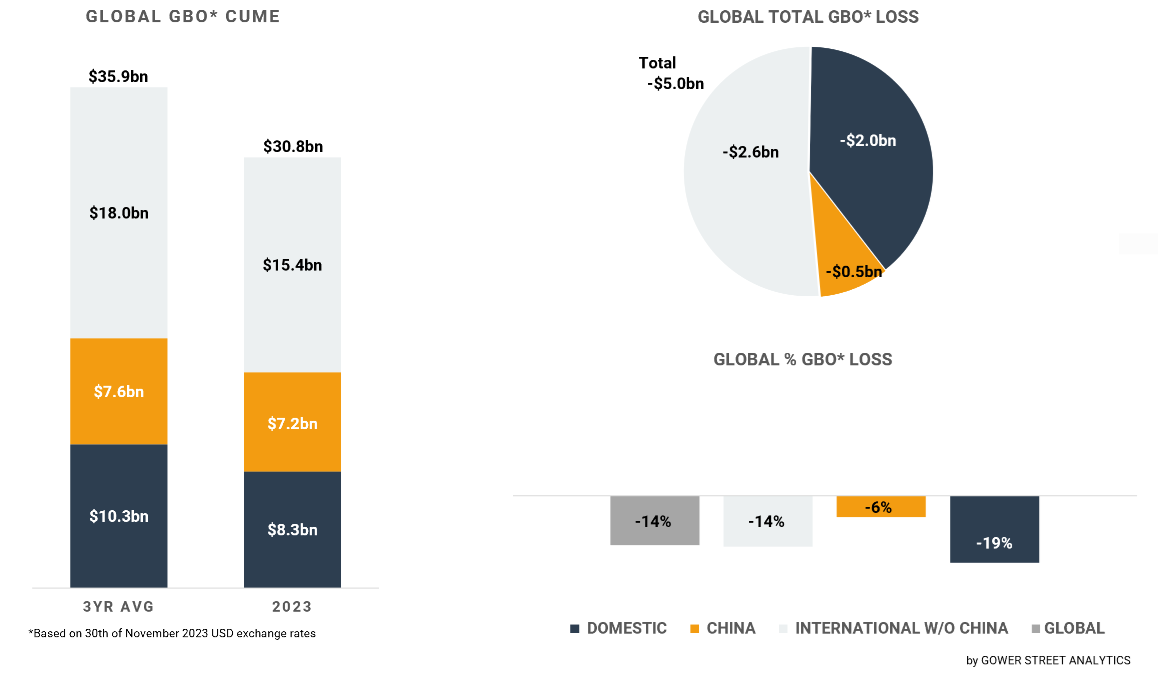

Consequently, the global gap to the pre-pandemic three-year average has widened again within the past month. Being behind -37% in November, the running year has been pushed down from -12% to -14%. It peaked at the end of August at just -9%! After eleven months, the total global box office is estimated to have reached $30.8 billion in 2023. It has already stood above the full-year result of each of the three prior years since September.

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

Like the prior month, November had numerous global releases that achieved solid box office levels with one title crossing $200 million and four above $100 million, of which two were October holdovers. However, no movie was able to break out significantly. Further an already soft release schedule in September and October limited wide holdover returns. The last movie crossing $300 million globally was MEG 2: THE TRENCH with $395 million, released at the beginning of August, nearly four months ago! Fourteen movies have reached that benchmark this year so far.

The highest grossing global release in November was THE HUNGER GAMES: THE BALLAD OF SONGBIRDS & SNAKES generating approximately $220 million in the month. The prequel of the successful franchise will most likely end around half of the lifetime of the final instalment of the original series, THE HUNGER GAMES: MOCKINGJAY – PART 2 ($653m). That puts it in the middle of youth adult movies like THE MAZE RUNNER ($349m), DIVERGENT ($289m) and MISS PEREGRINE’S HOME FOR PECULIAR CHILDREN ($297m).

THE MARVELS was the second highest grossing movie of November with approximately $191 million. It will most likely end around the lifetime of BIRDS OF PREY ($206m). That is a bit below DARK PHOENIX ($253m) and THE FLASH ($271m). It is still above this year’s disappointing superhero releases BLUE BEETLE ($129m) and SHAZAM! FURY OF THE GODS ($134m), however it will be the lowest grossing release of the incredible successful 33-movie-spanning Marvel Cinematic Universe so far.

The second high-profile theatrical opening from Apple, NAPOLEON, grossed $106 million within the month. This made it the third highest grossing global opening of November. It will most likely end around the level of Ridley Scott’s own ALIEN: COVENANT ($241m) and EXODUS: GODS AND KINGS ($268m) and clearly above his most recent movie, 2021’s HOUSE OF GUCCI ($166m), and Apple’s own prior month release KILLERS OF THE FLOWER MOON ($154m). The International gross is further looking to outperform Baz Luhrmann’s ELVIS ($137m).

Two very different titles that started to roll out in October also managed to crack the $100 million box office in November: FIVE NIGHTS AT FREDDY’S and TROLLS BAND TOGETHER. FIVE NIGHTS AT FREDDY’S added approximately $134 million for a cume of $284 million at the end of November. The fan-driven video game adaption already became the highest grossing Blumhouse production in their thriving 23-year history, ahead of SPLIT ($277m), HALLOWEEN ($260m) and GET OUT ($257m).

TROLLS BAND TOGETHER generated about $115 million within the month for a cume of $151 million at the end of November. The third part in the DreamWorks Animation franchise will most likely end a bit above this years’ PAW PATROL: THE MIGHTY MOVIE ($195m) and TEENAGE MUTANT NINJA TURTLES: MUTANT MAYHEM ($181m), around last year’s DC LEAGUE OF SUPER-PETS ($208m) and DreamWorks’ recent sequel CROODS: A NEW AGE ($217m), though clearly below the 2018 original TROLLS ($347m).

In contrast to the modest global result, the sub-region of Europe, Middle East, and Africa (EMEA) had a significantly better month. It contributed a bit over half (51%) of the International box office (incl. China), the by far highest ratio of the year. EMEA recorded the sixth highest grossing month of the year, just marginally behind May (-1%). In terms of gap against the three-year average the -24% deficit put it 8th among the months of this year.

The overperformance of NAPOLEON and HUNGER GAMES in the region was a major driver. For both titles three of the current top 5 performing International markets are in EMEA. Additionally 6 of the top 10 markets come from the region. It also helped that FIVE NIGHTS AT FREDDY’S only opened in November in Spain, France and Italy with strong results. Last but not least, local and international titles successfully filled certain gaps in the market (e.g. Hayao Miyazaki’s THE BOY AND THE HERON [$10.5m] was the highest grossing movie in France).

Major markets like the Netherlands (-9%), France (-16%) and Spain (-24%) were performing even better than the EMEA sub-region as a whole. Italy outperformed that by being an impressive +5% above the pre-pandemic three-year average and recording its best single month since January 2020! The key factor was local phenomenon THERE’S STILL TOMORROW (C’E ANCORA DOMANI). It grossed $25 million in November for an impressive current cume of $29.7 million. The black and white directorial debut of Paola Cortellesi is already the third highest grossing title of the year and it’s very likely that it will get in front of OPPENHEIMER ($30.3m) and BARBIE ($35.9m) by the end of its run to top the Italian year. That would make it the second highest grossing title, behind AVATAR: THE WAY OF WATER ($47.6m), since the start of the pandemic!

On the other side of the Atlantic the Domestic box office was much softer in November. The month was down on the three-year average by -43%. That is the biggest gap since September last year (-52%), and a glimpse behind December 2022 (-42%). From a total perspective the month looked marginally better. The $560 million still made it the third lowest grossing month of the year. It’s down on last year by -11% when BLACK PANTHER: WAKANDA FOREVER dominated with a monthly total of $374 million. Only HUNGER GAMES ($107m) got above $100 million within the month. The Domestic cume for the year is $8.3 million at the end of November, which has been above last year’s final gross of $7.5 million since mid-October.

China had a comparably muted month like the Domestic market. Only local thriller LAST SUSPECT managed to cross $50 million, with $67 million in November. US releases stayed at low levels. THE MARVELS contributed $15 million at #4, HUNGER GAMES $7.5 million at #8 and WISH $4 million at #13.

After an already disappointing Golden Week October period, November came in as the lowest grossing Chinese month since December last year with just $235 million. Although it nearly tripled last November’s $80 million it’s a low benchmark given that was the lowest grossing month since July 2020 ($31m), when cinemas just started to re-open after six months of closure. In terms of gap against the three-year average China was -50% down, the third widest of 2023. At the end of November China had achieved $7.2 billion for 2023. That is just behind its 2021 total of $7.3 billion at historical exchange rates.

The sub-regions of Latin America and Asia Pacific both had poor results in November like the Chinese and the Domestic markets, recording their lowest grossing months of the year. For Latin America it was the lowest since October last year, for Asia Pacific even the worst since March 2022. Against the three-year average Asia Pacific was down -35%, the second widest gap of 2023, just better than October (-38%). Latin America had the widest gap since September last year (-44%) with -34%.

These modest results continue to regress the deficit against the pre-pandemic three-year average for the running year around the world. The gap had been closing since April. The impact of a weaker release calendar since September has obviously been slowing down recovery. At the end of November, the Domestic market was -19% below the three-year average for the running year. That comes after cutting the deficit to -15% in August, down from -36% at the start of April. The International (exc. China) market now stands at -14%, following the reduction from -23% to -11% in the April to August period. Although far less dependent on the global release calendar China is also following this trend. At the end of November, China was tracking below the pre-pandemic average at -6%. In the period from June to August it had overcome the deficit from -13% to +1%.

November wasn’t a great month for the global theatrical industry. A more consistent, uninterrupted, and diverse release calendar is needed to reduce the current volatility of the theatrical market. Thankfully six months of strikes in Hollywood also have ended in November with an agreement between the actors and the studios. However, the delayed productions of that half year will continue to have an impact on the release calendar at least for the year to come.

The gaps in the past months have given space to unexpected winners at the box office. Movies that widened the range of what is a box office hit. TAYLOR SWIFT – THE ERAS TOUR opened in October just a month after its release was announced, grossing $250 million globally to become the second highest music documentary of all time, just a glimpse behind Michael Jackson’s THIS IS IT ($261m). FIVE NIGHTS AT FREDDY’S became the highest grossing Blumhouse production of all time and highest grossing title in the past three months, impressive for being tailored specifically for a very narrow target of young fans of the video game it’s based on. Furthermore, just like during the whole time since the pandemic disrupted the production cycle, local titles can shine even more. The Italian record-breaking hit THERE’S STILL TOMORROW smartly combines comedic, dramatic, and romantic elements against the backdrop of post-World War 2 Italy and the first Italian referendum where women were allowed to vote. An original movie, shot in black and white by a first-time director. A reminder of the variety of content and audiences that are out there that can help the theatrical industry to thrive.