This year February was a month of contrasts at the global box office. The Chinese market recorded its second-best month of the decade, pushed by their very lucrative New year holidays. The Domestic market operated on the other end. Weighed down by a dried-out release calendar it recorded the lowest grossing month since September 2022! The International markets performed between those two extremes. The better local and non-US titles were able to succeed, the smaller was the gap to pre-pandemic results.

The global box office accumulated $3.2 billion in February, crossing the $3 billion mark for the first time since August last year. It’s the 5th highest grossing month overall since the turn of the decade, performing -12% below the three-year (2017-2019) pre-pandemic average.

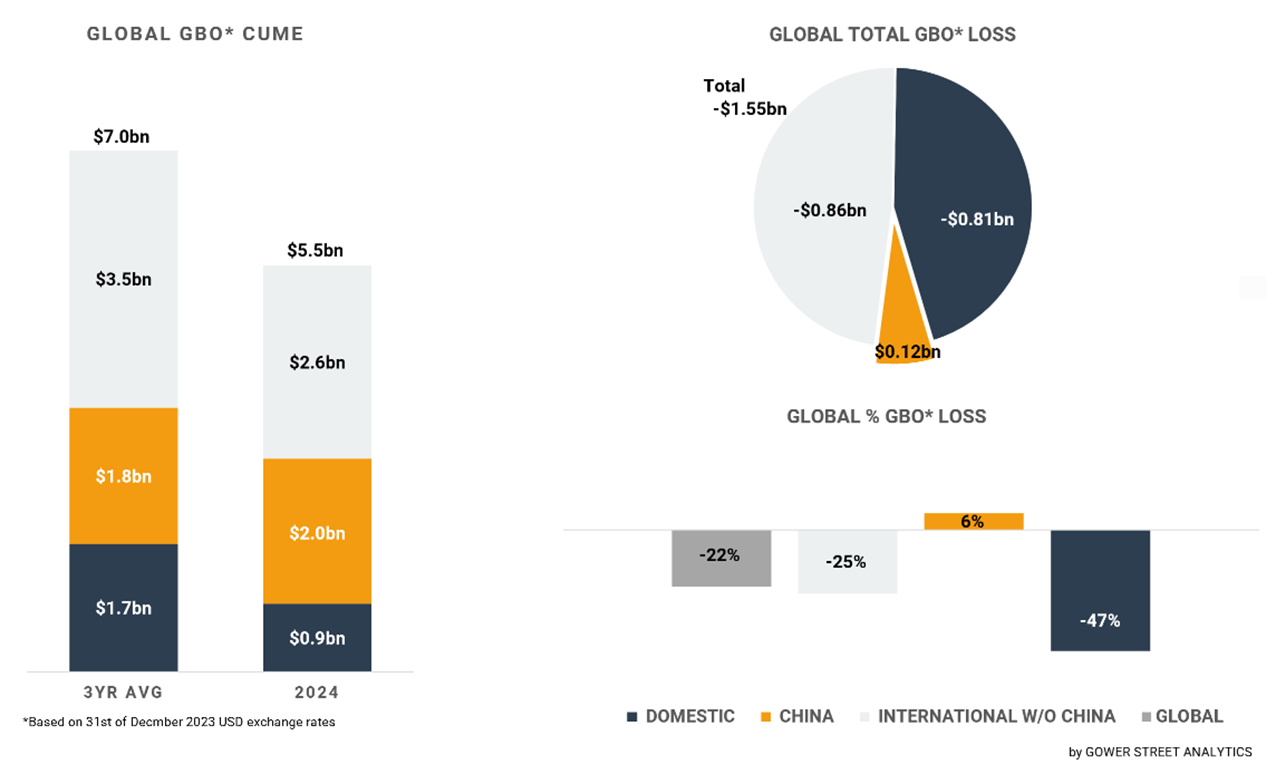

Total global box office to the end of February is estimated at $5.5 billion. This is currently tracking -6% behind 2023 at the same stage, but +22% ahead of 2022. The gap to the three-year average is -22% (or $1.55 billion) at that point.

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

As in January the amounts generated by single global releases were limited. Just one title was even able to cross $100 million within the month! This was Paramount’s bio-pic BOB MARLEY: ONE LOVE, the highest grossing globally-released title in February with approximately $132 million. ONE LOVE will most likely finish in the ballpark of ROCKETMAN ($195m) and STRAIGHT OUTTA COMPTON ($201m), clearly ahead of WHITNEY HOUSTON: I WANNA DANCE WITH SOMEBODY ($60m), but also noticeably behind Baz Luhrmann’s ELVIS ($288m).

The second highest global release in February was the Apple production ARGYLLE with $90 million within the month. The Matthew Vaughn movie, distributed by Universal, will end around his own KICK-ASS ($98m), a bit below THE MAN FROM U.N.C.L.E. ($110m), THE GENTLEMEN ($115m) and THE KING’S MAN ($126m).

Sony’s Marvel release MADAME WEB generated $84 million in February. The third highest amount by a global release within the month. Based on its current performance it will finish a tad above half of THE MARVELS ($206m). Even a bit behind last year’s superhero setbacks of BLUE BEETLE ($131m) and SHAZAM! FURY OF THE GODS ($134m).

Multiple globally released holdover titles followed the leading trio. Sony’s surprise hit rom-com ANYONE BUT YOU added approximately $68 million for a cume of $203 million at the end of the month. Universal’s holiday animation MIGRATION contributed another $62 million in February for a cume of $271 million to close the month. Finally, Warner’s WONKA served $62 million within February to bring the total to an impressive $620 million.

Nevertheless, the box office achieved by these global US releases looks pale compared to the results of the quartet of local tentpoles that reigned over Chinese New Year (CNY) this February. The highest grossing title for introduction of the Year Of The Dragon was comedy drama YOLO with $472 million, a remake of Japanese movie 100 YEN LOVE from 2014. YOLO is directed by and stas Jia Ling. Her directorial debut HI, MOM dominated the CNY in 2021, grossing an incredible $831 million.

The second highest grossing title of CNY was comedy sequel PEGASUS 2 with $444 million. It already clearly outgrossed its predecessor from 2019, which generated $251 million. The third highest grossing movie of the month with $304 million was another comedy, ARTICLE 20, directed by legend Zhang Yimou. The latest instalment of the long-running animated series BOONIE BEARS completed the quartet by earning $260 million in February – setting an all-time high for the franchise.

The four movies delivered a combined box office of $1.48 billion in February, a commanding 93% of the monthly Chinese total of $1.59 billion. This represented 49% of the global box office in February. It delivered the second best single-month result in China since the pandemic began. Of course, the month was competing with February 2021, which reached $1.72 billion – an all-time single-month record in China – coming in just -7% behind that and +9% ahead of the great CNY February in 2022, the third highest-grossing month of the decade.

Driven by another exceptional CNY, the Chinese market is standing on par with last year at the end of February with a cume of $2 billion. That is +6% ahead of the three-year pre-pandemic average. The second best of the tracked top 15 markets.

Conversely, the Domestic market – limited by a sparse release calendar – had the widest gap against the three-year average among the top 15 markets. At the end of February, it was at -47%. Pulled down from -43% a month ago with February being -51% behind. The widest gap in 17 months! February generated just $397 million in Domestic, bringing the cume to $919 million at the end of the month. That is -17% behind last year at the same time and +21% above the period in 2022. The obviously highest grossing Domestic title in February was BOB MARLEY: ONE LOVE, generating $75 million. That makes it the second month in a row without even one title crossing $100 million. The last time that happened was in August and September 2022!

The International market is a bit less impacted by the limited release calendar caused by the Hollywood strike, compared to Domestic. Local and international titles have more space to shine in each market when the supply of attractive US-product is shortened. This has been proven frequently since the pandemic disrupted both production and release cycles in 2020.

Consequently, in multiple top markets local and non-US titles claimed spots among the top title of the month. In the Netherlands local action-comedy COPPERS reached #1 and local rom-com VERLIEFD OP BALI #2. In Germany local comedy-drama from Warner Bros EINE MILLION MINUTEN took the top spot and with French title AUTUMN AND THE BLACK JAGUAR #3. In France four of the Top 5 were local films, led by comedy COCORICO. In South Korea local thriller EXHUMA got the #1 spot with an impressive $26 million, leading four non-US titles in the Top 6. In Australia local thriller sequel FORCE OF NATURE: THE DRY 2 achieved the #2 rank within the month. In Brazil drama sequel NOSSO LAR 2 ranked #3 and in Mexico Japan’s newest DEMON SLAYER instalment came in at #1 for the month.

These successes in Brazil and Mexico were not enough to prevent Latin America from having the weakest month of the three sub-regions. It had the widest gap against the three-year average with -30% and the biggest drop to the prior year, being -18% down. The sub-region of Europe, Middle East, and Africa (EMEA) managed to be +4% ahead of February last year. Still, being -25% short of the pre-pandemic average for the month. Asia Pacific (without China) was the strongest performing sub-region. This February it was up +13% on the same period last year. Especially a +60% upswing of South Korea supported that. The gap to the three-year average was just -15%.

The main driver of that was an impressive +30% growth on the pre-pandemic average by Japan in February. That pushes the territory to be +15% ahead on the three-year benchmark for the running year. This is the best of the tracked top 15 markets. Multiple successful local releases were key to that achievement. The newest part in the multiple decades running MOBILE SUIT GUNDAM franchise released at the end of January led the way, already becoming the highest grossing of the franchise with a current $25.1 million cume. The theatrical finale to the TV Series HAIKYU!! released on February 16 grossing the second highest opening weekend of the past 12 months with $14.9 million. Further live action Manga adaptation GOLDEN KAMUY was continuing playing strong after debuting in January to a current cume of $18 million. On top of that the latest DEMON SLAYER release opened February 2. While staying behind the tremendous performance of the prior theatrical offerings of the franchise, it still collected a cume of $13 million by month’s close.

Despite successes like these and the fabulous Chinese New Year results, February was another expected modest month. Suffering an ongoing spare release calendar. The few global wide releases of the month performed around their expected limited results. Strong local and international titles around the world leveraged the gap in individual markets and kept these close to last year’s performance at the same time. Still, it was far from enough to continue the path of needed growth to get back and beyond the pre-pandemic box office levels on a global scale. Some relief arrived in the final days of February with the impressive opening of the long-awaited DUNE: PART TWO. Giving the global market place an overdue worldwide tentpole. A first of many milestones in the direction of a higher frequency of wide releases on offer.