For the global box office the only way was up after September hit rock bottom. October delivered over a third (+38%) more in global box office than the previous month with a total of $1.8 billion. Still, that only gets the global box office up to a modest level. It’s only the 6th highest monthly performance so far this year.

It’s also significantly behind last year’s October result (-36%). At that time a strong roster of major global releases with NO TIME TO DIE ($774m), VENOM: LET THERE BE CARNAGE ($507m) and DUNE ($402m) plus a phenomenal Golden Week holiday in China pushed the global recovery forward to what remains as the 2nd best month since February 2020.

In contrast this October was challenged by the lack of new major global blockbuster content that started in July. At least in the final third of the month a much needed boost came from the release of BLACK ADAM, which helped lift the monthly result. At the end of the month the DCEU movie had already generated $113 million in the Domestic market and $139 million internationally for a global total of $252 million!

A welcome surprise for the theatrical world was the success of Paramount’s horror hit SMILE. It opened in the final days of September and rolled up a global cume of $188 million with $94 million coming from Domestic and $94 million from the international market.

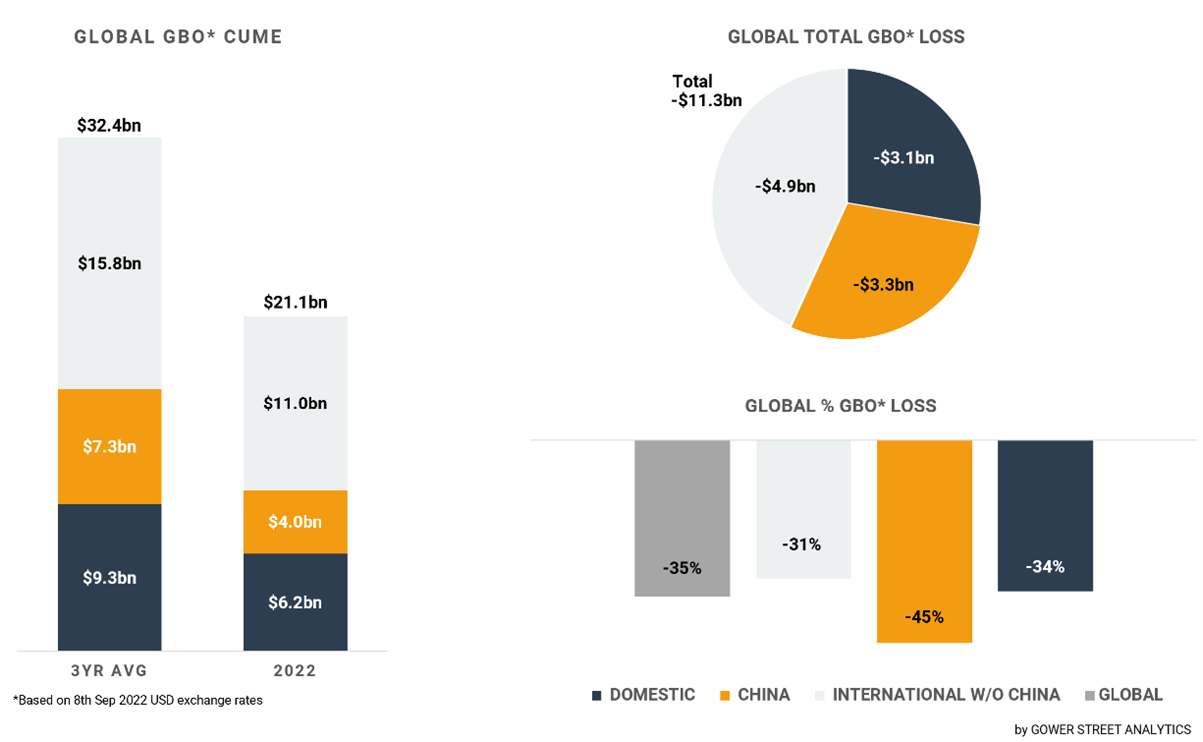

At the end of October global box office stood at an estimated $21.1 billion. This is over $5.5 billion (+36%) ahead of the same stage in 2021, but approximately $11.3 billion (-35%) behind the average of the last three pre-pandemic years. The current global cume is now at 99% of 2021 full-year result and will most likely overtake the $21.3 billion (historical exchange rates) at the beginning of November.

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

The International market (excluding China) contributed clearly over half (57%) of October’s global result with $1.04 billion. This brings the cume up to $11 billion. The EMEA region was the main driver of the October result. The monthly total of $622K represents 60% of the International result.

It’s the 2nd highest grossing month for the EMEA region this year, just behind July, and the 4th highest since the beginning of the pandemic. Nevertheless, the October total for EMEA is -23% down on the same month last year, which is the best performing one since February 2020. This October is also -29% below the three-year pre-pandemic average. October is an especially strong period in EMEA, historically the 4th highest grossing month of the year, being supported by school holidays, public holidays and a temperature change in many major markets.

Several major EMEA territories recorded their highest grossing month of the year so far in October, including Germany, France and Italy. The Netherlands had its 2nd and Spain its 3rd best. It was local product that mainly made the difference. In Germany family comedy sequel THE SCHOOL OF MAGIC ANIMALS 2 (DIE SCHULE DER MAGISCHEN TIERE 2) was the clear #1 of the month with $12.3 million. It’s already the local title with the highest admissions of the pandemic era. In France local thriller NOVEMBER was leading the monthly charts, attracting 1.7 million admissions. At #3 the local biopic SIMONE VEIL got another million people in. In Italy local drama THE HUMMINGBIRD (IL COLIBRI) was #2 in the month’s ranking with $2.5 million. In Spain local thriller GOD’S CROOKED LINES (LOS RENGLONES TORCIDOS DE DIOS) had a strong #3 in the country’s October charts with $4.0 million. In the Netherlands local hit SOOF 3, which opened Sept. 15, had strong holdovers that put it at #4 in the month with an additional $1.7 million, although a very strong performance from US romcom TICKET TO PARADISE, with $3.5 million at #1, was also a key factor. The Netherlands will most likely end on an impressive rank of #4 internationally for the Julia Roberts-George Clooney title.

While EMEA was on high in October, the APAC region recorded its lowest performing month since March this year. However, October is usually a calm period in the region, historically the 4th lowest grossing month of the year. This October is -39% below the three-year pre-pandemic average. However, it’s +15% up on the same period last year and -19% below the one in 2020. In 2020 Japan and it’s record-breaking release of DEMON SLAYER THE MOVIE: MUGEN TRAIN ($383m) inflated the region’s number.

As a stand out South Korea struggles to maintain the impressive momentum it got after restrictions were lifted at the end of April this year. In October it recorded by far the worst month since April, both in total ($44m) and percentage terms against the three-year average (-56%). At least it’s better than the results in 2021 (+22%) and 2020 (+48%).

Taiwan was not even able to achieve this. It’s down on both prior years (2020: -25%, 2021: -43%). It recorded the 2nd lowest grossing month of the year after September. Further October was down -65% against the three-year average for Taiwan, the lowest number of all 30 markets we monitor in our global State Of The Market report.

China was just marginally better with -61%. What should have been one of the best months of the year, ended just at #7 based on this metric and #5 in terms of total box office. October starts in China with the Golden Week holiday, usually the second most lucrative box office period in the Chinese calendar (after Chinese New Year). With a total of $306 million, this year’s October became the lowest grossing Golden Week holiday since 2013! A far cry from the $1.1 billion in 2021 (-72%) and $907 million in 2020 (-66%).

This year only one title was able to deliver a strong result with HOMECOMING grossing $197 million in the month. The second title in the monthly ranking, ORDINARY HERO, grossed just $27 million. This is no comparison to prior years’ hits like THE BATTLE OF LAKE CHANGJIN ($891m) and MY COUNTRY, MY PARENTS ($228m) in 2021 and MY PEOPLE, MY HOMELAND ($418m), JIANG ZI YA (LEGEND OF DEIFICATION) ($232m) and SACRIFICE ($167m) in 2020.

China’s cinema industry still suffers due to the zero-covid strategy of the country. The number of cinemas open by market share fell gradually over the month from 83.5% at the beginning to just 66% at the end. This is the lowest level since the week of May 7. The challenging pandemic circumstances combined with the increased restrictive release policy of Hollywood titles in China and the slowed down pipeline of homegrown tentpoles turned the fastest recovering global market into one of the hardest struggling ones.

The Domestic market outgrossed the Chinese for the 10th time in the last 12 months with a monthly total of $484 million. It’s the best month since July. Based on the percentage difference against the three-year average October was the 4th best month of the year, being down -33%. The three highest grossing titles of the month delivered 54% of the month’s box office with BLACK ADAM ($113m), SMILE ($86m) and HALLOWEEN KILLS ($61m). BLACK ADAM was the first title since July to gross more than $100 million within a month and is the highest grossing release since NOPE opened, three months ago on July 22.

The impact of a weaker release calendar since the end of July has obviously been slowing down the recovery. Having been closing the deficit against the pre-pandemic three-year average through May, June and July the 2022 box office in both the Domestic and International (exc. China) markets witnessed a slight regression since. At the end of October, the domestic market was -34% below the three-year average for the running year. That comes after cutting the deficit to -31% in July, down from -47% at the start of May. The International (exc. China) market stands at -31% now, following the reduction from -43% to -30% in the May to July period.

For the final two months of the year it’s mainly in the hand of BLACK PANTHER: WAKANDA FOREVER and AVATAR 2: THE WAY OF WATER to speed the global recovery process up again. Both titles carrying vast hopes on their shoulders as 2nd instalments of franchises whose first parts took in an incredible combined global box office of $4.3 billion, rank as #1 (AVATAR) and #14 (BLACK PANTHER) of the global and #4 (AVATAR) and #6 (BLACK PANTHER) of the domestic all-time records.

A version of this article appeared on Screendollars Nov. 4.