In May the positive box office trend of the past two months accelerated. The global box office hit $2.3 billion, up 28% up on the successful prior month April ($1.8bn). The latest month delivered the second best Domestic and International box office results of the pandemic-era, though China continued to fall behind recording the second lowest full-month box office of the pandemic.

The International market (excluding China) showed the lowest monthly deficit of the pandemic against the pre-pandemic three-year (2017-2019) average, just -15% ($251m) behind. With a total International box office of $1.4 billion it was its second highest grossing single-month since February 2020.

The Domestic market recorded the second highest grossing month since January 2020 with a total of $800 million, -19% down against the three-year average.

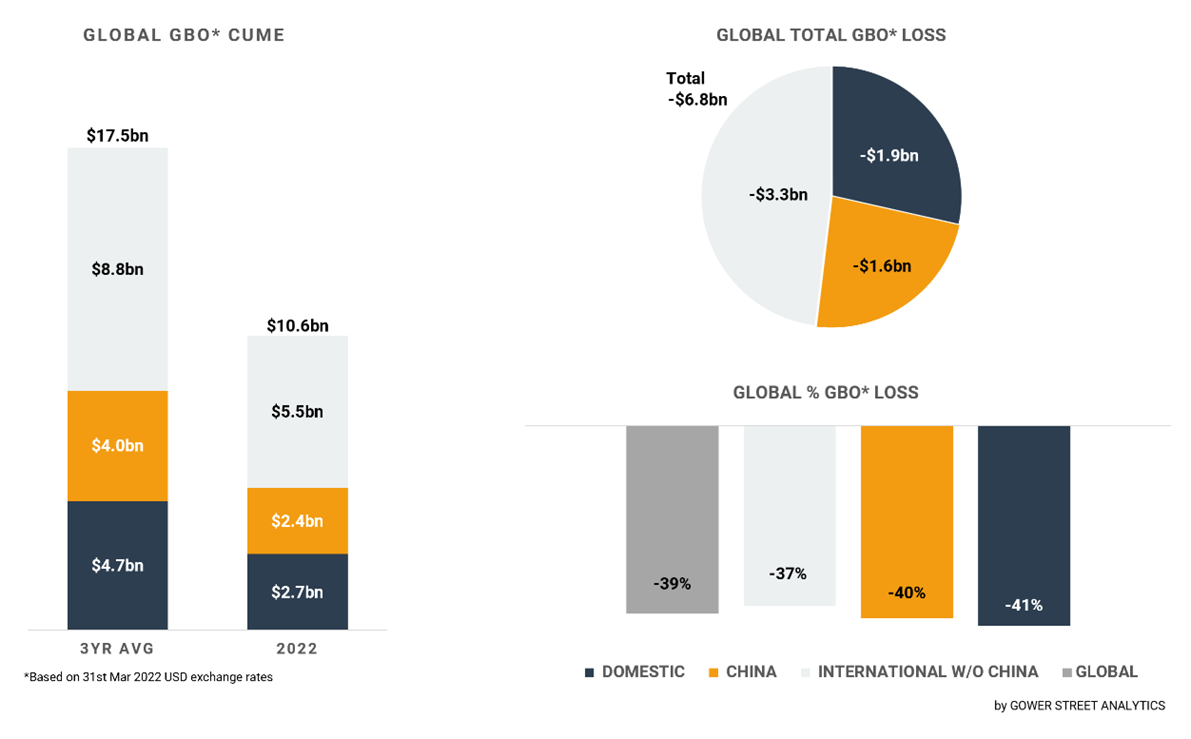

On this month’s Global Box Office Tracker (GBOT, above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

STRANGE goings on

The major drivers of these results were two global blockbusters. DOCTOR STRANGE IN THE MULTIVERSE OF MADNESS kicked off business in May and TOP GUN: MAVERICK closed the month out. The pair of titles contributed over two thirds of the Domestic (69%) and roughly half of the International (49%) May total.

DOCTOR STRANGE IN THE MULTIVERSE OF MADNESS delivered a box office of approximately $885 million within the month. It had a huge opening weekend of $452 million, but has seen a multiple on the lower end of recent superhero releases. However, globally it’s already the second highest grossing US title since STAR WARS: THE RISE OF SKYWALKER ($1.07bn) in December 2019, only behind SPIDER-MAN: NO WAY HOME ($1.89bn) from December 2021. The Domestic market easily ranked #1 globally on the title with $377 million, representing 47% of the market’s total within the month. That outstanding result was followed by South Korea’s $49 million (40% market share), UK/Ireland’s $48 million (37% MS), Mexico with $39 million (64% MS), Brazil with $32 million (67% MS), and Australia with $25 million (39% MS).

Taking Flight

TOP GUN: MAVERICK generated $341 million in less than a full play-week at the end of May. The film set opening records for star Tom Cruise in 32 markets, including the Domestic market. That is even more impressive given Cruise has been acting for four decades. Domestic was the highest grossing territory for TOP GUN as well, at #2 in the month with $176 million, representing a 22% market share. That terrific performance is followed by UK/Ireland with $27 million (21% MS), Australia with $13 million (20% MS), France with $12 million (13% MS), Japan with $9 million (6% MS) and Germany with $8 million (13% MS).

Five months into the year and the Global box office stands at an estimated $10.65 billion. This is $4 billion ahead of the same stage in 2021, but approximately $6.8 billion (-39%) behind the average of the last three pre-pandemic years (2017-2019). At the end of May, 2022 had already nearly achieved 90% the 2020 full year total ($11.8bn) and will overtake it in the coming weeks. The 2022 tally is at half of last year’s $21.3 billion result.

The APAC region achieved the most impressive result of all international regions in an overall positive month. It had the highest grossing month since January 2020, just -10% down on the average of the three pre-pandemic years.

Korean Recovery

The region benefited in May from the long-overdue comeback of one of the major international markets: South Korea. It grossed $124 million in the month, which made it by far the market’s highest grossing month since December 2019. The result was on par with the three-year pre-pandemic average (+2%) and bigger than the cumulative box office of the first four months of the year. The two key factors in that were, 1: the lifting of multiple major restrictions in South Korea as of April 25, allowing food consumption in theatres and the filling of all available seats; and 2: two major releases leveraged the increased capacity with a combined market share of 83%. DOCTOR STRANGE IN THE MULTIVERSE OF MADNESS at the beginning of the month, finally drove South Korea over the Stage 4 target on Gower Street’s Blueprint To Recovery (a week equivalent to the median of weekly business in 2018-2019). However, that result was surpassed by local crime thriller THE ROUNDUP, a sequel to 2017’s THE OUTLAWS, two weeks later. THE ROUNDUP had a monthly total of $54 million, and helped to push the May 19 play-week over the countries Stage 5 ”full recovery” target (a week equivalent to top quartile of weekly business in 2018-2019) for the first time.

South Korea was the only major box office market to have achieved neither stages 4 nor 5 on the Blueprint To Recovery up until this May. All other markets tracked in our global State Of The Market report had achieved all 5 Stages by the end of last year, with 19 markets (including Domestic) doing so in the December 17 play-week thanks to SPIDER-MAN: NO WAY HOME. That is a remarkable step in the global recovery process.

Another market from the APAC region that struggled for most of 2022 and grew significantly in May was Hong Kong. It recorded its second highest grossing month since December 2019. The success came after being allowed to re-open its cinemas at the end of the prior month (April 21), coming off a 3.5 month closure (the fourth, and longest, lockdown in the territory). From the 30 territories tracked in our State Of The Market report Hong Kong is still one of the just four markets that are tracking behind 2021 in the running year at -29%. Nevertheless, in May its result nearly doubled (+86%) the same month last year.

Getting Back to Pre-Pandemic Levels

Two more highlights from the APAC region are Australia and New Zealand. Both picked up on their strong April performance and had a May box office that was almost on par with the pre-pandemic three-year (2017 -2019) average (AUS -2%, NZ -3%). These are the lowest monthly deficits of the pandemic for both territories.

The Latin America region was also able to step up in May. Topping the previous second-highest-grossing month of April ($155m) with $202 million in May by nearly a third (+31%). That is just -16% down on the average of the three pre-pandemic years. DOCTOR STRANGE IN THE MULTIVERSE OF MADNESS had a commanding impact. In its opening play-week it pushed multiple markets above their Stage 5 target for the first time since SPIDER-MAN: NO WAY HOME last December.

The Europe, Middle East and Africa (EMEA) region’s box office showed the lowest uplift from April among the three sub-regions; it was on par with $609 million. This is still the third highest grossing month of the pandemic for EMEA. Moreover, from a seasonality point of view May is historically the third lowest grossing month of the year in the region. Therefore, the EMEA region recorded the second lowest percentage drop against the three-year average with -20%, just behind October 2021 (-7%). Outstanding performances from the major markets were coming from the Netherlands, which had a pandemic-era best of being 6% above three-year average, and the UK/Ireland just -4% behind, the second best of the pandemic.

Domestic vs China

The Domestic market was up 37% against April to achieve its second best result of the pandemic, only behind December 2021 ($956m). The percentage loss against the monthly three-year average (-19%) was behind only October 2021 (-15%). At the end of May the Domestic box office stood at $2.7 billion in 2022.

That is now higher than the $2.4 billion of China, a big shift with the Domestic market reclaiming its position as the #1 global box office market from China this month! China had overtaken the Domestic market in 2020 for the first time as its box office saw significantly faster and stronger recovery followings its first, 6-month, lockdown. It then quickly surged ahead of the Domestic market in early 2021 to easily retain its #1 box office market crown for a second year. This year, however, the market has struggled both with rising Covid cases resulting in cinema closures and a lack of major import releases.

China continued struggling for the third consecutive month. While being up on April (+26%) due to a May holiday uplift, the $112 million result was still the second lowest monthly box office in China since July 2020, when cinemas began re-opening. Both the Domestic and International markets continue to make slight in-roads into reducing their deficit against the pre-pandemic three-year average, however China’s position continues to worsen from -32% at the end of April to -40% a month later.

There is a reasonable hope that the situation in China will change for better in June, with Shanghai easing its restrictions at the start of the month. JURASSIC WORLD: DOMINION also secured an, increasingly rare, release date in China on June 10. The two prior instalments did $230 million in 2015 and $265 million in 2018. The release will be a major test of the market.

On a global scale the last months have shown strong recovery signs of the theatrical market. The steady flow of attractive movies helped to lift the markets’ total performance and increase sustainability of the industry worldwide. Basic levels of individual market results continue to be reached in growing frequency. In May, of the 30 territories tracked in our global State Of The Market report 25 reached the Stage 3 target, or higher, on the Blueprint To Recovery for a full play-week. That is on par with the pandemic best in December 2021 and ahead of 21 in April, the second best so far in the recovery process!

That accelerating trend is unlikely to change in June. The releases of JURASSIC WORLD: DOMINION, LIGHTYEAR, ELVIS and MINIONS: THE RISE OF GRU should guarantee a third consecutive month of significant recovery!

This article first appeared in Screendollars’ June 5 newsletter and on the Screendollars website here.