Gower Street Analytics has increased its 2023 Global box office projection to $32 billion.

With Q1 completed and Universal’s THE SUPER MARIO BROS. MOVIE providing a triumphant start to Q2, Gower Street analysts have reviewed their early Global box office estimate of $29 billion for 2023 announced in December. The updated projection represents a +10% improvement from the earlier estimate.

The announcement comes as the global industry gathers in Las Vegas for CinemaCon, the official convention of The National Association of Theatre Owners (NATO), which runs April 24-27.

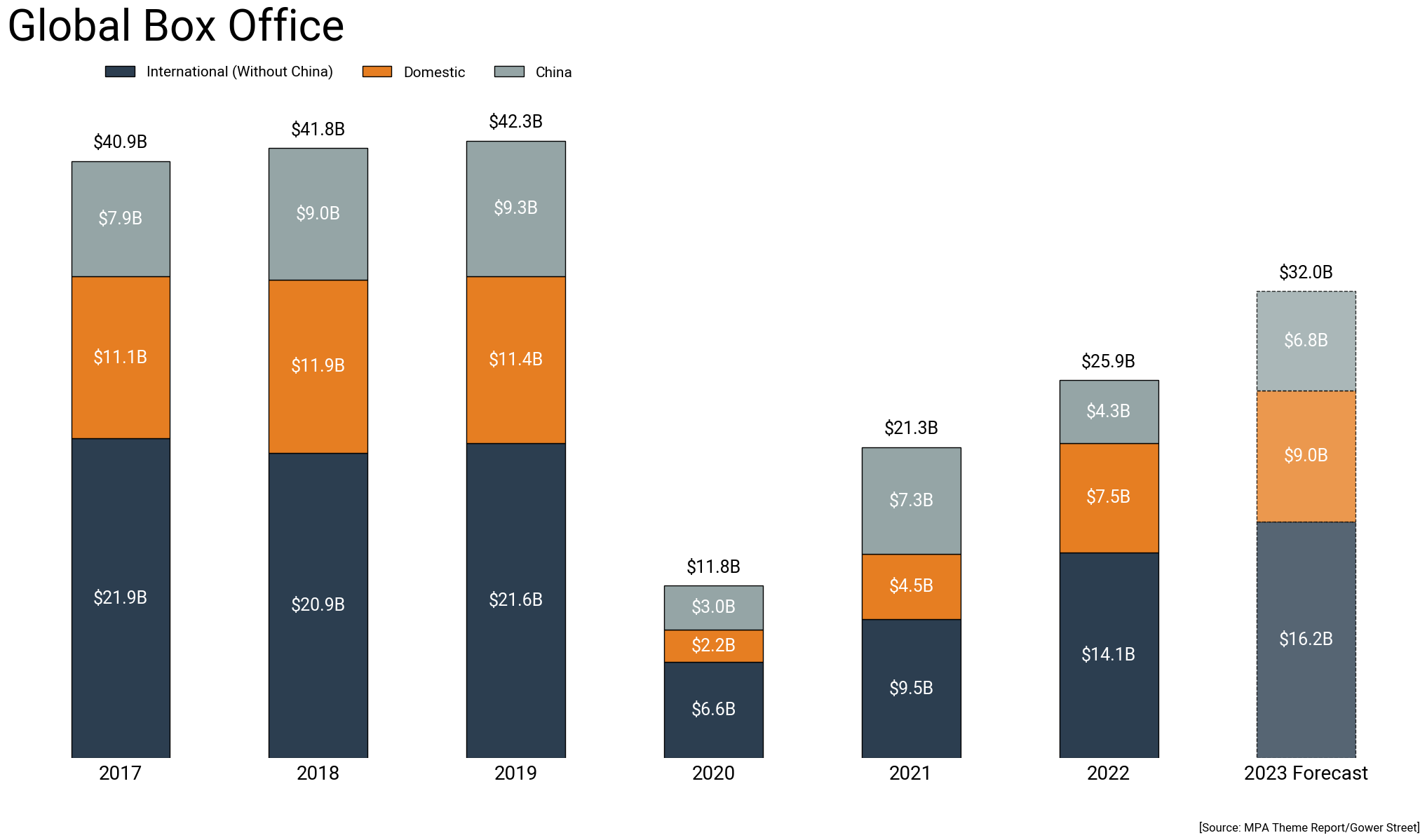

A $32 billion Global box office in 2023 would represent an approximate +23% improvement on 2022. It remains -20% behind an average of the last three pre-pandemic years (2017-2019), but shows how post-pandemic recovery of our business continues to improve.

The Domestic market slightly underperformed our Q1 projection (by -$100 million), but a growing release schedule has justified a modest increase in our earlier full-year estimate by $400 million to $9 billion.

China has seen a larger increase, from $5.6 billion to $6.8 billion. Following a disappointing 2022 our early estimates for China remained conservative while the industry looks for more consistent signs of improvement. The market showed stronger recovery in Q1 than expected, including a very good Chinese New Year period. However, there remain some significant signs of concern. Figures once again were very low in March and while more US imports have received a release these have generally not shown the levels of box office success that would be hoped.

The increase to $6.8 billion puts China back on a level equivalent to 2021 (at current exchange rates), but the increase currently comes almost entirely (approx. 90%) from how much Q1 actuals over-performed estimates. As our recovery predictions for the market were already more bullish for further into the year, and until the market shows more consistent recovery especially on import titles, we are holding our Q2-4 estimates relatively steady.

The International (excluding China) market has been raised +10% (or $1.4 billion), from $14.8 billion to $16.2 billion. A significant driver was a better than predicted Q1, led by the fantastic holdover business of AVATAR: THE WAY OF WATER. There was also support from a robust release calendar, local hits, and a number of non-US titles travelling well beyond their home markets (e.g. Japanese anime).

For the International market, January out-performed our original estimate by +23%, February by +10% and March by +2%. This added up to approximately $400 million in additional International revenues in Q1 than predicted in December. As in the Domestic market the release calendar has also gained additional titles later in the year which have helped improve predictions for the remainder of the year as well.

Additionally approximately 13% of the $3 billion Global gain is due to changes in currency exchange rates between December 2022 and the end of March 2023.

This projection, calculated utilizing data from Gower Street’s flagship FORECAST service and analyst assessment, is based on the current release calendar.

Please note: Figures shown in the stacked bar graph show US$ figures at historical exchange rates for years prior to 2023 and at current exchange rates for the Forecast year (2023). Figures for 2022 currently remain based on Gower Street’s January estimate of final results but will be updated, if necessary, from actuals reported in the MPA Theme Report when available. Percentage comparisons for 2023 against pre-pandemic years in the text are based on like-for-like local currency numbers converted at current exchange rates for greater accuracy.