In May the force was with the global box office. In particular with the International business. For the first time since January 2020, the International market (excluding China) reached the same box office level as the comparable month in 2017-2019 on average! International box office (excluding China), reached $1.54 billion in May, only -1% shy of the pre-pandemic average at today’s exchange rates. Only once since the start of the pandemic had the International box office previously achieved even a single-digit deficit compared to the average of 2017-2019 – in June 2022 with -4%. This is a major milestone in the recovery process.

The global box office reached $2.8 billion in May, following April’s $2.9 billion. It’s the first time since the beginning of 2020 that two consecutive months have delivered over $2.8 billion. Last summer June ($2.7bn) and July ($3.2bn) delivered above $2.7 billion in back-to-back months.

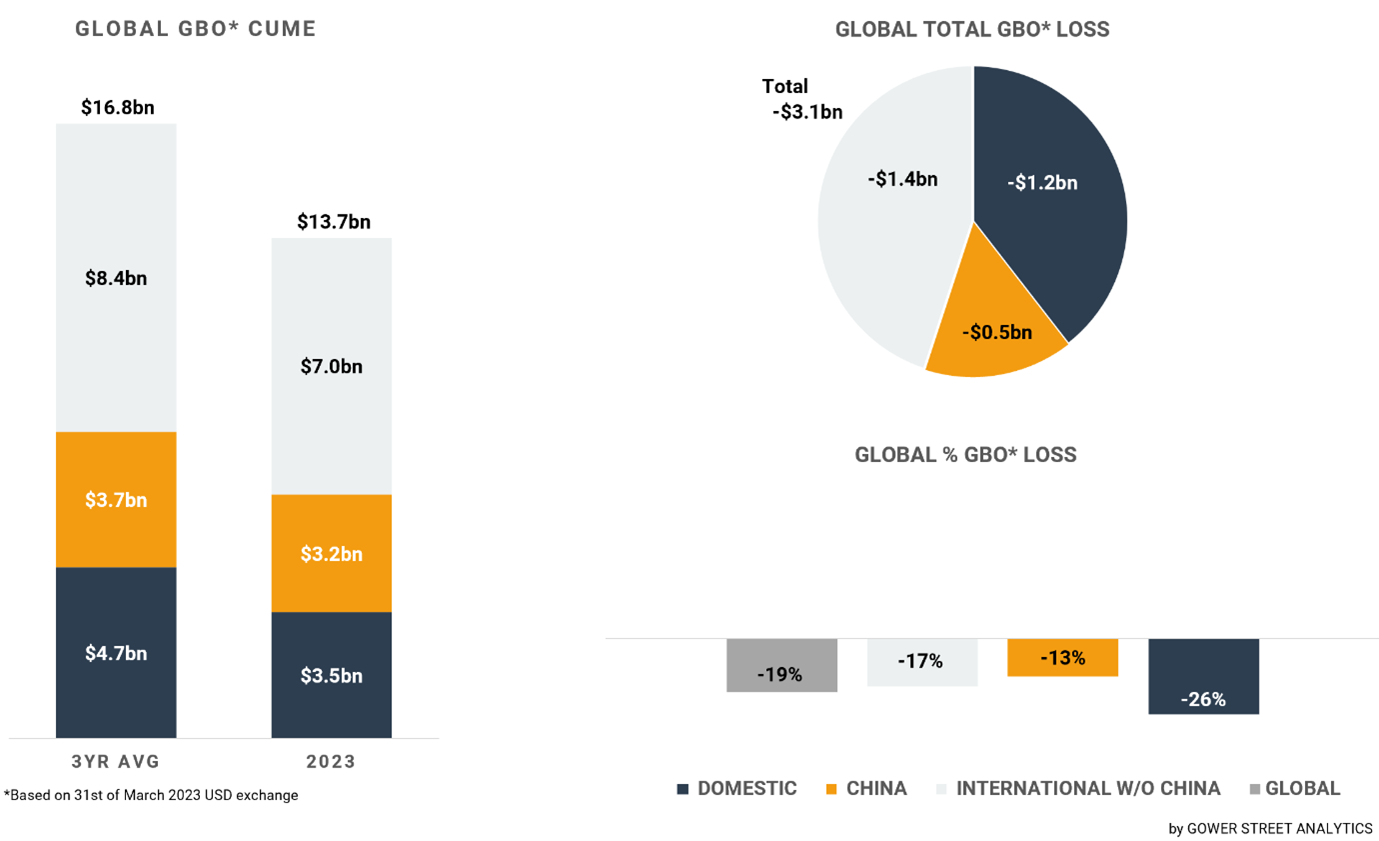

After the first five months of the year the total global box office is estimated to have reached $13.7 billion. With a bit less than half a year in, 2023 has already surpassed (+16%) the 2020 pandemic peak full year result of only $11.8 billion. 2023 is currently tracking +34% ahead of 2022 and more than doubles 2021 (+117%) at the same stage! It remains -19% (or $3.1 billion) behind the pre-pandemic three-year average, but that has narrowed a bit further from -21% a month ago.

On this month’s Global Box Office Tracker (GBOT, above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

A trio of major new releases and a strong holdover title dominated the global box office in May grossing a combined box office of $1.78 billion, 64% of the worldwide total! That left only marginal space for other movies to shine.

Globally the third part of GUARDIANS OF THE GALAXY achieved the highest box office in May with around $750 million. Despite strong tentpole competition the title showed great holds especially in light of recent MCU releases. The May total suggest GUARDIANS VOL. 3 will end between the two prior instalments globally (GUARDIANS VOL. 1: $773m, GUARDIANS VOL. 2: $864m). Internationally it did $439 million, thus it has the chance to top the trilogy (GUARDIANS 1: $440m, GUARDIANS 2: $474m). GUARDIANS 3 has also already surpassed the international lifetime total of the past three MCU releases (ANT-MAN 3: $262m, BLACK PANTHER 2: $405m, THOR 4: $418m). The $311 million GUARDIANS 3 earned domestically in May makes it more of a challenge to surpass VOL. 2 ($390m) and most likely also VOL. 1 ($334m) by the end of the run.

FAST X was the second highest global grossing title in May delivering approximately $537 million. Over three quarters (78%) came from the International market (inc. China) with $419 million. Internationally it is performing just slightly behind the prior instalment FAST 9 and most likely will achieve a total in the ballpark of that one ($553m). While still being a massive result, this is significant behind the franchise best $1.2 billion hit by FAST 7. The Domestic market moved even further away. At the end of May, FAST X had earned $118 million and looks unlikely to top any of franchise entry since FAST 3 in 2006 ($63m).

The Disney live action remake THE LITTLE MERMAID was the third highest grossing release in May with a monthly total of approximately $233 million, releasing just in the final play-week. In contrast to the two aforementioned titles the Domestic market has dominated this release so far. Achieving 60% of the May total with $139 million, though it should be noted week-2 holds were generally much stronger internationally.

Holdover hit THE SUPER MARIO BROS. MOVIE grossed slightly more than THE LITTLE MERMAID globally in May, adding approximately $260 million for a stunning total of $1.28 billion. It’s now the #19 highest grossing movie of all time globally! FROZEN II is the only animated title ahead at #13 with a $1.45 billion total.

The phenomenal result of the International market in May was led by the Latin American sub-region. Although being by far the smallest region, it was the one with the highest uplift against the three-year average with +16%! This is second only to December 2021 when the sub-region surpassed that with +29%. The running year is just -7% below the three-year average, reduced from -13% at the end of April.

Mexico was again the backbone of that positive development. It was internationally the second highest grossing market for FAST X ($30m) and THE LITTLE MERMAID ($11m) in May. Moreover, it was #3 for GUARDIANS OF THE GALAXY, VOL. 3 ($34m). For SUPER MARIO it’s still the #1 international market with $85 million! That continuing success helped to narrow the territory’s gap to the pre-pandemic box office to just -3% at the end of May, down from -7% a month ago.

The second biggest market of the sub-region, Brazil, recorded its highest grossing month of the year so far, and the third highest since January 2020. It was also only the second time it performed above the three year pre-pandemic average (+8%). It was the third highest grossing international market for FAST X ($19m) and #4 for THE LITTLE MERMAID ($5m). Brazil and Mexico were leading the whole Latin American sub-region, which consistently performed at or above pre-pandemic levels in May!

The sub-region of Asia Pacific (excluding China) also performed above the three-year average in May by +2%. Bringing down the gap for the 2023 cume vs 3-year average to -19%, from -24% at the end of April. In contrast to Latin America it was mainly the stand out performance of two territories that drove this performance. The rest of the region’s markets we track performed significantly weaker in comparison.

The usual suspect Japan recorded its second highest uplift against the three-year average with +35%. Malaysia surprisingly topped that with +43% – the highest number this more volatile market has reached so far. Key to Malaysian success, besides very good numbers from FAST X ($6.6m) and GUARDIANS 3 ($4.2m), was the impressive launch of local action sequel POLIS EVO 3. It delivered the third biggest opening ever for a local title in Malaysia and ended the month with $4.4 million. Additionally, POLIS EVO 3 already surpassed the lifetime of the first two instalments of the franchise.

Japan started the month with its best play-week since August 2019. This was due to a combination of the Japanese Golden Week national holiday period, the phenomenal opening of THE SUPER MARIO BROS. MOVIE, the terrific holdover of DETECTIVE CONAN: THE BLACK IRON SUBMARINE, and the opening of the movie spin-off of popular local drama series TOKYO MER (MOBILE EMERGENCY ROOM). These three titles also dominated the rest of May. SUPER MARIO just needed 31 days to cross ¥10bn ($72bn), the fastest ever for a non-local animated title in the market. DETECTIVE CONAN is at the same time already the highest franchise entry yet, as the 26th released title in the series. It’s also currently the 12th highest grossing animated title in Japan. Finally FAST X further helped to build confidence in US-studio releases in the market by opening to franchise-best numbers. The fabulous month pushed the market to be +2% ahead of its 2017-2019 average at the end of May. This saw Japan leading the top ten international markets at that point!

Among the sub-regions Europe, Middle East, and Africa (EMEA) had the biggest gap to the average pre-pandemic May performance with -9%. Nevertheless, it was just the fourth time the variance dropped into single digits and it was the second month in a row with that number. Multiple major markets achieved even levels around the three-year average like Austria (+3%), Netherlands (0%) and France (-1%). Italy (+4%) and Spain (+0%) particularly stood out, given neither had never previously even achieved a single-digit deficit in comparison to pre-pandemic levels. Spain saw a franchise-best opening for FAST X. Italy is currently the #3 international market for THE LITTLE MERMAID.

The International market (excluding China) had a higher share of the global box office with 55% compared to a three-year average of 50% in May. At the same time the Domestic market fell short, with only a 28% share of the global box office, down from 32% before the pandemic. The solid $785 million the market generated in the month was -21% below the pre-pandemic average. Nevertheless, it was the second highest grossing month since July last year and the one with the second lowest gap to the pre-pandemic average as well, after April. It further stayed at the same level as May last year (-2%).

It was the first time since July last year, that three titles grossed over $100 million domestically within a month. Simultaneously just 8 titles grossed more than $10 million, by far thelowest number since January this year, preventing a better result for the market in May.

Like the Domestic market, China was not shining as bright as the International market but had a stable month too. The monthly total of $494 million was -12% below the three-year average, the second best percentage since February last year. The month was dominated by Labor Day holiday releases like GODSPEED ($118m), BORN TO FLY ($77m) and ALL THESE YEARS ($24m). Additionally, two US studio releases helped to lift the month. GUARDIANS OF THE GALAXY, Vol. 3 contributed $81 million in May, making it the #2 global territory. FAST X delivered $115 million, putting it neck-and-neck with Domestic in the race to be the #1 global market for the title. While both performed below franchise peaks, they gave hope to observers that Chinese audiences were once again receptive to import titles. A shockingly low $2.5 million start for THE LITTLE MERMAID at the end of the month was quick to remind them that import successes in China have become the exception in the past two years rather than the norm they once were.

Globally May was an encouraging summer season kick off. June offers at least one wide release every week. This should secure that Domestic and International box office won’t fall back to lower levels. Even if records are not broken every week and some releases fall below expectations, the current release calendar is strong and dense enough to overcome. More titles with, ideally, more diversity will help to grow the markets. The full capability of the markets is still to be reached in most territories.