August posted another pandemic-era high at the International box office and the second biggest month of Global box office since the pandemic began. The month delivered a $2 billion global box office, up on July’s $1.9 billion and only lagging February’s $2.3 billion (which was fueled by an all-time record box office month in China). The International market (excluding China) contributed $1.11 billion to the August total, beating its previous pandemic-era high, recorded the prior month, of $960 million.

The month also saw the Domestic market reach $2 billion in total box office in 2021 ($2.09bn by month end). With the success this current weekend of Marvel title SHANG-CHI AND THE LEGEND OF THE TEN RINGS, this has since surpassed 2020’s year-end total of $2.1 billion ($2.16bn as of September 5). The Domestic market only saw 2021 business overtake 2020 at the same point in the year on August 21.

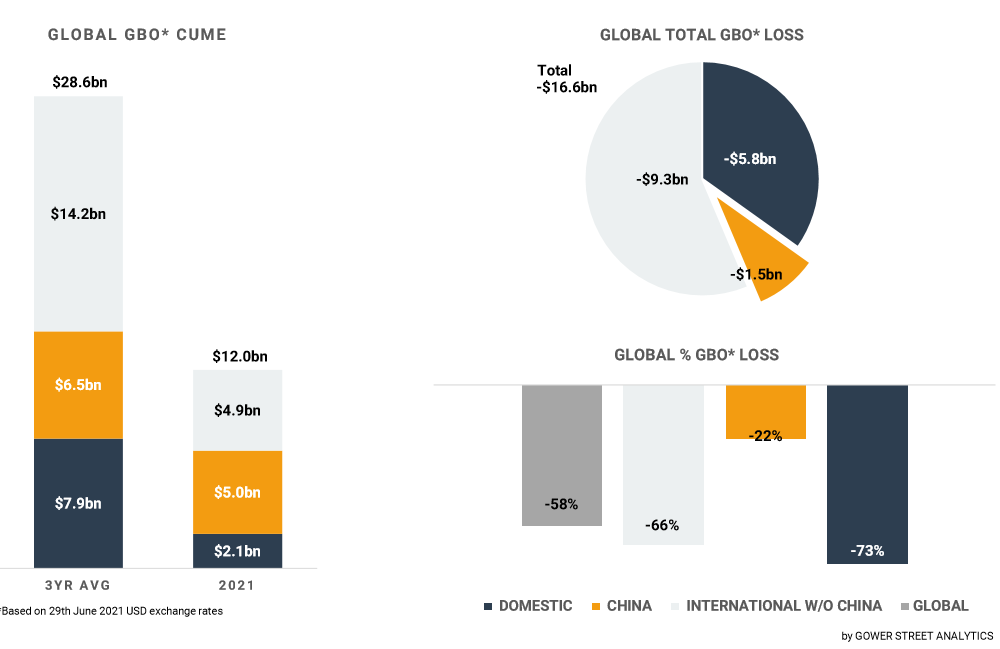

According to Gower Street’s latest monthly Global Box Office Tracker, as of August 31, the global box office stood at $12 billion in 2021. This is tracking 58% behind an average of 2017-2019, the three pre-pandemic years, ($28.6bn).

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three (pre-pandemic) years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

August was $1.8 billion down on the three-year average for the month. A reduction in monthly deficit from the $2.2 billion loss recorded in July.

Although China showed a similar $0.4 billion gross in August to July (in fact $390 million vs $420 million) the #1 global market recorded its biggest monthly deficit so far in 2021 compared to the three-year average. August tracked $710 million behind the average, a significant rise from the $460 million behind the average recorded in July. This was largely due to the continued lack of Hollywood releases in the market, with only two coming in August: LUCA and FREE GUY. The Pixar title disappointed with only $11.2 million in its first 12 days, having opened August 20. However, there was better news as FREE GUY opened August 27 and finally brought the first import #1 since F9 (aka FAST & FURIOUS 9) ended its 3-week reign atop the Chinese box office in the first week of June. FREE GUY has also held well in the market this weekend.

FREE GUY’s impressive holds in weeks 2 and 3 around the world have been a key talking point in the industry in the latter half of August. The film was a rare title this summer not offered up on PVOD or SVOD release simultaneously with theatrical. Audiences appear to have responded accordingly. Across the top 12 global markets (excluding China) the average week 2 drop for FREE GUY was just 24%. In week three, across the 10 of those markets to have played a third week on the title within August, the average drop was only 26%.

There was positive recovery news in August as The Netherlands became the first Western European market to achieve Stage 5 of Gower Street’s Blueprint To Recovery. This is measured as a box office play-week equivalent to a top quartile play-week of 2018-2019. The European market did so in the July-August crossover play-week, beginning July 29, but also repeated at the same level in the following (Aug. 5) week. The first full play-week in August also brought Japan back to a stage 5 level for the first time in 2021.

This article was originally published on Screendollars’ newsletter #184 (September 6, 2021) and on the Screendollars website here.