The global theatrical world has reached a new height of recovery in October. It delivered a monthly box office of $3.1 billion, by far the highest result since January 2020! From the 20 months in-between only three were able to slightly cross the $2 billion mark. In contrast to the prior record month of February this year, when China lifted the global number to $2.3 billion virtually on its own, this time it was a global effort!

A constant flow of attractive content was producing pandemic-era best performances in a myriad of countries around the world. 29 of the 30 territories tracked in our global State of The Market report reached the basic Stage 3 target, or higher, on Gower Street’s 5-Stage Blueprint To Recovery at least once during October. Nearly half of them (13) held above that level in all four full play-weeks. This displays a growing stability of the recovery.

Multiple countries were also overtaking targets for the first time. South Africa finally hit Stage 3, Portugal Stage 4, the UK and Germany took Stage 4 and Stage 5 in one go, while Austria reached Stage 5. Others repeated prior peaks with China, Russia, Netherlands and Argentina all returning to Stage 5 within the month. Numerous others recorded highest grossing weeks since the pandemic began, including Italy, Brazil, Turkey, Chile, Ecuador and Peru.

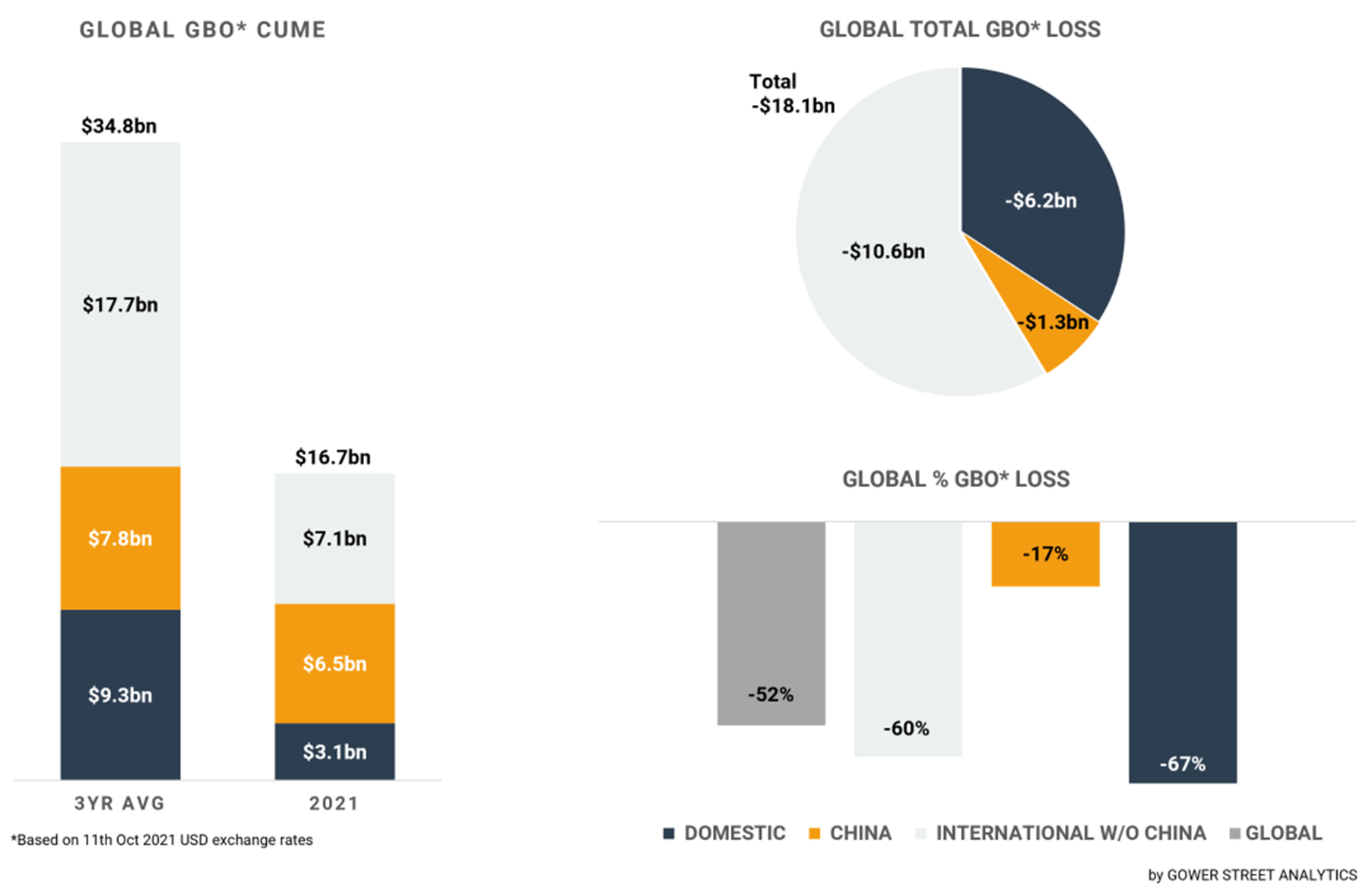

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three (pre-pandemic) years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

According to Gower Street’s latest monthly Global Box Office Tracker, as of October 31, the global box office stood at $16.7 billion in 2021. This is tracking -$18.1 billion behind an average of 2017-2019, a drop of -52%. Nevertheless, it’s already 39% above the year-end result for 2020.

The biggest part of the global box office growth in October was delivered across the International market (excluding China) with $1.3 billion bringing the cume to $7.1 billion by the end of the month. It’s beating its previous pandemic-era high, recorded in August, of $1.1 billion.

EMEA continues to be the highest performing International Region for the fourth month in a row, generating 66% of the international box office in October. This is a significant uplift from the 53% it represented as an average in the three pre-pandemic years for the same holiday-supported period.

A quarter of the EMEA result in October came from UK/Ireland (three-year average 18%), which had a particular strong month. Its $205 million monthly result outperformed the three-year average for the first time by +28%! The main driver of this exceptional result is of course NO TIME TO DIE. It contributed over half of the market’s monthly box office with $116 million. Its current total of $120 million already makes it #6 in the territory’s all-time rankings. However, two more releases had stand out returns in UK/Ireland with more than $15 million within October: VENOM: LET THERE BE CARNAGE with $20.3 million and DUNE with $18.2 million.

The same trio led Germany to a $114 million pandemic best month that was nearly on par with its three-year average (-2%). As in UK/Ireland, NO TIME TO DIE accounted for over half the month’s market total with $59 million. It was followed by DUNE’s strong holdover result of $8.2 million within October and the VENOM sequel with $7.4 million.

The October results for Germany and UK/Ireland are a remarkable step forward in their recovery process, representing over a third of their current year-to-date totals (UK/IRE 36%, GER 35%). Both territories were able to cut their 2021 cume percentage losses against their three-year average by around 10% from -74% at the end of September to -65% for Germany and -64% for UK/Ireland.

On the other side of the Atlantic the Domestic market also recorded the biggest box office results since February 2020 with $637 million topping the July result of $583 million! Not as skewed towards the success of one release as in UK/Ireland and Germany, the Domestic market saw two titles cross $100 million: VENOM: LET THERE BE CARNAGE ($190m) and NO TIME TO DIE ($133m). Two more did $50 million within the month: HALLOWEEN KILLS ($86m) and DUNE ($69m). These two even achieved these numbers despite being available day-and-date to subscribers of Peacock (for HALLOWEEN KILLS) and HBO MAX (DUNE) at no extra cost, a strong statement for the demand of the theatrical experience!

Also encouraging are the global results for the October releases. NO TIME TO DIE stands at $610 million now, it’s the second best (after F9, $721m) performing non-Chinese title since December 2019. VENOM: LET THERE BE CARNAGE has crossed $400 million globally and now ranks at #5 of the most successful US-studio releases of the pandemic, just after SHANG-CHI AND THE LEGEND OF THE TEN RINGS ($427m). DUNE has grossed $303 million at this point and is now director Denis Villeneuve’s biggest global hit, having overtaken BLADE RUNNER 2049 ($259m).

In China, THE BATTLE OF LAKE CHANGJIN is illustrating the country’s extraordinary post-pandemic market capacity. Opened for the October Golden week holiday – historically the second most lucrative frame after Chinese New Year – the release had grossed $847 million at the end of the month. It’s now ranked as China’s second biggest film of all-time just after the 2017 local release WOLF WARRIOR 2. It’s also already the highest grossing global title since STAR WARS: EPISODE IX – THE RISE OF SKYWALKER in December 2019.

Combined with October’s #2 title MY COUNTRY, MY PARENTS ($225m so far) the holiday openers finally put Chinese box office back on the upswing after a concerning four months. October was China’s second best month of the pandemic with a box office of $1.2 billion. This is just beaten by the country’s $1.9 billion in February this year – the highest grossing month of all time in China. October outperformed the month’s three-year average by +36%! At the end of the month China has achieved a total of $6.5 billion for 2021, tracking -17% behind the three-year average, a total of $1.3 billion.

Beside of the constant flow of major releases that help to keep the momentum going and stabilizes the markets, the essential base for the continuing recovery is a stable high percentage of market share by open cinemas worldwide. In the Oct. 18 play-week it hit a global pandemic era high of 90%. How fragile this base can be was illustrated over the final weekend of the month with the two strongest and most stable markets of a volatile 2021 both suffering cinema closures to different degrees. China had limited shutdowns across over a dozen provinces following covid increases. The closures represented approximately 13% of physical Chinese screens but only about 3% of available market share (as measured at pre-pandemic levels). More severe was the drop in Russia to just 37% of cinemas open by market share down from 87% at the beginning of the month. In Russia covid cases and deaths have been rising rapidly since mid-September to record levels and led to a national non-working week from Oct. 30 to Nov. 7 to get people vaccinated and slow down the spread of the virus.

Nevertheless, October still closed high with 88% of global cinemas open by market share. Moreover the October box office was globally just -8% behind the average of the three pre-pandemic years (2017-2019) for the month. No previous month in the pandemic has performed better than -40% behind the three-year average! October clearly showed that people are still hungry to go to the movies all around the world!