A disappointing Golden Week in China, missing global blockbusters, and no break-out mid-size entry could have caused a very poor October at the global box office. Thankfully, multiple local hits in individual major territories were at least able to prevent the worst and lift the aggregated global number to a soft $2.1 billion in October.

It’s the second lowest grossing month of 2025. Just ahead of March (+15%) and -10% below the next best, the prior month September. This October is only the fourth best this decade. Behind the past two years (2025: -5%; 2024: -10%) and record year 2021 (-31%). Just ahead of the month in 2022 (+6%) and 2020 (+26%). Clearly -36% below the three-year average (2017-2019), the second widest gap in the past twelve months.

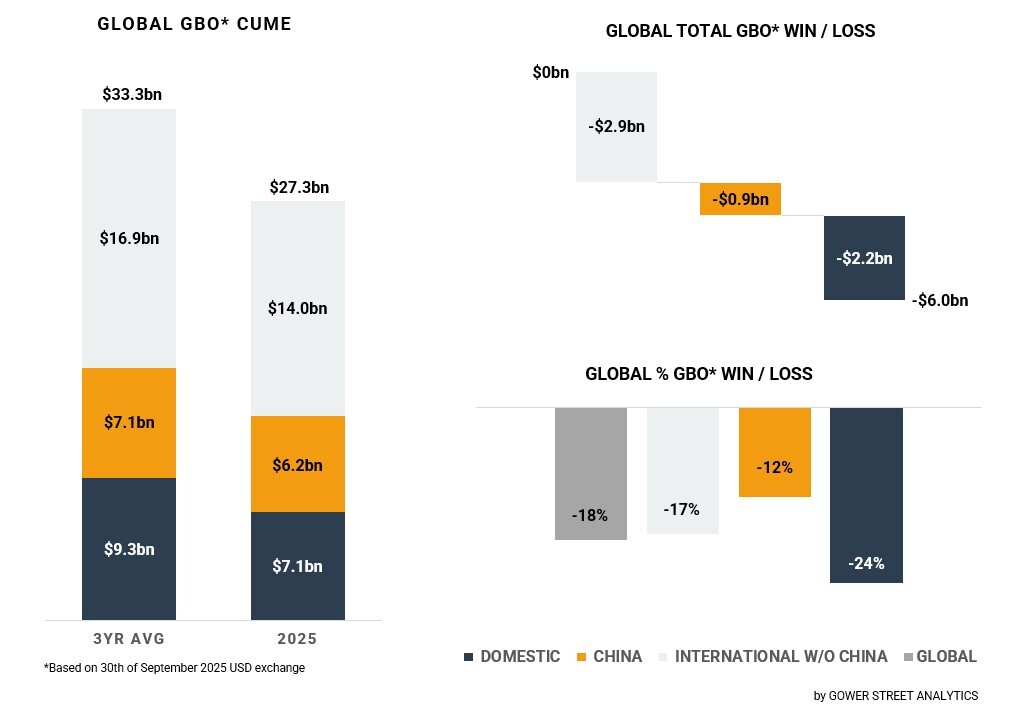

After ten months in 2025 the total Global box office is estimated to have reached $27.3 billion. That continues to be right in-between the past two years at that point, +6% above the same period last year and -7% below the one in 2023. The Global cume is -18% (or $6.0 billion) behind the pre-pandemic three-year average.

International box office (excluding China)

As in September the international skew of the major global releases in the market supported an overperformance of the International box office (excluding China) in October. The region contributed 59% of the worldwide box office in the month with $1.2 billion. This is the second highest share of the year so far, ahead of September’s 57% and just behind the 61% in March. It was the second highest grossing October of the decade. Slightly ahead of the past three years (2025: +4%; 2024: +3%; 2023: +7%) and -6% below 2021. Within the past twelve months the gap to the pre-pandemic average for the month was still the third widest with -27%, only besting February (-28%) and March (-36%)

Domestic

The Domestic market showed a -37% gap to the pre-pandemic average by achieving $465 million. This is the fourth widest gap of the past 12 months. The month itself is the second lowest grossing in the same period, which is not unusual given its historical low track record. Nevertheless, this October was below the ones in the past four years, even in double digits below October 2023 (-21%) and 2021 (-26%). Trailing last year’s October by -5% marks the fifth month in row, which grossed less than the same month last year.

This October was lacking a slate that attracted a wide audience. No title was able to cross $100 million at the Domestic box office in October. That is the first month since March this year and the second October in row which failed that threshold. Only two titles were even able to cross $50 million: TRON: ARES ($66m) and BLACK PHONE 2 ($56m). October had the lowest number of titles exceeding $40 million within the month since February this year (2). Thanks to Taylor Swift, the box office was not as bad as it might have been. After saving the box office in October 2023 with THE ERAS TOUR screenings, which grossed phenomenal $181 million in North America over multiple weekends, this year the three-day screening of her THE OFFICIAL PARTY OF A SHOWGIRL added $34 million to the monthly Domestic gross. This lifted the number of releases crossing $30 million within the month to 4, one more than last month, making it only the second lowest since April this year.

At the end of October, the Domestic cume for the running year is at $7.1 billion. That is +3% above last year at the same time and -9% below the period in 2023. The gap to the three-year average is at -24%. The Domestic market continues to only rank #14 of the tracked Top 20 major markets compared to the pre-pandemic average. It’s performing a bit better referring the year-on-year growth of the tracked Top 20 major markets after ten months on rank #10.

China

After the three highest grossing months of the year since the outstanding first two of the year, China had a disappointing October, only grossing $367 million and ranking #6 this year so far. In terms of gap against the three-year average the -53% deficit put it as fourth widest of the past 12 months. This hits especially hard as October starts in China with the Golden Week holiday, usually the second most lucrative box office period in the Chinese calendar (after Chinese New Year). This October was the second worst of the decade. While October this year was still up on the disastrous one in 2022 (+22%), it was below the mediocre past two years in double digits (2024: -27%; 2023: -28%) and far away from the $1.1 billion in 2021 (-65%) and $886 million in 2020 (-59%).

No title was able to cross $100 million within October. Still the four highest grossing movies combined contributed two thirds of the month’s total, led by war movie THE VOLUNTEERS: PEACE AT LAST, grossing $81 million within the month.

At the end of October, the Chinese cume for 2025 stands at $6.2 billion, which is the second best of the decade. Clearly +16% on last year, the third-highest growth of the tracked Top 20 major markets. Just -9% below 2023 at the same point in time. As a consequence of the soft October, China widened its year-to-date gap to the three-year average from -7% at the end of September to -12% now. Harshly down from the peak of +72% at the end of February.

Outlook

This year’s October was never expected to be record breaking, especially not after MICHAEL and MORTAL KOMBAT 2 moved out of the month over the past half year. The final results were nevertheless at the low of expectations, exacerbated by the poor Chinese Golden Week. Multiple territories used the gap in the global distribution pipeline and succeeded with local tentpoles, illustrating as often in challenging periods at the global box office in recent years: if attractive movies release and the audience is aware, they will come.

The next two months we will see more of that on the global scale. Three of the major movies of 2025 are about to release in the final two months of the year: WICKED: FOR GOOD, ZOOTOPIA 2 and AVATAR: FIRE AND ASH! These should secure a prosperous finale to 2025.