A month on from the close of 2020 official final numbers for different territories continue to be announced in the industry trade press. Regardless of the final individual numbers one thing is clear, no market remained unscathed. No headline made this more apparent than that announcing official Japanese figures in Variety earlier this week: “Japan Box Office Falls by (Only) 45% in 2020, Data Shows”. That qualifying “(Only)” both a celebration of the Japanese box office’s resilience, as the global market with the smallest box office deficit year-on-year, and a stark reminder of the devastation wrought on the theatrical industry around the world if a 45% loss was the best-case scenario.

But amid the constant roll-out of individual market data another change brought by the pandemic impact has gone largely overlooked: how the crisis has reframed global box office proportionately.

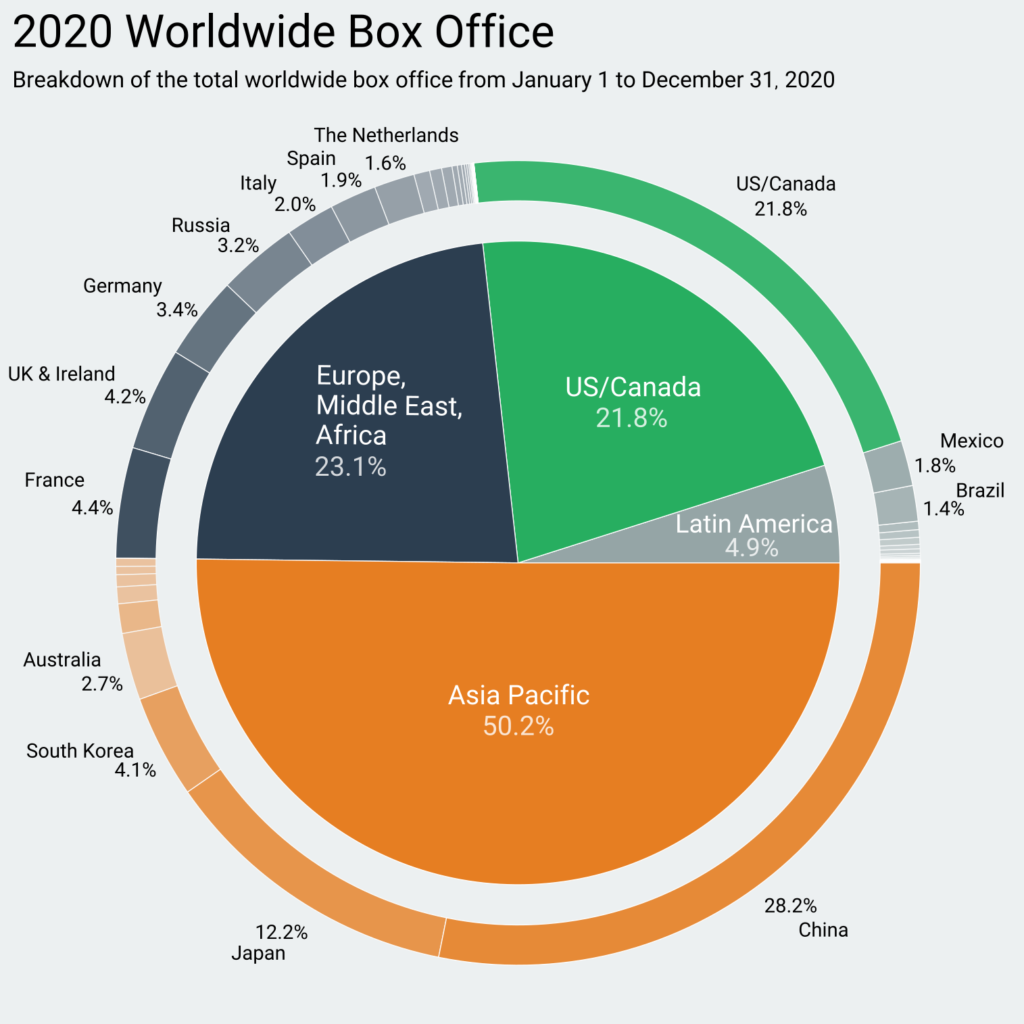

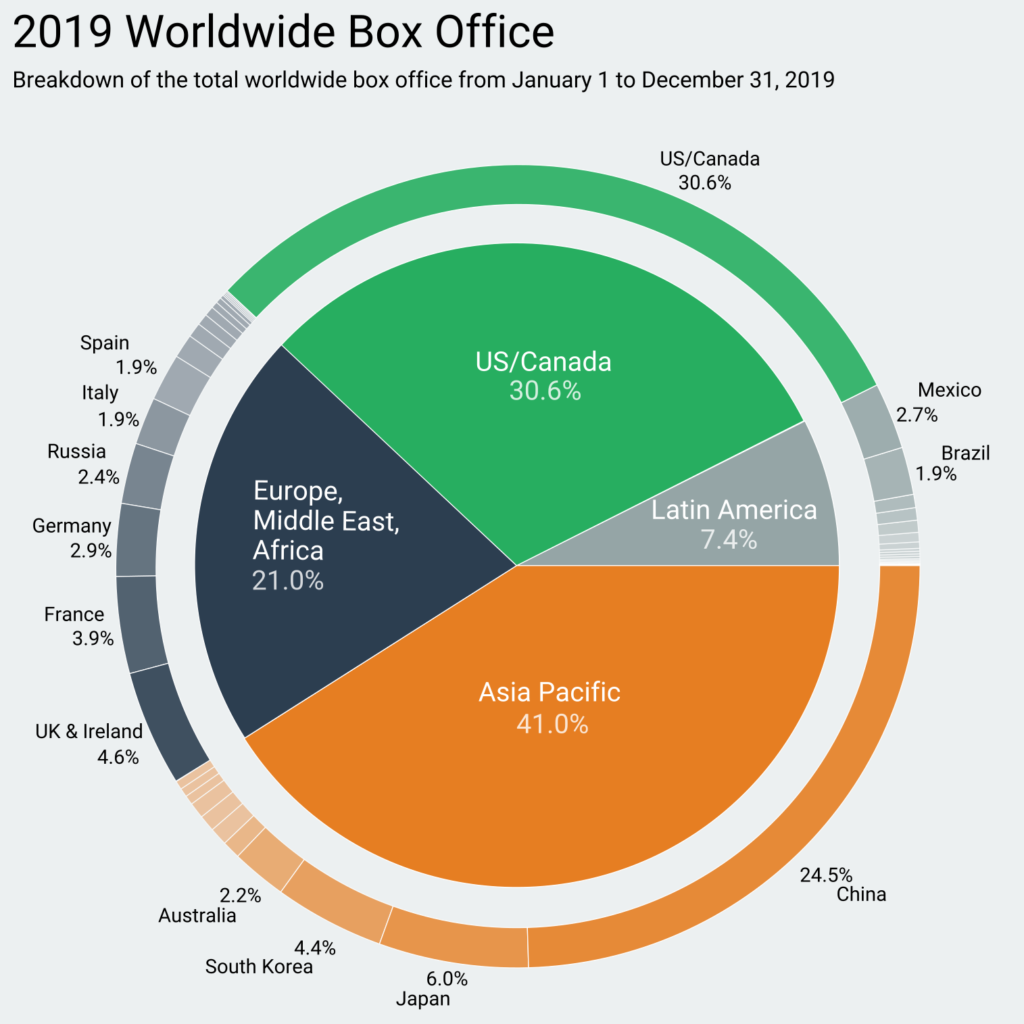

The pie charts above and below show the proportional representation of global box office regions in 2020 and 2019, respectively. Within each region the biggest contributing markets are also represented.

Two stories are immediately evident. The first, and most obvious, is the continued and dynamic power shift to Asia Pacific. For the first time, the Asia Pacific region represented over 50% of the global box office in 2020. This is up over nine percentage points from 41% in 2019 (a year-on-year rise of 22.4%). The three biggest international territories in 2020 were all Asia Pacific markets: China, Japan and South Korea.

However, while China, as expected, delivered the biggest portion (more than half) of the Asia Pacific result, becoming the #1 global market for the first time as previously reported, it was Japan that offered the biggest proportional growth, up 103% year-on-year compared to a 15% improvement for China. Japan was up over six percentage points (from 6% of global box office in 2019 to an astonishing 12.2% in 2020).

The Asian growth as a proportion of box office was offset by the shrinking representation of Domestic and Latin American box office. Domestic box office fell nearly 29% (and nearly nine percentage points) from 30.6% of global box office in 2019 to just 21.8% in 2020. Latin America experienced the biggest year-on-year drop (33.8%) as it fell two and a half percentage points from 7.4% to 4.9%.

The second story is subtler: the relative stability of the Europe, Middle East and Africa (EMEA) region within global representation. Despite the significant box office impact felt locally across multiple lockdowns, EMEA actually represented a slightly higher proportion of global box office in 2020 (23.1%) than is had in 2019, rising just over two percentage points (or 10% year-on-year). Within this region, France, Germany, Russia, and the Netherlands (the market with the smallest year-on-year loss in the EMEA region) all saw their proportions of global box office rise year-on-year. Italy and Spain remained on par with the previous year’s performance. However, UK/Ireland saw its proportion slip from 4.6% to 4.2%.

This shows that while box office was impacted in all markets there was a disproportionate impact on some markets: including Domestic, Latin America and UK/Ireland. There are likely a number of, often overlapping, reasons for this: a country’s handling of the response to the pandemic which may have more greatly impacted consumer confidence; a disproportionate reliance on Hollywood and other US product with an audience traditionally less engaged with local and/or arthouse/independent content; and longevity of closures. But these reasons alone may not present the full picture. The Domestic and UK markets undeniably over-rely on Hollywood content, but so does Australia which saw its proportion of global box office rise from 2.2% to 2.7% in 2020. Latin America has suffered some of the longest closures of any market around the world (Chile and Peru remain closed over 10 months from initial closure), but China was closed a full six months – far longer than many others.

As more and more Hollywood titles are further delayed the power shift to Asia Pacific is likely to continue this year. Gower Street is currently estimating Domestic box office for 2021 to reach approximately $6 billion if there are no significant further changes to the calendar (which, of course, there will be). The Domestic market is already tracking 93% behind both 2020 business and an average of business for the previous three years (2017-2019). In contrast, China (as of last weekend) was tracking 41% ahead of 2020 and on par with the average of the previous three years. If Chinese cinemas can remain open then, with Chinese New Year fast approaching on February 12 and bringing a plethora of local content for audiences to celebrate it, the new #1 global market and the Asia Pacific region will get a major head-start in 2021.

This article was originally published in Screendollars’ newsletter #153 (February 1, 2021).