From a general global perspective April delivered the same box office as March with $1.8 billion. From a detailed international perspective, the recovery has significantly improved in expanding the growth process over the majority of markets and an increasing number of attractive films.

Australia and the Latin American region scored their second best single-month results of the pandemic era. The Europe, Middle East and Africa (EMEA) region, and the International market as a whole (excluding China), scored the third best single-month result in April.

Twenty-two of the 30 territories tracked in our State Of The Market report showed an uplift against the prior month. That pushed the International market (excluding China) 8% above March ($1.03bn) and made it its third highest grossing month of the pandemic with $1.12 billion. This was only behind December ($1.6bn) and October ($1.3bn) last year.

That development was driven by a multitude of appealing global releases. It was not just thanks primarily to one commanding title like THE BATMAN in March or SPIDER-MAN: NO WAY HOME in January and December dominating the global marketplace. Instead it was thanks to a set of commercial global titles that opened in theaters on a weekly base in April.

Within the month two titles crossed $300 million: FANTASTIC BEASTS: THE SECRETS OF DUMBLEDORE ($323m) and SONIC THE HEDGEHOG 2 ($316m). Three more achieved $100 million within the month: MORBIUS ($161m), THE LOST CITY ($101m) and THE BAD GUYS ($101m). While not all of the releases reached the performance level some might have hoped, they are an important step in getting the number, frequency and size of releases nearer to pre-pandemic levels. Pulling a wider range and more diverse crowd back into cinemas. This helps to lift the markets’ total performance and increase sustainability of the industry.

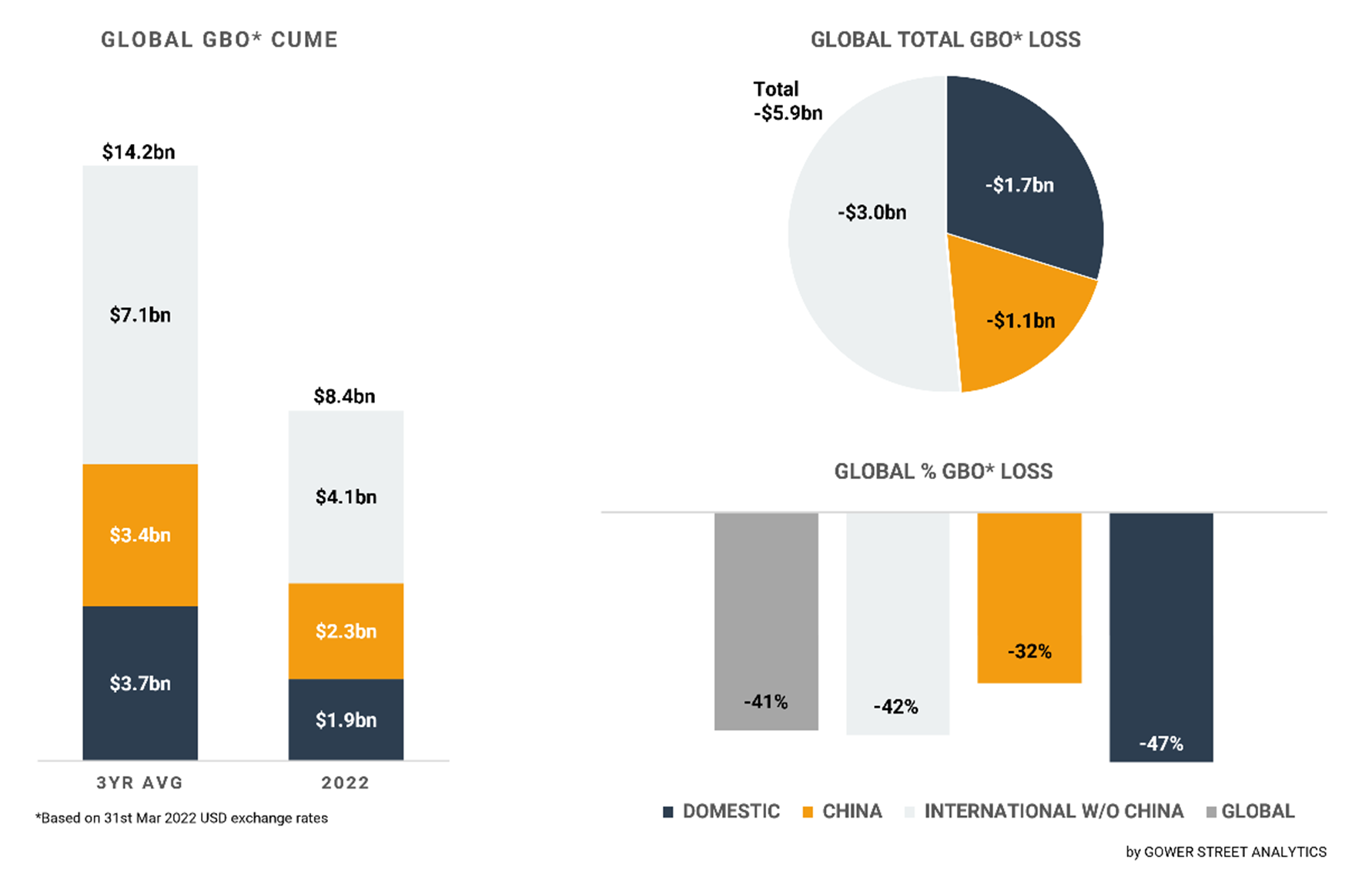

Four months into the year and global box office stands at an estimated $8.4 billion. This is nearly $3.1 billion ahead of the same stage of 2021, but approximately $5.9 billion behind the average of the last three pre-pandemic years (2017-2019). At the end of April, 2022 has achieved nearly three-quarters (71%) of the 2020 full year total ($11.8bn) and is just shy of two-fifths (39%) of last year’s $21.3 billion result.

On this month’s Global Box Office Tracker (GBOT, above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

The EMEA region generated more than half (54%) of the International market (excluding China) in April. With $607 million it’s the 3rd highest grossing month of the pandemic for EMEA, only behind October ($873m) and December ($811m) last year. At the end of April the region had a cume of $2.3 billion, which is over six times as high (+513%, $376m) as last year at the same time when just a few markets were operating and slightly above the 2020 cume in the same period (+4%, $2.2bn) when everything was closed since mid-March. However, it’s still -40% below the three-year pre-pandemic average.

In April multiple markets in EMEA closed the gap significantly. Austria was just -5% below the pre-pandemic three-year average. The Netherlands was below -11%, Germany -22% and France -23%. Encouraging signs for the months to come.

The Latin America region stood out in April by reaching their 2nd highest grossing month of the pandemic with $155 million, just behind December 2022 ($262m). The strong performances of SONIC THE HEDGEHOG 2 and FANTASTIC BEASTS: THE SECRETS OF DUMBLEDORE in the region were the main driver. In the April 15 play-week both titles lifted Mexico and Panama up to Stage 4 level on Gower Street’s 5-Stage Blueprint To Recovery (a week equivalent to the median of weekly business in 2018-2019) for the first time in 2022. Colombia crossed the target that week for only the second time and Brazil for the third time this year.

In the Asia Pacific region Hong Kong was finally allowed to re-open its cinemas on April 21 after a closure of 3.5 months, the fourth, and longest, lockdown in the territory! It was the last fully-closed market among our tracked markets. Business immediately crossed the basic Stage 3 target on the Blueprint To Recovery (a week equivalent to the lowest grossing week in 2018-2019) in the first play-week back. The performance was driven by multiple delayed openers with FANTASTIC BEASTS: THE SECRETS OF DUMBLEDORE, MOONFALL, SING 2 and SCREAM, despite only just over 56% of cinemas by market share being open for the return weekend.

Another highlight from the Asia Pacific region came from Australia. It had its 2nd highest grossing month of the pandemic. For the first time this year Australia surpassed the Stage 4 marker in the April 8 play-week and even progressed to the highest-level Stage 5 (a week equivalent to top quartile of weekly business in 2018-2019) on the Blueprint To Recovery in the following week. The market was lifted by autumn holidays, Easter and a strong slate.

While the International market grew in April, China dropped even further -38% from the already poor result of March ($143m). The $89 million result in April was the lowest outcome in China since July 2020, when cinemas started to re-open after six months of closure. Additionally, the number of cinemas open by market share fell to the lowest number since that time, dipping just below 50% in the April 15 play-week.

The rise of COVID-19 cases and the drastic restrictions following them are muting the results in China at the moment. At least at the beginning of May the number of cinemas open by market share had risen to 69% again, the highest in seven weeks.

In April, China was only the 5th highest grossing market globally behind Domestic, Japan, UK/Ireland and France. For 2022 so far it’s still #1 standing at $2.3 billion, being -32% below the three-year average, a total of -$1.1 billion against the average. Over 71% of that total was solely generated in the Chinese New Year dominated February!

It’s very likely that within the next month Domestic will overtake the 2022 year-to-date box office of China and reclaim the #1 position within the global theatrical market – something it conceded to China in 2020 and 2021. At the end of April the Domestic market was still slightly behind with a total box office of $1.95 billion. April was the second consecutive month clearly ahead of China, the eighth time in the past 12 months!

With a April performance of $583 million, the domestic market is down marginally -2% from the prior month ($597m). It’s the 5th best month of the pandemic just behind July 2021 ($584m). Over a quarter (27%) of the monthly box office was taken by SONIC THE HEDGEHOG 2 with $158 million. That was followed by an impressive variety of titles that produced crucial returns. April had a pandemic-high of nine titles with a single-month box office higher than $20 million. Seven of them reached even more than $30 million, another pandemic record. The five films that got to at least $40 million within the month were on par with July 2021 as the best since the pandemic began.

The share of growing success between an increased number of films is a strong sign of recovery of the theatrical market. The same can be said about the consistency and breadth of the worldwide recovery. Basic levels of individual market performance are reached in growing frequency. In April, of the 30 territories tracked in our global State Of The Market report 21 on average and 20 as a median reached the Stage 3 target, or higher, on the Blueprint To Recovery for a full play-week. These are the second highest monthly numbers in the pandemic after December 2021!

These indicators of the recovery should improve all the more from now on. Coronavirus numbers continue to go down, restrictions are reduced, and audience confidence grows in out-of-home activities again! The re-openings in China and Hong Kong helped return the global number of cinemas open by market share to 85% at the end of April, up from 80% a month earlier.

DOCTOR STRANGE IN THE MULTIVERSE OF MADNESS kicking off business in May and TOP GUN: MAVERICK closing the month out, should prove a powerful combo.; two long-awaited blockbusters of a size that haven’t been released within a single month in a while. With JURASSIC WORLD: DOMINION, LIGHTYEAR, ELVIS, MINIONS: THE RISE OF GRU, THOR: LOVE AND THUNDER, NOPE and BULLET TRAIN in June and July the frequency further increases to deliver a big tentpole title on nearly a weekly basis! Finally!