The past few weeks have witnessed a scale-back of global recovery as markets across the EMEA region have been forced to re-close due to rising virus cases and renewed governmental restrictions.

Just as it had been back in March, Italy was one of the first to re-close from Oct. 26 with closures planned until at least Nov. 24. Other markets followed, including: France (Oct. 30-Dec. 1), Germany (Nov. 2-30), Austria (Nov. 3-30), The Netherlands (Nov. 4-19), England (Nov. 5-Dec.3).

Still more have seen scaling back. Lockdowns in many Spanish regions have resulted in the number of cinemas open by market share falling from 90% to 67% in recent weeks. UAE has fallen from 98% to 85%.

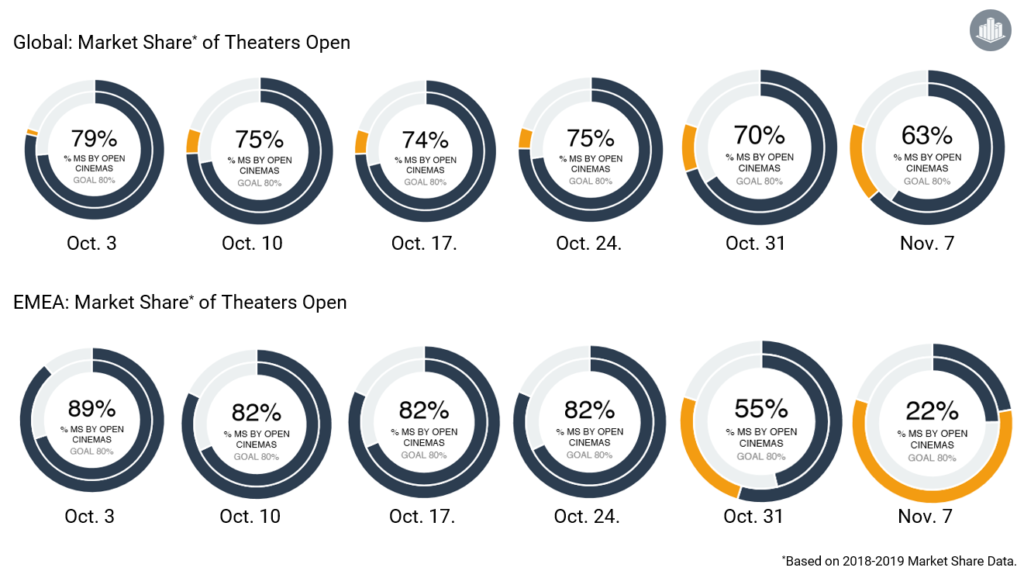

Since the beginning of October the market share (based on data from 2018-2019) of open cinemas across the EMEA region has fallen from 89% to just 22% this past weekend.

There have also been re-closures and scale-backs in other regions. The Malaysia Association of Film Exhibitors announced a voluntary decision to re-close during November following rising cases, that had already brought restrictions and closures is some states. The Canadian province of Manitoba also witnessed substantial scale-back in the past week, from 95% open by market share to just 14%.

All this has had a heavy impact on the current global cinematic footprint, which has retracted from to 79% (its highest level achieved since recovery began) to 63% in the same period.

However, there have been some counteractive, positive moves. On Monday (Nov. 9), South Korea lifted capacity restrictions, which had been re-imposed in mid-August. In Australia, cinemas in Victoria were finally given the go-ahead to begin re-opening Sunday (Nov. 8), albeit with a harsh (20 person) capacity limit until Nov. 23 (when it will expand to 100).

Even as England closed, other parts of the UK/Ireland market already shut have started to re-open, with Wales (Nov. 9) and Northern Ireland (Nov. 13) due to allow re-opening this week. The Republic of Ireland, which had already seen re-closure since early October, is expected to remain closed until at least the beginning of December. Scotland is operating a tiered system that means some cinemas remain open.

In Brazil, the market share of open cinemas has now reached 75% having been below 40% in mid-October. This was driven by the re-opening of major chains Cinemark and Cinépolis in late October and the local launches of Disney’s THE NEW MUTANTS (Oct. 22) and Warner Bros’ TENET (Oct.29). The X-MEN spin-off drive Brazil to immediately hit the Stage 2 target of its Blueprint To Recovery (a single day gross equivalent to the lowest grossing day of the past two years) on Saturday Oct. 24. Panama also saw cinemas re-opening for TENET’s Oct. 29 launch with 57% of cinemas by market share back in operation. That in turn led Panama to achieve its Stage 2 target on Saturday Oct. 31 – the most recent market to do so.