The number of open theaters in the Domestic market has been falling since early October. The Domestic market share (based on data from 2018-2019) of open theaters since recovery began topped out at 61%. This was a level first achieved over the Sept. 25-27 weekend and maintained for the following weekend (Oct. 2-4).

Since then numbers have receded. The initial driver in this recovery regression was the re-closure, from Friday Oct. 9, of most Regal theaters by owner Cineworld Group. The decision to do so followed the most recent delay to James Bond film NO TIME TO DIE. The Oct. 9-11 weekend, Domestic market share of open theaters dropped to 52%.

The market share of global theaters open also hit a high (of 79%) in early October – just shy of the 80% marker that is the goal of the theater-focused Stage 1 target of Gower Street’s Road To Recovery. With Cineworld UK circuits also closing Oct. 9, European and therefore Global numbers also took a knock (Global dipped to 75% for the Oct. 9-11 weekend).

This week Regal announced that its 18 locations still operating across New York and California would be closing Thursday, ahead of the current weekend; while California appears likely to re-close theaters in multiple counties, expected to move into more restrictive categories of the state’s tiering guidance, next week; and Oregon will shut-down theaters from Wednesday for two weeks (Nov. 18). Meanwhile, hopes that the allowance for some theaters in New York state to re-open might be extended anytime soon to New York City looked less likely as Governor Andrew Cuomo imposed a statewide 10pm curfew on various hospitality venues.

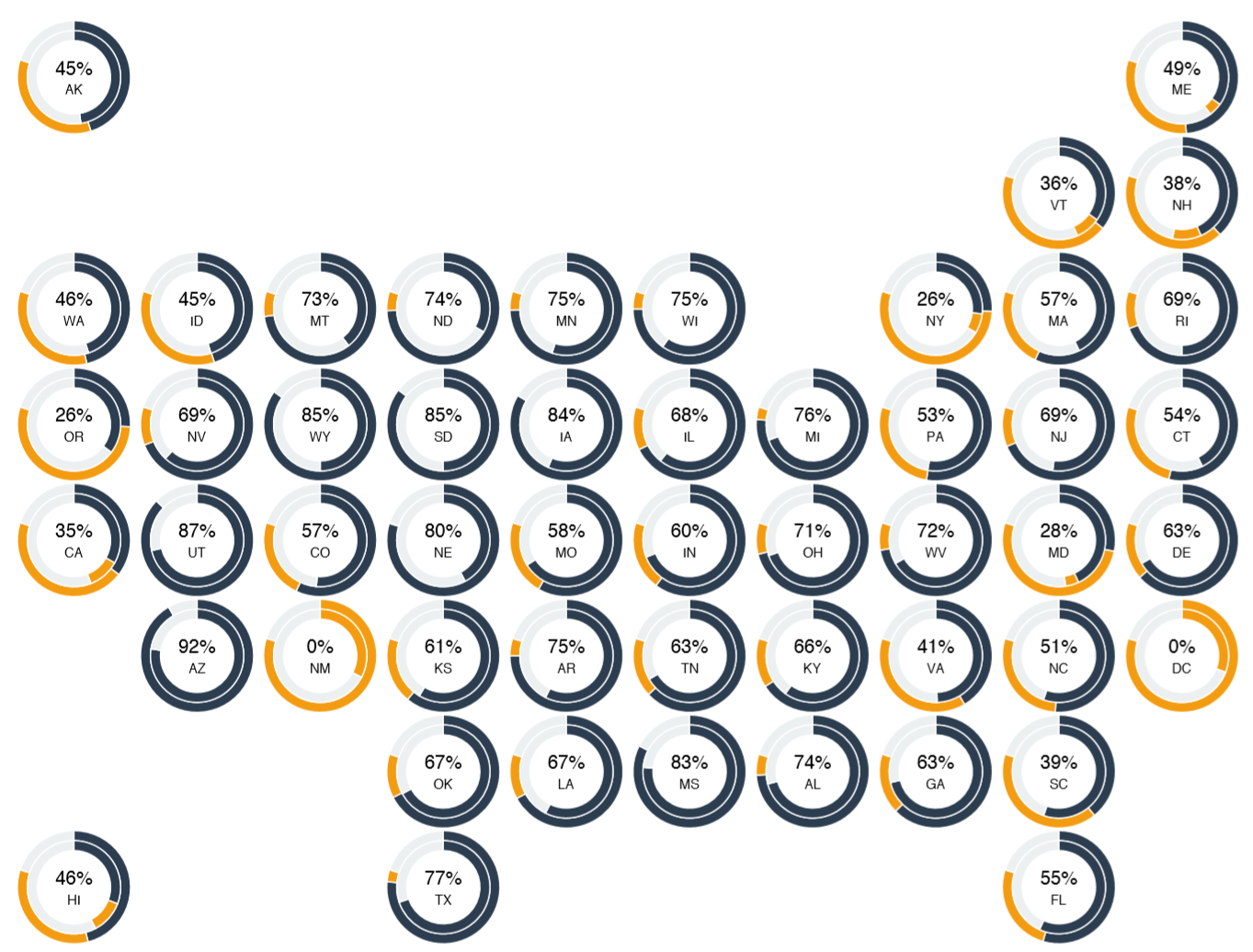

So, ahead of these latest set-backs, where did the 50 states currently stand? Below is our “electoral map” of the US states displaying the market share of open theaters in each as of last weekend.

Last weekend (Nov. 6-8) the Domestic market recorded 55% of theaters open by market share. This 3% had been clawed back primarily from the re-opening of New York theaters outside NYC from Oct. 23 (the state had 26% of theaters open by market share last weekend), but also notable expansion in Michigan (7% to 76%), Nebraska (68% to 80%), North Carolina (30% to 51%) and Washington (4% to 46%).

There has also been retraction in the same period. Alaska has halved since early October from 92% to 45%. Other big drops have occurred in Delaware (99% to 63%); Colorado (73% to 57%); Florida (74% to 55%); Georgia (84% to 63%); Idaho (82% to 45%); Kansas (85% to 61%); Maine (69% to 49%), New Hampshire (74% to 38%); Oklahoma (88% to 67%); South Carolina (87% to 39%); Tennessee (86% to 63%); Virginia (78% to 41%); West Virginia (95% to 72%). Another 13 states have seen their numbers dropping by more than 10 percentage points.

Canada has also seen new shutdowns. Quebec required cinemas to re-close in Montreal and Quebec City from Oct. 1, dropped the market share of those open from 89% to 23% in a week. It has since regressed further to just 8%. Manitoba had fallen to just 14% of theaters by market share being open last weekend, down from 95% just a week earlier, as local virus cases surged. Ontario (89% to 47% since the beginning of October) has also been affected.

With many European markets now also re-closed or scaled-back the market share of open theaters across the EMEA region has fallen from a high of 89% at the start of October to just 22% last weekend. This has been influential in bringing the Global number down to 63%, even as Latin America expands (43% to 57%).

The result, inevitably, is continued uncertainty. The Domestic market had already been slow to return, grossing approximately $300 million in the seven months April to October. This compares to approximately $1.6 billion internationally (excluding China) in the same period and an astonishing $1.8 billion in China in the 3.5 months following its July 20 re-opening.

With Hollywood studios having largely written 2020 off for their product theatrically, exhibitors face a hard winter ahead.

Gower Street’s US state Growth Trackers feature in our weekly Domestic Road To Recovery report. Global, Regional and international market Growth Trackers feature in our weekly International Road To Recovery report. Click here to subscribe to either report.

This article was originally published in Screendollars’ newsletter #143 (November 16, 2020).