This week Gower Street is introducing a new regular feature to its Road To Recovery report: the Global Box Office Tracker.

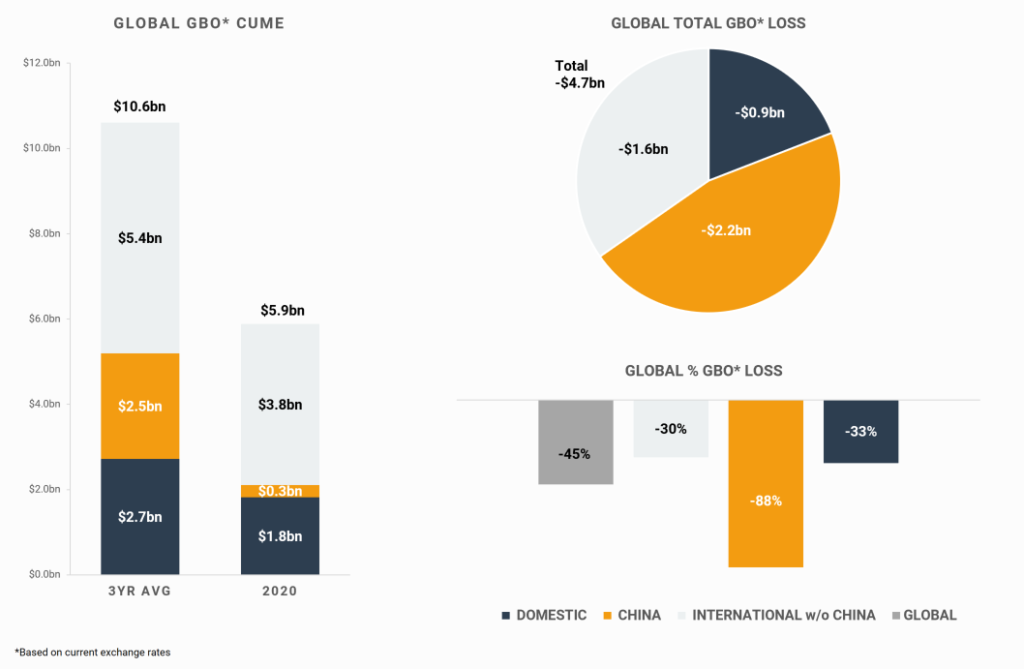

The Global Box Office Tracker (GBOT) looks at daily figures for 2020 across global markets and compares them against the average figures in each market for the past three years to indicate the current deficit levels we are facing worldwide.

Three graphics display how business is tracking in the domestic market, in China and internationally (excluding China), with focus not only on global cumes but also where the losses are coming from. The intention is to enable our readers to track what is happening globally and how the make-up of the deficit changes over time.

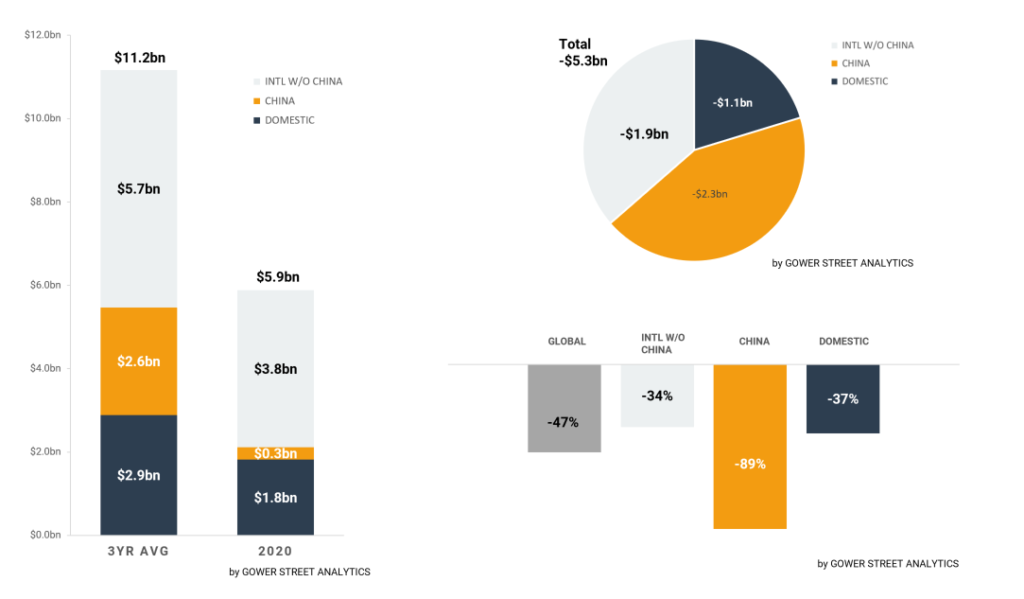

These changes are immediately evident even as we look at data in the GBOT for the calendar Q1 of 2020 (above) compared to the latest GBOT showing global business through Sunday April 5 (below). The 5-day difference has added a further $600 million to the global deficit in 2020 compared to the average of the past three years.

The total box office (shown in the stacked bar graph) can be seen to expand for the average of the past three years, while that for 2020 naturally remains static with virtually all global cinemas now in shut down.

The proportion of losses (shown in the pie graph) explains where the deficit is coming from. While China remains the biggest contributor, having seen cinemas close nearly two months ahead of most other major markets, its proportion of the total has shrunk marginally from 46.8% of the deficit to 43.4% as those in domestic and in other international markets are growing.

Why the proportion of losses is shifting is shown by the two bar graphs. In the percentage loss bar graph we can see that the domestic deficit compared to the average of the past three years grew by 4% between March 31 and April 5. The same difference can be seen for international markets (excluding China), which account for approximately half of that $600 million additional loss since March 31 (shown on the stacked bar graph). The domestic market accounted for approximately $200 million.

Overall this resulted in the global deficit extending from 45% to 47% over the short timeframe.

This shift will continue to become more apparent over time as domestic and international losses mount. If China is able to re-open ahead of other markets this will also have an impact. Gower Street is tracking all key markets for indications of re-openings and will highlight these in the Road To Recovery report.

The Global Box Office Tracker will be updated in every Road To Recovery report, available twice weekly via Gower Street’s home page.

We will continue to regularly add and improve new features to the report.