Summer doesn’t last forever, not even at the movies. July and August were the two highest grossing months at the global box office since December 2019; two consecutive months that performed on or above pre-pandemic levels. As expected, September couldn’t live up to that. September is historically the weakest performing month of the year. However, even relative to that, the $1.95 billion generated in September 2023 globally was -19% short of the average of the last three pre-pandemic years (2017-2019). That is the biggest deficit against the pre-pandemic average since March this year (-36%).

Still, the recovery is continuing. This September was an improvement to the same period in the past three years (2020: +94%, 2021: +38%, 2022: +43%). This is encouraging given the strikes in Hollywood haven’t helped promotion of theatrical distribution in September. Despite its limitations September can be a prosperous box office period, with capacity that is too rarely fully exploited. It shouldn’t stay a self-fulfilling prophecy that it’s the lowest grossing month of any year.

September brought Q3 to a close. Due to the strength of July and August the final month’s performance was enough to lift the whole Quarter +3% above pre-pandemic box office levels for the first time. The past three quarters are the three highest grossing of the decade. Growing each time, topped by the $10.1 billion global result in Q3 (+29% vs. Q1, +18% vs. Q2)!

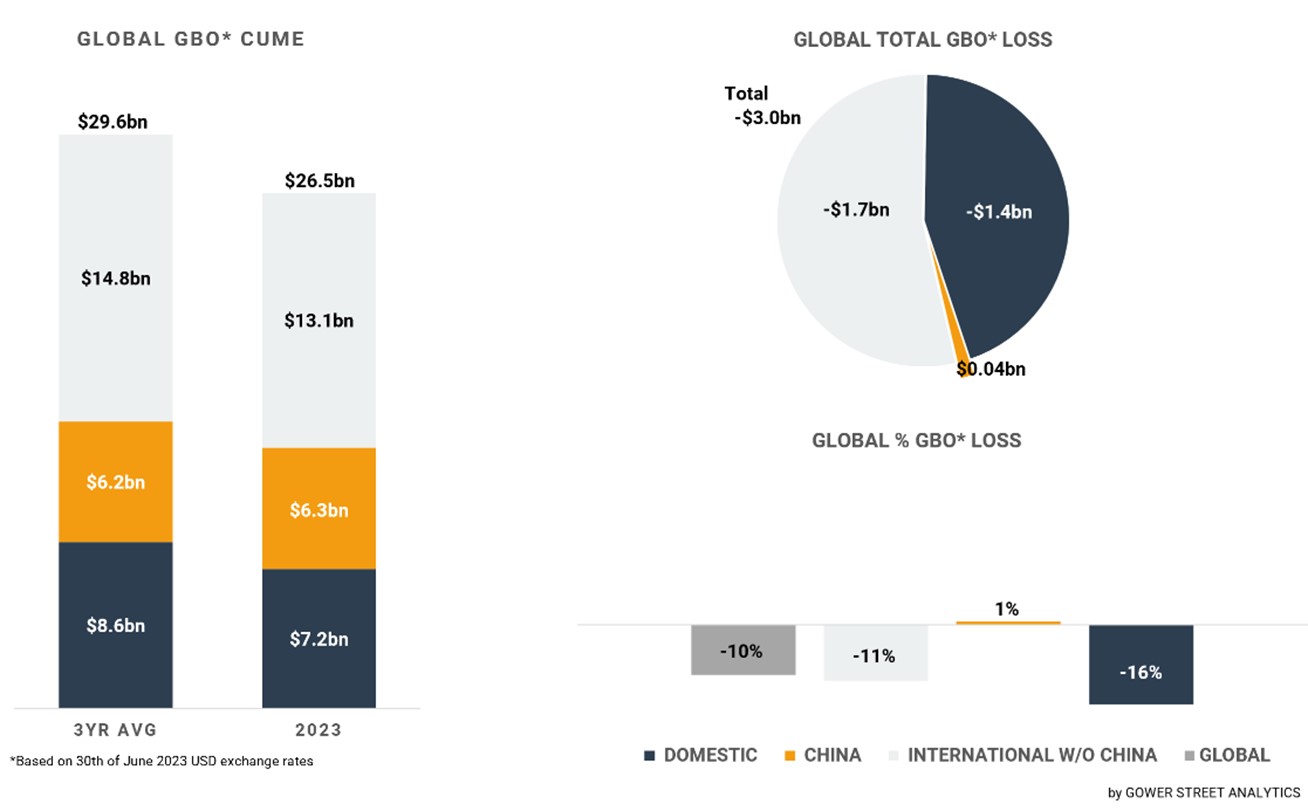

As a result of that the total global box office for 2023 has already overtaken the full-year result of each of the three prior years after just nine months. At the end of September, the total global box office is estimated to have reached $26.5 billion. The gap to the three-year average has narrowed to -10% from -17% at the end of June!

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

In the month that could easily been called Sequeltember, the box office was dominated by newest entries of multiple franchises.

Globally THE NUN 2 achieved the highest box office in September with $226 million. The current cume suggests it will end as the highest grossing entry of the CONJURING Universe since the first NUN ($366m) in 2018, already above THE CONJURING: THE DEVIL MADE ME DO IT ($206 million) and soon crossing ANNABELLE COMES HOME ($231m). The first instalment of THE NUN, which also marks the highest grossing entry in the Universe, is out of reach and will most likely be missed by around -28%.

THE EQUALIZER 3 was the second highest global grossing title in September with $157 million. As consistent as a franchise can be, part three stayed in the ballpark of the prior instalments so far. THE EQUALIZER 1 did $194 million, part 2 did $190 million. While domestic might fall marginally short, the international market may even end slightly above the first two. THE EQUALIZER 3 is still set to be released in Latin America and Japan throughout October.

The third highest grossing global new release in September was A HAUNTING IN VENICE, generating $87 million. Kenneth Brenagh’s third Hercule Poirot case couldn’t turn the direction after the disappointing pandemic hit DEATH ON THE NILE, which ended at $138 million globally. The third part looks to end even around -15% behind that. A far cry away from MURDER ON THE ORIENT EXPRESS, which surprised in 2017 grossing $353 million.

In the third month of release BARBIE and OPPENHEIMER had more to give. OPPENHEIMER added approximately $123 million in September. A bit less than half of that was coming from China with $50 million. Christopher Nolan’s epic now stands at a $934 million cume, overturning BOHEMIAN RHAPSODY ($911m) during this month to become the highest grossing biography of all time.

BARBIE added approximately $73 million for a total of $1.434 billion. It now ranks as the #14 movie of all-time globally, ahead of AVENGERS: AGE OF ULTRON ($1.41bn) and marginally behind FROZEN 2 ($1.454bn).

Geographically the biggest part of the global box office in September was generated across the International market (excluding China) recording a worldwide box office share of 55%. And a bit over half of it (51%) is coming from EMEA.

Despite this, September was the lowest grossing month for EMEA since September last year, just marginally behind June this year (-1%). The month was trailing the three-year average by -17%, the biggest gap since March this year (-28%).

That couldn’t prevent the third Quarter becoming the highest grossing Quarter of the decade, pushing Q4 of 2021 from that place (+15%), and performing an impressive +6% above the pre-pandemic average – the best quarter for the region so far and leading clearly all sub-regions on that metric this past quarter.

Italy was essential to this success. The country struggled for a long time since the start of the pandemic, being behind most other markets in the recovery process. This year Italy made a huge step forward, catalysed by multiple industry initiatives. Especially in the traditionally weak Italian summer period when the trend accelerated, cutting the gap against the three-year average for the running year in half from -28% at the end of June to just -14% at the end of September! Although September itself was the first month in Italy since April that was below pre-pandemic levels, it was just -9% behind. OPPENHEIMER was the #1 title with $13.8 million, benefiting from a later release date on Aug. 23. Italy is currently ranked #6 globally for Nolan’s hit. THE NUN 2 ($6.9m) and HAUNTING IN VENICE ($6.5m) followed on rank 2 and 3 in the market’s month. Two franchises with a strong track record in Italy, the market has currently recorded the sixth highest market result for THE NUN 2, while for HAUNTING IN VENICE it is third (The setting definitely helped in that context).

THE NUN 2 was also a major driver to get Latin America to have the lowest gap of all sub-regions against the three-year average in September with just -6%. Mexico is a strong #2 market globally with the title generating $20.3 million so far. Brazil follows just behind on #3 with $9.6 million and Argentina is at #11 with $4.7 million.

For the whole Quarter Latin America was nearly on par with pre-pandemic levels (-1%). This is a small step back from the tremendous Q2 this year, that was +9% above this benchmark. The total box office for the quarter was also -17% below that record quarter. Q3 is nonetheless the clear 2nd best quarter of the decade for Latin America.

For the Asia Pacific region (exc. China) the third quarter also had a bigger gap to the three-year average with -16% compared to Q2 with -9%. In terms of total box office Q3 was able to be a glimpse ahead of Q1 (+1%) and record the best Quarter of the decade.

In September the Asia Pacific region had the biggest shortfall against the pre-pandemic levels of all sub-regions (-21%). The month even stayed -2% behind the same period last year. The major driver of that short coming was the struggling South Korean market, having a gap of -36%! Only HONG KONG was worse (-42%).

The Asia Pacific region was not able to narrow the distance to the three-year average over the third Quarter for the running year. It remains down -17% at the end of September, the same as at the end of June. Latin America improved marginally from very good -4% to -3% in that period. Only EMEA made significant progress in Q3, jumping from -17% to -10%.

China saw a big jump from -10% to +1% over the third quarter. At the end of September it was the only major market besides Germany (+4%) and the Netherlands (+8%) to be out-pacing pre-pandemic levels for the running year. September was not the major driver for this, coming in -9% behind the pre-pandemic average. It was a calm month grossing $389 million, the lowest monthly total since March this year. The #1 film was local thriller DUST TO DUST with a modest $60 million, followed by OPPENHEIMER with $49.5 million. The $60 million cume of Christopher Nolan’s epic is an encouraging example for a non-Chinese release in the market.

This past weekend the Chinese box office surged again due to the start of the Golden Week holidays, one of the most lucrative periods at Chinese box office. Multiple local blockbusters opened and on the final three days of the month the market generated over a third of its full month result – a satisfying closure to the best quarter of the decade in China beating Q1 2021 by +7%. The three-month period performed an incredible +21% better than the pre-pandemic average grossing $2.66 billion this year.

The Domestic market came in just slightly higher with a total of $2.70 billion, on par with Q2 this year. Compared to the pre-pandemic average it was in the same ballpark, ending only -1% below. September was far below that level being -29% behind. The biggest gap since March (-35%). The $485 million monthly gross was even the lowest total since October last year. No title crossed $100m within the month for the first time since September last year.

The Global third quarter was a testament to the strength of the global box office, accelerating the recovery process up to a box office above pre-pandemic levels. As expected, September was a small step back compared to the prior months. Number and frequency of attractive global new releases out of the US started to decrease a bit again. Most likely that will continue for the final quarter of 2023. While this final Quarter is projected to end above Q4 2022, it’s unlikely it will get as close to pre-pandemic levels as the past two quarters.

A pleasant surprise were the short-term additions of two blockbuster concert films with TAYLOR SWIFT – THE ERAS TOUR on October 13 and RENAISSANCE: A FILM BY BEYONCÉ on December 1. Both artists already lifted the Domestic economy with their tours in Q2. A spill-over to the cinema is a welcome addition to the theatrical offering. Given that the number of theatrical movie releases is still significantly below pre-pandemic times and the two strikes this year – of which one has thankfully now ended – will prevent that changing in the short term, this is highlighting untapped potential in the market.