In September, global cinemas accounted for $1.5 billion in box office. This is clearly down from $2 billion in August, the second-best month of the pandemic. However, still a positive result taking the seasonality into account as September is historically the weakest performing month of the year. This September recorded the lowest total monthly loss since January 2020 with $1.1 billion against the average of the last three pre-pandemic years (2017-2019).

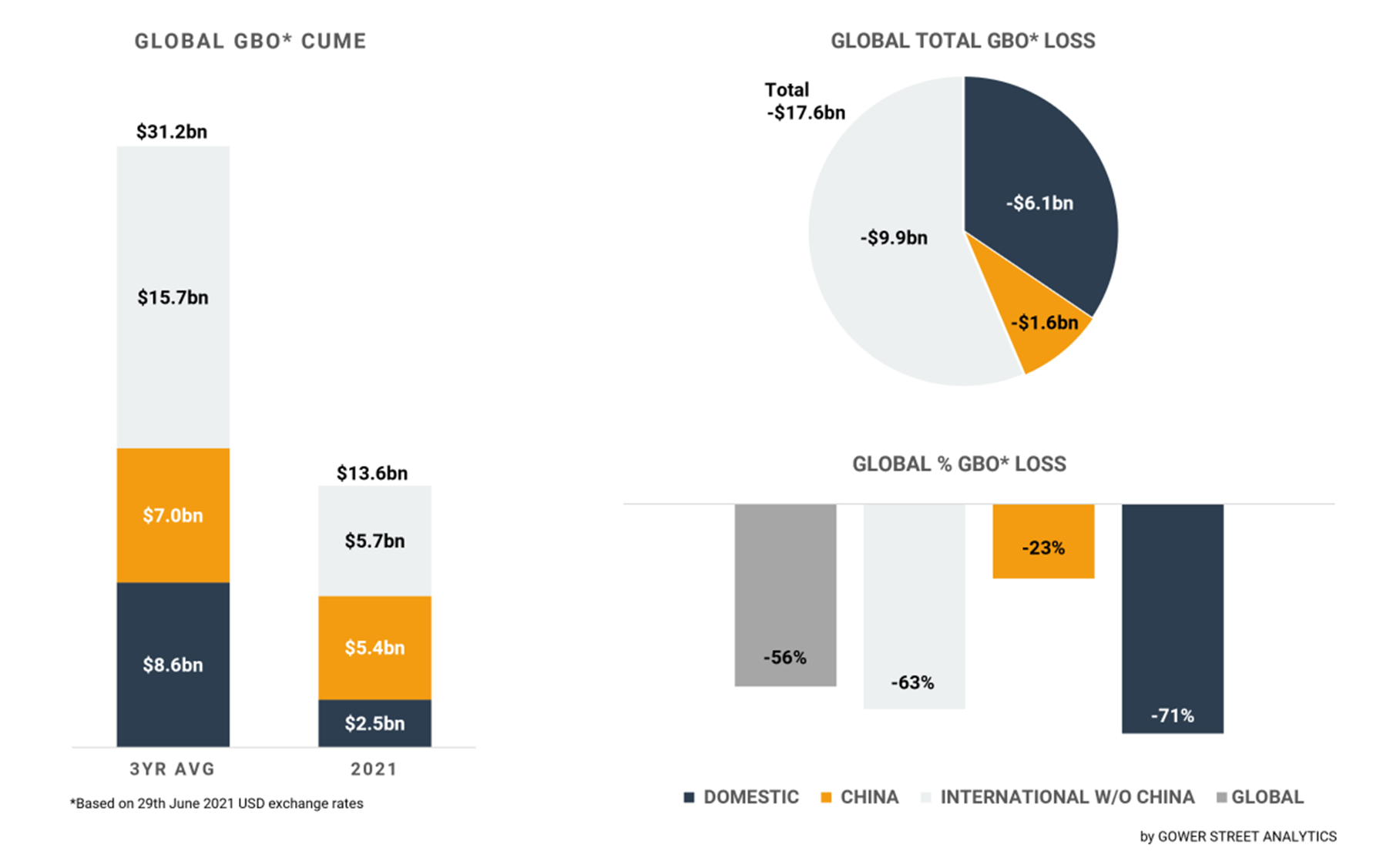

According to Gower Street’s latest monthly Global Box Office Tracker, as of September 30, the global box office stood at $13.6 billion in 2021. This is tracking -$17.6 billion (-56%) behind the average of 2017-2019. Nevertheless, it’s already 13% above the year-end result for 2020 ($12bn according to the MPAA’s Theme Report 2020).

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three (pre-pandemic) years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

For the fourth month in a row, the Domestic market outperformed China as highest grossing territory globally. Domestic contributed $0.4 billion in September, mainly driven by just one title: Marvel release SHANG-CHI AND THE LEGEND OF THE TEN RINGS with $200 million. On its September 3 release it set a new Labor Day Weekend record. SHANG CHI’s three-day opening of $75.4 million and 4-day at $95 million, crushed the previous Labor Day record-holder 2007’s HALLOWEEN remake ($26.4m 3-day, $30.6m 4-day). It’s also the highest grossing film domestically since December 2019, with a current total of $212 million. This is ahead of the pre-pandemic released BAD BOYS FOR LIFE ($206m) and pandemic hit BLACK WIDOW ($184m).

By the end of September, Domestic had achieved a total of $2.5 billion for 2021, tracking -71% behind the three-year average, a gap of -$6.1 billion. Despite domestic gaining traction in recent months, this is still less than half of China’s 2021 cume at the beginning of October ($5.4 billion).

However, in September, China had their lowest grossing month of the year so far with $0.3 billion. Despite it usually being a calm month, this is even less than last year’s September result (-14%), when the market had just re-opened. In contrast to last year’s local blockbuster THE EIGHT HUNDRED ($440m total), which dominated that month, no release was able to break out this year. There were only two title that crossed $50 million within the month. Local release CLOUDY MOUNTAIN with $64 million (current total $66 million) and August holdover FREE GUY with $62m (current total $94 million).

China’s loss for 2021 is -$1.6 billion at the end of September, which is -23% down against the three-year average. While still being in a much better position than most markets, this is far away from being over 20% ahead earlier this year. A disappointing summer ate up the record results of Chinese New Year week, and February as a whole and the 5-day May Day holiday.

Consequently, box office for the International market (excluding China) was able to move ahead of China over the September 10-12 weekend for the first time in 2021. By the end of the month its cume is at $5.7bn up from $4.9 billion at the end of August. That makes September the 3rd best month since February last year for the International market (excluding China).

This positive performance was significantly lifted by two long-awaited studio releases, DUNE and SHANG-CHI. Both were responsible for a third of the monthly result. While still waiting for a release date in China, SHANG-CHI opened in most international territories and got impressive returns from all regions with $28 million in the UK, $15 million in South Korea and $7.6 million from Mexico. DUNE concentrated its first wave of releases mainly in EMEA. The leading markets so far are Russia with $20 million, France with $17 million and Germany with $16 million in box office.

The opening of DUNE helped EMEA to be the highest performing International region for the third month in a row, accounting for 57% of September’s result (vs. 47% historically). Prior to that streak, APAC dominated the first half of the year. The main difference is the number of open cinemas. The majority of EMEA’s cinemas were closed until the middle of May. EMEA has now been nearly fully operating for three months with currently 94% of cinemas open by market share. However, multiple restrictions are still in place.

Russia is one of the few EMEA markets that hasn’t been closed in 2021. It reached another important step in the recovery process when the September results outperformed their three-year average for the first time (+10% ahead). For the running year Russia is -22% behind, which is the lowest deficit of all Comscore-tracked markets. It’s currently the fourth biggest market in the world.

In APAC, two major markets are struggling with the pandemic more severely. Since August, major parts of Australia and New Zealand are in lockdown. The situation is easing, but at the end of September just 40% of cinemas by market share were open in Australia and 53% in New Zealand. This has already delayed major releases like DUNE, which is now planned to open December 2 in both territories.

In another challenged APAC market, Malaysia, a third closure of cinemas came to an end September 9 after 3.5 months. At the end of September, 70% of cinemas by market share had already re-opened their doors. This has helped to push the global market share of open movie theaters to a new pandemic-era high with 89% as of September 30. This is up from 85% a month ago and tops the previous high of 88% recorded at the end of July.

A healthy framework for the promising month of October. Long awaited and multiple delayed studio tentpoles finally arrive with NO TIME TO DIE, VENOM 2 and HALLOWEEN KILLS; DUNE sees its second wave of releases including the Domestic market, the UK and China (all Oct. 22); and the second biggest box office week of the year in China after Chinese New Year opens this month with the Golden Week holiday. So far everything looks on track to push the pendulum of recovery to new positive hights!