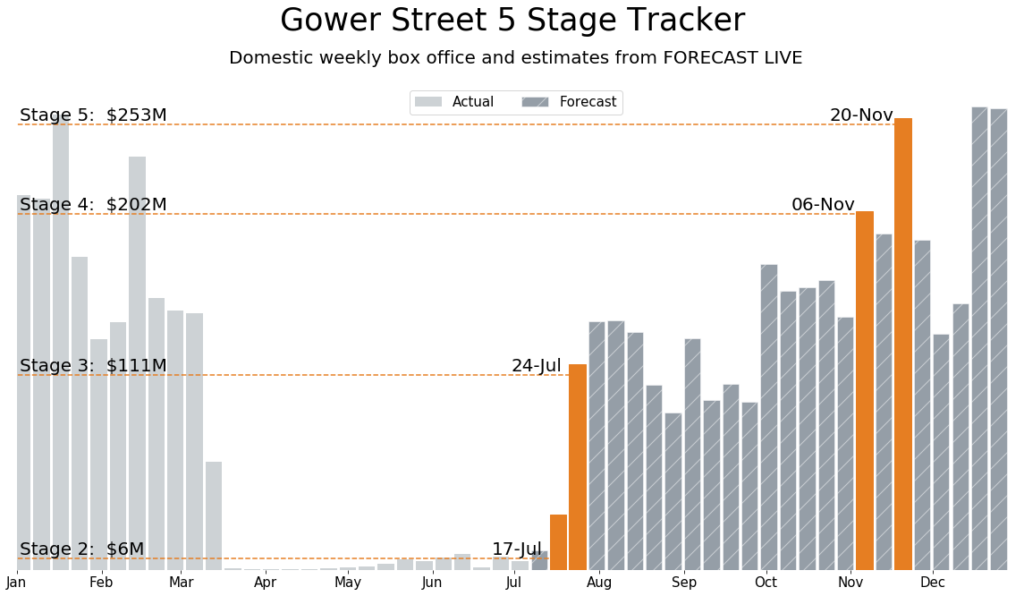

The past 10 days saw a flurry of news and activity that brought hope and concern alike, but also brought some clarity to recovery plans. With latest changes and announcements taken into account, Gower Street currently estimates the domestic market has the potential to hit Stage 5 on our 5-stage Blueprint To Recovery guidelines by Thanksgiving.

As we discussed last week, the move of Christopher Nolan’s TENET back two weeks (to July 31) in the release calendar caused a domino effect. Other titles moved back, a couple moved up, some exited the year, a few remain unset.

But there was also good news coming from the exhibition sector. The three biggest US circuits, AMC, Regal and Cinemark, as well as Canada’s Cineplex, all announced re-opening plans that should see a majority of domestic movie theaters re-open by mid-July. AMC expects to have approximately 450 locations operating from July 15 with most remaining sites up and running before the end of the month. Regal is looking at a July 10 re-opening. Cinemark saw some Dallas locations back in play this past weekend but expects to open most sites between July 3-17. Cineplex will start with six sites in Alberta from next weekend (June 26) with the rest planned to follow in early July as allowed.

At the end of May, Gower Street published an article on our website outlining where we expected to see key Domestic box office recovery markers occurring. Written by Box Office Analyst Yaz Khan, as part of a series of articles from our film team focused on the major markets currently offered in our flagship FORECAST theatrical market simulation service, it laid out how our team of analysts had been working to ensure our predictive market totals accounted for many factors in the wake of the COVID-19 pandemic. These included: capacity restrictions; economic pressures; audience willingness to return; differing re-opening plans per exhibitor; different states/regions re-opening at different times; lack of product; and more.

There are four box office markers on our 5-stage Blueprint To Recovery (Stage 1 is hit when 80% of theaters by previous-year market share are re-open). Stage 2 requires a single day to achieve an equivalent box office to the lowest grossing day from the previous two years (2018-2019). For the Domestic market we identify that as a day gross of $6.3 million. Gower Street currently predicts this will occur July 17 (see graph). Irrespective of the loss of TENET from that date, several new openers including THE BROKEN HEARTS GALLERY, combined with the second week of UNHINGED as AMC re-opens a majority of locations, should help achieve the mark.

We have already seen a number of international markets, most recently Japan (June 12) and New Zealand (June 13), achieve their own Stage 2 markers. Those markets that have achieved the marker have done so either with a majority of movie theaters back in play; a big-title driver (LITTLE WOMEN proved the catalyst in Japan); or a combination of the two. Last weekend saw the Domestic market 33% of the way towards the Stage 2 marker on Saturday June 13.

Stage 3 (a week equivalent to the lowest grossing week from the previous two years) is expected to be achievable week-commencing July 24. This will mean the market delivering a weekly box office in excess of $111 million, returning to the levels seen in the three weeks prior to the March 13-19 week that brought shut down earlier this year. The July 24 week currently brings the launch of MULAN to aid in that recovery goal. Should MULAN move it is certain this marker would be delayed.

The Stage 4 marker requires weekly box office to hit a level equivalent to median-week levels of the past two years: approximately $200 million. This will require a significant easing of capacity restrictions. In its re-opening guidelines, AMC laid out a phased-plan for easing restrictions that could see the chain move gradually from a 30% capacity restriction upon re-opening, to 50% by Labor Day weekend in early September, and hopefully a return to full capacity for Thanksgiving. Gower Street currently anticipated Stage 4 as being narrowly achievable in the week commencing November 6, with the opening of BLACK WIDOW.

That AMC full-capacity Thanksgiving goal also coincides with our predicted Stage 5 marker. This is a box office week equivalent to the top quartile from the past two years and would indicate true recovery. This is calculated for the Domestic market as a week delivering approximately $250 million. Gower Street currently estimates that this could be achievable in the week commencing November 20 (which concludes on Thanksgiving – Nov. 26) and brings the heady combination of Pixar’s SOUL and James Bond film NO TIME TO DIE (which moved up five days to Nov. 20 last week). The weeks commencing December 18 and 25 are also currently expected to deliver above this level.

Of course, much can change. Predictive analytics is always subject to a changing market and the current situation is arguably more fluid than most. But it is reassuring to note that the Domestic markers identified above saw little change as a result of the recent spate of calendar changes – which had no effect on Stages 3-5. If a second wave of the virus, and additional closures, can be largely avoided it currently appears we may all have something extra to be thankful for come Thanksgiving.

As well as the Domestic market as a whole, Gower Street continues to track growth towards the Blueprint To Recovery markers in every US state and Canadian province in our Road To Recovery report.

This article was original published in Screendollars’ newsletter #122 (June 22, 2020)