What a way to end the year! This December the International (excluding China) and Domestic markets recorded the third-highest grossing month since December 2019! Generating a combined box office of $2.67 billion in the month. That is only behind July 2023 (-17%) and July 2024 (-4%) results.

This fabulous result also pushes the quarterly result to $6.5 billion making it the highest grossing Q4 of the decade and the 4th highest quarter in that period overall. Moreover, December closes the highest-grossing half year since 2019 with a total of $13.3 billion! That is +5% ahead of last year’s second half ($12.6bn).

For the whole year of 2024 the International (excluding China) and Domestic markets combined to finish only marginally (-3%) below the prior year, grossing $24.2 billion. Given the limited release calendar of 2024, caused by the long-running actors’ and writers’ strikes in Hollywood 2023, this can be seen as a significant success. It is another testament of the theatrical industry’s resilience.

A return to pre-pandemic levels was never expected for 2024. The International (excluding China) and Domestic markets stayed -20% behind the average of the last three pre-pandemic years (2017-2019).

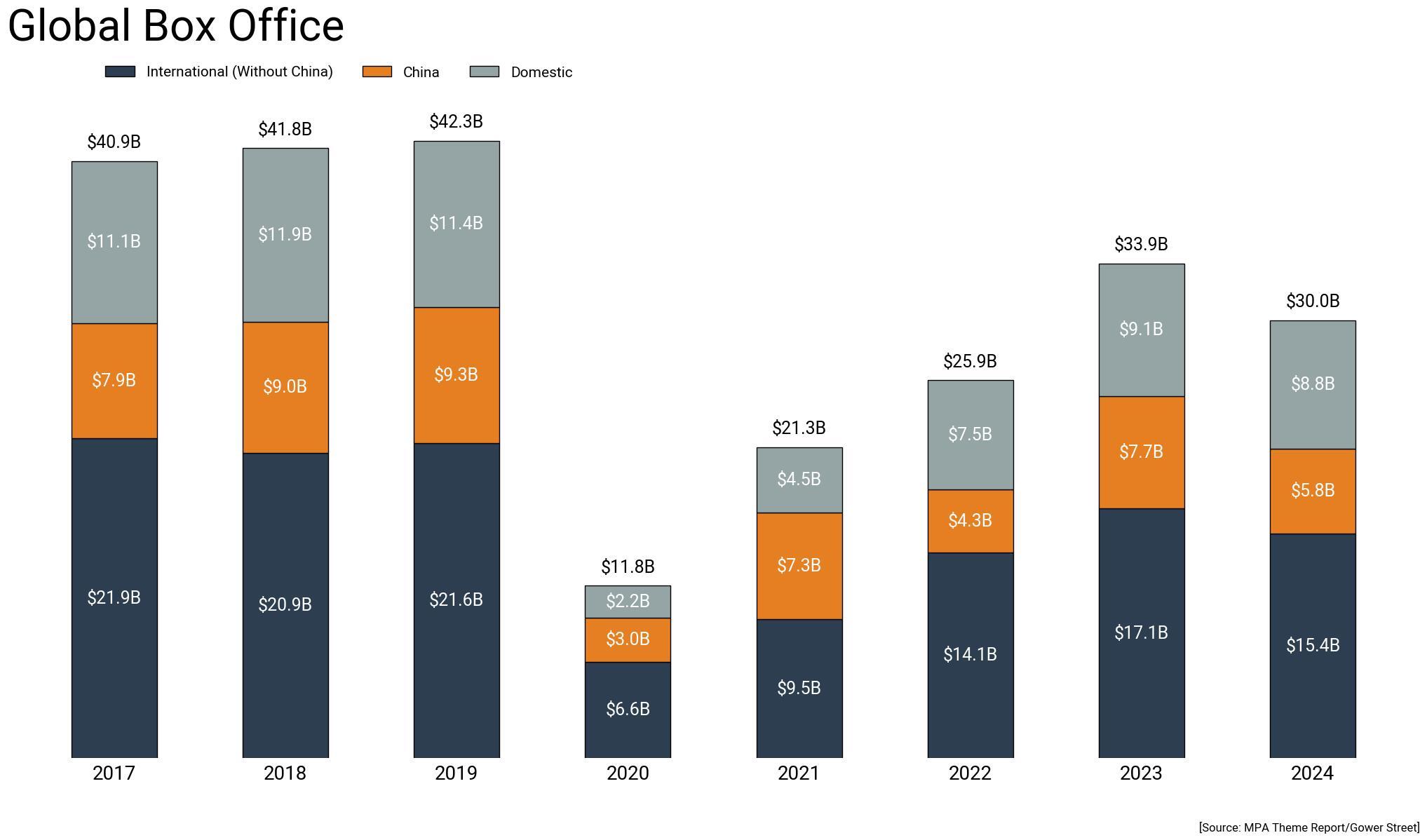

Adding the mediocre result of China this year the Global box office grossed $30 billion in 2024. That is -7% down on 2023 in current US$-exchange rates, but clearly above the prior recovery years (2022: +21%, 2021: +55%, 2020: +174%). A substantially strengthened dollar has challenged many major international markets severely in 2024. Consequently, the year-on-year gap to 2023 at historical exchange rates widens to -11%.

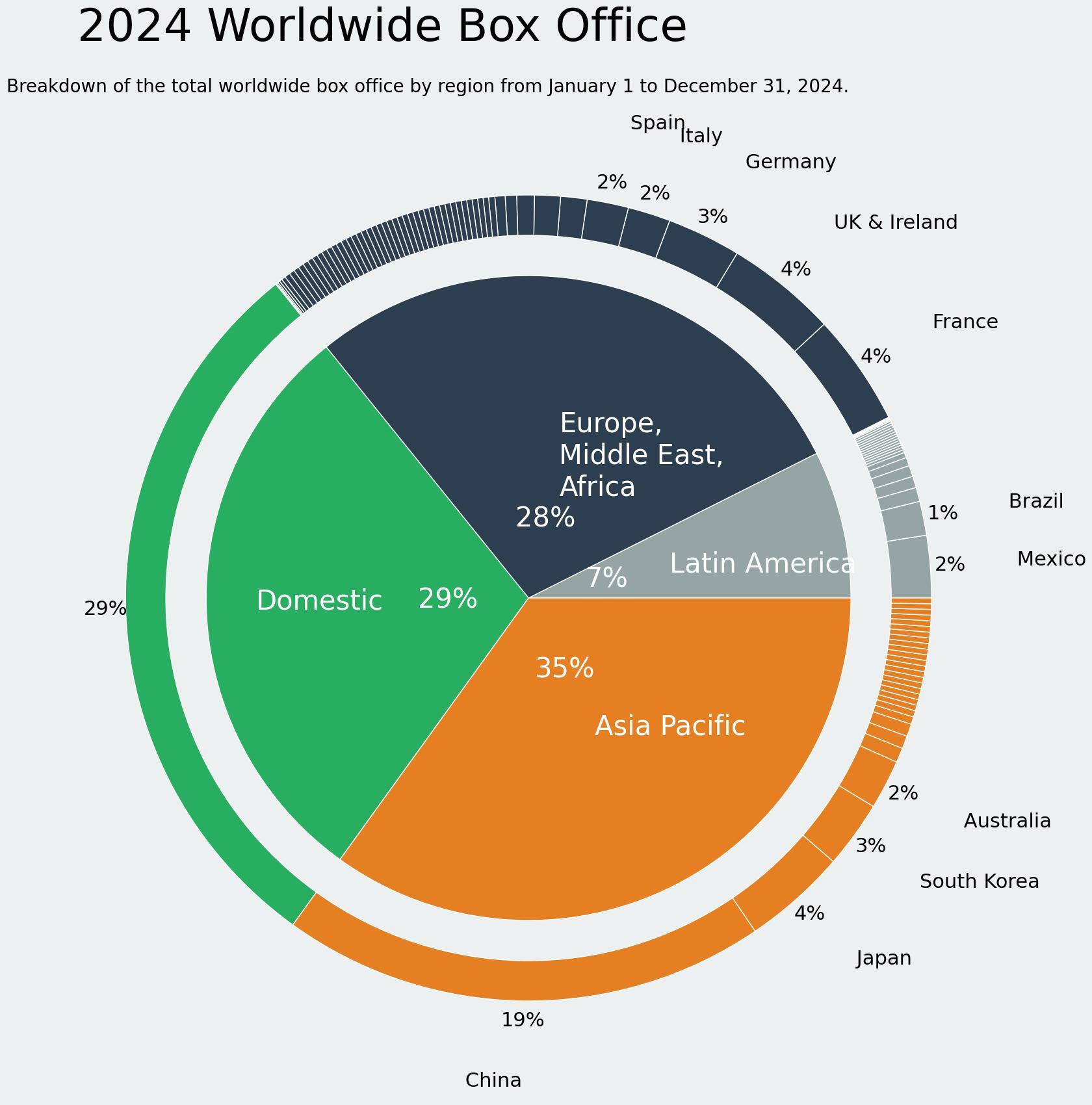

For a breakdown of the 2024 results by region and key market see the sunburst graph (below).

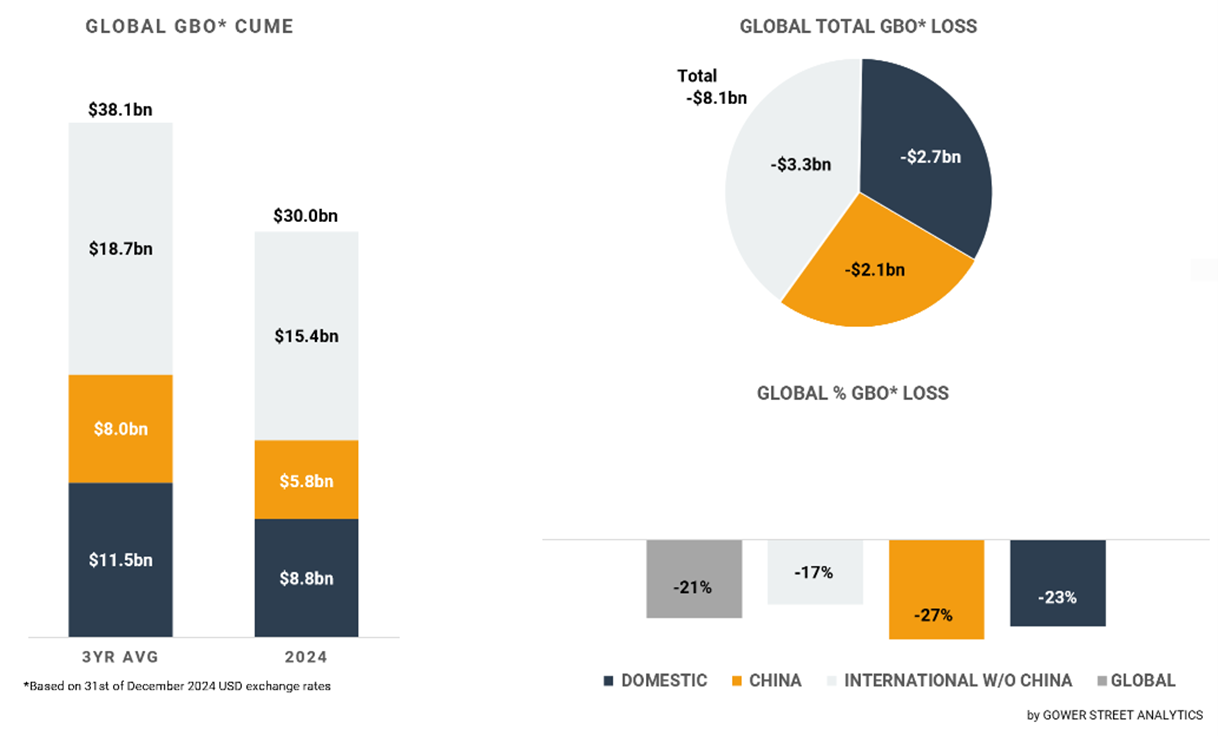

On this month’s Global Box Office Tracker (GBOT, below), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

China struggled in 2024, staying volatile. It recorded the highest year-on-year decrease of all tracked markets with -22%! It was also the only tracked market beside Russia tracking below the 2021 total (by -9%). Its $5.8 billion 2024 total is -27% behind the average of the last three pre-pandemic years. The biggest international market also ended the year more on the low end. The $321 million December total was just ranked #8 in the year. The -46% gap against the three-year average is China’s 3rd widest of 2024.

In contrast to China, the Domestic market had a great finish to the year. The highest grossing global market in 2024 generated $992 million in December, the #2 month of the year after July (-17%). It was also the 5th highest-grossing month of the current decade in the market and the best December result since 2019! The strong mix of movies in the market was key. It was only the third time since May 2019 that four titles grossed more than $100 million within one month: MOANA 2 at #1 with $214 million, followed by WICKED ($190m), SONIC THE HEDGEHOG 3 ($152m) and MUFASA: THE LION KING ($128 million). Adding the excellent December result the Domestic market finished 2024 with a $8.8 billion total. That is -3% down on 2023 and -23% below the pre-pandemic benchmark.

The International market (excluding China) delivered $1.68 billion in December, -8% behind the 2017-2019 average. This brought the total International box office for 2024 (excluding China) to an estimated $15.4 billion. This is -2% behind 2023 and -17% behind the pre-pandemic average, at current exchange rates. Comparison to recent years are shown in the bar graph (below).

Like December last year the month was not dominated by a single title. Multiple tentpoles achieved a remarkable box office. The five highest grossing global movies combinedly contributed $1.6 billion.

In a family driven holiday slate Disney’s sequel MOANA 2 had fabulous holdover numbers. It was clearly the highest grossing movie in December. The animated hit added an impressive $604 million in the month for a cume of $904 million. It will end its run as #3 globally released title in 2024 and the third to cross $1 billion. This follows two other Disney releases with INSIDE OUT 2 ($1.7bn) at #1 and DEADPOOL & WOLVERINE ($1.34bn) at #2, ahead of Universal’s DESPICABLE ME 4 ($970m).

The second highest-grossing title in December also came from Disney with MUFASA: THE LION KING, generating $366 million within the month. MUFASA already outgrossed MARY POPPINS RETURNS ($350m) from 2018 and DUMBO ($357m) from 2019. Given the current performance MUFASA will also outgross MALEFICENT: MISTRESS OF EVIL ($494m), CINDERELLA ($544m) from 2015 and THE LITTLE MERMAID ($570m) from 2023. It should end a bit above the lifetime total of WONKA ($635m) and FANTASTIC BEASTS: THE CRIMES OF GRINDELWALD ($656m). However, this will be less than half of the tremendously successful THE LION KING, which grossed $1.66 billion in 2019 and is still ranked at #10 of the highest-grossing movies of all-time globally.

Universal’s Broadway-adaptation WICKED continued its great run in December. As third highest-grossing movie WICKED added approximately $319 million within the month for an excellent $649 million cume. It will end its run as the #5 globally released title in 2024, ahead of Warner’s DUNE: PART 2 ($715m).

The fourth biggest global movie in November was Paramount’s SONIC THE HEDGHOG 3 with $241 million. The third instalment of the very successful franchise already outgrossed the lifetime of the first part ($320m) at the beginning of January and will surpass SONIC 2 ($405m) later in that month. Based on the current performance SONIC 3 will very likely end above PUSS IN BOOTS: THE LAST WISH ($485m) and 2014’s TEENAGE MUTANT HERO TURTLES ($493m; a bit below KUNG FU PANDA 4 ($548m).

Finally, Paramount’s holdover hit GLADIATOR II added approximately $134 million in December for a remarkable $439 million cume at the end of 2024!

Coming into 2024 it was obvious that it wouldn’t be a direct continuation of the recovery growth of the prior years. The impact of the 2023 strikes on the release calendar, in terms of global-appeal Hollywood product, was significant. It already slowed down the global box office in the final quarter of 2023 and it continued to do so in 2024, especially in the first half.

The second half of the year picked up with a more filled calendar and multiple break-out hits. In that context it is remarkable to end just -3% below the prior year for the International (excluding China) and Domestic markets combined at current US$-exchange rates. Just the strengthened dollar avoided a higher total result, losing over $1 billion in exchange rates!

The spaces in the release calendar at least helped to let a multitude of titles shine. Every single success was encouraging. They highlighted the demand for a wide and diverse slate of movies. A key factor for a sustainable recovery and growth of the theatrical industry.

2025 will be the first year since 2019 which is only indirectly influenced by the disruptive events of the pandemic and strikes. With these restrictions disappearing the status quo of the theatrical industry will shape more clearly. After the small contraction of 2024, 2025 is expected to grow more significantly again fuelled by a more robust studio slate and independent productions.