On paper February looked like a challenging month for box office going in. On the plus side, significantly more closures, both Domestically and Internationally, in 2021 meant the month was certain to be up on the same month the previous year in those markets. However, a lack of clear global tentpole releases; the loss of a number of titles (re-dated in December and early January amid concerns about the Omicron covid variant); and the challenge in China of facing-off against an all-time record February haul in 2021, meant continuing the recovery gains recorded in Q4 2021 looked like a big ask.

We needn’t have worried too much. Against the odds February recorded an impressive global box office of $2.88 billion – approximately 27% ahead of February 2021. The result made February 2022 the third highest grossing month since January 2020! Only October ($3.1bn) and December ($2.94bn) in 2021 came in ahead.

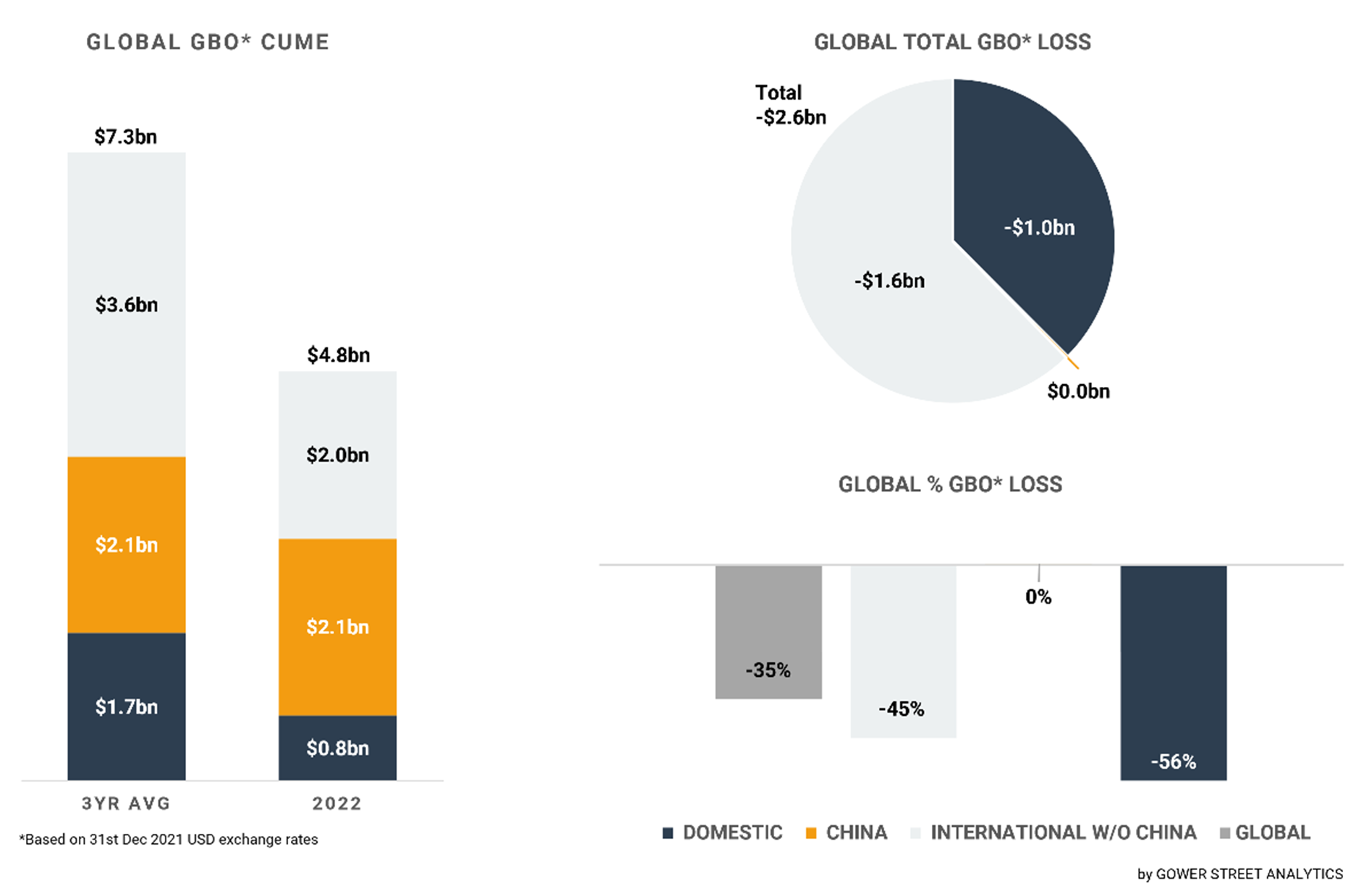

Total global box office to the end of February is estimated at $4.78 billion. This is currently tracking 46% ahead of 2021 at the same stage, but is still 35% (or $2.56 billion) behind the average of the last three pre-pandemic years (2017-2019).

On this month’s Global Box Office Tracker (GBOT, above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

While February came in just 2% behind the SPIDER-MAN: NO WAY HOME-fueled December, the comparative regional market shares were turned upside down.

After China had a mediocre result in December it dominated the global performance in February driven by Chinese New Year (CNY) – historically the most lucrative theatrical week of the Chinese calendar. China grossed $1.63 billion in February, with the CNY holiday falling on the first of the month this year. This represented 57% of the global box office in February and delivered the second best single-month result in China since the pandemic began.

Of course, the month it was competing with was February 2021 when a record CNY result and continued strength of its titles in subsequent weeks resulted in a $1.88 billion haul – an all-time single-month record in China. While the holiday came later (Feb. 12) in 2021 and this year’s roster of titles included the sequel to THE BATTLE AT LAKE CHANGJIN (the October 2021 release that went on to become China’s highest-grossing release of all time) the market (which was also hosting the Winter Olympics in Beijing between Feb. 4-20) was not able to set another new record, although fell just -15% short of the previous year’s record monthly result.

THE BATTLE OF LAKE CHANGJIN II was, indeed, the top performer grossing just over $600 million in the month. This was followed by comedy TOO COOL TO KILL ($389m), comedy-drama NICE VIEW ($202.5m) and the latest in the BOONIE BEARS animated franchise – a CNY tradition – BOONIE BEARS: BACK TO EARTH ($144m), which scored the best result in the franchise to date. Unfortunately, while US releases have started to be dated again in China, one of the first major studio releases to land, Kenneth Branagh’s DEATH ON THE NILE on Feb. 19, failed to ignite in the Chinese market, generating just $9 million by month end (Branagh’s MURDER ON THE ORIENT EXPRESS grossed $34m in China, including an $18.6m opening).

In December, the Domestic and International (excluding China) markets each recorded their biggest box office results since before the pandemic began, mainly thanks to the release of SPIDER-MAN: NO WAY HOME. In February, non-Chinese markets suffered an ongoing slow flow of attractive wide new releases. Consequently, the Domestic and the International (exc. China) markets each generated their lowest box office results since September last year. Nevertheless the Domestic market’s $366 million February result was still more than six times (+542%) as high as in the same month last year ($57m). The International (exc. China) market almost trebled (+181%) the February 2021 total of $312 million with $876 million.

While the process of recovery has slowed down a bit at the beginning of the year, the current year to date results are additionally showing a significant rise against last year. The International (excluding China) markets had a cume of $1.96 billion at the end of February. In 2021 this number was only reached in the second half of May. Domestic only reached its February-end 2022 cume of $756 million at the beginning of June in 2021.

The Europe, Middle East and Africa (EMEA) region fared slightly better within the month than the other international regions, down 40% against the pre-pandemic three-year average compared to -53% in Asia Pacific (exc. China) and -56% in Latin America. EMEA highlights included UK/Ireland, which was down just 28% against the three-year average led by SING 2 ($30m in February) ahead of UNCHARTED ($25m) and aided by continued strong business for January-holdover BELFAST ($10m). The Netherlands, which came roaring back to life at the end of January following a Dec. 19-Jan.25 lockdown, also delivered impressive business, down just 19% against the three-year average. This was dominated by SPIDER-MAN: NO WAY HOME, which lost five weeks of business due to the lockdown, with $7.5 million, supporting by a backlog of titles all opening in February led by SING 2 ($2.2m).

As of the end of February, Japan had the best tracking of any major market outside China against the pre-pandemic three-year average, at just -7%. This was helped by a strong February which came in 20% behind the average, headed by 2021-holdover JUJUTSU KAISEN 0. The top February release was musical WEST SIDE STORY ($6m).

Despite tracking on par with the three-year average after two months of release, China is one of the few markets actually seeing a deficit against 2021! The market is tracking 15% behind the same stage in 2021, due to that record February last year. Russia was also tracking behind year-on-year by the end of February (-6%) and that is likely to worsen with all five major studios having now pulled planned Russian releases following the country’s invasion of Ukraine, with titles including THE BATMAN, TURNING RED, SONIC THE HEDGEHOG 2, THE LOST CITY and MORBIUS all currently pulled in the market.

Hong Kong in also suffering the impact of cinema closures since January 7 and an ongoing Covid crisis. The market is now down 28% against 2021 and 90% against the three-year average. Taiwan is currently down 8% against last year.

SPIDER-MAN: NO WAY HOME continued to play well in February, adding over $100 million during the month and bringing its global cume to $1.85 billion. At the beginning of January Sony moved its next Marvel title, MORBIUS, out of a planned late January slot leaving the calendar without a major tentpole until another Sony title, video game adaptation, UNCHARTED. That film proved the biggest hitter of the month after the CNY titles with approximately $230 million. DEATH ON THE NILE delivered just over $100 million globally. The month kicked off with the releases of both Roland Emmerich’s disaster movie MOONFALL and Paramount’s stunt-comedy JACKASS FOREVER. The pair pulled in $47 million and $69 million, respectively, with Domestic the major player on JACKASS, accounting for 77% of global market share compared to just 40% for MOONFALL. Animated hit SING 2 added approximately $84 million in the month. In the Domestic market the 5th biggest title of the month was DOG, with $31.6 million between release on Feb. 18 and month end. The Presidents’ Day weekend release enjoyed a surprisingly strong hold (-32%) in its second weekend.

March has gotten off to a strong start with THE BATMAN this weekend, grossing nearly $250 million in its opening weekend, but then global tentpoles are largely absent until the beginning of April with MORBIUS and SONIC THE HEDGEHOG 2 (THE LOST CITY hits Domestic last week of March, but rolls into most international markets in mid-to-late April). Only DreamWorks Animation’s THE BAD GUYS will be entering the fray, releasing in mid-March in much of the international marketplace, although English-language markets will have to wait for April. Pixar’s TURNING RED exited a planned theatrical release in favor of a March 11 Disney+ debut, announced in early January. DOWNTON ABBEY: A NEW ERA also exited a March release plan in January, delaying to April 29 in the UK and May 20 in the US. Guy Ritchie’s OPERATION FORTUNE: RUSE DE GUERRE also moved out of a mid-March slot for an as-yet-unset later-year release. International players will be watching the middle of the month closely in China when both UNCHARTED (March 14) and THE BATMAN (March 18) have secured release dates.

This article was originally published on Screendollars’ newsletter (March 6, 2022) and on the Screendollars website here.