The global box office hemorrhaged more than $3 billion in April bringing the total global losses in 2020, when compared to an average of the past three years, to $8.1 billion. The make up of those losses is also changing significantly as the impact on domestic and international markets outside China is increasingly felt.

Last month Gower Street introduced a new regular feature, the Global Box Office Tracker (GBOT) to its International Road To Recovery reports. The GBOT looks at daily figures for 2020 across global markets and compares them against the average figures in each market for the past three years to track current deficit levels and how the make-up of the global deficit changes over time.

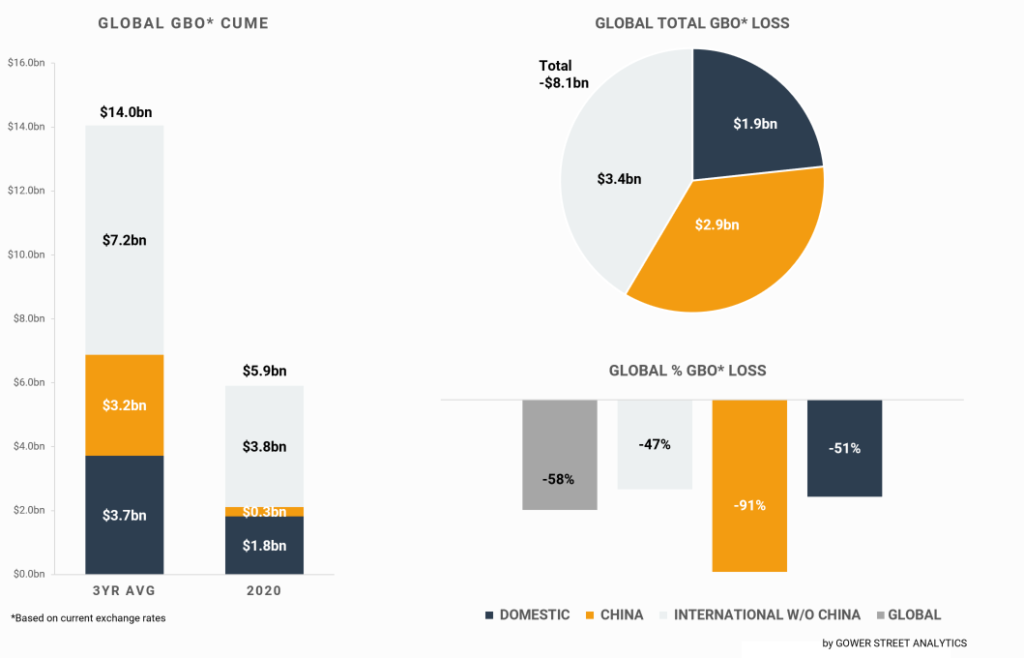

The stacked bar graph on the left shows total levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three years and where those losses are currently coming from. The bar graph on the bottom right shows the percentage drops globally.

The dramatic change from a month ago at the end of Q1 is evident. Total global losses have gone from $4.7 billion to over $8 billion in the 30 days of April. This has been exacerbated in recent days as losses accelerated, jumping nearly $1 billion between April 25 and 30. This is due to the absence of any new titles to counter the 2019 release of global box office record-breaker AVENGERS: ENDGAME. The Marvel title began its global rollout on April 24 of that year, with almost all markets (including domestic) open by April 26. The film grossed $1 billion in its first five days.

There has also been a clear shift in the proportion of losses, shown on the pie chart. At the end of Q1 China, which saw movie theaters close nearly two months ahead of the rest of the world in late January, accounted for nearly 47% of the total loss. Now the #1 international market accounts for only 36%, with the rest of the International marketplace having overtaken it with 42% of the loss. The Domestic loss has more than doubled from $0.9 billion to $1.9 billion.

Globally the box office to the end of April was down 58% compared to the average of the past three years. China, one of the few major growth markets, was down 91%, while International (excluding China) was down 47% and Domestic 51%.

There are positive signs afoot. This week a number of US states have allowed traditional theaters to re-open, starting with Georgia on Monday April 27 (although it would be an immense understatement to say uptake has been slow!). More drive-ins are opening this weekend across the 22 states where they are currently in operation.

South Korea was the only one of the 12 leading international box office markets which never closed down completely but did see its major circuits close a portion of their sites. These have mostly reopened this past weekend for a 4-day holiday. Markets in Europe are also now starting to set re-opening dates. Czech Republic was the first to do so, later bringing its reboot date earlier to May 11. Norway will re-open theaters May 7; Switzerland June 8. China also looks to be heading for June after an announcement this week from Beijing’s municipal government.

However, despite these openings (and hopefully more to follow or be announced soon), the impact of losses will continue to accelerate in the coming months with a scarcity of new releases. AVENGERS: ENDGAME added another $1 billion globally in its second week (hitting the $2 billion mark after 11 days in release) last year. By the end of June, Disney’s late-May release of ALADDIN had taken around $875 million worldwide and Pixar’s TOY STORY 4 was at half a billion after 11 days.

The first major global blockbuster still currently on the schedule for 2020 is Christopher Nolan’s TENET on the July 17 weekend. By the same point in time last year, AVENGERS: ENDGAME had overtaken AVATAR to become the highest grossing film of all-time worldwide ($2.8bn); while ALADDIN and SPIDER-MAN: FAR FROM HOME were only a week-away from hitting $1 billion apiece. THE LION KING would also join the $1 billion by August 1 having launched in most global markets the equivalent weekend to TENET this year (China went a week earlier).

Gower Street’s Global Box Office Tracker is updated twice a week in our International Road To Recovery report, which monitors all key international markets for virus progression, theater re-openings, losses and growth. We are monitoring US states and Canadian provinces in a Domestic version. Both are available in our Reports section.

This article was originally published in Screendollars’ newsletter #115 (May 4, 2020).