It has been another crazy week of ups and downs for the global movie industry. The #1 international market, China, slowly began to reopen on Monday, reaching 18% of cinemas by market share back open by mid-week ahead of the first new releases this weekend. South Korean hit TRAIN TO BUSAN PRESENTS PENINSULA showed the astonishing power of a much-anticipated tent-pole title to fuel box office recovery, not only at home but abroad. Then the release calendar underwent another massive reshuffle Thursday as MULAN shifted to unset (alongside several other titles); THE LAST DUEL, TOP GUN: MAVERICK, A QUIET PLACE, PART II and THE CONJURING: THE DEVIL MADE ME DO IT all migrated to 2021; and a raft of further-out titles, including the four AVATAR sequels and next three STAR WARS films were all delayed a year (setting their stalls out through December 2028!).

Amid the positive and negative news, the international market continues to grow. As we looked at last week the number of open cinemas is growing each week. Individual markets are also seeing growth.

In the Asia Pacific region territories including Japan, South Korea, Malaysia and New Zealand all now have over 90% of theaters open by market share. Hong Kong was at 89% before a set-back saw sites re-closing July 15 until July 28. Singapore, which only allowed re-opening from July 13, was already at 76% by its first weekend.

European markets have generally taken a more cautious approach to re-opening, in part due to their closer proximity to the originally intended global goal of July for then-dated blockbuster content which enabled large exhibitors to react to calendar changes and delay re-openings. France and Netherlands were rare examples, following in the footsteps of much of Asia Pacific, in re-opening most sites in a co-ordinated effort. As of last weekend both territories saw over 97% of movie theaters by market share reporting business.

But more gradual starts elsewhere are increasingly showing growth. By last weekend Portugal had hit 90% of movie theaters by market share open; while Germany and UAE had crossed 70%; and Spain was at 67%, even with Catalonia re-imposing closures.

The Korean powerhouse

This past week saw South Korea become only the second global market to achieve the Stage 3 target of Gower Street’s Blueprint To Recovery (a week equivalent to the previous lowest box office week of the past two years). The Asian major hit the target in the week commencing July 16 thanks to the success of TRAIN TO BUSAN sequel PENINSULA.

As shown on the Growth Trackers for South Korea (above), the week easily achieved the required goal of ₩13.7 billion. The box office hit over ₩17.5 billion ($14.6m) for the week, according to our partners at Comscore Movies.

The market had previously come close to the Stage 3 target three weeks earlier with another Korean zombie film #Alive, achieving 93% of the goal in the week commencing June 25. However, PENINSULA was in a class of its own. The much-anticipated sequel single-handedly generated enough box office to achieve Stage 3, taking over ₩16.0 billion in the July 16-22 play-week and nearly ₩19.0 billion including previews. That success also took South Korea 55% of the way to Stage 4 (matching the median box office week of the past two years).

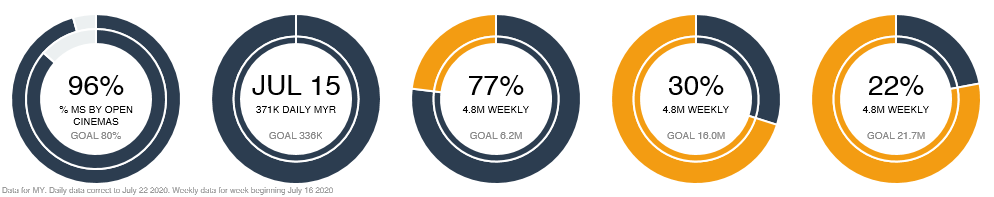

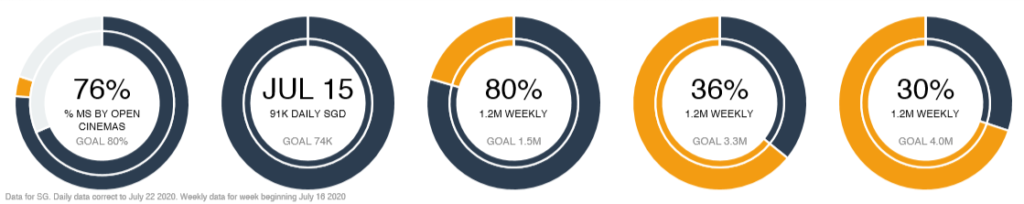

With over 90% market share the success of PENINSULA once again shows the importance of major releases to box office recovery, bringing audiences back to cinemas. This was not limited to the film’s home market. Both Malaysia (below, top) and Singapore (below, bottom) achieved Stage 2 on July 15 – the opening day of PENINSULA in those markets. In Malaysia, PENINSULA’s opening day accounted for 92% market share; in Singapore it was 88%. The film also drove each market to its best showing yet on the Growth Tracker for Stage 3.

The Growth Tracker is not yet available for Taiwan’s latest play-week (as with those previewed above it will feature in the coming week’s Gower Street Road To Recovery report), however early figures show that a powerful combination of PENINSULA and Taiwanese local title A CHOO also took Taiwan past Stage 3 and may even take it to Stage 4 once final numbers are confirmed. If so, Taiwan would be the first market to achieve the median-week marker.

The need for titles

The dynamic recovery of those Asia Pacific markets where PENINSULA landed last week proves the need for major titles. In markets where growth is evident those performing best have been markets with either a strong pipeline of new local content on offer (France, Korea), or with a back-log of unreleased Hollywood titles available (Japan). Catalog titles, both classic re-release and late-2019/early-2020 release resurrection, have offered some succour, especially at an initial phase of re-opening, but in those markets with a limited offering of new titles initial surges in business from keen returnees has proven unsustainable.

In the Netherlands market re-opening on June 1 immediately saw Stage 2 on Gower Street’s Blueprint To Recovery achieved, showing the core audience were keen to return without delay. The first week of full business (June 4-10) generated €1.5 million, according to Comscore, but the following three weeks failed to match it. It took the release of local family title PIRATES DOWN THE STREET in the July 2 week (€2.4m) to re-invigorate the market as it headed into school holidays. This was then backed up by a €2.5 million week (week-commencing July 9) when the local title was backed up by Warner Bros’ SCOOB!, which opened #1.

SCOOB! previews in Spain on July 15, fuelled the market’s achievement of its Stage 2 Blueprint To Recovery goal – coming at the end of week 7 since re-opening, in contrast to Netherlands. Just as LITTLE WOMEN and DOLITTLE openings fuelled Stage 2 and 3 targets being hit in Japan last month, this latest recovery achievement in Spain also demonstrates the importance of new Hollywood product in aiding recovery in markets with less available local content. However, with a pipeline of Hollywood not forthcoming the European market is now looking forward to Sony’s release of Santiago Segura’s highly anticipated local family comedy sequel FATHER THERE IS ONLY ONE 2 next week (July 29) as a key audience driver.

Independent films are also offering successful options, with distributors often finding exhibitor options not normally open to them. France’s Condor Distribution launched MR JONES on day one of French re-opening. Condor’s Alexei Mas told the audience for this week’s Screendaily webinar (July 23) that, had the film released in its originally planned spring slot it would have played at around 150 theaters. Instead it launched in approximately 400 and has now played in over 1,000 French cinemas, becoming Condor’s biggest box office success. But while these titles offer options for theaters and opportunities for independent distributors they are yet to prove key drivers on their own. France has seen a succession of local titles dominating box office.

Also speaking on the Screendaily webinar, Hamish Moseley, managing director of the UK’s Altitude Film Entertainment (one of the few distributors offering a slate of new movies to open UK exhibitors in the first difficult weeks back), said the market could not be sustained with only a few new releases. “We need a diverse and strong pipeline of films to cater to all audiences, and we need that soon,” said Moseley.

You can sign up to our free trial of the Road To Recovery reports (featuring growth trackers for all 50 US states as well as Canadian provinces and 30 global markets) here.

This article was originally published in Screendollars’ newsletter #127 (July 27, 2020)