As anticipated a lack of new major blockbuster content on offer in September led to a significant regression in global box office fortunes. The month’s $1.34 billion result was the worst single-month Global box office result of 2022 so far, and the first time since April that global numbers failed to reach at least $2 billion (July topped $3bn).

The result also marked the worst month since April in comparison to the average of the last three pre-pandemic years (2017-2019). September’s global figures fell -44% short of the three-year average ($2.37bn).

September brought Q3 to a close and, despite the slimline release calendar during August and September, the quarter experienced an almost identical difference to the pre-pandemic average as seen in Q2. The July-September period delivered a global box office of approximately $6.71 billion, -31.4% from the Q3 average for 2017-2019 ($9.78bn). The Q2 total ($6.44bn) had seen a -31.7% difference again the average.

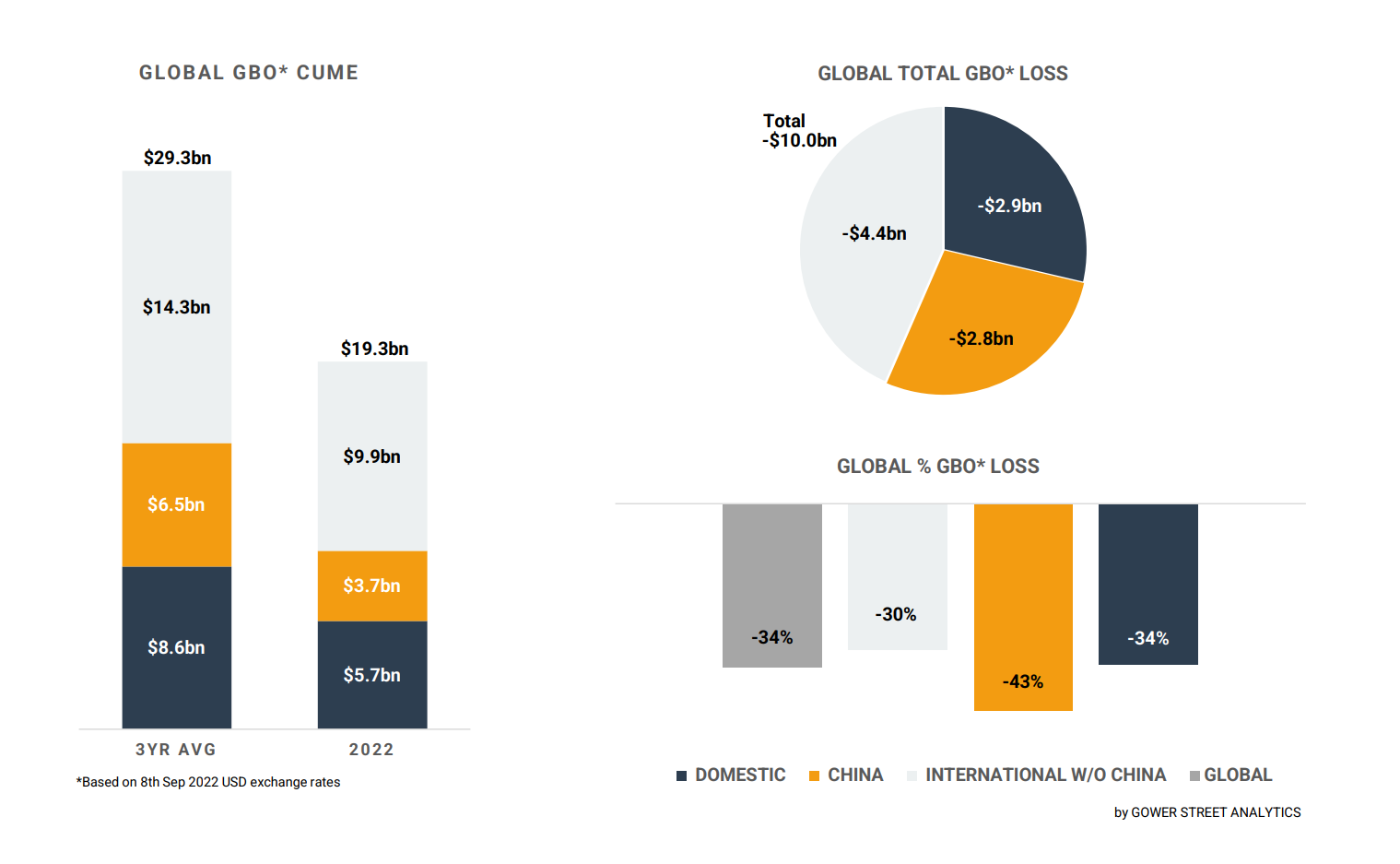

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

It should be noted that, due to significant exchange rate fluctuations in recent months, we have recently revised all our exchange rates. The current strength of the US dollar has impacted US$ totals, but all percentage changes shown and discussed are based on local currency comparisons for a true reflection of market changes.

The Domestic market was -52% behind the three-year average for September – the worst month-to-month comparison since February (-54%). China was an even more severe -59% behind, it’s worst result since May (-82%).

The International market (exc. China) performed better: -34% compared to the three-year September average – only marginally worse than the August result (-32%). However, this still marked a notable regression from the -17%, -5%, and -14% results seen for May, June, and July. It was also the first time since March that the International market (exc. China) failed to deliver over $1 billion, grossing an estimated $820 million for September 2022.

International performance was aided by individual territory overperformers (such as DON’T WORRY DARLING in UK/Ireland) and late roll-out titles (such as DC LEAGUE OF SUPER PETS in Australia), but a key driver came from local content filling the gap left by the lack of global-release Hollywood titles – particularly in the Asia Pacific region. Asia Pacific (exc. China) saw box office tracking just -20% behind the pre-pandemic in September, compared to -41% in Europe, Middle East and Africa (EMEA) and -44% in Latin America.

This is most evident in Japan which, once again, delivered the best result (in comparison to the pre-pandemic September average) of any major market:-4%. This follows a run of good performances in Japan from April through August (-14%, -16%, +12%, -19%, -11%) and is primarily thanks to the continuing success of anime ONE PIECE FILM: RED. The latest entry in the ONE PIECE franchise was released in early August and by September close had delivered $120.4 million in Japan. Of that just over $27 million came within September – more than twice the gross of the next biggest title, Sept. 16 release SILENT PARADE ($12.2m). ONE PIECE FILM: RED was also the top earning title for September in Taiwan, grossing $1.38 million of its $5.63 million local total within the month.

In Malaysia, where the Sept. 22 release of ONE PIECE FILM: RED ranked #2 for the month ($1.29m), local hit AIR FORCE THE MOVIE: SELAGI BERNYAWA topped the chart. The film, which, grossed more than half ($3.63m) of its $6.5 million total gross within September having released August 25.

In Hong Kong the September box office was actually ahead of the pre-pandemic September average by +4% – the first time the market has performed ahead of pre-pandemic numbers since re-opening in late-April. This was again fuelled by local success with comedy TABLE FOR SIX dominating charts since its opening on September 8 and grossing $6.2 million by month-end. There was also strong support from August 25 opener local sci-fi thriller WARRIORS OF FUTURE ($4.4m in September). Both films now rank in the all-time top 5 for Hong Kong productions with WARRIORS OF FUTURE selling nearly 915,000 tickets since release in the market and TABLE FOR SIX just shy of 781,000.

Other local titles leading their market’s box office in September included China (GIVE ME FIRE – $49.2m), South Korea (CONFIDENTIAL ASSIGNMENT 2: INTERNATIONAL – $43.3m), France (KOMPROMAT – 456k adms), Spain (TAD THE LOST EXPLORER AND THE EMERALD TABLET – $4.9m in September, having released Aug. 26), Denmark (BAMSE – $3.17m of $4.14m), Norway (OLSENBANDEN – SISTE SKRIK! – $2.11m), the Netherlands (SOOF 3 – $1.73m), Finland (THE GRUMP: IN SEARCH OF AN ESCORT – $1.53m), and Turkey (TAY – $473k). Meanwhile Maori drama MURU scored well with New Zealand audiences ($623k), finishing second for the month behind TICKET TO PARADISE ($678k).

TICKET TO PARADISE was the dominant title in more markets than any other, proving the star-draw of Julia Roberts and George Clooney was a winner with international audiences. As well as New Zealand, markets where it topped September business included: Germany ($4.91m), Saudi Arabia ($2.61m), UAE ($1.56m), Austria ($908k), Portugal ($641k), South Africa ($299k), and Panama ($120k).

Other titles taking the lead in September included: ORPHAN: FIRST KILL (Mexico – $5.18m, Brazil – $4.31m, Peru – $967k, Argentina – $859k, Chile – $615k); DC LEAGUE OF SUPER PETS (Australia – $7.96m, Singapore – $594k, and Colombia $510k); THE WOMAN KING (Domestic – $41.5m, West Africa – $490k); DON’T WORRY DARLING (UK/Ireland – $5.5m); MINIONS: THE RISE OF GRU (Italy – $3.72m in September of $14.4m total); THREE THOUSAND YEARS OF LONGING (Russia – $2.63m); and WHERE THE CRAWDADS SING (Sweden – $1.99m).

With BLACK ADAM arriving in October, followed by BLACK PANTHER: WAKANDA FOREVER in November, and AVATAR: THE WAY OF WATER in December, expectations are high for a strong Q4 finish to the global year after a couple of slow months. Following Gower Street’s exchange rate adjustments, and a disappointing Golden Week result in China, the current end-of-year Global box office estimate is expected to be approximately $26.5 billion.

A version of this article appeared on Screendollars Oct. 6.