International box office losses due to the COVID-19 global shutdown have now overtaken China. Gower Street estimates that the global box office has lost $7.6 billion so far in 2020 against an average of the past three years! Splitting that figure out to look at domestic, international (excluding China) and China, we see that the #1 international market represents $2.8 billion with the remaining international markets now recording the biggest loss with $3.1 billion, having leap-frogged China late last week. The domestic market currently contributes $1.8 billion in losses.

Gower Street’s new animated global loss tracker shows the growth and distribution of box office loss over time. Initial year-on-year growth in the domestic and international markets are evident, even as China starts to quickly suffer major deficits. International and domestic losses begin to appear in February before the devastating blow of mid-March closures sees both accelerate.

The figures show a marked change from the beginning of the month, when Gower Street launched the first version of its global box office tracker. At the time cinemas in the domestic and most international markets had been closed only a few weeks. China was already more than two months into a total shutdown, even having had a brief flirtation with re-openings towards the close of March. Having closed just ahead of the lucrative Chinese New Year week, one of the market’s two biggest box office weeks alongside October’s Golden Week, China accounted for $2.2 billion of a then $4.7 billion loss. Remaining international markets collectively accounted for $1.6 billion and domestic market losses were still under $1 billion.

China understandably accounted for by far the biggest portion of losses early on, having ordered its 10,000 plus cinemas to close on January 23. Nevertheless 80% of global cinemas remained open for the next six weeks. The mass closure of theaters across Europe and the US came in mid-March and with COVID-19 spreading further most of the rest of the world followed. This development hit rock bottom on April 5 with less than 1% of global cinemas open. After the pandemic spread all over the world China’s share of the total losses began to decrease, as those in domestic and other international markets grew. In other words, the shares are heading to normalize.

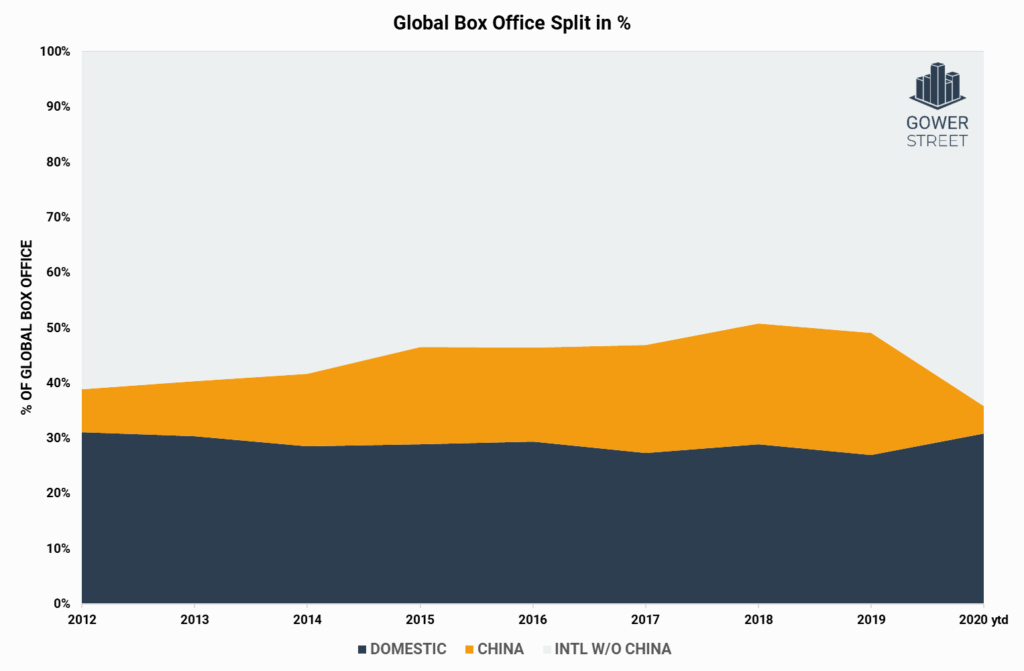

Current market share across the three key global markets is anything but normal. While many may wish they had a time machine to take them back to before this crisis, the situation has brought its own time-travelling twist. Looking at the current split of global box office share you might well ask “is it 2012 or 2020?” In year-to-date box office for 2020, China accounts for less than 10% of the worldwide theatre grosses. The rest of the international market accounts for over 60%. The domestic market makes up nearly one third. These are levels unseen in eight years as China has enjoyed further, rapid development since overtaking Japan in 2012 to become the leading international market. China’s estimated loss so far in 2020 is already greater than its entire annual box office for 2012 – and it’s not even May!

Gladly a tentative timeline for the re-opening of cinemas is starting to emerge. A number of markets across Asia and Europe appear to have seen the peak of the virus pass, with the number of active cases now steadily dropping, although many continue to see numbers climb. Yesterday Czech Republic got the first international country to announce a date for the re-opening of cinemas with May 25. Still there remain no firm plans in any other closed international market but a potential timeline around July looks hopeful following recent comments from UNIC (the international union of cinemas) as well as consideration of the current release schedule. Meanwhile in the US cinemas in some states, including Georgia, Oklahoma and Texas, will test ground this week with local governor’s allowing a return to business. Despite this major chains AMC and Cinemark have indicated they do not plan to re-open theatres until at least July.

With different markets likely to return to operation at different times we can expect to see the proportions of the global loss tracker continue to shift further over time.

Gower Street is continuously tracking all key markets for first signs of re-openings and will highlight these in the international and domestic versions of the Road To Recovery report, available on our Reports page.