The Domestic market out-performed China, for the first time since China’s July 2020 re-opening, during June. Bringing the best box office result since the pandemic began in the Domestic market, June lay further foundational stones for recovery despite a slight retraction in global box office compared to May.

According to Gower Street’s latest monthly Global Box Office Tracker (GBOT), the global box office retracted slightly in June from the previous month grossing $1.3 billion, down from $1.4 billion in May. However, this is a normal trend and no cause for concern.

The average global box office for the three pre-pandemic years (2017-2019) was $3.3 billion in May compared to just $3.0 billion for June. What’s more, the monthly deficit compared to the three-year average was reduced for June, with 2021 standing $1.7 billion behind the average compared to $1.8 billion in May (both March and April lost $2.4 billion compared to the three-year average).

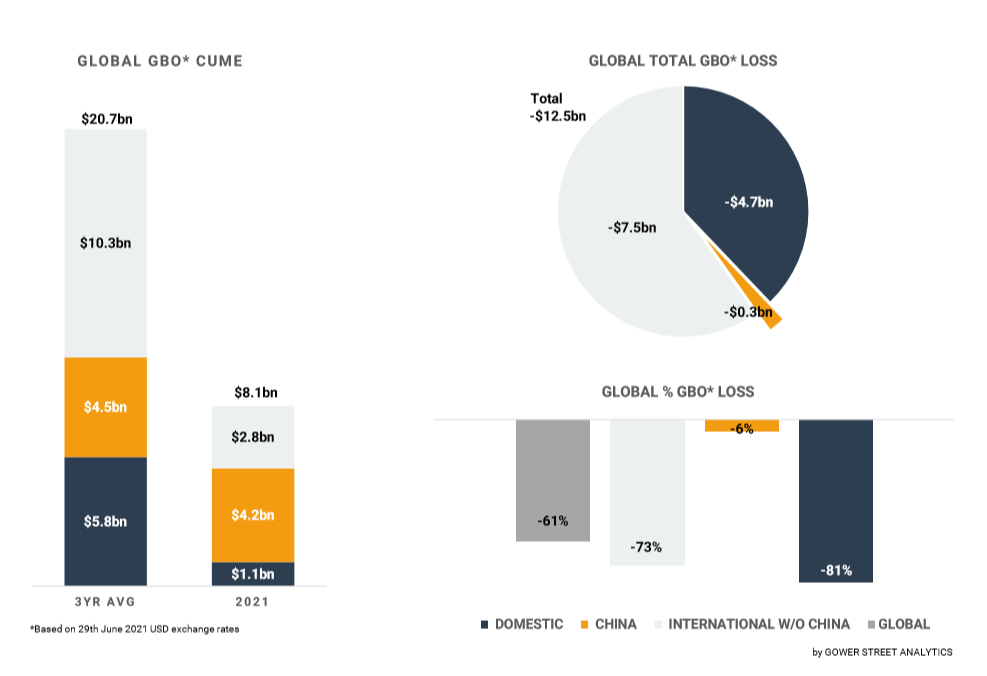

The stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three (pre-pandemic) years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

The more important news recovery news for June is Domestic growth and what that contributes to global recovery. The Domestic market grew its box office in June ($0.4bn, up from $0.2bn the previous two months). This is in part thanks to two hit sequels. A QUIET PLACE, PART II arrived at the close of May for the Memorial Day weekend scoring a, then, pandemic-era high opening and fuelling box office results into June.

The Memorial Day play-week went on to achieve the Domestic market’s Stage 3 target on Gower Street’s Blueprint To Recovery (a box office play-week equivalent to the lowest grossing play-week of 2018-2019) for the first time since the pandemic began – a major, and long overdue, milestone. The same week saw 29 US states achieve their Stage 3 targets for the first time, with Louisiana following in the following (June 4) play-week (35 states have now achieved the marker). The end of the month then brought the pandemic-era’s biggest box office success, F9: THE FAST SAGA (which scored the biggest Domestic opening since STAR WARS: THE RISE OF SKYWALKER back in December 2019).

Both A QUIET PLACE, PART II and F9 (aka FAST & FURIOUS 9) have also shown the enthusiasm of audiences around the world to return to movie theaters where they can. By the end of June, Paramount’s horror sequel had grossed over $250 million worldwide and F9 over $400 million ($429m to July 1). F9’s roster of international openings for the June 25 weekend included UK/Ireland and Portugal, scoring the best opening since 1917 (the movie not the year!) back in January 2020; Brazil, where it was the top opening since JUMANJI: THE NEXT LEVEL, also in January 2020; Mexico, where it delivered the best opening since FROZEN 2 in November 2019; Panama, also the best result since 2019; and Colombia (best of the pandemic era).

Universal’s action juggernaut opened in New Zealand for the June 17 play-week, driving that market back to the Stage 4 level on our Blueprint To Recovery (equivalent to the median play-week of 2018-2019) and delivering the market’s best pandemic-era play-week. Among its June 25 openings, it drove Colombia to achieve not only Stage 3 for the first time, but also Stage 4 – only the second Latin American market to do so; the other, Argentina, repeated at Stage 4 for the June 25 play-week, delivering 88.5% of its Stage 5 target (equivalent to a top quartile play-week of 2018-2019) into the bargain. Mexico repeated at Stage 3, achieving 93% of its Stage 4 target; while Brazil hit its Stage 3 for the first time. UK/Ireland, Netherlands and Panama all repeated at Stage 3 levels in the play-week; and Portugal was another Stage 3 first-timer thanks to the F9 boost (the film single-handedly accounting for 90% of the required target).

Another contributing factor to improved Domestic performance was the continued rise in the number of movie theaters re-opening. At the close of May the market share of theaters operating had hit 75%. This grew further in June to stand just shy of 79.5% by month’s end. This included the return of several Canadian provinces including Alberta (for the June 11 weekend – immediately driving the province to its Stage 3 target); British Columbia for the June 18 weekend; and Nova Scotia for the June 25 weekend. Some drive-in locations also re-opened in Ontario from June 11.

The month also delivered big news on the global front concerning market share of open theaters, which hit 80% for the first time since the pandemic began over the June 11 weekend (80.2%). It had risen to 82% by the end of the month. Renewed closures in South Africa and parts of Australia, including Sydney, from June 28 may result in a contraction, though hopefully these may be mitigated by further re-openings in Germany and Turkey from July 1.

The main reason for the slight retraction in global box office fortunes in June was China, where box office for the month was approximately $0.3 billion – half the 3-year average and well down on May’s $0.8 billion. This meant it was the first time since China re-opened last July, that the Domestic market delivered a monthly box office higher than that in the recently crowned #1 global market!

It is worth noting, however, that May’s Chinese box office was 25% ahead of the three-year average helped by a record Labour Day holiday and the earlier, May 21, release there of F9 (which has grossed approximately $215m in the #1 global market). China lacked a big new release in June with the top openers, Taiwanese title MAN IN LOVE ($33m) and PETER RABBIT 2 ($25m), failing to make the market’s top 25 releases of 2021 so far (which include 12 titles over $100m).

This article was originally published on Screendollars’ newsletter #175 (July 5, 2021) and on the Screendollars website here.