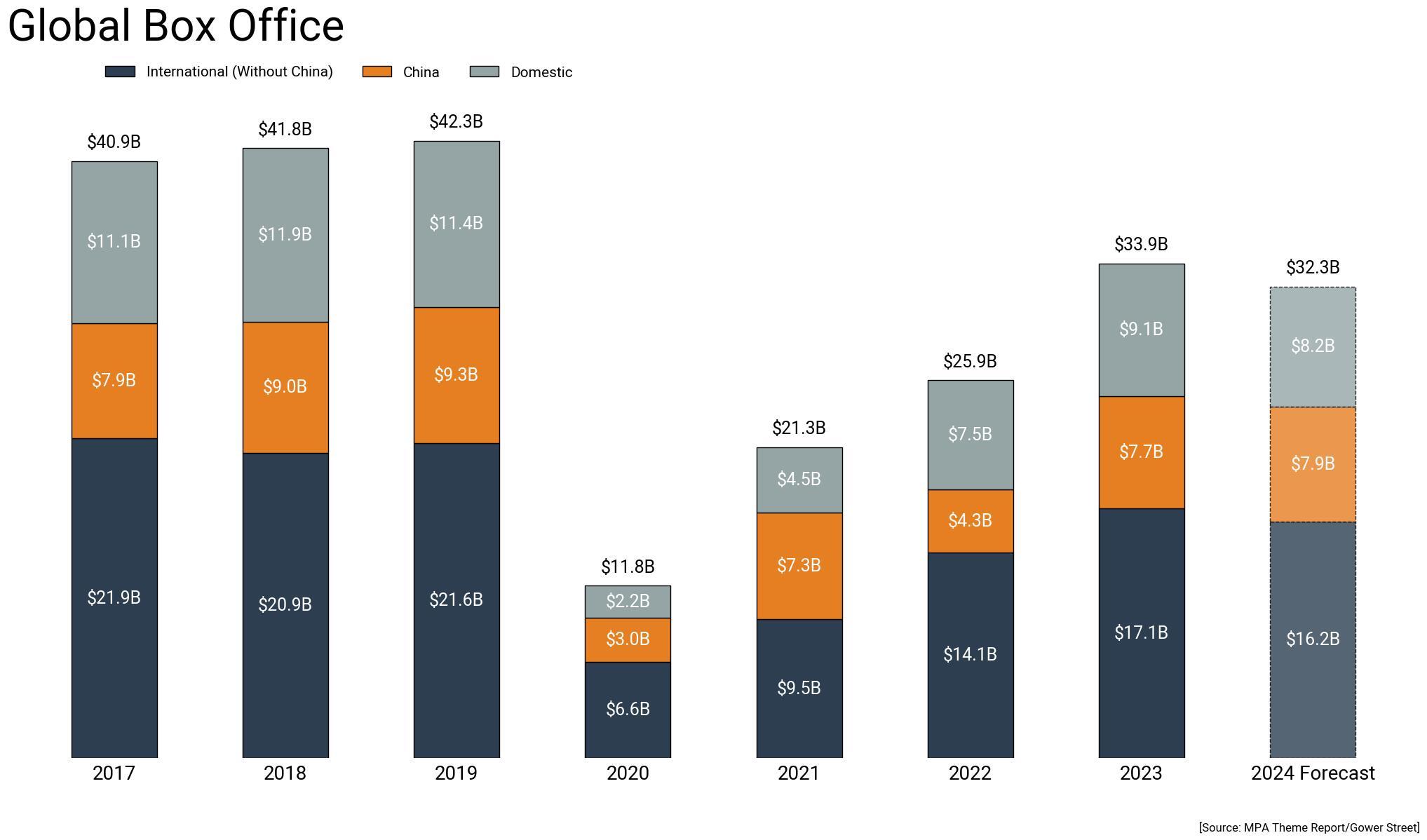

Gower Street Analytics has revised its 2024 Global box office projection to $32.3 billion.

The announcement comes as the global industry gathers in Las Vegas for CinemaCon, the official convention of The National Association of Theatre Owners (NATO), which runs April 8-11.

The revision is a marginal increase on the original projection of $31.5 billion published in December. It is notable however that the increase would have been greater were it not for exchange rate changes between December and now essentially wiping out over a third of the gains seen collectively across International markets.

Actuals for Q1 were 1% ahead of our projections in the Domestic market and in China. For the International market (exc. China) they were 11% ahead of our estimates. There have also been a number of changes to the 2024 release calendar since our first projection was announced in December and overall gains in our estimate can primarily be attributed to titles that have been added to the release calendar.

Overall our projection has seen only modest gains of approximately $200 million in the Domestic market, $550 million (in US$ terms) in the International market (exc. China), and remained relatively static for China. China is the only one of the three key markets projected to see a year-on-year improvement. The Asian major was tracking 6% up on 2023 at the same point at the end of March

Among the International sub-regions, Europe, Middle East & Africa (EMEA) has seen the biggest gain ($463m), while Asia Pacific (exc. China) has also seen a slight increase ($157m), thanks to year-on-year gains in Q1 in Japan, South Korea, and Australia. In EMEA, Italy, UK/Ireland, Spain, Russia, and the Netherlands have all seen Q1 improvements over the same period for 2023. Unfortunately a slower start in Latin America has resulted in a slight decrease in the full-year estimate for the region. It should still be noted, however, that Brazil did record a small year-on-year gain for the first quarter.

A $32.3 billion Global box office in 2024 would represent an approximate 5% decrease year-on-year (a 3% decrease at current exchange rates) from 2023. The 2024 revised estimate remains -18% behind an average of the last three pre-pandemic years (2017-2019).