In February, global cinemas accounted for $2.3 billion in box office. This is the best global monthly result since January 2020. It more than doubles the prior month’s result ($1 billion). This record month materializes the hope of a strong post-pandemic future for the theatrical business to come. At the same time, it illustrates like no month before the current divide of the global theatrical landscape.

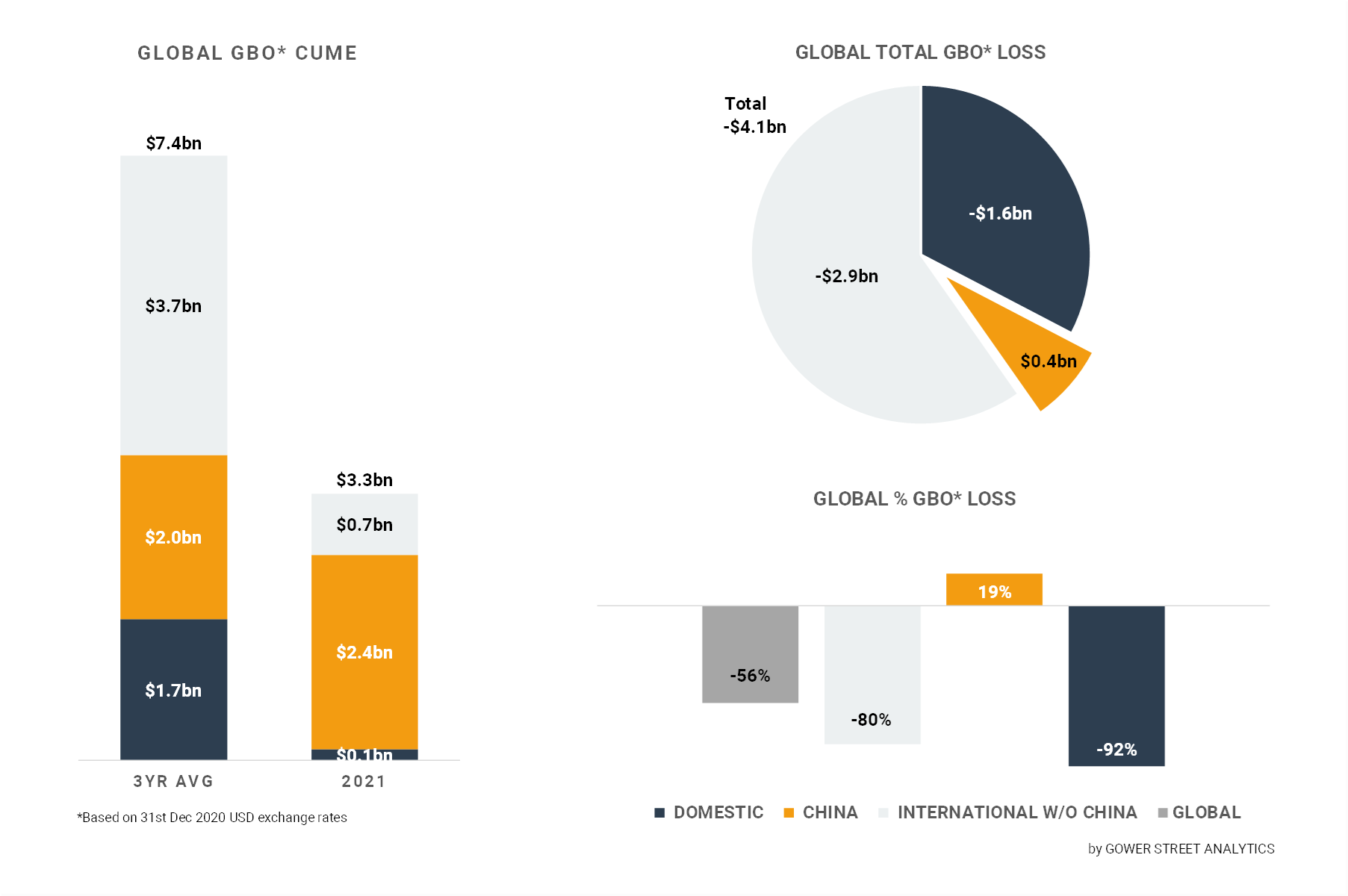

Gower Street’s latest Global Box Office Tracker (GBOT) shows that 2021 global box office grew to $3.3 billion in February, from $1 billion a month ago. At the end of February, the current 2021 global box office deficit compared to the average of the last three pre-pandemic years (2017-2019) is -$4.1 billion, a drop of -56%.

An impressive 82% of the global box office in February was delivered by China with $1.9 billion. This time around Chinese New Year even overachieved its promise of being historically by far the most lucrative theatrical season of the year in China. It resulted in a new all-time record for single-month box office in the market. As a result, China’s 2021 box office grew from $0.5 billion to $2.4 billion within the last month. This already represents 78% of China’s 2020 full year total ($3 billion)! Consequently, China is 19% and $0.4 billion ahead of the 2017-2019 three-year average for the first two months of the year.

The stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three (pre-pandemic) years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

The second highest contributor to the box office in February was the International market (excluding China), with $0.3 billion. However, this is the lowest monthly international box office since July. The 2021 International box office total reached $0.7 billion at the end of February with a deficit against the three-year average of -$2.9 billion (-80%).

The Domestic market continued to see very slow growth. In February, the Domestic box office rose from $0.07 billion to $0.13 billion; tracking -92% behind the three-year average, a total of -$1.6 billion.

After being the first market to close cinemas due to the COVID-19 outbreak, just ahead of the Chinese New Year (Jan. 25) holiday last year, China had a record breaking turn this year. CNY delivered a new global record for biggest ever single-market opening (surpassing the 2019 Domestic launch of AVENGERS: ENDGAME – $357m) with DETECTIVE CHINATOWN 3 reaching $396 million over CNY weekend. China also achieved their biggest box office weekend with a colossal $697m. This paved the way for their biggest play-week ever with $1.3 billion over the holiday week. This is even more remarkable and promising as much of the country was still operating under 75% (or lower) capacity restrictions.

The February box office in China was dominated by a host of new titles on offer for the holidays, catering to all audiences, with the top seven chart positions all filled by CNY new releases. However, two titles stood out, accounting for 74% of the enormous monthly result: fantasy drama HI, MOM ($740m) and DETECTIVE CHINATOWN 3 ($662m). They are already at #3 and #5 of the highest grossing films of all-time in China. Both are additionally far ahead of last year’s global #1, Chinese hit THE EIGHT HUNDRED ($440m).

The International market (excluding China) continued, as in all months since March to be driven by Asia Pacific. Almost three-quarters (72%) of the International box office in that period was generated in the region. This is more than double the share of pre-pandemic Februarys (34%, avg. 2017-2019).

One pillar of that performance was the re-opening of cinemas in Hong Kong on February 18, after being closed since December 2. It was the end of their third and, until now, longest closure. Hong Kong re-opened cinemas with a number of delayed releases. The market share of cinemas operating immediately returned to over 90%. The box office of the first week back right away crossed the Stage 3 target on Gower Street’s Blueprint To Recovery (measured as a weekly box office result equivalent to the lowest grossing week in the previous two pre-pandemic years). It was also Hong Kong’s fourth highest grossing week since January 2020.

Nevertheless, Japan remains the backbone of APAC’s majority share of International. It contributed 40% of APAC’s result in February. Despite restrictions being in place in Tokyo and three neighbouring prefectures since January 8, the February 6 play-week (including the National Foundation Day holiday) was only just shy of returning to Stage 5 of their Blueprint To Recovery (measured as a weekly box office result equivalent to those in the top quartile of weekly business in the previous two pre-pandemic years). Local romantic drama I FELL IN LOVE LIKE A FLOWER BOUQUET was the main driver. It was the highest performing title of the month, grossing $19.3 million. At #2, in its fifth month, the highest grossing release of all-time in Japan DEMON SLAYER THE MOVIE: MUGEN TRAIN added another $12 million. After two months in 2021, Japan is only -31% behind the three-year average, an improvement from -36% a month ago.

Except for China, Russia is currently the only Comscore-tracked market that is performing better than that. It is showing a deficit of just -21% against the three-year average at the end of February (from -25% at the end of January). Russia’s box office cume in 2021 of $120 million, makes it the fourth biggest market in the world so far, only -10% behind Domestic. A significant driver in February were the historically strong national holidays on February 22 and 23 that helped boost the February 18 play-week to hit Russia’s Stage 5 Blueprint To Recovery level for the third time. This spilled over to the following weekend, recording the market’s second biggest weekend since March 2020 ($11.1m, topped only by the Dec. 31 weekend). The result in February was caused by multiple local releases led by fantasy production UPON THE MAGIC ROADS ($11.5m) and two US animated hits SOUL and TOM & JERRY. SOUL delivered $9.3 million of its current $17.6 million within the month. It has outperformed both INSIDE OUT and FROZEN in Russia.

While Russia runs ahead on the Road To Recovery and has contributed 63% of EMEA’s current 2021 cume, the rest of the region has shrunk further. UAE was the latest market to impose new restrictions, forcing cinemas to shut from February 5 in Abu Dhabi and Al Ain until further notice. In other Emirates the capacity of cinemas has been reduced to 50%, which resulted in additional closures. This has lowered the number of cinemas open by market share to just 17% in EMEA, from a peak of 89% at the beginning of October.

At least a small positive sign was seen in EMEA as the UK Government set the tentative date for the return of indoor cinemas in England at May 17. The date, while still more than two months away, finally provides an indication of when major, and currently closed, Western European markets may be able to return.

There was some better news in Latin America. In Chile, cinemas were finally allowed to re-open from February 18 after 11 months of closure. Already in its second week Chile hit the Stage 2 target of its Blueprint To Recovery (measured as a daily box office result equivalent to the lowest grossing day in the previous two pre-pandemic years). This helped the region, combined with expanding re-openings across other countries, to increase the number of cinemas open by market share to 48% at the end of February. This is up from 36% a month ago, but still down from a high of 64% in mid-December.

Progress, even if slow, can also be observed in the Domestic market. Washington and Quebec have re-opened movie theaters; while notable rises appeared in multiple areas including Oregon and New Brunswick. This pushed the number of movie theaters open by market share up from 42% a month ago to 46% at the end of February; although this is still well below the peak of 61% at the end of September. Despite the limited availability of theaters, TOM & JERRY, on the final weekend of the month, achieved the second biggest opening result since the pandemic closed theaters in March 2020 with $14.1 million. This is even more impressive given that it was accessible simultaneously at home for HBO MAX subscribers. Another very promising sign for a continuing recovery is the permission to re-open indoor movie theatres in New York City from this weekend (March 5), having been closed for almost 12 months – one of the longest lasting continuous closures of the exhibition sector seen around the world.

Globally the number of cinemas open by market share grew to 59% by the end of February. Slightly up from 56% a month earlier. This is down from a peak of 79% at the end of September. However, it is the highest level since mid-December.

This article was originally published in Screendollars’ newsletter #158 (March 8, 2021).