February marked a further encouraging step in climbing up the box office ladder to pre-pandemic heights. However, it once again illustrated that it’s a long way up.

The month generated a global total of $2.3 billion. 27 of the 30 territories tracked in Gower Street’s weekly global State Of The Market report were significantly above their result in the same month last year. All 30 territories are tracking above their 2022 total at the same stage after two months! Even so, the month itself only sits in the middle of the last 12 months globally, at #6 in total box office and #7 in terms of percentage against the average of the three pre-pandemic years in the same period (-38%).

A continuing sign of strength is the breadth of recovery. For the four full play-weeks within February, 26 of our tracked territories crossed on average, and as median, at least Stage 3 of Gower Street’s 5-Stage Blueprint To Recovery on a weekly basis. This is an impressive 11 territories (+73%) more than last February. Stage 3 equals the lowest grossing play-week of 2018-2019 so serves as a base-level for demonstrating consistent recovery. Moreover, for just the 2nd time in three years all 30 territories crossed at least that level at the same time in the play-week commencing February 17 – just seven weeks after that record was hit for the first time.

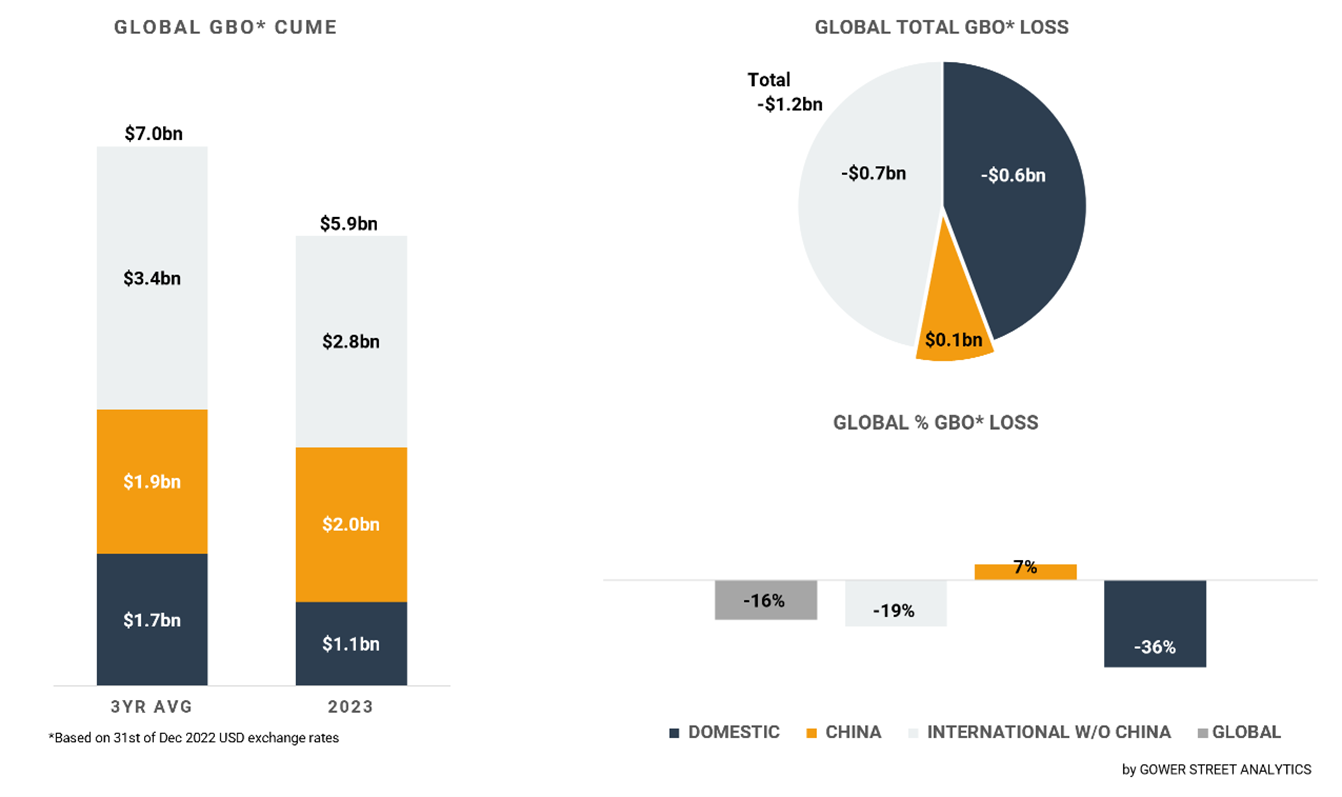

Total global box office to the end of February is estimated at $5.9 billion. This is currently tracking +30% ahead of 2022 and nearly doubles 2021 (+94%) at the same stage! Nevertheless, it’s still -16% (or $1.2 billion) behind the average of the last three pre-pandemic years (2017-2019).

On this month’s Global Box Office Tracker (GBOT, above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

ANT-MAN AND THE WASP: QUANTUMANIA was clearly the biggest movie at the global box office in February. It generated $368 million in the month. QUANTUMANIA recorded a franchise-best opening, but it still fell well short of the trio of Marvel sequels released in 2022. It further had a heavy 2nd weekend drop in most major markets, which could see QUANTUMANIA struggle to match the $624 million global total of 2018’s first sequel ANT-MAN AND THE WASP.

ANT-MAN AND THE WASP: QUANTUMANIA was the awaited first major global blockbuster release in two months since Disney’s own phenomenally successful AVATAR: THE WAY OF WATER. The James Cameron film still managed to be the #2 global US-studio title of the month, adding approximately $150 million within February for a total of $2.27 billion. It is now the #3 movie of all-time globally. It has the same rank Internationally and is #9 in the Domestic all-time list.

The only other US-studio release that managed a global box office of over $100 million within the month was PUSS IN BOOTS: THE LAST WISH. The sequel, that started its roll-out in December added approximately $103 million in February for a cume of $444 million. A release in Japan is still to come on March 17.

In China multiple local Chinese New Year (CNY) holdover titles were dominating the market in February. The top 5 titles were all originally released on the January 22 holiday and generated 84% of the month’s total. The group was led in February by THE WANDERING EARTH 2, which added $165 million to reach a total of $579 million, and FULL RIVER RED, which added $150 million for a total of $660 million.

The first two Marvel titles to release in China since 2019 unfortunately did not leave a significant mark. ANT-MAN AND THE WASP: QUANTUMANIA stands at $33 million and BLACK PANTHER: WAKANDA FOREVER at $16 million – a far cry from prior instalments of both franchises, which all crossed the $100 million mark.

The Chinese market grossed $553 million in February, its 2nd highest grossing month in the past 12 months. As in January it was the top grossing market globally. After the first two months of the year, China’s box office is at $2 billion. This is +7% above the three-year pre-pandemic average, as well as +6% above last year, but -10% below the same period in 2021.

In contrast the Domestic performance was a bit weaker. The monthly gross of $506 million only ranks #9 among the past 12 months and is the lowest since October 2022. The running year now stands at $1.1 billion at the end of February, which is -36% below the three-year average. Nevertheless, it’s +45% higher than at the same point last year and more than 8 times the comparable 2021 cume (+731%).

As in many markets ANT-MAN AND THE WASP: QUANTUMANIA contributed the majority (34%) of that amount with $171 million. No other title generated more than $50 million. That is the 2nd lowest number in the past 12 months. At the same time 11 smaller February releases and holdover titles achieved more than $10 million in the month. That is the peak number since re-opening, reached just three times in that period before. A positive sign for a broadening range of movies on offer.

Europe, Middle East, and Africa (EMEA) was the highest grossing International sub-region in February, generating over half of the monthly international total (57%) and recording its 4th highest grossing month in the past 12 months. However, it also had the highest monthly gap of the sub-regions against the three-year average with -27%. That increased the year-to-date gap to -19%. Of all sub-regions EMEA further had the lowest uptick against February last year with +23% and +41% for the year so far.

In contrast the Latin America sub-region nearly doubled its monthly result (+96%) and increased the year-to-date total (+71%) in comparison to last year. The sub-region was further able to close the year-to-date distance to the pre-pandemic average down to -17% with a monthly value of -15%.

The sub-region of Asia Pacific (excluding China) sits in the middle of the other two. Like EMEA it had a weaker February than January and increased the gap to the three-year average in the running year to -20%, with a monthly value of -24%. At the end of February, the sub-regions box office is +50% higher than last year, the month itself is +66% above.

Highlighted by the sub-regions the International (excluding China) marketplace was clearly stronger in February and the year so far compared to the domestic one. An important driver of that was – as often since the start of the pandemic – the local and international product that helped territories around the world to overcome the improved but still subpar flow of attractive global new releases out of the US.

France, for example, recorded its 3rd highest grossing month of the current decade, just a glimpse behind last December(-1%) and December 2021 (-11%). The historically strong school holiday season was dominated by the newest entries of two local franchises with ASTERIX & OBELIX: THE MIDDLE KINGDOM (3.9 million admissions) and ALIBI.COM 2 (2.9m adms). ANT-MAN AND THE WASP: QUANTUMANIA followed substantially behind at #3 (1.2m adms).

While the process of recovery has slowed down a bit in February, the month itself and the current year to date results are showing a significant rise against last year! In the upcoming weeks and months, the number and frequency of attractive global new releases out of the US increases again. March is starting with CREED III this weekend followed by SCREAM VI, 65, SHAZAM! FURY OF THE GODS, JOHN WICK: CHAPTER 4 and DUNGEONS & DRAGONS: HONOR AMONG THIEVES up until the end of the month. The number and scale of global releases is a considerable improvement compared to the first two months of this year and the same month last year.