It didn’t come as a surprise that October was a challenging month at the box office, but it was still disappointing. It is becoming clear that the high speed recovery of the summer demonstrated an achievable potential more than a new normal.

Global box office achieved $2.23 billion in October. That makes it the fourth lowest grossing month of the year so far, marginally ahead of February (+0.3%, $2.22bn), March (+7%, $2.08bn) and September (+15%, $1.95bn) but well below the next highest month May (-20%, $2.78bn).

In terms of the gap against the monthly average of the last three pre-pandemic years (2017-2019) it showed the third biggest deficit of the year with -28%. This is only ahead of February (-39%) and March (-36%), and a bit behind September (-19%). It was a far cry from the three months this year that performed above the pre-pandemic benchmark (July +17%, January +6%, August +1%).

Compared to October last year the month still showed +18% growth, but that was significantly less than prior months. There has also been a better October result since the start of the pandemic: October 2021 which grossed $2.9 billion, +30% more than this year. At that time a strong roster of major global releases including NO TIME TO DIE ($774m), VENOM: LET THERE BE CARNAGE ($507m) and DUNE ($402m), plus a phenomenal Golden Week holiday in China, pushed the global recovery forward to what is still the sixth best month since February 2020.

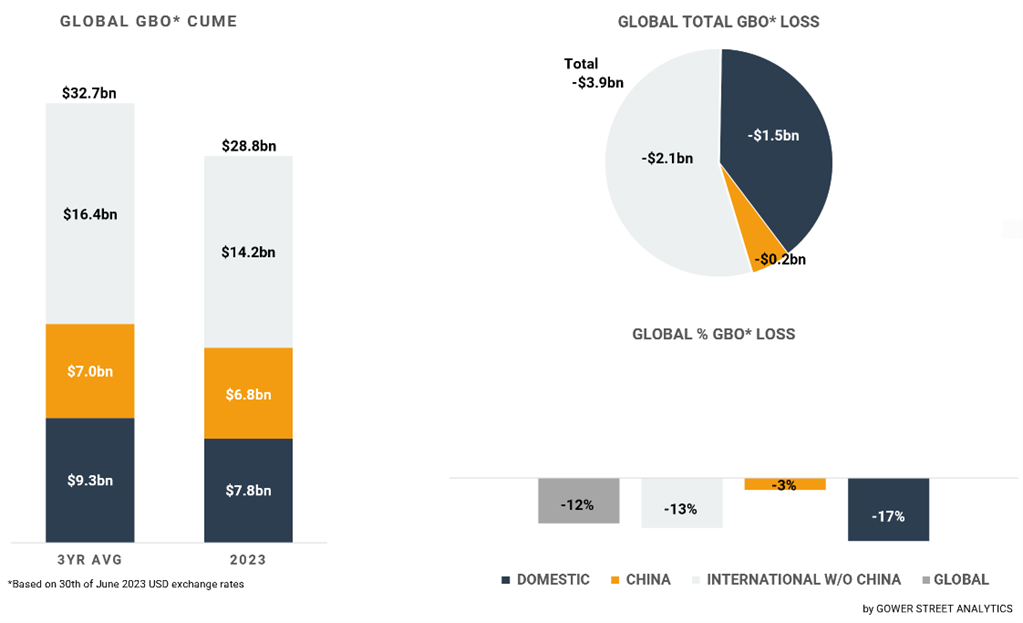

Back in 2021 the closure of multiple major markets plus numerous restrictions around the world were holding off releases in the first half of the year and pushed many titles to the second part of it. This and last year the number of attractive global movies ready to be released from September onwards was lower than needed to sustain the levels of recovery achieved earlier in both years. Consequently, the gap to the three-year average has widened again within the past month from -10% to -12% for the running year. At the end of October, the total global box office is estimated to have reached $28.8 billion. That is already above the full-year result of each of the three prior years.

On this month’s GBOT (above), the stacked bar graph on the left shows total box office levels split out by the three key global markets: Domestic, China and International (excluding China). The pie chart indicates the current deficit compared to the average of the past three pre-pandemic years (2017-2019) and where those losses are currently coming from. The bar graph on the bottom right displays the percentage drops globally.

October had numerous global releases that achieved solid box office levels. One title crossing $200 million, three above $100 million and one near to $100 million. However, no movie was able to break out significantly. Further an already soft release schedule in September limited holdover returns. The last movie crossing $300 million globally was MEG 2: THE TRENCH with $395 million, released at the beginning of August, nearly three months ago.

The highest grossing global release in October was the concert film TAYLOR SWIFT – THE ERAS TOUR with approximately $203 million. That is already more than double the lifetime of JUSTIN BIEBER: NEVER SAY NEVER ($99m) from 2011 and just a bit behind 2009 music documentary MICHAEL JACKSON’S THIS IS IT ($261m). TAYLOR SWIFT – THE ERAS TOUR was nevertheless quite a Domestic-skewed success, grossing 74% of its October cume in North America.

The third highest grossing global movie of the month – PAW PATROL: THE MIGHTY MOVIE – was far more Internationally focused, achieving 64% of its $169 million cume outside of the Domestic market. The roll out started at the end of September and added $137 million of its current cume in October. The second PAW PATROL instalment has already overtaken the pandemic-hit first film in the franchise (+16%, $144m).

Unsurprisingly three of the highest grossing releases of the Halloween month were horror titles. Opening on the final weekend of October FIVE NIGHT’S AT FREDDY’S grossed an impressive $150 million globally as #2 of the month. It broke horror and Blumhouse related opening records in multiple markets and has a good chance of getting above THE NUN 2 ($266m) to become the highest grossing horror release of the year. The result of the fan-driven video game adaption is even more remarkable given it has been released simultaneously on streamer Peacock domestically. It was a another Domestic skewed title, with a 59% global share, although also scored big in Latin America further proving the strength of the genre in that region.

THE EXORCIST: BELIEVER – another Universal Blumhouse Horror – followed as the #4 global release in October with $122 million within the period. This reboot by David Gordon Green, who also directed the recent HALLOWEEN reboot franchise, will most likely end in the ballpark of HALLOWEEN KILLS ($133m) and last year’s SCREAM ($138m). It has already beaten HALLOWEEN ENDS (+17%, $104m), but will just get to around half of 2018’s HALLOWEEN ($260m).

Completing the horror triple was another Domestic-skewed title, SAW X, adding approximately $72 million in the month globally for a cume of $94 million (54% coming from Domestic). That is already more than double the result of the pandemic-hit prior instalment SPIRAL from 2021 (+135%, $40m). It will also overtake JIGSAW ($103m) from 2017 at the beginning of November, but will likely fall a bit short of 2010’s SAW 3D ($136m) and end as #5 in the long-running franchise.

Another special release in October was KILLERS OF THE FLOWER MOON. The first high-profile theatrical opening from Apple, in this case distributed via Paramount, the 3.5-hour film collected $94 million within the month. It was best performing in the EMEA region. It will most likely end around the lifetime of HOUSE OF GUCCI ($153m), a bit below HATEFUL EIGHT ($161m). That would be the lowest global grossing Scorsese and DiCaprio collaboration, far below their peak in 2014 with WOLF OF WALL STREET ($407m).

Driven by the Domestic-skewing performance of TAYLOR SWIFT – THE ERAS TOUR ($151m) and FIVE NIGHT’S AT FREDDY’S ($89m) the market had a better month than most of the world. It was just -20% behind the pre-pandemic average for the month, which was ahead of the global gap (-28%) and within the top group of territories. It ranks in the middle of the current year (#5) for that metric. The total box office of $571 million is just the 3rd lowest at the same time, which is not unusual for that period of the year. The Domestic cume for the year is $7.75 million at the end of October, which is now also higher than last year’s final gross of $7.5 million.

China had a more muted month. October has often been one of the best months of the year in China, but ended #6 for 2023 so far with a total of $501 million. In terms of gap against the three-year average the -34% deficit put it 7th among the months of this year. October starts in China with the Golden Week holiday, usually the second most lucrative box office period in the Chinese calendar (after Chinese New Year). While October this year was up on the disastrous one last year (+70%, $294m) it was far away from the $1 billion in 2021 (-52%) and $871 million in 2020 (-43%).

Regionally, Latin America had the lowest gap against the pre-pandemic average for the month, just -12% behind. After a very strong year for the sub-region so far this relatively strong number is only the 7th best of the year. It holds the same rank in terms of box office. As does Europe, Middle East, and Africa (EMEA), despite generating 58% of the International (excl. China) box office within the month. The EMEA region couldn’t benefit as usual from October being an especially strong period. Historically the fourth highest grossing month of the year, being supported by school holidays, public holidays, and a temperature change in many major markets. Compared to the three-year average the sub-region recorded the second worst month of the year so far with -28%. The sub-region of Asia Pacific had an even weaker month with October its lowest grossing month of the year so far and the one with the largest gap against the three-year average (-38%). That is disappointing even considering that October is usually a calm period in the region, historically the fourth lowest grossing month of the year.

These modest results led to a slight regression of the deficit against the pre-pandemic three-year average for the running year around the world. The gap had been closing against the pre-pandemic three-year average since April. The impact of a weaker release calendar since September has obviously been slowing down recovery. At the end of October, the Domestic market was -17% below the three-year average for the running year. That comes after cutting the deficit to -15% in August, down from -36% at the start of April. The International (exc. China) market now stands at -13%, following the reduction from -23% to -11% in the April to August period. Although far less dependent on the global release calendar China is also following this trend. At the end of October, China was tracking below the pre-pandemic average at -3%. In the period from June to August it had overcome the deficit from -13% to +1%.

For a long time it has been expected that the number and frequency of attractive global new releases out of the US would decrease a bit in the final four months of 2023. The ongoing strike dispute in Hollywood made it even more severe. Besides the marketing challenges the strike creates, it’s having an impact on the release calendar. First the upcoming GHOSTBUSTERS sequel, KRAVEN THE HUNTER and DUNE: PART TWO were pushed to 2024. Now the issue extends to next year. Multiple tentpoles like the next MISSION IMPOSSIBLE, Pixar’s ELIO and Disney’s SNOW WHITE were just pushed back a year to 2025. As a result of that, 2024 will continue to suffer gaps in the release calendar and a slowdown of the global box office growth.

Nevertheless, this October showed that a lack of product can also help to create new successful approaches. TAYLOR SWIFT – THE ERAS TOUR, the highest grossing movie of the month only announced its release slightly over a month prior to opening. It had a unique release pattern of playing 4 days per week and was distributed via an exhibitor. THE ERAS TOUR proved a huge help in preventing the box office slump of October being even more severe. The release may inspire further new ways to draw audiences into cinemas. It was always a need, but now more than ever.